Posted on 16 Jul 2025

Morning Brief: Steel major ArcelorMittal recently announced that all commissioning work at its hydrogen (H2)-based direct reduction (DR) plants in Germany would remain suspended as the market scenario (especially volatile energy prices) was not conducive to the commercial adoption of green hydrogen. Steelmaker ThyssenKrupp, too, previously warned that H2 was still not a viable solution in Europe.

Of course, energy inflation in Europe after the outbreak of the Russia-Ukraine war has been a major concern for the steel industry. However, industry watchers have questioned ArcelorMittal's delay in implementing a fit-for-the-future technology such as H2-DRI citing short-term challenges in the steel industry such as energy inflation, overcapacity and deterioration in prices and profits.

Even though emerging technologies such as battery electric vehicles have given hydrogen fuel cells a run for their money in the mobility sector, the role of H2 as the fuel of the future in the hard-to-abate sectors such as global shipping and iron and steel remains undoubted.

Interestingly, in contrast to Europe, Indian renewable energy prices have dropped dramatically over the last decade, thereby creating potential for green H2.

How green is hydrogen?

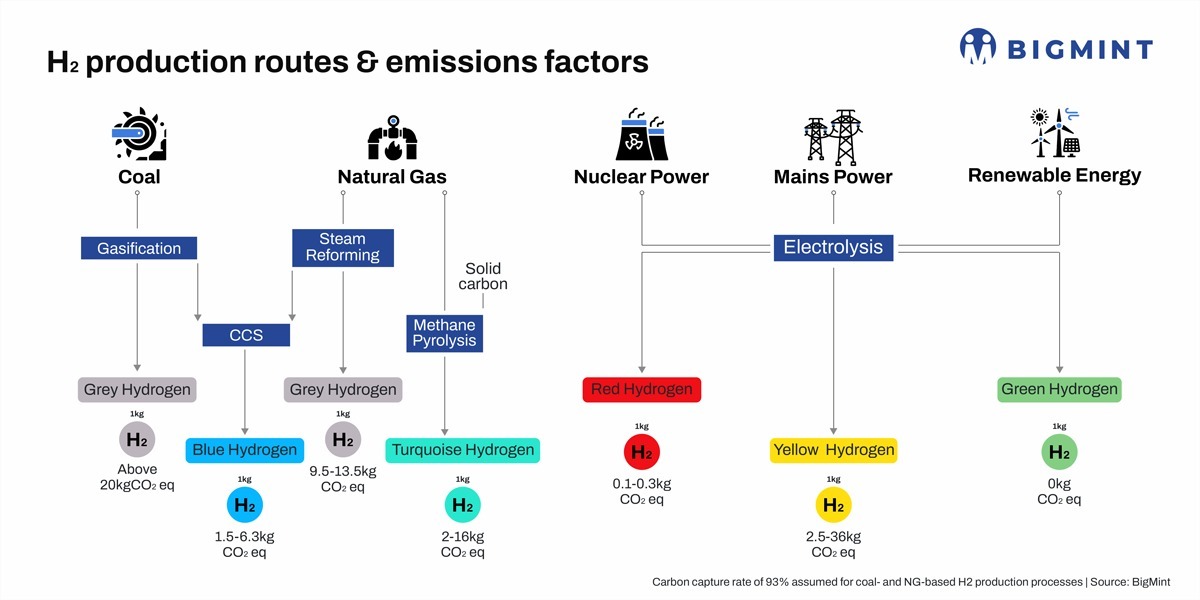

The disturbing fact is that only 4% of global hydrogen production today is through electrolysis, the rest being accounted for by steam methane reforming (48%), oil reforming (30%) and coal gasification (18%), as per International Renewable Energy Agency (IRENA).

Low-emission hydrogen is being taken up very slowly in existing applications, accounting for just 0.7% of total hydrogen demand and 1% of global hydrogen production in 2023.

Cradle-to-gate emissions accounting is necessary to calculate the upstream emissions associated with hydrogen production. For example, natural gas (NG)-based hydrogen production has the emissions-intensive oil and gas supply chain and methane leakage associated with it. Even if 100% of CO2 capture in blue hydrogen production is made possible, still CO2 equivalent emissions will be over 2kgCO2e/kgH2.

On the other hand, producing hydrogen via water electrolysis through the use of direct grid electricity (yellow hydrogen) in geographies with a high grid emissions factor like India (0.7 tCO2/MWh) will increase emissions from hydrogen production many times.

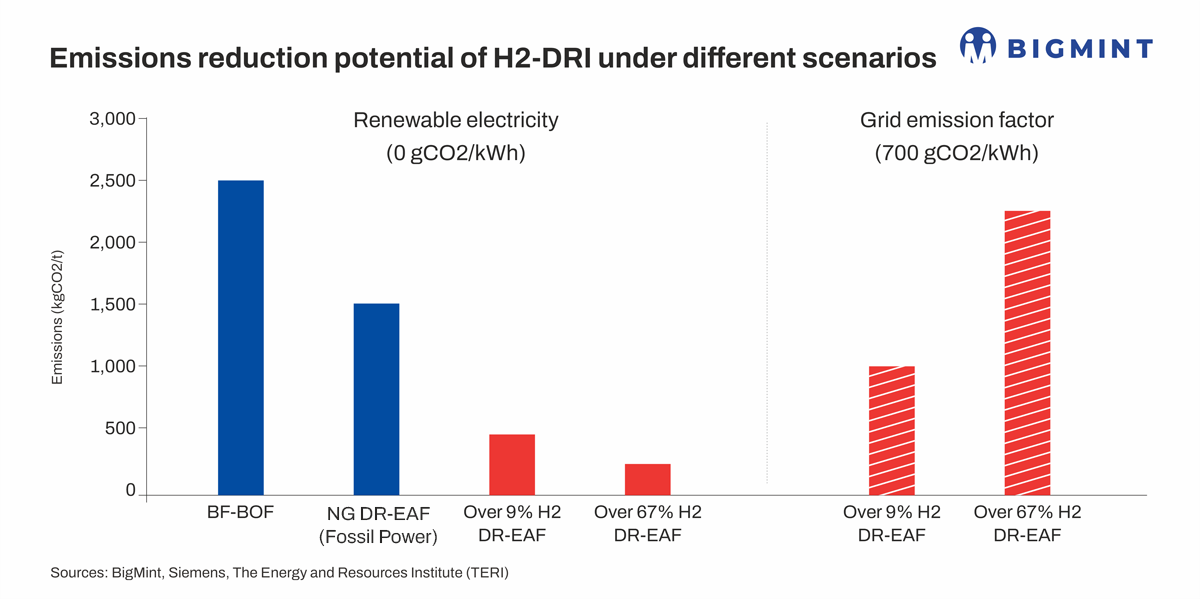

Therefore, the use of green H2 is essential to decarbonise iron production. The top graph shows that even over 67% of H2 blending in shaft furnace gas feedstock will not yield any meaningful reduction in carbon emissions due to the high grid emissions factor of India. So, renewable electricity is of the essence.

Key challenge for India

India's Ministry of New and Renewable Energy (MNRE) has established a definition for green hydrogen which specifies that well-to-gate emissions (i.e., including water treatment, electrolysis, gas purification, drying and compression of hydrogen) must be limited to 2 kgCO2e/kgH2.

The National Green Hydrogen Mission envisages development of green hydrogen production capacity of at least 5 million tonnes (mnt) per annum by 2030 for the abatement of 50 mnt of carbon emissions, with renewable energy capacity expected to touch 500 GW from around 190 GW today.

It takes roughly 50 MWh of non-fossil electricity to produce 1 tonne of hydrogen. Back-of-the-envelope calculations suggest that 5 mnt of hydrogen will require 5,000,000 x 50 = 250,000,000 MWh, or 250 TWh of clean electricity. For perspective, this was around 14% of India's total electricity consumption in 2024.

"Of course, we need to take into account that electrolyser efficiency will increase by 2030. Nevertheless, approximately 250 TWh of clean electricity means 115 GW of wind + solar at a blended combined utilisation factor (CUF) of 25%, a green energy expert informed BigMint.

In a country where direct electrification needs are huge, roughly 115 GW of clean electricity just for production of hydrogen or derivative green fuels is indeed a massive challenge.

Cost factor

To produce virgin metallics (DRI or HBI) from lump iron ore or pellets require approximately 650 Nm of hydrogen (or 58 kg) per tonne of DRI. The Ministry of Steel estimates that if 65% of the 198 kg (261 scm) per tcs of natural gas at $8/MMBtu is replaced with 41.5 kg/tcs of green hydrogen then the cost escalation per tonne of steel would be 5.5% by 2030-2031 under the base case scenario.

Hydrogen has the potential to replace 65-70% of natural gas consumption in a shaft furnace, depending on the technology adopted. The breakeven price of hydrogen ranges from $0.75-2.02/kg for a natural gas price of $8-18 per MMBtu.

However, for the BF-BOF route the breakeven price of H2 is much lower at around $0.48-0.88/kgH2.

As per the Ministry of Steel, considering that the industry will use green hydrogen only when breakeven prices are achieved and that there are no other policy interventions to support the industries meet their escalated production cost, uptake of green hydrogen will happen only if its cost reduces to below $ 1 per kgH2.

The theoretical H2 demand of 3.5 mnt/year in the steel industry by 2030-31 would require nearly 70 GW of RE capacity and 28 GW of electrolyser capacity, according to the Ministry.

Source:BigMint