Posted on 14 Oct 2025

LION Industries Corp Bhd could close down its two long steel mills in Banting and Bukit Raja, Klang, held under wholly owned Amsteel Mills Sdn Bhd, industry sources familiar with the company tell The Edge.

While details are scarce, the closure may take place as early as the end of this year, the sources say.

The Banting and Klang plants produce steel bars, speciality bars and wire rods for the construction and manufacturing industries. They are the core revenue generator for Lion Industries.

The company is also involved in property development, and via its 74%-owned, publicly traded Lion Posim Bhd (KL:LIONPSIM), it distributes building materials, sanitary ware, tap fittings, tiles, ironmongery and lubricants, among others.

In response to an email from The Edge on whether Amsteel would be shut down, a company spokesperson says, “Amsteel is in operation though the steel industry, domestically and globally, is facing challenging times. The company is continuing to focus on improving operational efficiencies, strict cost containment and diversifying its product range while exploring new opportunities and fostering sustainable growth.”

A check on the Companies Commission of Malaysia website indicates that Amsteel suffered losses in four of the last five financial years. In FY2024, it incurred an after-tax loss of RM100.82 million on the back of RM1.12 billion in revenue.

In FY2021, the only year it posted a profit in the last five years, it chalked up an after-tax profit of RM887.37 million on RM2.13 billion in revenue. However, a check on Lion Industries’ financials indicates that Amsteel’s earnings could have been bolstered by a gain on the disposal of a subsidiary company amounting to RM440.5 million and a gain of RM193.1 million from a secured debt settlement arrangement.

As at end-December 2024, Amsteel had total assets amounting to RM1.2 billion and total liabilities of RM1.07 billion. It is noteworthy that its current liabilities, which need to be settled within 12 months, amounted to almost RM700 million.

Amsteel’s share premium and reserves were at negative RM550.92 million as at end-December 2024.

Lion Industries has not been performing well, either. For the six months ended June 2025, it suffered a net loss of RM83.4 million on RM657.28 million in revenue. For the previous corresponding period, the company recorded a net loss of RM71.51 million on RM838.51 million in revenue.

As at end-June this year, Lion Industries had deposits, cash and bank balances of RM102.9 million. On the other side of the balance sheet, it had short-term loans of RM112.1 million and long-term loans and borrowings of RM22.42 million. Accumulated losses stood at RM360.17 million.

On its prospects, Lion Industries said in the notes accompanying its financial statement, “The operating environment for Malaysia’s steel industry is expected to remain challenging in the upcoming quarter. The industry continues to face persistent overcapacity, intense competition and rising operational costs, all of which weigh on margins and overall performance.

“In response to these challenges, the group will adopt a proactive approach to address the current market conditions. Key areas of focus will include improving operational efficiencies and enforcing strict cost containment measures.”

Perhaps the writing was already on the wall.

Lion Industries and Amsteel have been selling assets, and are in the process of disposing of two pieces of freehold land measuring 19.78 acres and seven acres for RM67.96 million and RM24.07 million cash respectively to Unichamp Mineral Sdn Bhd in a related-party transaction.

Lion Industries is 34.59% controlled by Tan Sri William Cheng Heng Jem, a businessman who has vast interests in steel as well as retail via Parkson Holdings Bhd (KL:PARKSON).

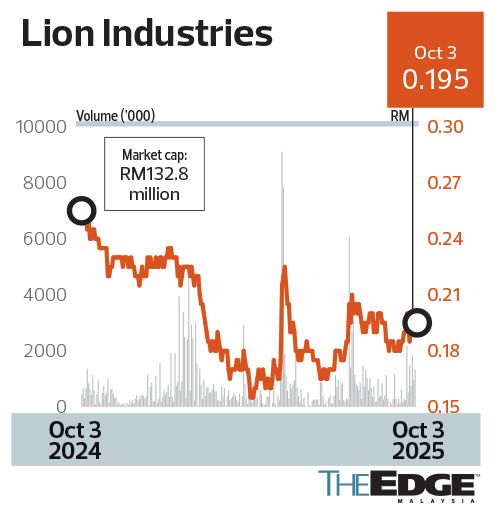

Shares of Lion Industries — which also has businesses in China and Cambodia, among others — ended trading last Friday at 19.5 sen, translating into a market capitalisation of RM132.8 million.

On the domestic front, industry sources say the competition brought about by Alliance Steel (M) Sdn Bhd — wholly owned by Guangxi Kunyi Investment Co Ltd, which operates a US$1.4 billion steel mill in a 710-acre facility in Malaysia-China Kuantan Industrial Park — has adversely impacted the local players.

In late 2023, four of the larger long steel companies in Malaysia — Ann Joo Resources Bhd (KL:ANNJOO), Malaysia Steel Works (KL) Bhd (KL:MASTEEL), Southern Steel Bhd (KL:SSTEEL) and Lion Industries — asked the government for assistance, claiming that Alliance Steel had violated the terms of its manufacturing licence and was dumping certain specifications of steel in the local market.

It should be noted that Alliance Steel’s presence in Malaysia is the result of a government-to-government initiative. It manufactures square billets, high strength bars known as rebars, high speed wire rods and large scale H-shaped steel bars and H-beams, among other products.

There is a requirement in its manufacturing licence that Alliance Steel exports at least 50% of its production of the iron and steel supply chain unless the products are not currently produced in Malaysia, such as H-beams.

Source:The Edge