Posted on 16 Jul 2025

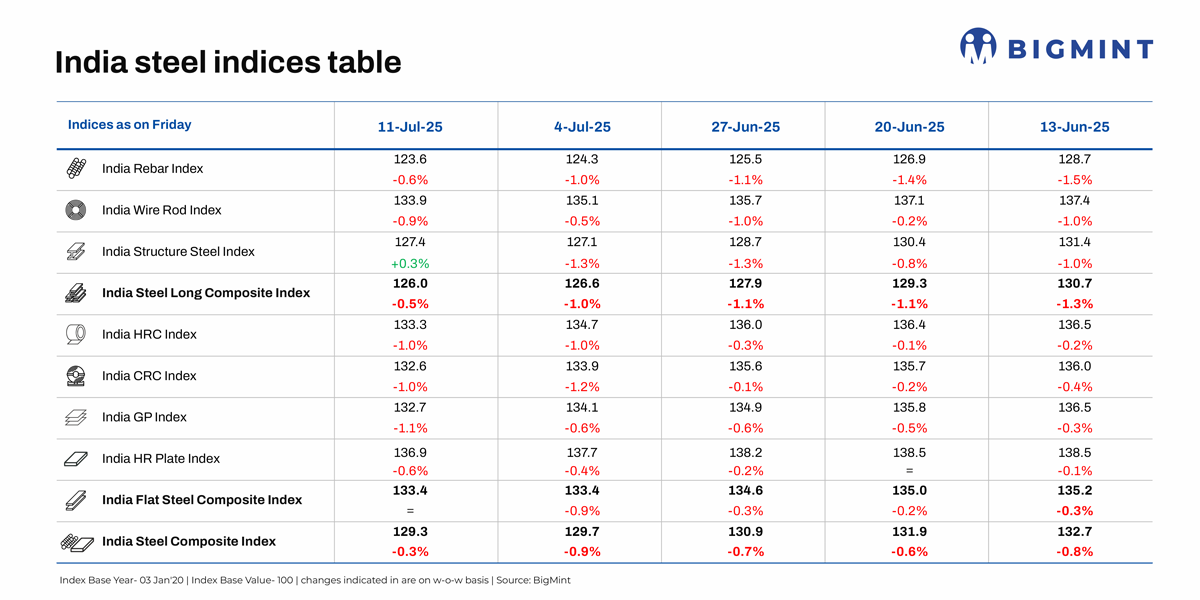

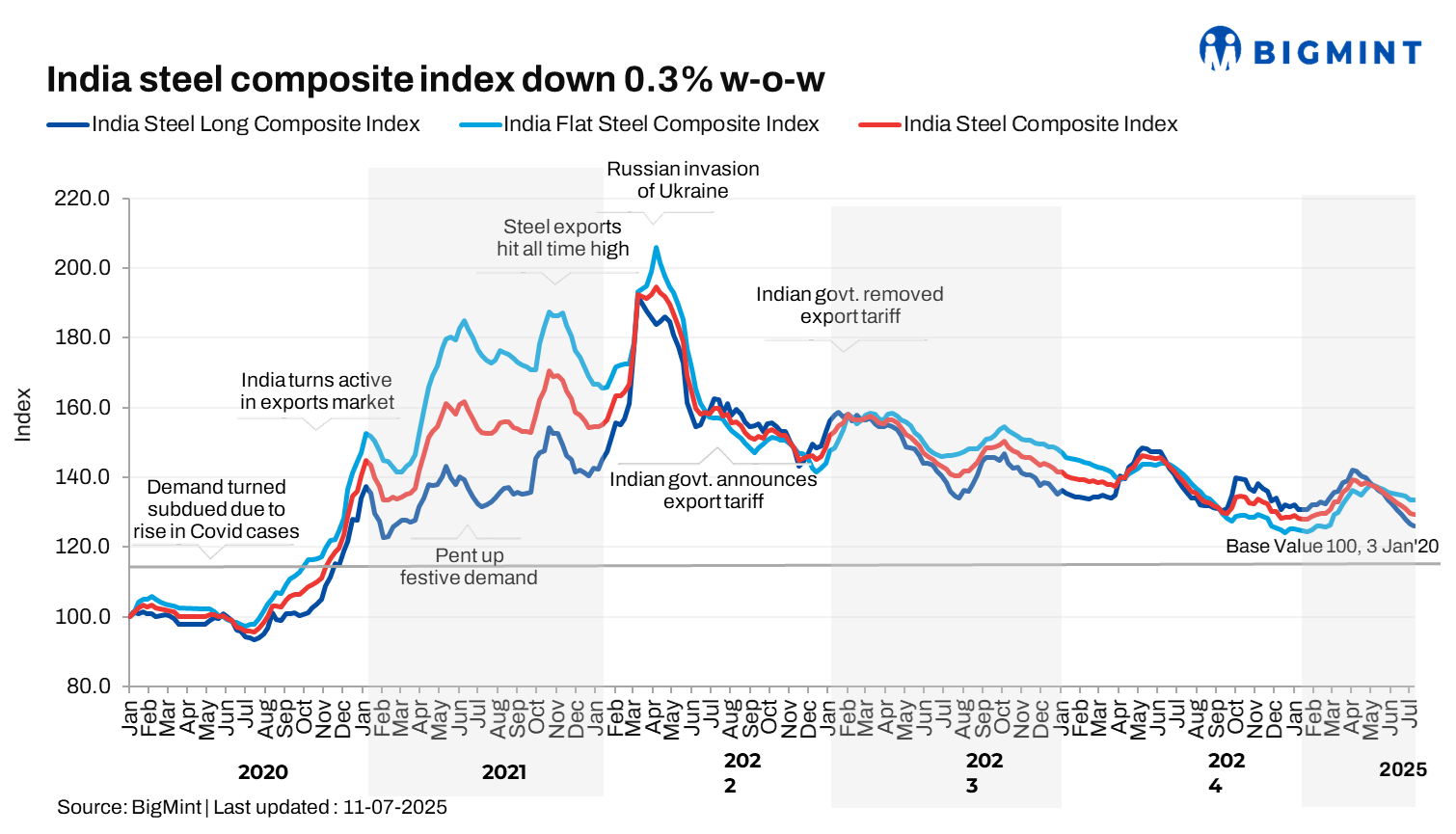

Morning Brief: BigMint's India steel composite index, a barometer of the domestic market and steel prices, edged down by 0.3% w-o-w on 11 July 2025, reflecting a steady downtrend in the domestic steel market.

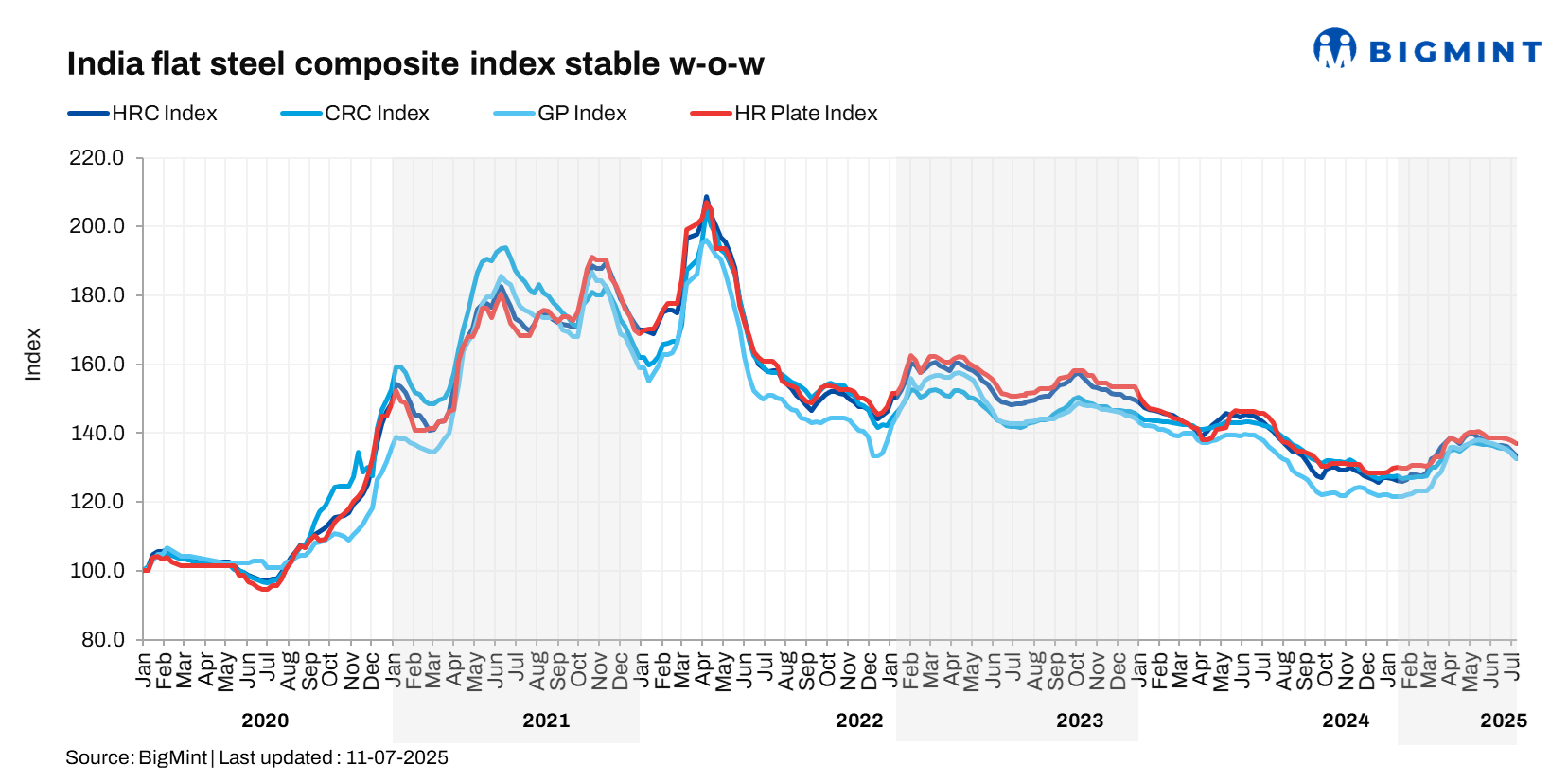

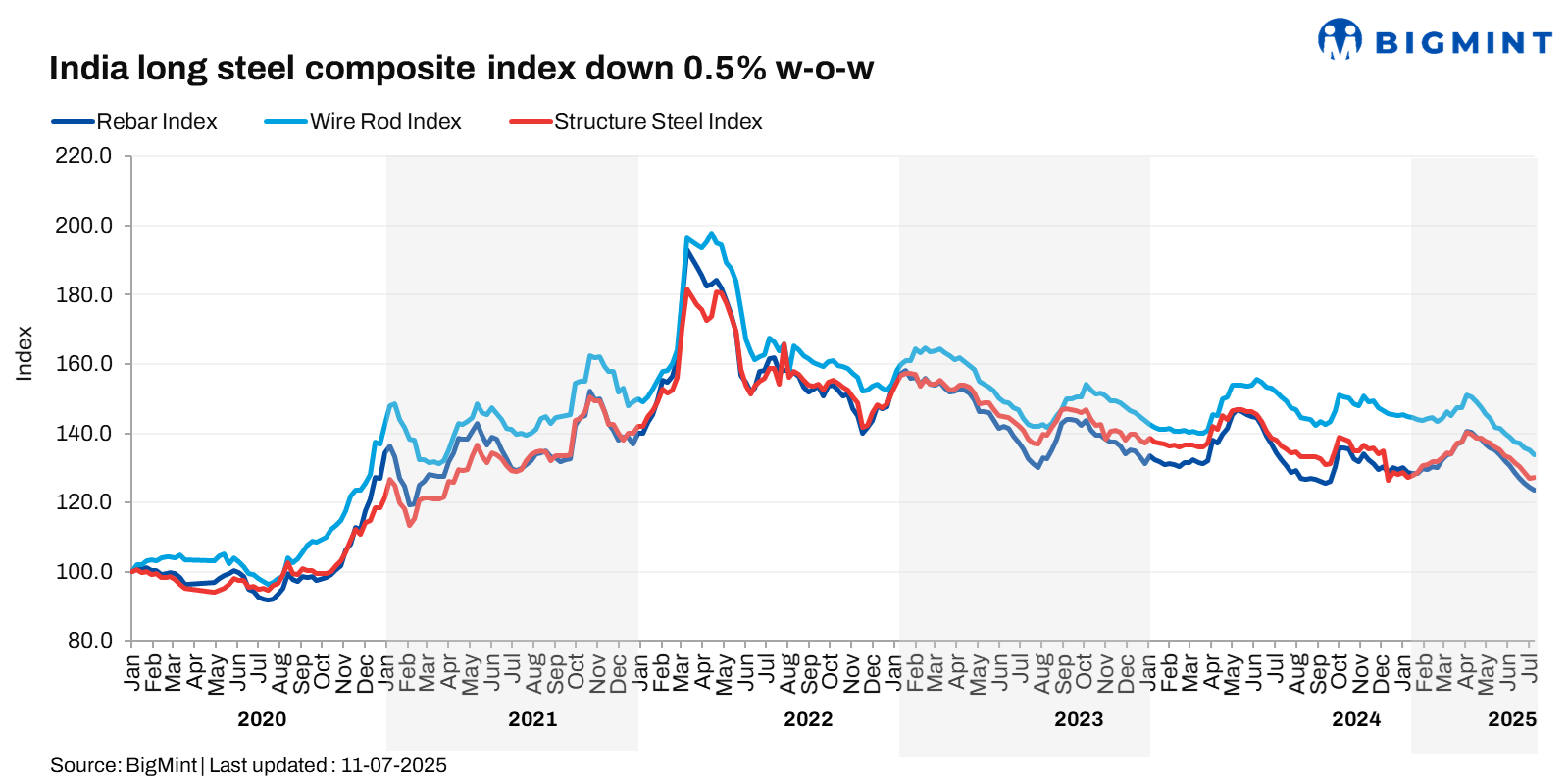

While the HRC and CRC indices fell by 1% each, the longs composite index dropped 0.5%. Prices remained under pressure amid seasonal downturn and weakening global steel prices.

The index was assessed at 129.3 points on 11 July. Except for a brief spell in January-February this year, such low levels had last been seen during the pandemic period in December 2020. So, steel prices are sliding to almost four-and-a-half-year lows - showing both the extent and depth of the slump in the market and increased pressure on domestic producers.

Analysis of price movements

HRC prices drop: BigMint's benchmark assessment for HRCs (IS2062, Gr E250, 2.5-8 mm/CTL) dropped by INR 500/t ($6/t) w-o-w to INR 49,900/t ($582/t) on 8 July. CRC (IS513, Gr O, 0.9 mm/CTL) prices declined by INR 400/t ($5/t) w-o-w to INR 56,500/t ($659/t). These prices are ex-Mumbai for the distributor-to-dealer segment and exclude 18% GST.

Heavy monsoon rainfall in different part of the country impacted trade, leading to a downturn in demand across most sectors.

"The market is currently experiencing a challenging phase," a market participant told BigMint. "The earlier optimism surrounding the potential implementation of the safeguard duty has subsided, resulting in the erosion of most of the recent price gains. Buyer enquiries have slowed while credit realisation cycles are extending beyond normal timelines, indicating liquidity pressure," he added.

Earlier in July, the Tier-1 mills had rolled over HRC prices for the month amid tepid demand.

HRC export prices stable w-o-w: Indian HRC export offers to the EU remained stable w-o-w at $595/t CFR Antwerp ($545/t FOB main port India). A deal of 40,000 t was heard concluded at $600/t CFR Antwerp for August shipment. However, Europe's HRC market remained bearish as of early-July, with ample domestic and import supply squeezing margins.

Indian mills also maintained a cautious stance towards exporting to the Middle East due to stronger domestic realisations, competitive Chinese offers, and geopolitical uncertainty.

BF rebar trade prices edge down:Trade-level BF rebar prices declined by INR 700/t ($8/t) w-o-w to INR 49,200/t ($573/t) exy-Mumbai, as per BigMint's assessment on 11 July. Prices are exclusive of GST at 18%. Buyers stayed on the sidelines, purchasing only for urgent requirements amid the continuous drop in prices.

IF rebar prices show mixed trends: IF rebar trade prices showed mixed trends w-o-w across markets amid limited trade activities. Prices were stable at INR 43,000/t ($501/t) exw Mumbai. Inventories stayed elevated at 12-15 days, keeping market sentiment weak. There were production cuts in some regions due to maintenance shutdowns.

Outlook

Indian steel prices remain under pressure as weak demand and heavy monsoon rains continue to slow trading activity across markets. With limited buyer interest and no signs of demand recovery, sentiment remains bearish.

As monsoon rainfall disrupts logistics, flat steel distributors in key markets face subdued activity and limited inquiries from downstream sectors such as appliances, construction, and infrastructure. Consumer goods sales are reported to be below expectations, and industrial product demand is also notably low.

On the other hand, amid high inventories in the longs segment, market participants are apprehending a further slide in prices.

India Steel Composite Index

The India Steel Composite Index is assessed on a weekly basis, every Friday at 18:30 IST, as per the weighted average prices based on manufacturing capacity and production.

BigMint considers the Composite Index with the base year being 3 January 2020 (financial year 2019-2020) and the base value as 100. The Composite Index does not give the absolute price but a trend of the market. The Indian steel industry is broadly classified into the BF-BOF and the electric/induction furnace routes. Keeping this broad classification in view, BigMint proposes to release the Composite Index by considering both production routes by manufacturing capacity and the production weighted method to compute the index for India.

Source:BigMint