Posted on 29 Dec 2025

As the global trade environment improves, China's indirect steel exports are expected to grow 4-5% from the 2025 volume to around 150 million tonnes in 2026, primarily driven by resilient performance in key downstream sectors including machinery, automobiles, and shipbuilding, according to Mysteel's new forecast.

This outlook aligns with Mysteel's projection of a medium-to-high 4.5% increase in China's total export value in 2026.

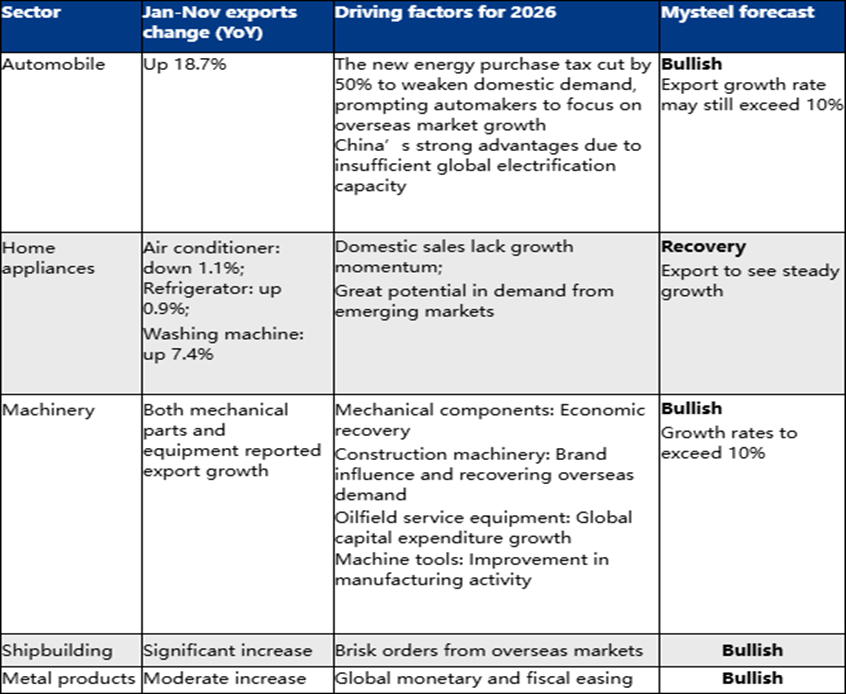

A major contributor will be the continued strong exports of steel-intensive electromechanical products such as machinery, automobiles, and home appliances. In 2025, China's export growth from these three sectors alone is expected to account for over 60% of the total increase in indirect steel exports, Mysteel's forecast report notes.

Electromechanical products -- including machinery, metal products, ships, steel structures, home appliances, containers, automobiles, motorcycles, and rail vehicles -- are mostly steel-intensive downstream products, and their export volumes broadly reflect China's indirect steel exports, Mysteel understands.

Sources: Mysteel, public information

Several macroeconomic and policy factors are expected to support this positive outlook. In 2026, the global economy is projected to see a mild recovery, with major developed economies likely to maintain accommodative fiscal and monetary policies, significantly improving global liquidity.

Against this backdrop, international institutions such as the International Monetary Fund (IMF) and the World Bank forecast global GDP growth to rebound to the 3-3.2% range in 2026.

Meanwhile, China's export markets are becoming increasingly diversified, with demand from emerging economies in ASEAN, Africa, and other Belt and Road Initiative countries emerging as a key growth driver. This diversification is expected to provide a buffer against potential global trade uncertainties.

Domestically, China's reintroduction of an export licensing system for 300 steel products, effective January 1 2026, is expected to support steel exports over the longer term, according to the report. Under the system, Chinese steel exporters must obtain licenses by submitting formal export contracts and manufacturer-issued quality inspection certificates.

The policy is intended to steer China's steel exports toward higher value-added products. While it may curb direct exports of regular steel products, it is expected to enhance the competitiveness of premium steel used in high-end manufacturing, thereby creating more favorable conditions for indirect steel exports, the report notes.

For 2025, Mysteel forecasts that China's indirect steel exports will reach around 143 million tonnes, an increase of 9.5 million tonnes or 7% on year.

Source:Mysteel