Posted on 18 Jul 2025

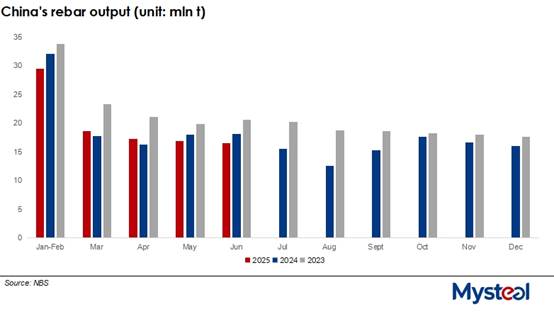

China's total rebar production dropped by 3% on year during the first half of 2025 to reach 98.3 million tonnes, widening from the 1.6% on-year decline recorded for the January-May period, according to the latest data released by the National Bureau of Statistics (NBS) on July 17.

This also meant that rebar accounted for 13.4% of China's 734.4 million tonnes of finished steel output over January-June, lower by 1.2 percentage points from the same period last year, Mysteel Global calculated based on NBS data.

In June alone, China produced 16.6 million tonnes of rebar, down 8.1% on year and 1.8% lower on month. Meanwhile, the country's finished steel output totaled 127.8 million tonnes last month, up 1.8% from a year earlier, the NBS data showed.

The rebar rolling capacity utilization rate among the 137 Chinese steelmakers that Mysteel regularly tracks echoed the NBS result, as their run rate averaged 46.9% in June, falling by 2.8 percentage points on month and by a larger 4.6 percentage points from June last year.

Market sources attributed the lower rebar output last month to the fact that many Chinese steelmakers had slowed their pace of production and conducted maintenance on steelmaking facilities in response to sluggish demand in summer and weakening domestic steel prices.

Indeed, trading activity remained muted. The spot trading volume of long steel – including rebar, wire rod and bar-in-coil – among the 237 domestic trading houses monitored by Mysteel averaged 100,392 tonnes/day last month, down 2% from May and 15.9% lower on year. Market participants cited sweltering weather and frequent heavy rains as key factors limiting construction activity and dampening buyer interest.

A major drag on long steel demand continues to be China's ailing property sector. Property investment declined by 11.2% on year in H1, deepening from the 10.7% drop in January-May. New construction starts by floor area also plunged by 20% on year during the same period, the NBS statistics showed.

On the other hand, China's spot rebar prices softened last month, with the national price of HRB400E 20mm dia rebar, for example, slipping by Yuan 19/tonne ($2.6/t) on month to Yuan 3,211/t and including the 13% VAT as of June 30, according to Mysteel's assessment.

Source:Mysteel Global