Posted on 22 Jul 2025

Morning Brief: India's steel export-import figures reflect a subdued and fragile market in H1CY'25, as compared to the same period last year. While India was able to temper its import growth with the 12% provisional safeguard duty, export momentum fizzled out, due to sluggish end-user consumption and persistent global price weakness.

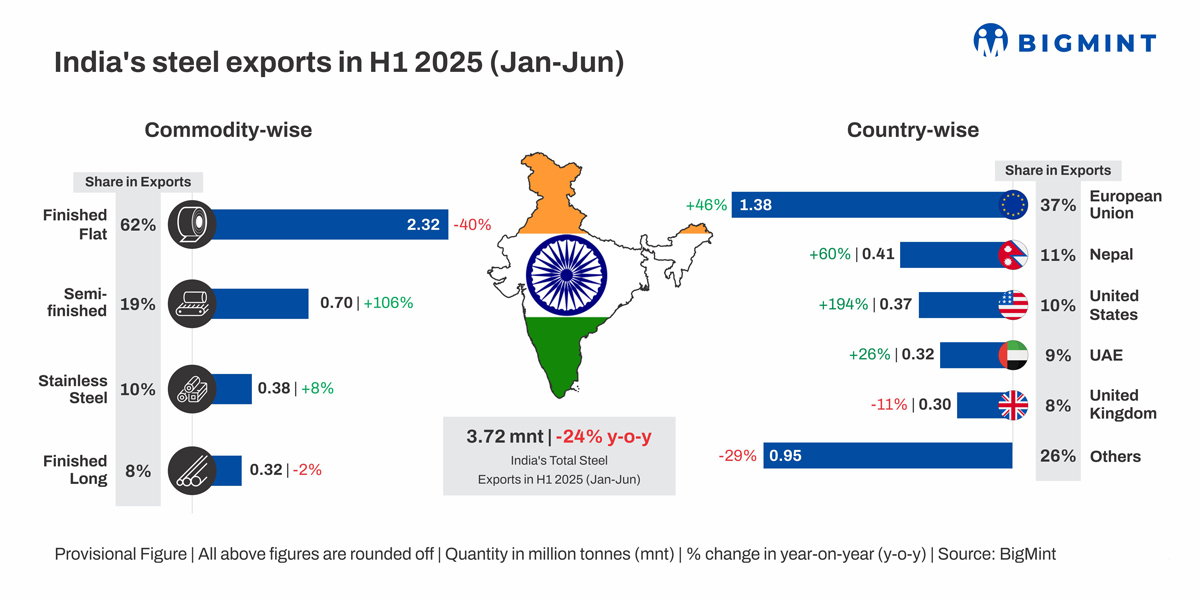

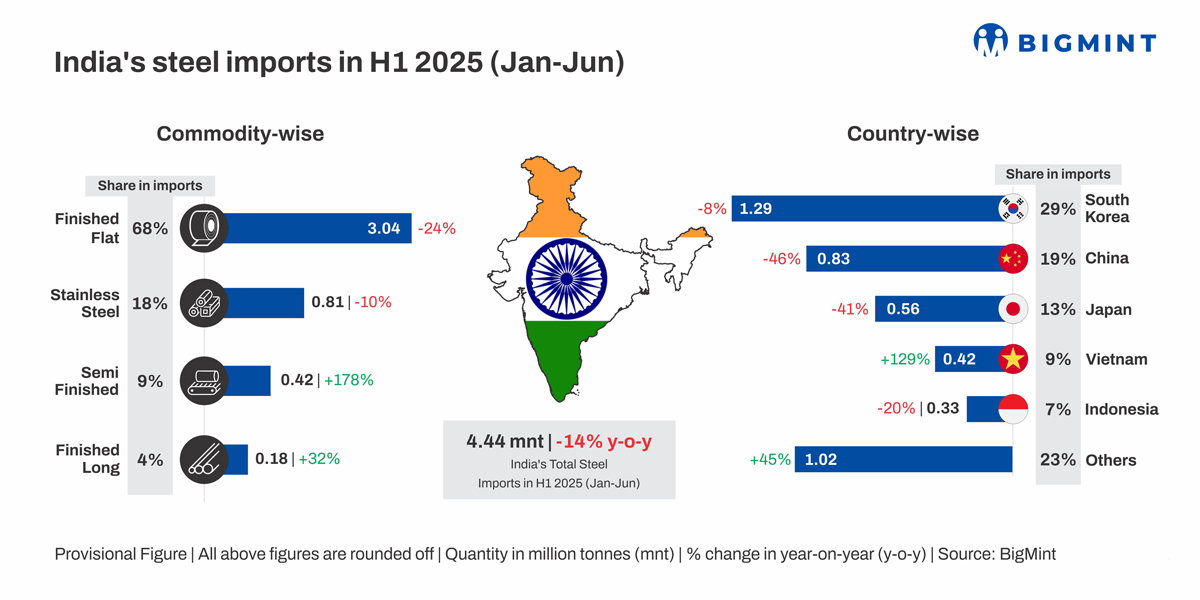

India's steel exports were down by a deep 24% in H1CY'25 to 3.7 million tonnes (mnt) from 4.9 mnt in H1CY'24, while imports fell a lower 14% to 4.4 mnt against 5.2 mnt in the corresponding period last year. All figures include stainless steel.

India remained a net importer during this period, with a trade deficit of 0.7 mnt compared to 0.3 mnt in H1 last year.

Export basket shifts, key destinations see notable drops

India's export basket shifted in H1CY'25, with the share comprised by hot-rolled coils (HRCs) receding and pipes and tubes and cold-rolled coils (CRCs) gaining prominence instead. Semi-finished (billet) exports also doubled. Volumes to major export destinations also eroded by a significant degree.

Product-wise exports

Among India's carbon steel exports, finished flats stood at 2.3 mnt in H1CY'25, falling by 40% y-o-y to a 62% share overall (77% in H1CY'24). Of the various sub-categories, shipments of HRCs and plates crashed by 68% y-o-y, to just 593,000 t. As a result, the share of HRCs/plates, which stood at around 50% of India's total flats exports in both CY'23 and CY'24, dived to a mere 26% in H1CY'25.

Conversely, Indian pipes and tube exports increased 11% y-o-y to 802,000 t, attributed to robust demand from the Middle East, among other destinations. This category accounted for 34% of India's flat exports, the largest. CRCs also increased 17% y-o-y to 331,000 t, with the majority likely going to the EU.

Notably, billet exports doubled to 700,000 t, with Nepal procuring a large chunk due to surging power tariffs. These factors made the direct procurement of billets more cost-effective.

Longs dipped by a minor 2% to 315,000 t (8% share of total) against 323,000 t in H1 last year (6% share).

EU turns main market for Indian HRCs but demand subdued: India's HRC exports were primarily directed to the EU in H1CY'25, driven by comparatively attractive pricing. In January-March, Indian offers to the EU failed to fetch a response due to the ongoing anti-dumping investigation, but activity picked up following India's exemption from the provisional duties imposed. Even then, trade was sluggish due to lacklustre demand, though Indian mills were able to command better prices for their products in the EU compared to other markets.

HRC exports to Middle East, Vietnam languish: On the other hand, HRC exports to the Middle East and Vietnam shrank, as Chinese offers dropped significantly due to weak domestic demand and pricing pressures. This ultimately rendered Indian HRC prices uncompetitive, and Indian mills were also unwilling to offer their products at such rock-bottom rates due to better realisations at home.

Indian HRC offers remain higher than competitors: Indian HRC export offers to the EU were at about $540/t FOB main port at the beginning of the year, and following the preliminary results of the anti-dumping duty in late-March, they increased to $580-600/t FOB over April-May. Meanwhile, Indian offers to the Middle East and South Asia were last heard at $495/t FOB main port in late-March.

Offers from other major exporters were lower. Japan's HRC offers fell to $462.5/t FOB Tokyo in May from $485/t in January. Parallelly, China's offers hit a five-year low of $445/t FOB Rizhao in June from $467.5/t in January. South Korea's hovered within $488-515/t in February-May, while Russia's decreased to $452.5/t FOB Black Sea in June from $480/t in January.

Country-wise exports

Reflecting the muted sentiments, Indian exports to the EU fell a massive 46%, to 1.4 mnt in H1CY'25 against 2.6 mnt in H1CY'24. Meanwhile, shipments to Turkiye more than doubled to 80,000 t due to a significant volume of billets exported. Exports to Nepal also encountered a sharp 60% uptick y-o-y. UAE saw a healthy 26% uptick to 318,000 t, while Saudi Arabia and Vietnam experienced drops of 76% and 93% y-o-y, to 46,000 t and 14,000 t, respectively.

Safeguard duty stems flats imports but concerns remain

The provisional 12% safeguard duty helped curb flat imports, with landed costs superseding domestic prices.

Product-wise imports

Finished flat (carbon steel) imports fell 24% y-o-y to 3.0 mnt, led by a 37% drop in HRC arrivals to 1.2 mnt. Flats remained the mainstay of imports, at a 68% share of the total, with HRCs making for 27% of overall volumes.

Meanwhile, semi-finished imports surged twofold to 0.42 mnt due to imports of slabs from a steelmaker's own overseas unit.

Arrivals of longs increased 32% y-o-y to 0.18 mnt (4% share).

Country-wise importers

Among the primary exporters, China and Japan saw volumes contract by 46% and 41% y-o-y to 0.83 mnt and 0.56 mnt, respectively. However, South Korea recorded a modest 8% decrease to 1.29 mnt.

Safeguard duty lifts import costs: After factoring in the duty, landed costs of Chinese ($470/t CFR India) and South Korean HRCs ($520/t CFR India) stood at INR 51,153/t and INR 52,259/t in early-July, respectively, higher than domestic prices of INR 50,700/t ex-Mumbai, excluding GST.

Concerns emerge as HRC imports rise in Jun: However, concerns have emerged, given that HRC imports rose to a five-month high of 0.22 mnt in June against 0.14 mnt in May. Market participants have suggested that exporters are keeping offers to India significantly low to ensure that landed costs, following the safeguard duty, remain at par with domestic prices.

As such, industry stakeholders have called for a hike in the duty, while the government, in July, has announced its intention to check for mandatory BIS compliance of the raw materials used to make imported steel. Although implementation has been deferred, this move is expected to block a significant volume from entering India.

Outlook

India's steel export and import outlook for H2CY'25 remains challenging, with steel overcapacity and trade tensions dampening demand across geographies and posing the threat of increasing dumping into India.

Additionally, the CBAM has fostered uncertainty regarding future shipments to the EU. However, with high energy costs and carbon prices in the EU affecting production costs, leading Indian mills may find this an opportunity to channel low-emissions steel exports to the EU in the short-to-mid-term.

Meanwhile, China's steel production is on the decline, which may help support global prices and lead to a recovery in India's export momentum. This may also alleviate India's import burden.

Parallelly, while efforts to further muzzle imports are underway, it is yet to be seen how much of an impact they will have. Some market participants suggest imports of products not easily available domestically may also be plugged, which could adversely impact the manufacturing segments.

Overall, while both exports and imports are expected to decline, the current scenario suggests that the former may face a steeper cut y-o-y.

Source:BigMint