Posted on 25 Nov 2025

For many years, economic growth in China meant using more and more steel. This is no longer the case. GDP grew by 5.2% in January-September, according to the National Bureau of Statistics of China. At the same time, apparent steel consumption fell by 5.7% to 649 million tons, according to estimates by the China Iron and Steel Association (CISA).

The protracted crisis in the housing sector is an important but not the main reason for the decline in demand for steel. The fundamental factor is the transition of the economy to a post-industrial model. Based on this, we should consider the trends in seel consumption in China, which has been declining for the fifth consecutive year.

Economic growth has had a positive impact on the solvency of Chinese households. In January-September, the average monthly disposable income per capita increased by 5.2% – to $4,570.

In addition, on May 20, the People’s Bank of China lowered the base LRP interest rate on 1-year loans by 10 basis points (bp) to 3% per annum. The rate on 5-year loans was also reduced by 10 bp to 3.5%. Both rates are now at historic lows.

The five-year rate affects the cost of mortgage loans, while the annual rate affects all other loans, including car loans. As a result, total loans to households increased by $103.98 billion in January-October, and loans to businesses increased by $1.94 trillion. In turn, retail sales of consumer goods rose by 4.5% – to $5.14 trillion.

Nevertheless, household consumption still accounts for about 40% of China’s GDP, compared to the global average of 56%. The authorities are aiming to increase this share. But first and foremost through services, not commodity consumption. This is a very important clarification. It is confirmed by the latest macroeconomic statistics for the first nine months.

During this period, value added in China’s service sector rose by 0.8% to $8.34 trillion. It accounted for 58.4% of the country’s GDP. Value added in industrial production grew faster, by 6.2%. But it accounted for only $5.19 trillion, or 36.4% of GDP.

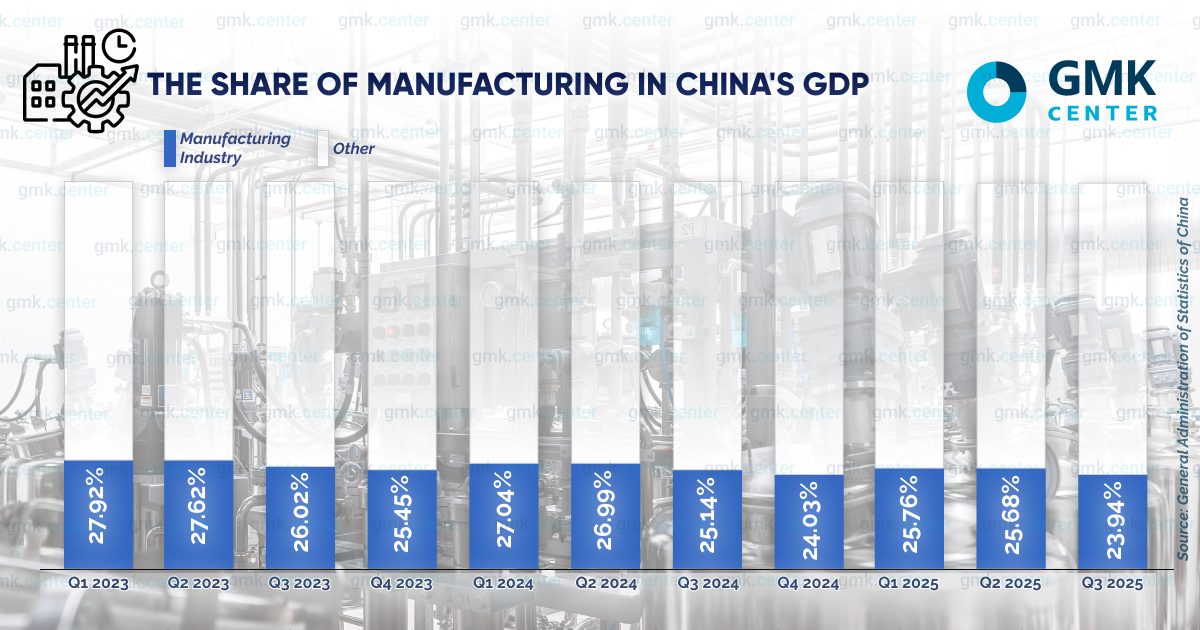

If we look at the contribution of the manufacturing industry, it was the lowest in the last three years in the past quarter.

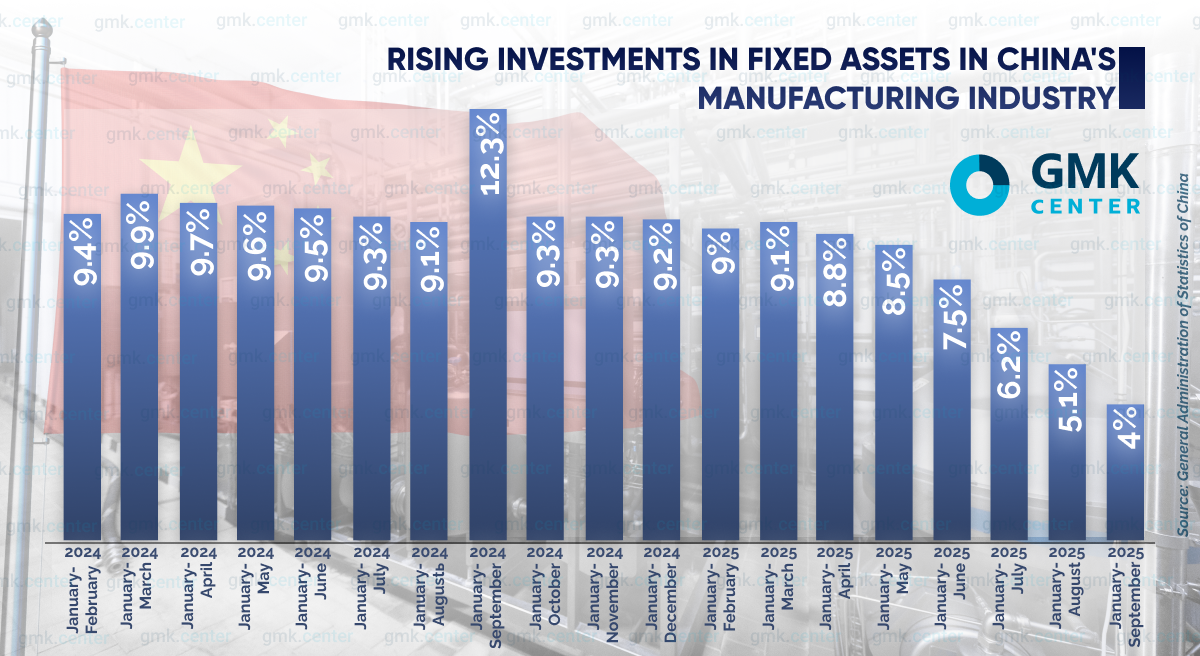

Investment in fixed assets declined slightly, by 0.5%, to $5.23 trillion. However, the growth rate of investment in fixed assets in the manufacturing industry has recently slowed down by half.

These are truly revolutionary changes for the Chinese economy, as the previous model was based on investment in basic industries. Now that investment is declining and consumption is growing at a relatively slow pace, it is becoming increasingly difficult to achieve the planned GDP growth. This is especially true in the context of widespread anti-dumping measures against exports from China.

The reduction in capital investment in fixed assets has had a negative impact primarily on construction, where government financing programs play a key role, while the automotive sector has been able to benefit from increased household purchasing power. Accordingly, flat steel producers in China now feel much more confident than long steel producers.

Passenger car production in China increased by 13.3% to 24.33 million units in January-September, according to the China Association of Automobile Manufacturers (CAAM). At the same time, domestic sales rose by 12.9% – to 24.36 million units.

Car exports from China in monetary terms increased by 14.3% – to $112.8 billion, according to the General Administration of Customs. This figure is a historic record.

This shows that Chinese car manufacturers continue to compete successfully in foreign markets. They have led the trend towards the electrification of transport. And now, electric cars from China are confidently outperforming their renowned competitors on their home turf, even despite the import duties imposed on them. This is largely contributing to the boom in Chinese car manufacturing that we are currently seeing.

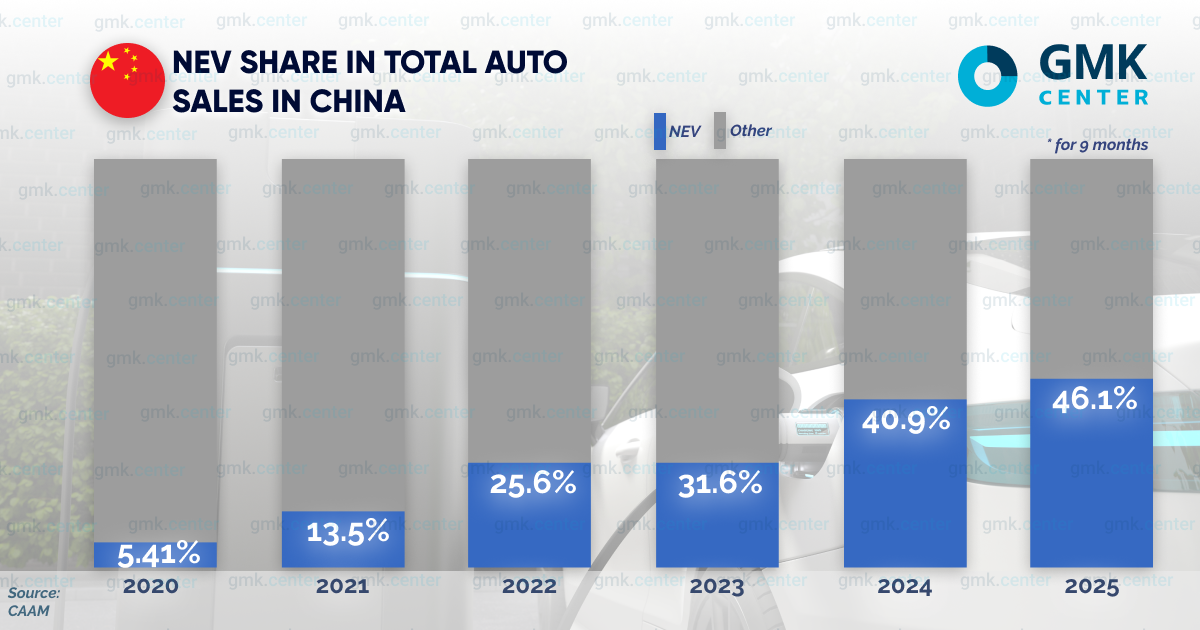

But this does not mean that the industry is not facing challenges. The most important one is the tightening of government policy on electric and hybrid vehicles (NEVs), whose share of the Chinese car market has increased significantly in recent years.

To ease the transition period, many automakers have launched tax difference guarantee programs. These are intended for customers who finalize their purchase by the end of November 2025 but will receive their car in 2026. For them, the difference in tax benefits will be compensated by the seller. This means significant additional costs for the automotive industry.

Finally, regional subsidy programs for trade-in schemes, which provide additional payments to car owners when they exchange their old car for a new one, are being tightened and even phased out.

Another important signal is the absence of NEV production from the list of strategic industries in China’s draft five-year development plan for 2026–2030, adopted by the CPC Central Committee and published at the end of October 2025. NEV production was included in this list throughout 2011–2025. This exclusion means a reduction or even a complete cessation of state subsidies for this sector of the automotive industry.

Production statistics for the next few months will show how successfully the Chinese automotive industry will be able to cope with these challenges. It is possible that they will be negative, which will lead to a reduction in demand for rolled steel. This is similar to what is already happening in shipbuilding, an important consumer of thick-gauge rolled steel.

China accounts for 51.7% of global shipbuilding completions and 68.3% of new orders for January-June 2025. This is the undisputed world leader. However, the industry is showing signs of decline. During the reporting period, Chinese shipyards completed the construction of ships with a total deadweight of 24.13 million tons, a decrease of 3.5% year-on-year.

In addition to the automotive industry, other engineering industries also contribute significantly to the consumption of flat-rolled products. For example, sales of excavators in January-August increased by 17.2% to 154,180 units, according to the China Construction Machinery Manufacturers Association (CCMA). Domestic sales grew by 21.5% – to 80,630 units, while exports grew by 12.8% – to 73,550 units.

Almost half of sales were accounted for by foreign sales. But how long will Chinese manufacturers be able to withstand the pressure of tariff barriers, which is constantly increasing? The answer to this question will largely determine the future prospects for steel demand in China.

The Chinese housing sector has been significantly overheated in recent years. This is why its volume is now shrinking, despite the increasing availability of new apartments and houses.

Housing sales for January-August amounted to 860 million square meters. This is 39% lower than the average for the same period in 2021-2024. At the same time, in August, the number of projects started decreased by 20% year-on-year, to 551 million square meters, according to the National Bureau of Statistics.

The area of buildings commissioned in January-October decreased by 16.9% – to 348.61 million m2, including in the residential segment – by 18.9% – to 248.66 million m2.

The ratio of new housing sales in January-August to housing commissioned in January-October shows how large developers’ “inventories” are – the volumes that remained unsold during the construction boom of previous years. This is why investment in housing construction and its volumes are declining and cannot sustain steel demand.

Therefore, consumption of long products is mainly driven by the construction of infrastructure (bridges, railways), industrial buildings, logistics complexes, and energy facilities.

For 2025, the central government has approved such projects for the provinces totaling $111.8 billion. Among them are the expansion of high-tech production centers in the Greater Bay Area and the Yangtze River Delta.

In addition, between January and May 2025, the Chinese Ministry of Transport invested $167.5 billion in infrastructure, of which $120.1 billion went to road construction.

The funds are earmarked for financing 83 major projects in 27 provinces. One of them is the construction of a 468.5 km high-speed railway from Yichang to Fulin with an estimated cost of $17.8 billion. As a result, investment in railway fixed assets increased by 5.7% – to $94.8 billion in January-October.

The rapid development of wind energy also has a positive impact on steel consumption. Unlike solar power plants, which have low steel intensity, wind power plants (WPPs) use steel both for the production of turbines and for the construction of wind towers.

In 2024, China set a record by commissioning 80 GW of new WPPs. The government’s plans for the current year envisage an improvement to 94 GW. As a result, the total capacity of Chinese WPPs will reach 520 GW. Thus, the construction industry’s target of 2.1% growth by the end of 2025, set by the party leadership, seems quite realistic.

On September 11, the Ministry of Industry and Information Technology and seven other ministries jointly published the “Work Plan for Ensuring Stable Growth of the Automotive Industry (for 2025-2026)”. The document envisages the production of 32.3 million cars in 2025, including 15.5 million NEVs. This is slightly less than previously forecast by CAAM: 32.9 million and 16 million units. Car exports are expected to increase by 6%. CAAM had predicted a 14% increase to 5.46 million units.

The government plan does not contain any targets for 2026. S&P Global Mobility gives a positive forecast for the Chinese automotive industry in 2026, citing a favorable macroeconomic situation without specifying the expected production and export volumes. However, according to estimates by the China Passenger Car Association (CPCA), average annual car sales in 2026–2030 will reach 40 million units. This means a significant increase in demand for automotive steel products.

The outlook for thick-gauge rolled steel consumption is also favorable. As of July 1, the total order book of Chinese shipyards reached 234.54 million tons. This is 36.7% higher than a year ago.

The construction of metal-intensive facilities such as floating wind farms deserves special mention. The program, previously approved by the National Development and Reform Commission (NDRC), provides for the commissioning of 15 GW of offshore wind power annually in 2026-2030.

Overall, during this period, the capacity of Chinese wind farms is expected to increase 2.5 times compared to this year, to 1,300 GW. This represents enormous sales potential for manufacturers of wind turbines and steel structures for construction.

However, overall demand for long products will continue to decline, as the consequences of the housing market “overheating” have not been fully overcome. It is important to note that China’s urbanization is virtually complete. According to the draft 5-year plan for 2026–2030, high-quality development will be a priority for the real estate sector.

Particular attention will be paid to comprehensive renovation – the development of “smart cities.” The steel intensity of such projects is significantly lower than that of traditional construction, and investment in infrastructure and industrial buildings will continue to decline.

Therefore, based on the results of 2025, the Irish consulting company Research&Markets forecasts growth in the Chinese construction industry of only 2.1%, and an average of 3.9% in 2026–2029. For comparison, in 2020–2024, the figure was 8.6%.

The Chinese government’s policy of prioritizing the development of the service sector, which includes information technology, and high-tech industries such as microchip manufacturing, is creating a steady trend toward reducing the steel intensity of the economy as a whole.

As a result, according to estimates by consulting firm Wood Mackenzie, China’s share of global steel demand will decline from 49% in 2024 to 31% by 2050. The dynamics suggest an annual decline in steel consumption of 5 million tons in 2025–2035, accelerating to 7 million tons in 2036–2050.

The World Steel Association forecasts a more significant decline in 2026, by 1% compared to this year.

In turn, S&P Global Commodities, citing market participants surveyed, notes that steel consumption in China’s manufacturing industry will remain stable in 2026. However, as in this year, its growth is unlikely to fully offset the decline in demand in the construction sector.

It follows that the official Beijing needs to work more actively to reduce supply by promoting the closure of excess steelmaking capacity. This is because local producers are sending more and more of their products to foreign markets amid declining domestic demand. And this could crush the global industry.

Source:GMK Center