Posted on 31 Jul 2025

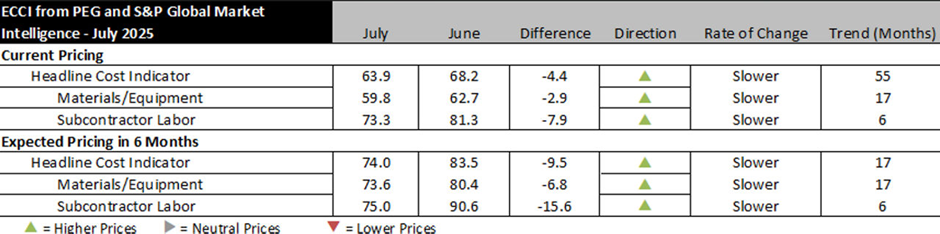

Engineering and construction costs continued to show gains in July, according to the Engineering and Construction Cost Indicator from PEG and S&P Global Market Intelligence. The headline Engineering and Construction Cost Indicator, a leading indicator measuring wage and material inflation for the engineering, procurement and construction sector, saw a net decline to 63.9 this month, but remains elevated. The sub-indicator for materials and equipment costs decreased by 2.9-points to 59.8 while the sub-indicator for subcontractor labor costs decreased to 73.3 in July from 81.3 in June.

The materials and equipment indicator experienced a third month of declines in July after surging in April. Four of the 12 components declined compared to last month, outpacing increases in six components while two remained unchanged. Most of the increases seen in July were relatively modest compared to the declines seen in June. Carbon steel pipe and alloy steel pipe saw the largest gains, increasing by 13.9-points and 11.1-points, respectively. This was accompanied by milder increases seen from copper-based wire and cable, shell and tube heat exchangers, fabricated structural steel and turbines. These gains were offset by large declines seen in the two ocean freight categories, which moved both back towards neutral. Additionally, overall declines were seen in transformers and redi-mix concrete, decreasing by 13.9-points and 17.9-points, respectively.

“The significant drop in freight rates observed in July 2025 signals a reduction in frontloading activity, leading to a retreat of rates for the latter half of the year,” said Keyla Goodno, Economist, S&P Global Market Intelligence. “As the peak season has been pulled forward and kept brief, we are likely to see softer demand, further impacted by an oversupply of ships and containers in the market for the rest of the year.”

The sub-indicator for current subcontractor labor costs experienced a pullback in July, decreasing to 73.3 after a reading of 81.3 last month. Decreases were seen in the U.S. Northeast and West regions, as well as inboth Eastern and Western Canada. All labor categories in these four regions decreased this month. Both regions of the U.S. saw decreases ranging from 16.7- to 25.0-points. Meanwhile, all categories in Canada decreased by around 25.0-points. All contractor categories in the U.S. Midwest and U.S. South regions saw modest increases in July.

The six-month headline expectations for future construction costs indicator saw a further decrease to 74.0 in July. The six-month expectations indicator for materials and equipment came in at 73.6, which is 6.8-points lower than last month’s figure. Ten of 12 categories saw decreases in July, led by a 16.7-point declines from transformers down to 83.3 and ANSI pumps and compressors down to 66.7. Only two categories saw increases on the month though neither would be described as significant.

Meanwhile, the six-month expectations indicator for subcontractor labor saw a widespread pullback in July. The U.S. Midwest, South and West regions saw notable declines ranging from 12.5- to 16.1-points, contrasted with no change in the U.S. Northeast. Meanwhile, declines of around 25 points were seen for both the Eastern and Western regions of Canada. Despite the magnitude of the decrease, the overall sub-contractor labor outlook reading remains very high at 75.0 in July.

Respondents reported few shortages this month, largely confined to electrical equipment categories. Market commentary continued to note general uncertainties related to tariff policy.

Source:S&P Global Commodity Insights