Posted on 16 Jul 2025

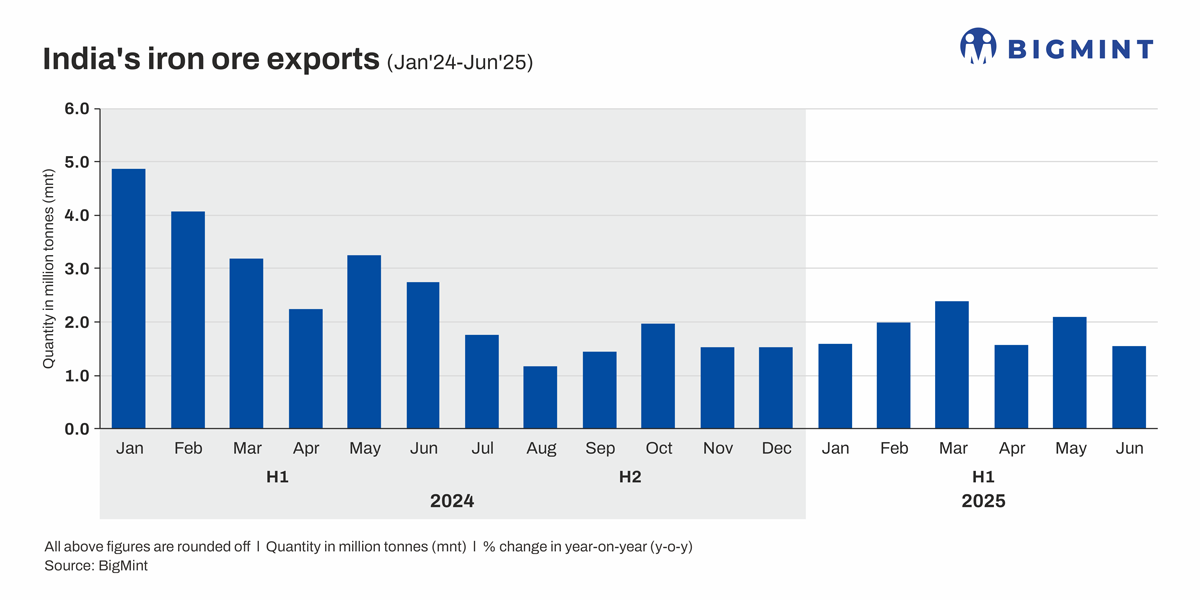

Morning Brief: India's exports of iron ore fines and lumps, predominantly fines of grades below Fe 58%, plunged 45% y-o-y in January-June 2025 (H1CY'25) to around 11 million tonnes (mnt) compared with over 20 mnt in the same period of last year, as per latest BigMint data.

In volume terms, exports of iron ore decreased by more than 9 mnt y-o-y during the six-month period and the entire reduction was due to lower demand in China which accounted for 96% of India's iron ore exports in H1CY'25.

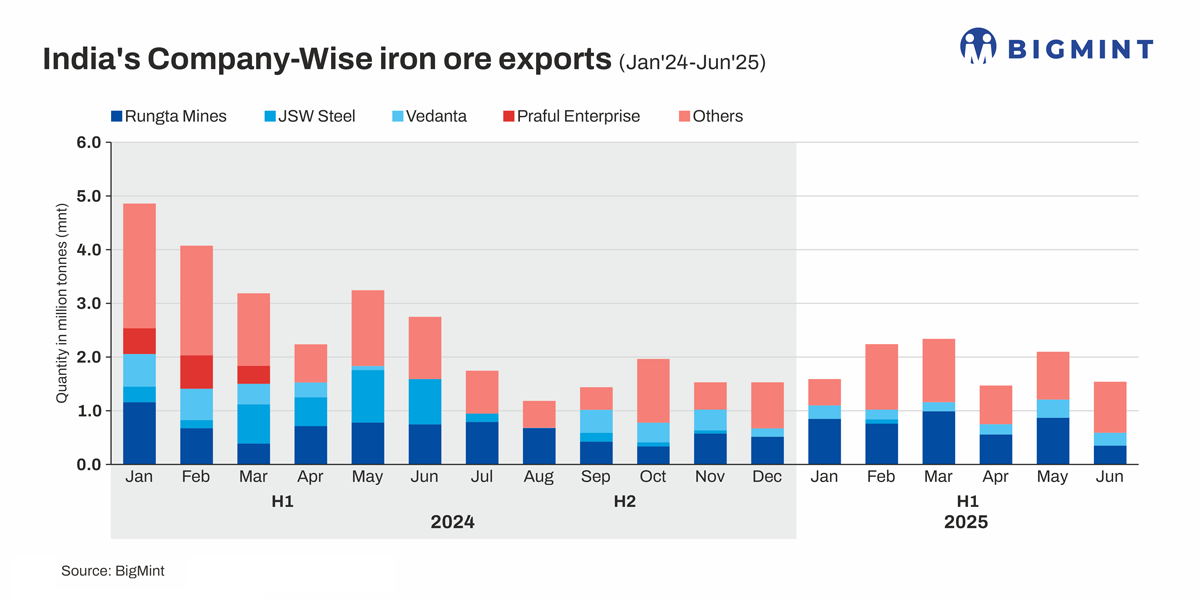

India's exports of iron ore in 2024 were around 38 mnt. The major exporters in H1CY'25 were Rungta Mines at 4.38 mnt followed by Vedanta (1.23 mnt), OCL Iron and Steel (over 1 mnt), and plenty of other players with comparatively lower volumes ranging from 0.4-0.1 mnt.

Why exports plunged in H1CY'25?

Decrease in shipments to China: Exports to China fell sharply by 46% y-o-y in H1CY'25 to 10.57 mnt compared with 19.66 mnt in the corresponding period of last year. China's crude steel production for January-May 2025 totalled 431.63 mnt, representing a 1.7% decrease compared to the same period in 2024, according to the National Bureau of Statistics (NBS).

Iron ore imports by China decreased 4% y-o-y in H1CY'25, although June was an exception. The downtrend in steel production was primarily due to a debt crisis and overcapacity in the real estate and construction sector, slowdown in infrastructure, as well as declining margins of producers. So, the steel industry downtrend was the primary reason for lower imports by China.

Export prices unviable for India: Indian (Fe 57%) export prices fell $30/t to $60/t FOB east coast in May from $90/t in January 2024. Such a steep decline put off exporters, as it significantly reduced margins and made overseas shipments unfeasible. Notably, benchmark Australian Fe 62% fines prices dropped significantly y-o-y in H1CY'25. Benchmark fines stood at over $107/t CNF China in June 2024 compared with $94/t CNF in June 2025.

The decrease in global iron ore prices increased the competitiveness of mainstream iron ore fines for Chinese buyers, with discounts widening amid the decline in the Fe 62% index. This was another reason why Indian low-grade fines, preferred by buyers because of low costs, increasingly lost favour in the Chinese market.

Outlook

Volumes to China experienced a mild recovery in May, buoyed by pre-monsoon restocking demand and the 90-day truce in the reciprocal tariff war with the US. China, which buys about 75% of global seaborne iron ore, is expected to import almost 110 mnt in June, up 11% over May imports of around 98 mnt.

Re-stocking of inventories following the decline in seaborne iron ore prices and comparatively low port inventories of around 132-133 mnt in early June boosted China's June imports.

However, the potential reduction in crude steel production in the second half of 2025, with CISA forecasting a 4% drop in output, weak steel prices, and export restrictions mean that China's steel industry is likely to face further pressure going forward. Therefore, iron ore demand is unlikely to rebound.

If global iron ore prices remain as weak as they currently are, Indian exporters of iron ore are likely to witness a slowdown in Chinese demand momentum and decrease in shipments in H2CY'25.

Source:BigMint