Posted on 16 Sep 2021

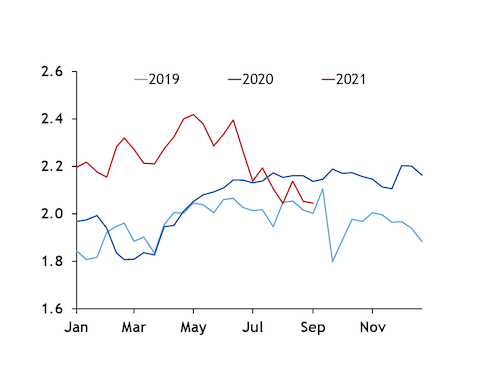

China Iron and Steel Association (Cisa) member mills slowed crude steel output slightly to 2.0449mn t/d over 1-10 September as output curbs were maintained at the start of the peak autumn demand season.

The early September pace fell by 0.4pc from 21-31 August and down by 4.3pc from a year earlier. It was nearly as slow as the pace in early August when mills increased maintenance activity during the slow summer demand season.

Cisa data include more than 100 of the country's largest steel mills.

The absence of a strong rebound in output at the start of the year's peak construction activity period means mills are following policies to curb second-half output.

Beijing has pushed mills to flatten full-year 2021 output to 2020 levels, with provinces off the pace to meet targets having sent mills notices from early July to keep production within last year's levels. This month the cuts have intensified in China's second-largest steel-producing province Jiangsu.

China's crude steel output slumped by 13.2pc from a year earlier in August but year-to-date output is still up by 5.3pc. For China to limit 2021 output to the 1.065bn t produced in 2020, it can only produce 332mn t over September-December, or an average of 83mn t each month, to meet the flat growth target.

Markets today reacted more to the slowdown in Cisa steel output than a slower drawdown in weekly steel inventory data released today. The most active rebar contract rose as much as 3.4pc before closing up by 0.84pc at 5,541 yuan/t, while the most active hot-rolled coil contract rose by as much as 2.7pc before closing up by 0.98pc at Yn5,743/t. China's most active iron ore futures contract closed down by 3.94pc at Yn670/t, off its earlier lows down more than 5pc. October SGX 62pc iron ore futures fell by $8.15/t, or 7pc, to $107.25/t in late Asia afternoon trade.

Cisa 10-day average steel output (mn t/d)

Source:Argus