Posted on 06 Aug 2025

After rising strongly on buoyant sentiment throughout July, Chinese steel prices will probably retreat in August as fundamentals regain dominance in domestic ferrous markets, Mysteel's chief analyst Wang Jianhua predicts in his latest monthly outlook.

Last month, Mysteel's assessment of China's national composite steel spot price averaged Yuan 3,472/tonne ($483.6/t) including the 13% VAT, higher by a marked 3.2% compared with the average price during June. Notably on July 30, the price hit a more than five-month high of Yuan 3,619/t.

Domestic steel prices in July were driven up by several ferrous industry developments announced by the central government, including a pledge to stamp out involution-style competition among Chinese enterprises and a crackdown on overproduction of coal, as reported, two issues seen as impacting steel production and profits.

Entering this month, however, domestic steel prices lost ground rapidly, with the national price falling to Yuan 3,549/t by August 4, Mysteel assessed.

"Market participants had anticipated some strongly positive outcomes from the Meeting of the Political Bureau of the CPC Central Committee in Beijing, plus the trade talks between China and U.S. both held at the end of July," Wang commented. "But the actual results proved disappointing," he remarked.

At the conclusion of the Politburo meeting on July 30, no major economic stimulus policy was announced, while the negotiations on reciprocal tariffs between China and the U.S. yielded no progress beyond extending the existing suspension period, Wang explained. "The current (steel) price decline reflects a market correction of the earlier excessive optimism," he noted.

Apart from the underwhelming macroeconomic environment, Chinese steel prices may also face downward pressure from persistently abundant supply, Wang warned.

Chinese steelmakers have seen their profit margins improve significantly over the past few weeks thanks to the large rises in steel prices, which encouraged the mills to keep their production running hot, a Mysteel survey showed. This was despite the fact that the government has frequently called for steel production cuts to ensure sustainable industry development.

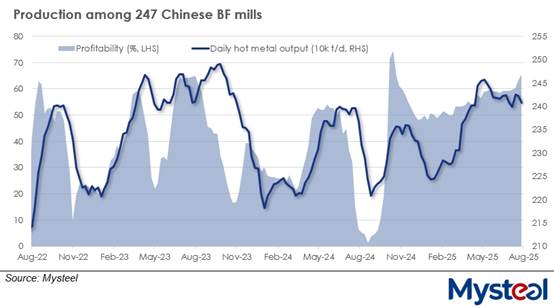

By the end of July, for example, more than 65% of the 247 blast furnace (BF) steel producers under Mysteel's survey could make some profits when selling their products, the highest ratio of profitable mills since October last year.

During last month, the combined output of hot metal among the same 247 mills averaged some 2.41 million tonnes/day, higher by 0.9% compared with the same month last year, the survey showed.

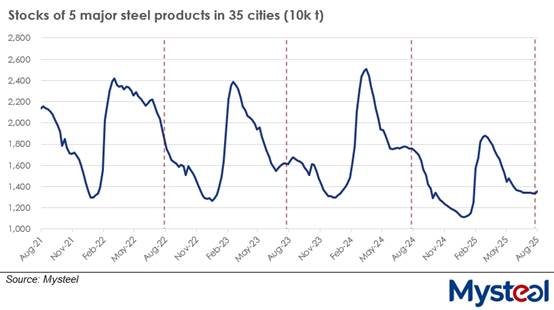

Nevertheless, China's steel prices could still stage a recovery later this month, as the low volumes of steel inventories across the country indicate that the market can largely absorb the current output, even as the steel sector is experiencing its typical summer lull, Wang suggests.

At the end of July, the total stocks of the five major carbon steel products held by steelmakers and trading houses across the 35 cities under Mysteel's monitoring stood at 13.5 million tonnes, lower by a significant 23% compared with the same period last year, though the volume had edged up 0.8% from end-June.

"The implementation of either voluntary output reduction by steelmakers or mandatory production cuts by authorities would support a rebound in steel prices in August," Wang proposed.

Source:Mysteel Global