Posted on 22 Jul 2025

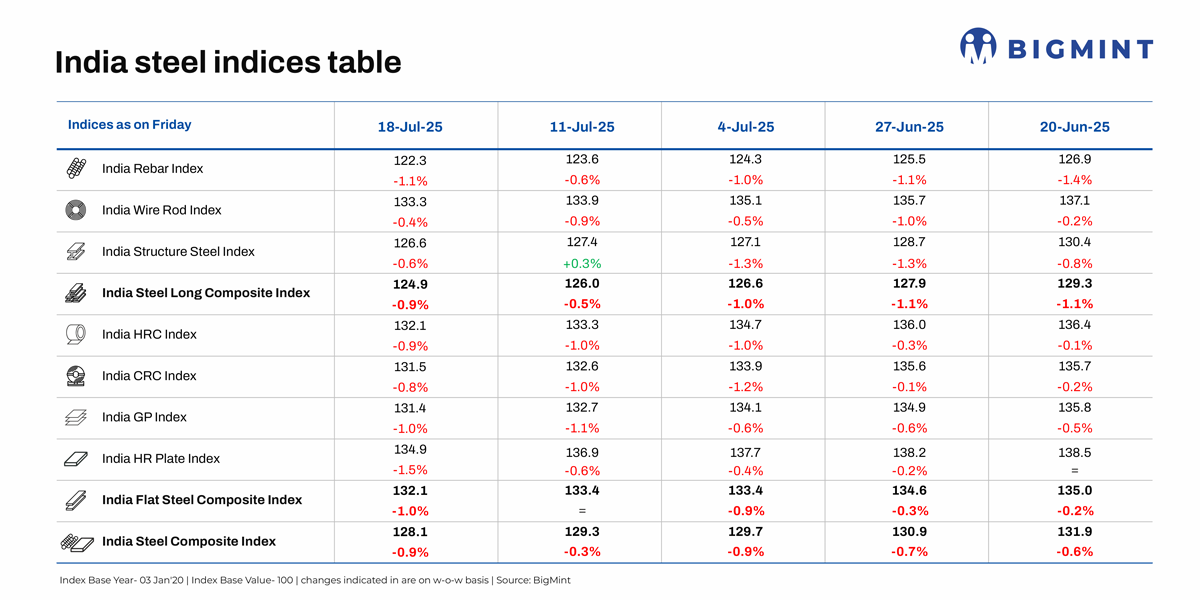

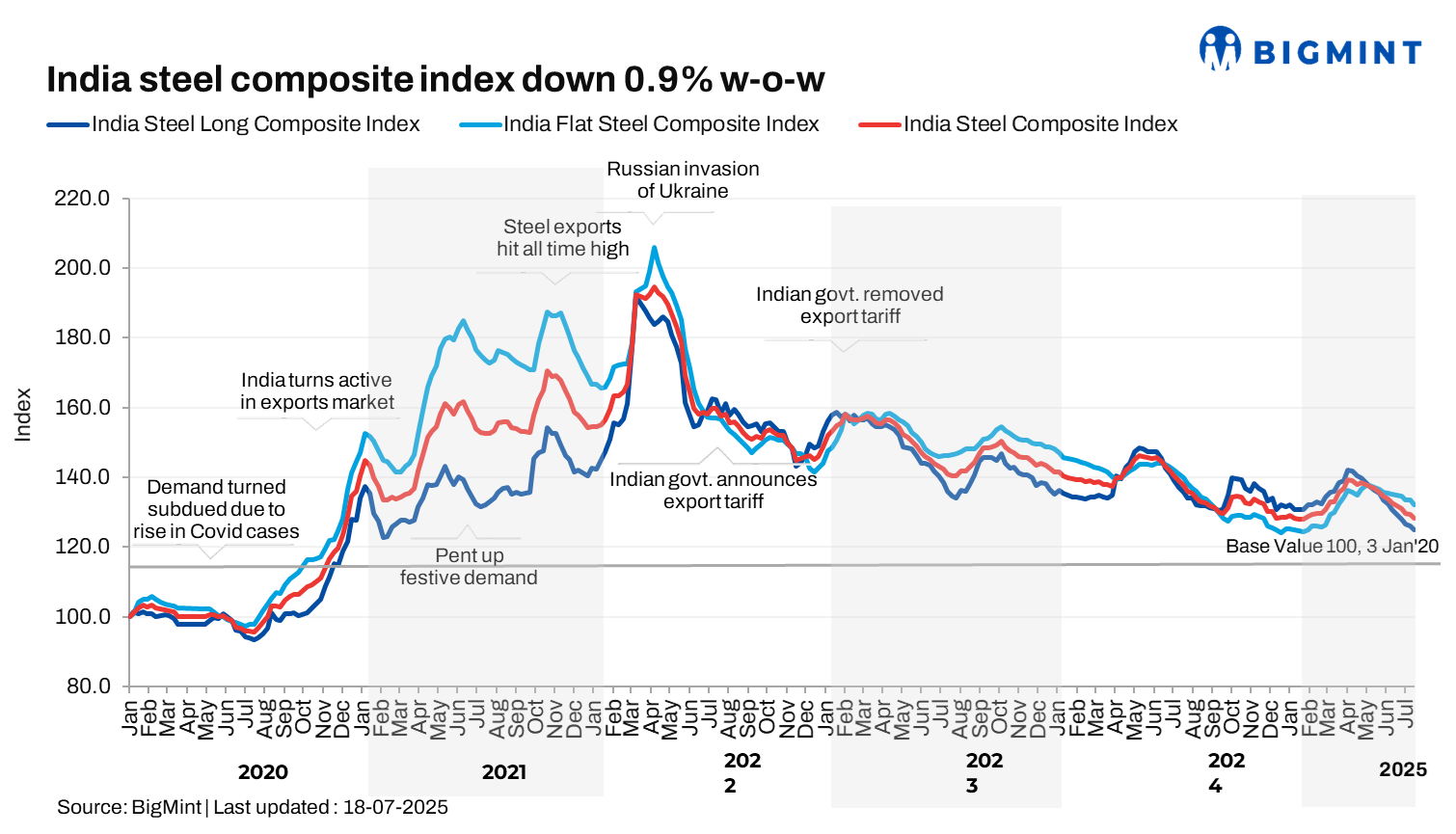

Morning Brief:BigMints flagship India steel composite index, which gauges domestic steel market movements and prices, witnessed a 0.9% w-o-w drop on 18 July 2025, with prices of key steel products continuing their downward trend. Domestic steel prices have declined to nearly four-and-a-half year lows to levels last seen during the pandemic period.

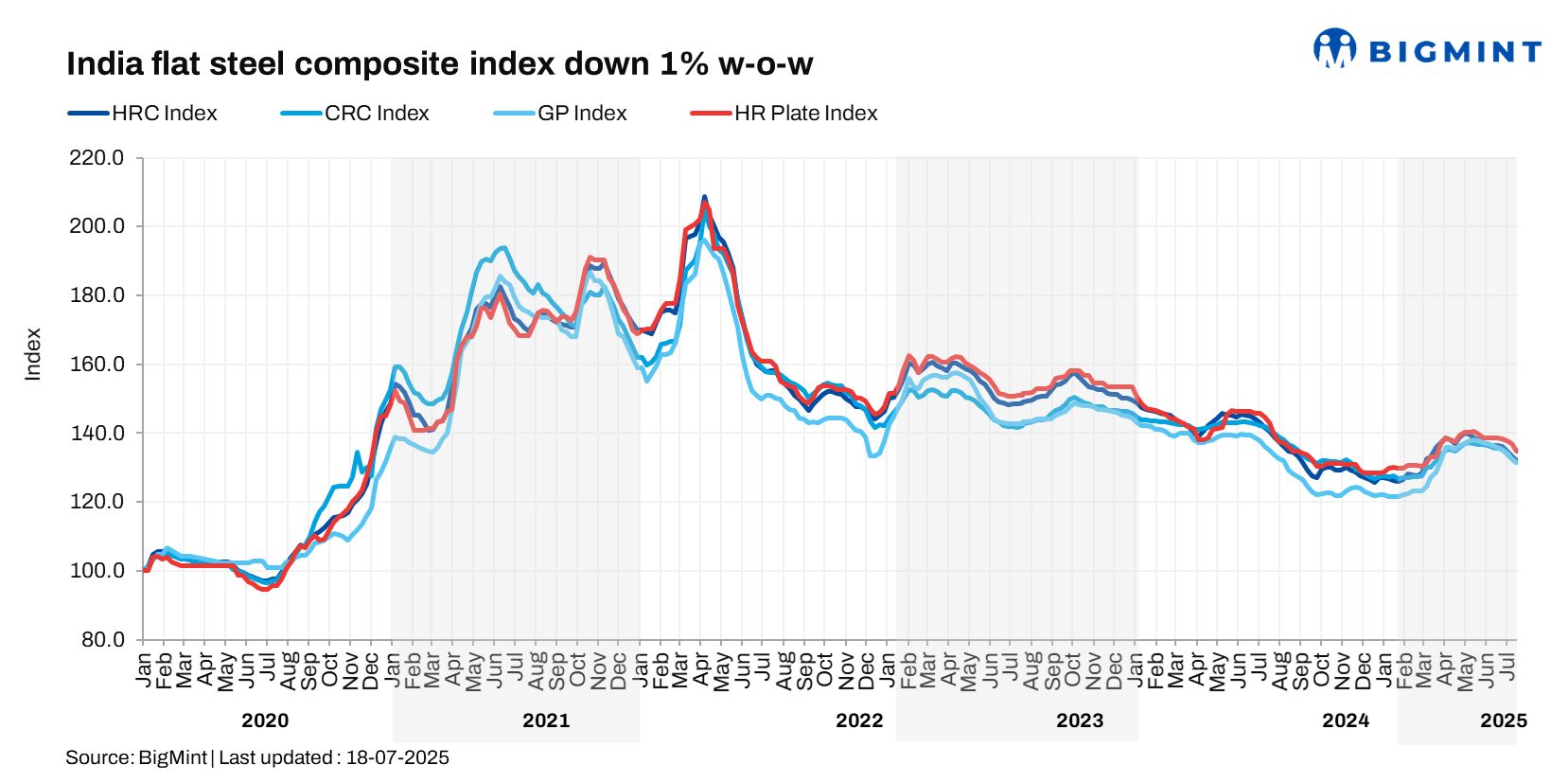

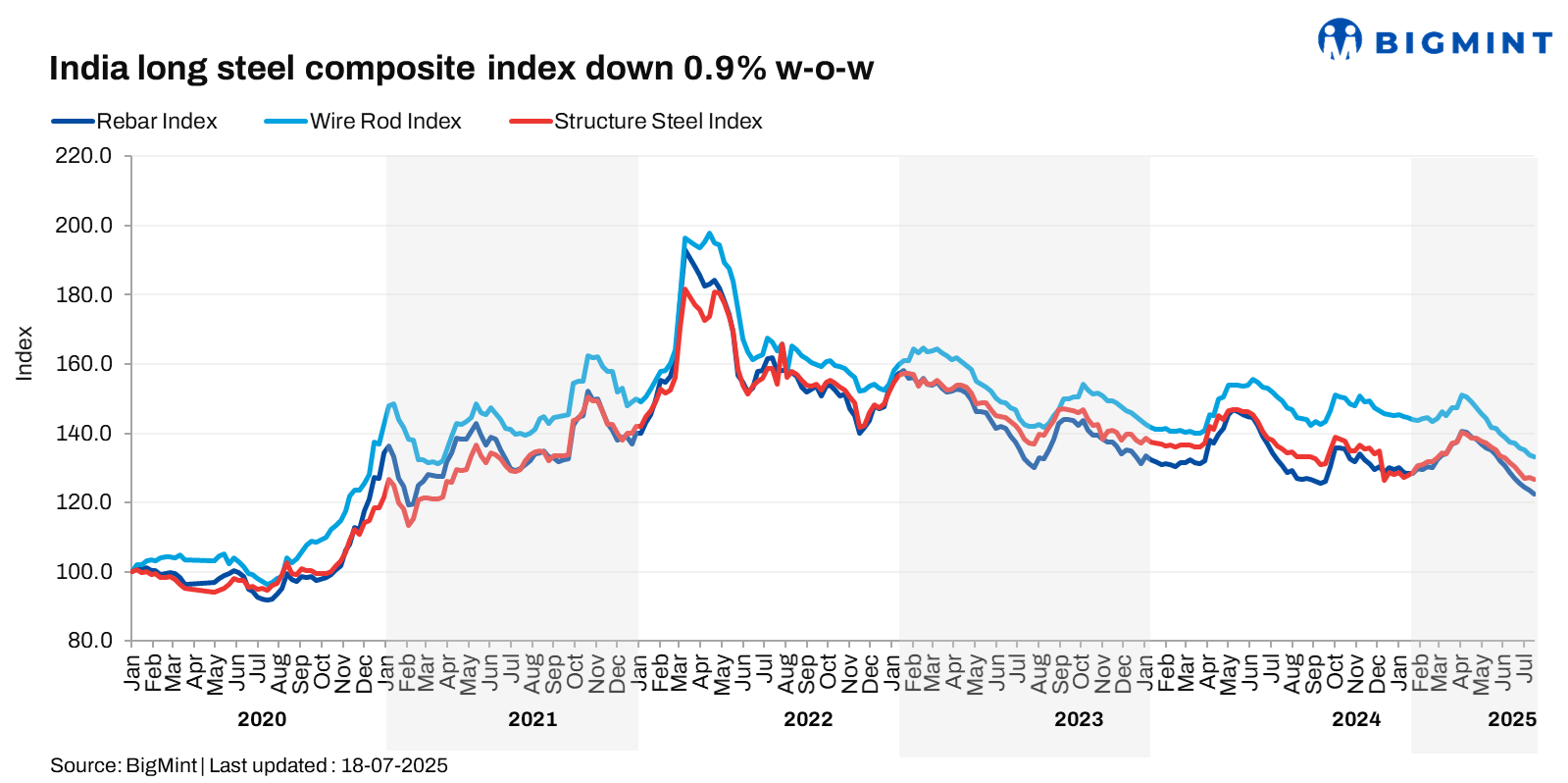

Notably, steel flats and longs both recorded w-o-w declines: the flat composite index fell by 1% w-o-w compared to 0.9% for the longs index. Clearly, the positive impact of the 12% safeguard duty imposed on steel imports in mid-April has been short-lived at best.

Analysis of price movements

HRC, CRC prices edge down:BigMints bi-weekly HRC (IS2062, Gr E250, 2.5-8 mm/CTL) assessment dropped by INR 700/t ($8/t) w-o-w to INR 49,200/t ($574/t) on 15 July against INR 49,900/t ($582/t) a week ago. CRC (IS513, Gr O, 0.9 mm/CTL) prices fell INR 500/t ($6/t) w-o-w to INR 56,000/t ($653/t). These prices are ex-Mumbai for the distributor-to-dealer segment and exclude 18% GST.

Market sentiment was subdued on dull demand, with no visible signs of recovery. Inventory with distributors remained elevated, reflecting slow offtake. Buyers preferred to wait and watch, expecting further correction in prices.

A market participant told BigMint: "The market remains under significant pressure and is showing clear signs of weakness. Given the current downward trend, prices are likely to decline further, potentially reaching pre-safeguard duty levels. Based on prevailing indicators, HRC (CTL) prices may drop to around INR 48,000/t by the end of the month."

The ongoing financial strain is becoming increasingly evident across the market. Delayed payments and tight liquidity conditions are significantly hampering purchases. In many cases, transactions are being executed on highly flexible payment terms. In addition, the growth in bulk HRC and plate imports in July also seems to be pressuring domestic prices.

Rebar prices decline:Trade-level BF rebar prices declined by INR 800/t ($9/t) w-o-w to INR 48,400/t ($562/t) exy-Mumbai on 18 July. Prices are exclusive of GST at 18%. Prices declined on weak demand, cautious market sentiment, and seasonal slowdown in trade momentum. Buyers adopted a wait-and-watch approach due to the prevailing disparity between bids and offers, while distributors aimed to offload previously procured high-cost inventories.

IF rebar prices dropped by INR 100/t ($1/t) w-o-w to INR 43,400/t ($504/t) exw-Mumbai as on 18 July. Order bookings remained subdued despite trade discounts, as buyers continued need-based procurement. Inventory levels stayed elevated at 12-15 days, keeping market sentiment weak. The BF-IF rebar price gap narrowed w-o-w to around INR 5,000-5,500/t ($58-64/t) in Mumbai.

Outlook

HRC and CRC prices may remain under pressure due to weak seasonal demand, high inventories and liquidity constraints. Buyers are cautious amid expectations of further price cuts and limited restocking interest. It is widely expected that prices may fall to INR 48,000/t levels for HRC by the end of July. On the other hand, market participants expect further correction in rebar prices, with a potential bottom likely to be reached in the near term.

Although the influx of imports had subsided from April to June, a slight increase in July has raised concerns that exporters in key countries are trying to find workarounds to evade the safeguard duty. The apprehension of dumping has intensified amid tariff wars and weak global demand and the call for doubling the duty, or raising it considerably higher, has only grown louder.

India Steel Composite Index

The India Steel Composite Index is assessed on a weekly basis, every Friday at 18:30 IST, as per the weighted average prices based on manufacturing capacity and production.

BigMint considers the Composite Index with the base year being 3 January 2020 (financial year 2019-2020) and the base value as 100. The Composite Index does not give the absolute price but a trend of the market. The Indian steel industry is broadly classified into the BF-BOF and the electric/induction furnace routes. Keeping this broad classification in view, BigMint proposes to release the Composite Index by considering both production routes by manufacturing capacity and the production weighted method to compute the index for India.

Source:BigMint