Posted on 25 Jul 2025

The modern Turkish steel industry took shape in the 2000s driven by the broader industrialization of the country’s economy. The authorities had two scenarios. The first was to create large integrated BF-BOF plants. The second was to build EAF scrap-based plants. Both options had one common drawback: the lack of their own raw material base.

In the first case, they would have had to import iron ore, and in the second, scrap. Therefore, there was no choice of the “lesser evil” here. Nevertheless, by focusing on the development of EAF steel industry, the government took a very far-sighted step. The average CO2 emissions per 1 ton of finished steel in Turkey is about 1 ton. In essence, local steel is already green. This means that it does not require as much investment in decarbonization as in many other countries.

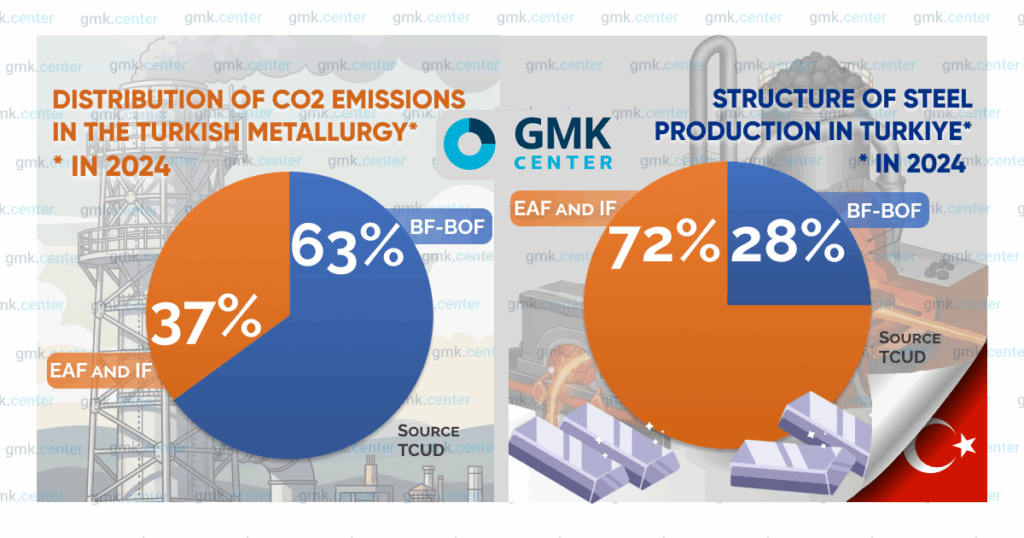

Electric arc furnace production dominated the industry structure even before industrialization. In 2000, EAF accounted for 69% of all capacity, which then amounted to 19.8 million tons. In 2022, when capacity reached 54.6 million tons, the share of EAF grew to 75%. Today, the Turkish steel industry consists of 27 EAF plants and 11 IF plants with a total capacity of 41 million tons, and three large BF-BOF plants with 17.8 million tons per year. These three enterprises generate most of the industry’s emissions. However, their share in the total steel production is not that significant.

In 2021, when Turkish steel production reached a record high of 40.4 million tons, greenhouse gas emissions from BF-BOF amounted to 25 million tons, and from EAF-IF – 15 million tons. At that time, the total production volume of BF-BOF plants was 11.5 million tons, and that of EAF-IF plants was 28.9 million tons. As a result, electric steel plants generate an average of 0.52 tons of CO2 per ton of steel, while integrated plants – 2.17 tons. This is not that much. For example, in India, the figure is 2.54 tons. But this is still higher than the global average of 1.92 tons.

In other words, the decarbonization of the Turkish steel industry will primarily consist of reducing emissions from the Erdemir and Isdemir plants owned by OYAK Mining Metallurgy Group and the Kardemir plant owned by Kardemir Karabuk Demir Celik Sanayi ve Ticaret A.S. Unlike their EU counterparts, they cannot rely on government subsidies and must instead depend solely on their own investment capabilities.

Therefore, the companies’ roadmaps do not imply a restructuring of existing capacities, but only an increase in energy efficiency and the construction of new, conditionally green EAFs. Plans are underway to build EAFs with a combined capacity of 1.4 million tons at the Erdemir plant and 2.5 million tons at İsdemir. These new furnaces are intended to supplement, rather than replace, existing BF-BOF capacities.

Moreover, the new EAFs will run on DRI. Initially, it will be obtained using natural gas, and later (approximately after 2040), when the necessary market conditions are in place, it will be obtained using hydrogen technologies.

Among the major improvement projects, the following can be highlighted:

Thus, the İsdemir and Erdemir steel plants intend to reduce CO2 emissions by 25% from 2022 levels by the end of 2030 and by 40% by 2040, said Erdemir CEO Niyazi Aken Peker. OYAK’s total investment in the green transformation in 2025-2030 will amount to $3.2 billion. Of this amount, 70-80% will come from foreign sources of financing.

Also noteworthy is Kardemir’s $1.5 billion investment program for 2025-2029. Under this program, a significant portion of energy consumption will be transferred to renewable energy sources (RES). In particular, by the end of 2026, the company’s RES capacity will reach 250 MW. In 2024, it commissioned a 4 MW solar power plant and a 24 MW wind farm. Therefore, a huge leap forward is expected in the next 1.5 years.

As a result of modernization efforts aimed at improving energy efficiency, Kardemir successfully reduced its CO2 emissions from 3.4 to 2.3 tons per ton of finished steel between 2017 and 2021. And at the end of last year, the company commissioned a comprehensive energy consumption monitoring system, a new step in this direction. By 2030, Kardemir will reduce emissions by another 15% from current levels, according to Chairman of the Board Ismail Demir.

Turkish EAF plants are advancing at a faster pace due to their technological advantages. For instance, Diler Iron & Steel Industry & Trade Inc., which operates a 1.5 million ton per year facility in Dilovası, has already cut CO2 emissions by 15,000 tons through the commissioning of a 25 MW solar power plant. In April, CEO Fatih Gekce confirmed plans to expand investments in renewable energy. The company aims to reduce its Scope 2 emissions by 98% from current levels by 2030 and transition to zero-emission steel production by 2035.

Veysel Yayan, Secretary General of the Turkish Steel Producers Association (TCUD), stated that fully decarbonizing the country’s steel industry will require average annual investments of around $1 billion through 2053 – a level of financing that is manageable for domestic producers.

An important driver of decarbonization in the Turkish steel industry will be the launch of the greenhouse gas quota market. The climate law providing for the creation of a national emissions trading system (ETS TR) was adopted by the Grand National Assembly on July 2.

According to the document, emission permits for industrial enterprises, including steel ones, will be sold on the Istanbul Energy Exchange (EXIST). The law also provides for sanctions.

For example, late submission of emissions reports to the Ministry of Environment, Urbanization, and Climate Change will result in a fine of $12,500 to $125,000. The total amount of fines for the reporting period cannot exceed $1.25 million. In addition, violators face the blocking of their bank accounts.

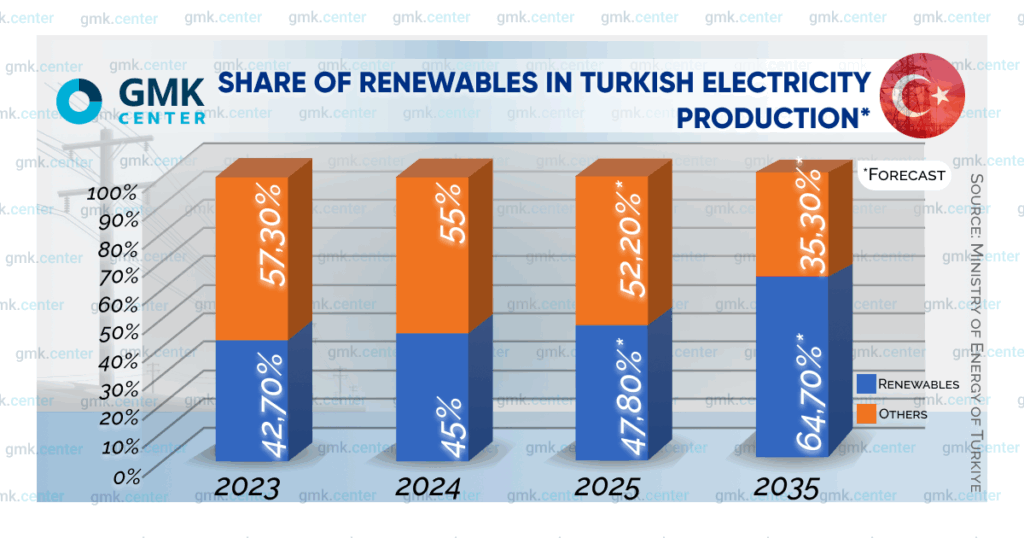

The climate law was adopted as part of the nationwide 2053 Net Zero program. According to this program, the Turkish economy should achieve zero greenhouse gas emissions by 2053. This seems realistic given the pace of development of alternative energy sources.

According to the Turkish Ministry of Energy, this year the installed capacity of hydropower plants should increase by 200 MW to 32.395 GW, solar power plants by 3.844 GW to 22.6 GW, wind power plants by 2.431 GW to 14.8 GW, and geothermal power plants by 2.796 GW to 4.487 GW. Accordingly, the share of renewable energy sources in the total energy potential will increase.

The expansion of renewable energy in Turkey’s electricity mix is outlined in the country’s Renewable Energy Roadmap through 2035, prepared by the Ministry of Energy and approved by the government. Achieving the targets will require $28 billion in investment. Once implemented (alongside the growth of nuclear energy), this strategy will enable not only integrated steel plants (ISPs) but also all EAF and induction furnace (IF) facilities to transition entirely to clean energy sources.

As is well known, nuclear energy is also carbon neutral. Therefore, the authorities attach great importance to its development. By the end of this year, power unit No. 1 with a capacity of 1.2 GW at the Akkuyu NPP should start operating in test mode. In total, it will consist of four such power units.

In addition, Turkey is negotiating with Russia, China, South Korea, and Canada on the construction of two more nuclear power plants, Sinop and Trakya. It is also negotiating the construction of small modular reactors (SMRs). As a result, the installed capacity of nuclear power plants is expected to increase to 7.2 GW by 2035 and to 20 GW by 2053. After that, the share of nuclear energy in electricity generation will reach 30%.

This will create the basis for the industrial production of green hydrogen, which will be used in ISP blast furnaces instead of coke.

Turkey’s Hydrogen Technology Strategy and Roadmap, adopted in 2023, sets ambitious targets for green hydrogen development. It envisions the installation of 2 GW of electrolysis capacity by 2030, expanding to 5 GW by 2035, and reaching 75 GW by 2053.

This is perhaps the most critical aspect of Turkey’s decarbonization strategy. At present, there are no pilot projects in operation. In order to reach the planned target, it is necessary to commission 1 GW of electrolysers per year.

It is also worth noting that to achieve Net Zero by 2053, the primary focus for hydrogen technology deployment in Turkey is the cement industry rather than steel. This is due to the sector’s higher annual CO₂ emissions (49 million tons), which exceed those of the steel industry by 22%.

The cost of H2 production in accordance with 2053 Net Zero should decrease to $2.4/kg by 2035 and to $1.2/kg by 2053. However, it is clear that the Turkish government will not be able to follow Brussels’ example and subsidize this production. Therefore, the availability of hydrogen resources in the future is now in question.

Thus, it can be said that the Turkish steel industry has made significant progress towards low-carbon steel. However, there is a serious obstacle on this path in the medium term.

Source:GMK Center