Posted on 16 Jul 2025

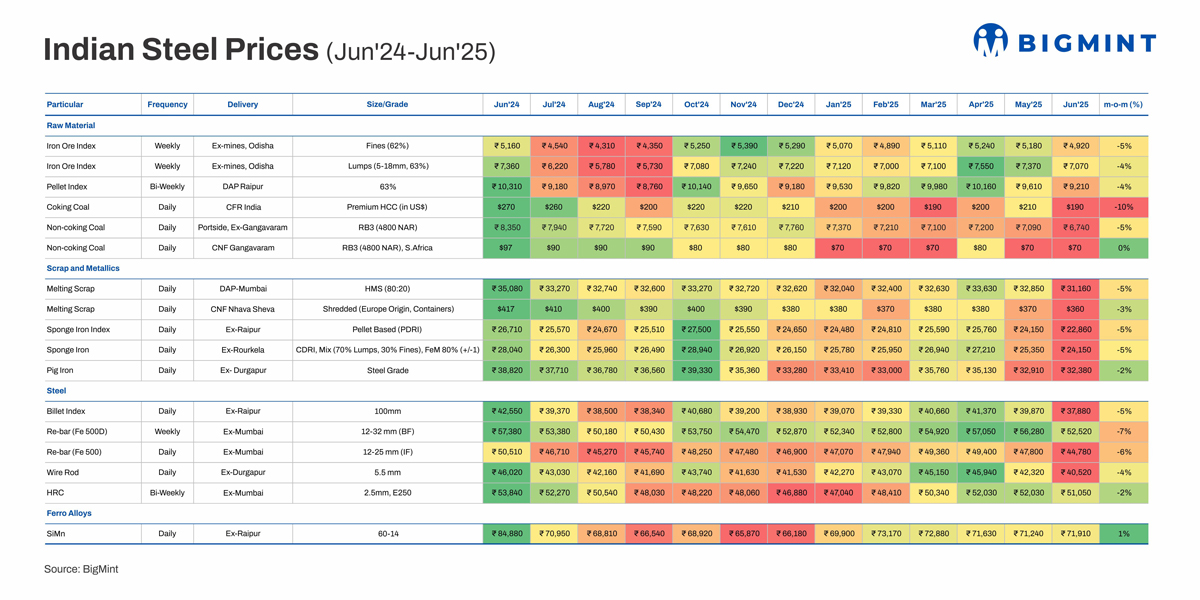

Morning Brief: Indian steel and steelmaking raw material prices trended lower in June 2025, remaining largely in the negative zone as seasonal slowdown, supply surfeit amid soft demand, and weak global steel market sentiments continued to weigh on prices.

While prices of flat products such as HRC showed a marginal correction m-o-m, longs prices, as well as those of metallics, showed a steeper decline. In fact, y-o-y comparisons reveal an even sharper downfall in domestic prices of metallics and steel - which reveals the extent of contraction that the domestic steel market is currently witnessing.

Price movements in Jun'25

Iron ore: The country's largest iron ore miner, NMDC, reduced prices of lump ore and fines by INR 140-150/t ($2/t) m-o-m on 4 June, thereby setting the tone for the entire month. Later in OMC's auction from Odisha, 2 million tonnes (mnt) were booked, with bids falling by INR 250/t ($3/t) for fines and INR 350/t ($4/t) for lumps compared to the May auction. Even as iron ore production increased marginally in May, downtrend in the steel market weighed on iron ore prices.

Pellets: Muted trade and bid-offer disparities saw BigMint's domestic index for pellets, PELLEX, eroding 4% m-o-m in June. Need-based buying amid soft steel market sentiments and competitive offers from neighbouring regions impacted prices in central India. Prices have come under further pressure owing to NMDC's price cut in early July.

Coking coal: BigMint's coking coal CFR India index witnessed a sharp $20/t m-o-m drop in June, down 10%. The index fell to a three-month low amid bearish steel market sentiment, cost-effective offers from Canada, and decline in domestic met coke prices. Successive rounds of coke price cuts in China, too, weighed on PHCC prices.

Thermal coal: South African thermal exports to India used, mainly in sponge iron production, dropped sharply by 47% to 2.02 mnt in June from 3.78 mnt in May, the lowest in four months. With sponge iron prices in key markets dropping to the lowest levels in over four years, demand for coal remained under pressure. High port stocks and sufficient allocations at domestic coal auctions resulted in a drop in inquiries for imports. However, portside prices showed a decline m-o-m, while seaborne prices remained flat.

Ferrous scrap: Both imported and domestic scrap prices edged down m-o-m in June. Apart from the overall steel market blues, a slowdown in the construction segment due to an early monsoon, availability of cost-effective alternatives such as sponge iron, and liquidity shortfalls weighed on scrap demand.

Sponge iron: The major reason behind the downfall in the Indian sponge iron market in June was the persistent weakness in demand from the finished steel segment, which led to cautious buying by the rolling mills and secondary producers. Construction activity slowed due to monsoon further curbing demand. Export orders from traditional markets like Nepal and Bangladesh remained muted, offering little support to domestic trade.

Pig iron: Pig iron prices further declined in June due to weak demand from the finished steel segment and rising inventories with producers which forced them to offer discounts to clear stocks. Recent auctions, including those by NMDC, received lower bids, reflecting subdued sentiment and limited buying interest.

Silico manganese: Domestic silico manganese (60-14) prices inched up marginally by 1% m-o-m in in Raipur as key smelters responded to oversupply by strategically curbing production, prompting localised price recoveries. These output adjustments helped ease inventory pressure and restored some balance to regional silico manganese markets.

Billet: Sluggish finished steel offtake dampened trade momentum in billets, with prices diving 5% m-o-m. Lower raw material tags also failed to provide cost support, and overall, market confidence was poor, given a slowdown in construction activity due to the early arrival of the monsoon.

Rebar: Reinforcement bar prices originating from the BF as well as IF routes fell by 6-7% m-o-m in June. Indian Tier-1 mills reduced rebar list prices by up to INR 1,500/t ($17/t) for early-June deliveries as against prices prevailing in end-May. Rebar inventories at Tier-1 mills increased by approximately 10% m-o-m in early-June. Declining prices and subdued demand posed challenges for mills in securing new orders.

Wire rod: Wire rod prices dropped 4% m-o-m in June after a steeper decline in May. Weak downstream demand, lack of momentum in government infrastructure projects, as well as inventory liquidation by suppliers led to the sustained downtrend in prices.

HRC: While mills kept their HRC, CRC list prices unchanged for June, prices in the trade segment fell due to a combination of softening demand and the early arrival of monsoon. The onset of monsoon prompted market participants to reduce inventory levels by selling existing stocks. This proactive destocking was driven by expectations of decreased demand during the monsoon period.

Outlook

India's steel imports are on a downward trajectory after falling sharply y-o-y in April-May. The support offered by the safeguard duty explains why flat steel prices showed only a marginal decline in June despite the overall gloomy scenario. Restrictions imposed on input materials for steel imports will result in further tightening of imports, thereby supporting domestic prices.

In the longs segment, the impact of the seasonal slowdown will take some time to lift, while gradual inventory drawdown might lead to a partial recovery in the near term even as prices bottom out.

NMDC has revised iron ore prices downward for July, thereby setting the tone for pellets and metallics prices. The downtrend in steelmaking raw material prices is likely to continue in July.

Source:BigMint