Posted on 22 Jul 2025

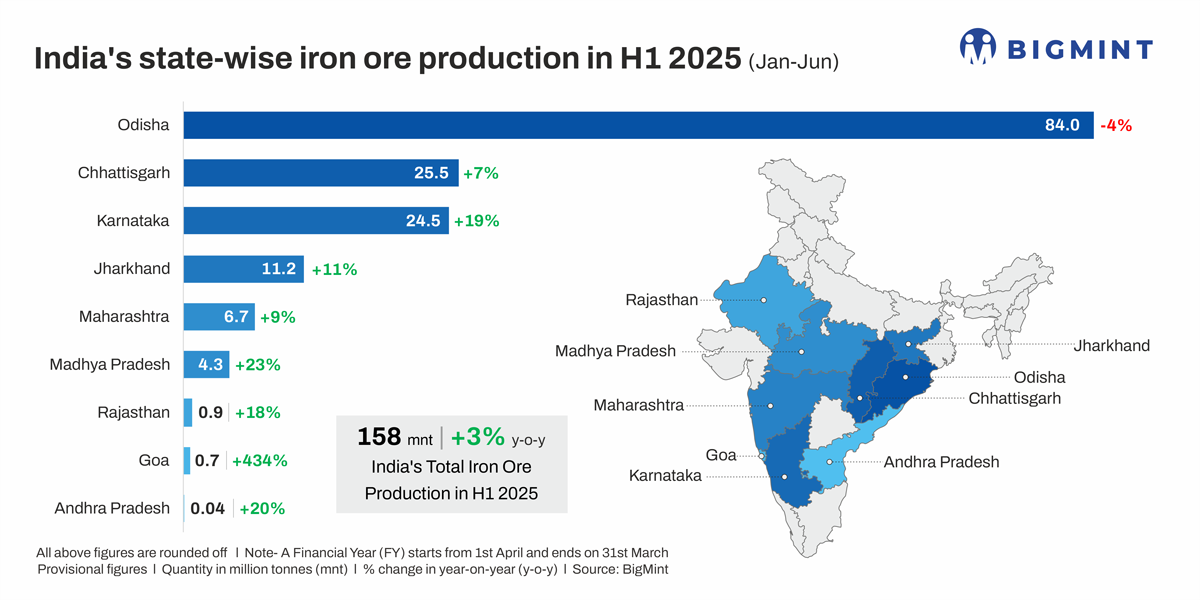

Morning Brief: Indias iron ore production increased by a slight 3% to 158 million tonnes (mnt) in H1CY'25 compared to 153 mnt in H1CY'24, according to provisional data maintained with BigMint.

Volumes were bolstered by a sharp 19% y-o-y rise in output in Karnataka, while Odisha, the leading producer, witnessed a 4% drop. In fact, all states, barring Odisha, saw an increase in production volumes.

Notably, cumulative output from smaller miners surged 39% y-o-y to 32 mnt, indicating robust mining activity among minor players. Their share in India's production matrix increased to 20% in H1CY'25 against 15% in H1CY'24.

Factors influencing India's iron ore production in H1CY'25

Rising crude steel production boosts iron ore demand: India's crude steel production increased 7% y-o-y in Jan-May'25 to 66.5 mnt against 61.9 mnt, as per data compiled by BigMint. Higher production of crude steel boosted demand for iron ore. Meanwhile, production of direct reduced iron (DRI) also rose 10% y-o-y to 29 mnt in H1CY'25.

NMDC lifts production as it sets higher FY'26 target: NMDC remained the leading producer in H1CY'25, at 25 mnt. Production rose 6% y-o-y, with the miner setting a guidance of around 55.4 mnt, which is the maximum environmental clearance (EC) provided to it. Notably, NMDC's output stood at 44 mnt in CY'24, down 4% from 46 mnt in CY'23.

Rungta gets higher EC for Sanindpur mines: In mid-December 2024, Rungta's Sanindpur mines in Odisha received an EC to increase its iron ore production to 22.9 mnt per annum (mnt/year) from 19.7 mnt. This, along with strong production from its Oraghat mines, helped Rungta boost its volume by 12% to 11 mnt.

Goa's output rises after Vedanta starts Bicholim: Following a six-year gap, Vedanta commenced mining operations at Goa's Bicholim mineral block. Consequently, Goa's production increased to around 1 mnt in H1CY'25 compared to 0.1 mnt in the corresponding period last year (CPLY).

Operational hurdles, subdued steel market impact Odisha's production: In Odisha, 84 mnt were mined in H1CY'25 against 88 mnt in the year-ago period, reflecting a slight 4% drop. This moderated the rise in India's overall iron ore production.

The Odisha Mining Corporation (OMC) recorded a 15% y-o-y drop to 20 mnt, primarily because of lower production y-o-y in Q2CY'25. The decline could be attributed to elevated iron ore inventories at the beginning of the fiscal year, which prompted the miner to adjust its production strategies.

April onwards, OMC's auctions fetched weaker responses, with declines in either offtake, bids, or prices, reflective of a downtrend in downstream segments.

An early monsoon could have also disrupted mining activity, though Julys volumes are likely to have faced a more significant impact than June.

Outlook

India's iron ore production is expected to climb up to 325-330 mnt in FY'26 from 289 mnt in FY'25, according to BigMint's projections. NMDC and OMC are expected to lead the uptrend, with the former raising its production guidance to around 55 mnt for FY'26 and the latter expected to target 46 mnt in the same period. To provide context, NMDC and OMC mined 44 mnt and 36 mnt in FY'25. Additionally, Lloyds Metals' Surjagarh mine is set to expand its capacity to 55 mnt per annum, with an initial mining phase of 26 mnt/year.

The steady rise in India's steel production and consumption will continue to support iron ore production.

Source:BigMint