Posted on 16 Jul 2025

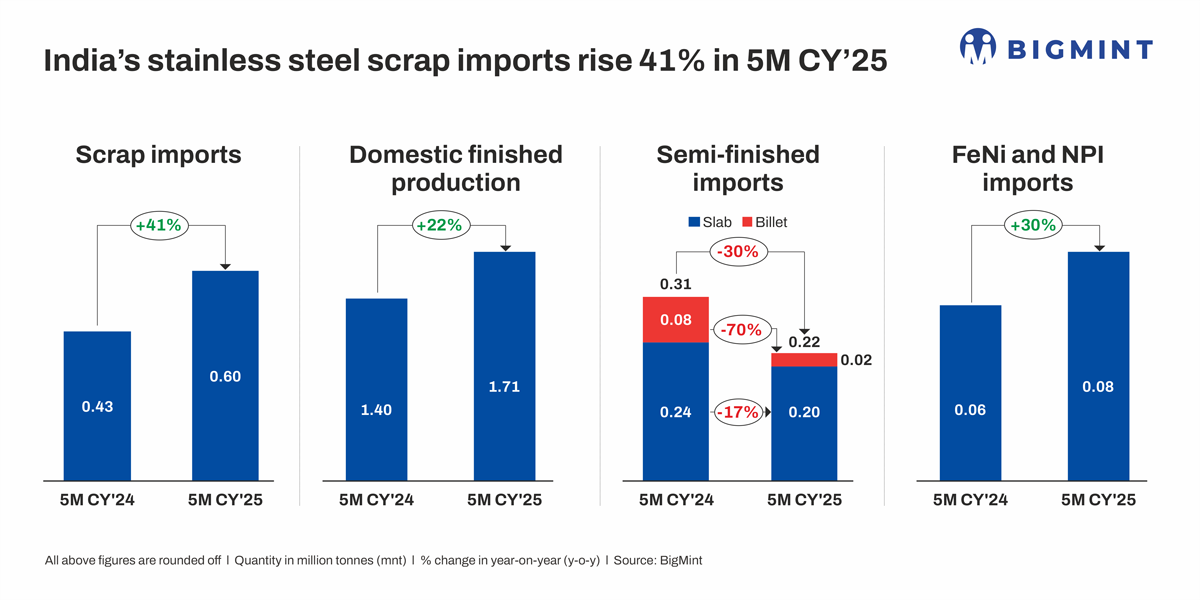

Morning Brief: India's stainless steel sector witnessed a remarkable surge in scrap imports during the first five months of calendar year 2025 (5MCY'25). As per BigMint data, total stainless steel scrap imports reached 0.602 million tonnes (mnt), marking a sharp 41% increase compared to 0.426 mnt in the corresponding period last year.

This sharp rise in scrap imports coincided with a decline in arrivals of semi-finished products like slabs and billets, prompting greater use of scrap and raw materials such as ferro nickel to support production. Notably, Indonesia, a key supplier, saw its exports of semi-finished products and ferro nickel to India decline during this period.

Series & grade-wise imports

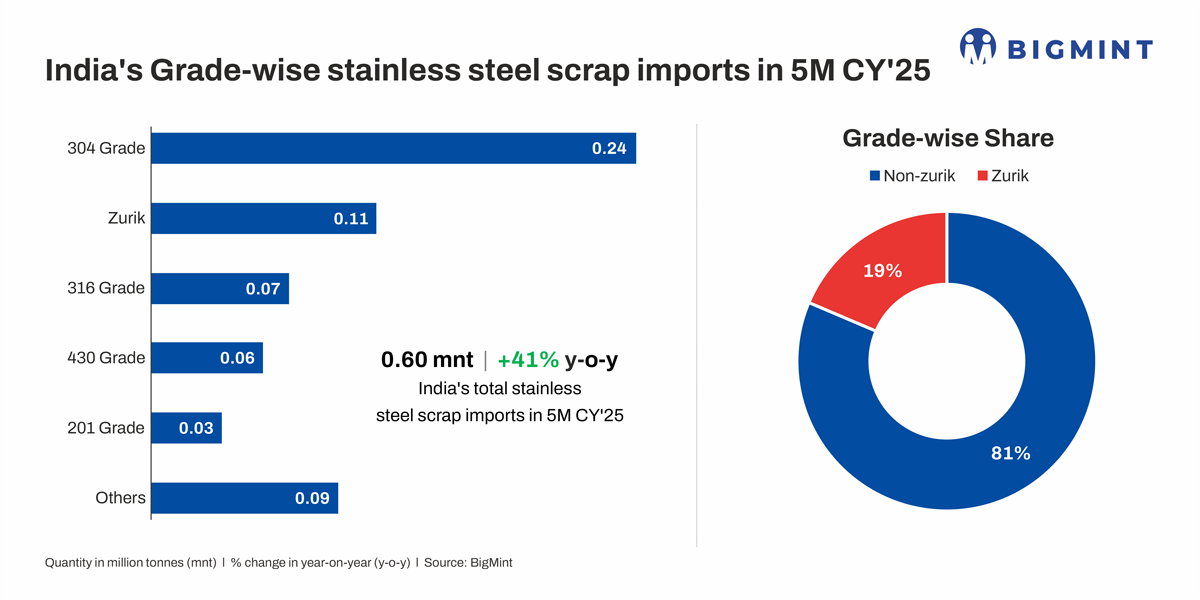

Data shows that 300-series scrap dominated the market, accounting for 0.431 mnt of total imports in 5MCY'25, a substantial 56% increase from the previous year. Imports of 200-series scrap increased by 8% to 47,000 t, as per data, while 400 series saw a 6% rise in imports to reach 79,000 t.

Grade-wise, imports of 304 grade scrap surged 72% to 0.239 mnt, while zurik rose by 24% to 0.111 mnt. Imports of 316 grade increased sharply by 75% to 68,000 t. Imports of 430 and 201 grades edged up by 4.4% and 10%, respectively, while other grades increased by 26%, reflecting broad-based demand across grades.

Country-wise imports

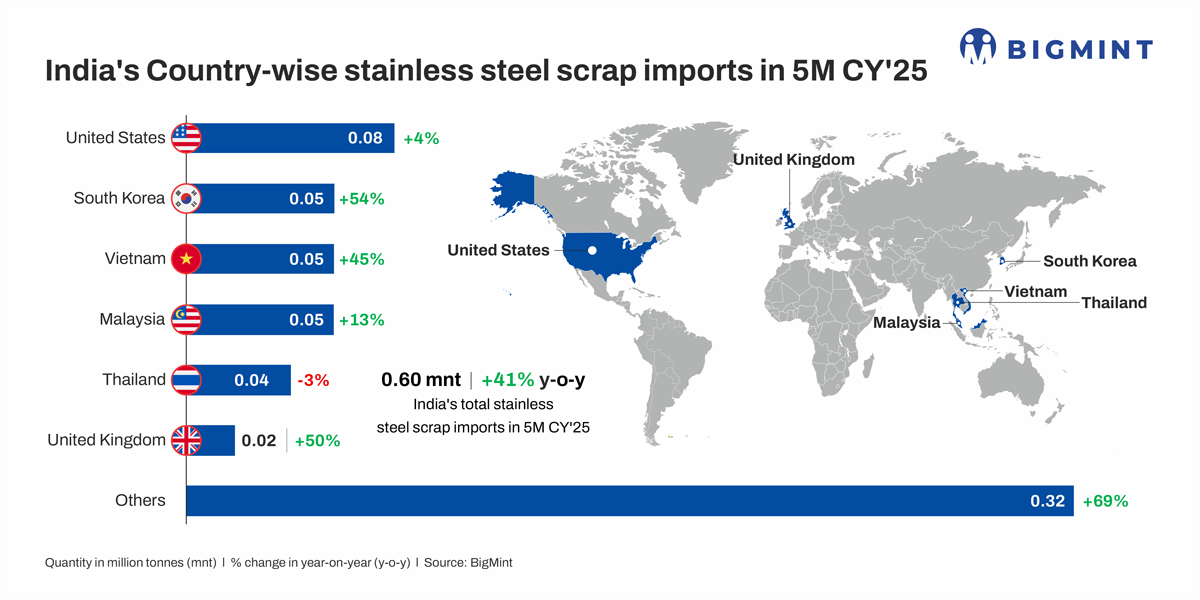

The United States remained the top supplier, with imports rising 4% to over 76,000 t. Vietnam and South Korea posted even stronger growth in stainless steel scrap exports to India of 45% and 53% respectively, as Indian buyers sought to diversify their sourcing and capitalise on competitive offers. Imports from Malaysia and the United Kingdom also saw double-digit growth; however, Thailand registered a slight decline.

Why SS scrap imports surged in 5MCY'25

Growth in domestic production: India's stainless steel production posted robust growth in the first five months of 2025. Total output reached 1.71 mnt, marking a 22% increase compared to 1.41 mnt during the same period last year.

This growth was driven by an 18% rise in flats production, which climbed to 1.18 mnt, and a notable 30% surge in longs output, reaching 0.53 mnt. Higher domestic production triggered increased scrap imports.

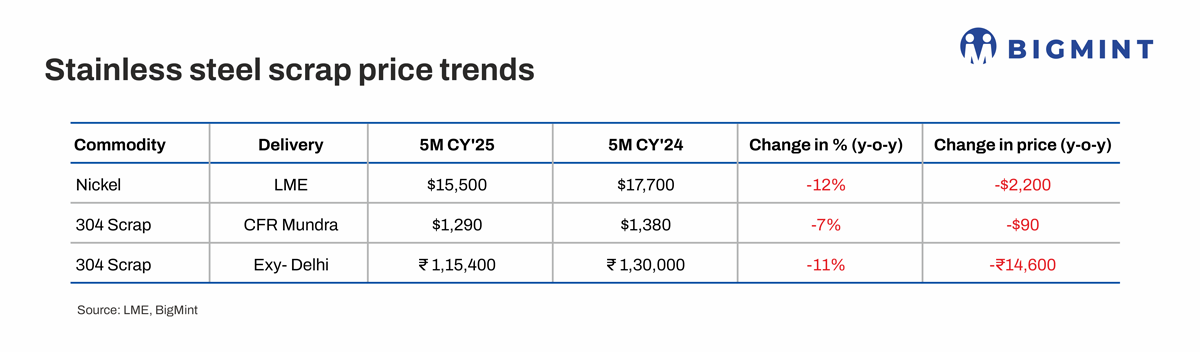

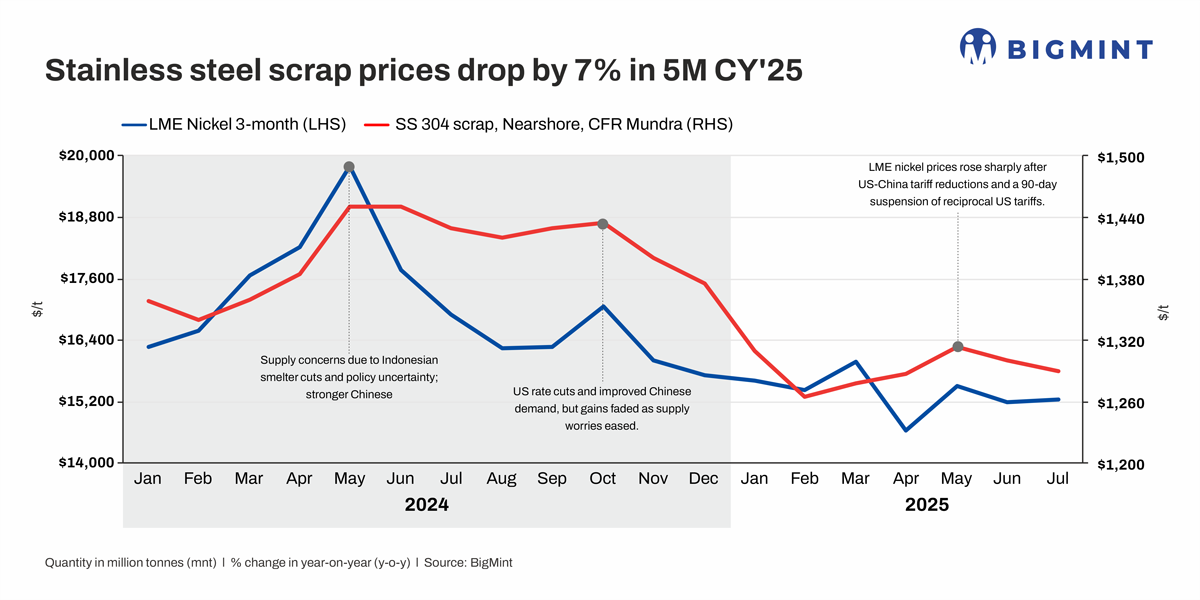

Declining imported scrap prices: Imported scrap prices averaged $1,280-90/t in 5MCY'25, down 6% y-o-y. Domestic 304 scrap prices also fell by 11% y-o-y to INR 115,000-116,000/t. The decline in global prices was largely driven by a 13% drop in LME nickel prices, which averaged $15,491/t during the period, as global nickel inventories swelled by 154% to 189,226 t.

These price trends made imported scrap more attractive, as the landed cost of imported scrap remained INR 2,000-3,000/t lower than domestic material, prompting mills to source imported scrap.

Sharp drop in imports of semis: India's imports of semi-finished stainless steel products saw a notable decline in 5MCY25, with slab imports falling 17% to 0.197 mnt and billet imports plunging 70% to just 22,000 t.

In contrast, imports of ferro-nickel, a key substitute for scrap in stainless steel production, rose by 30% to 79,000 t. Indonesian ferro nickel imports dropped by 20% to 0.468 mnt in 5MCY'25.

Indonesian policy shifts affect exports: Indonesia's plans to reduce nickel mine quotas in 2025, coupled with rising domestic demand for nickel, have led to a decline in exports of semi-finished products and ferro nickel to India during the first five months of the year. Global ferro nickel production has also slowed, while Indonesian suppliers are increasingly prioritising their domestic smelting industry.

These factors have resulted in a noticeable drop in Indonesian ferro nickel and slab arrivals in India, impacting raw material sourcing for Indian mills and boosting the demand for scrap.

Outlook

Indian stainless steel scrap imports had dropped marginally in FY'25 to 1.3 mnt due to higher arrivals of semis at competitive prices. However, in 5MCY'25 there has been a trend reversal of sorts.

Notably, US exports have edged up by only 4% during the period. This is a matter of concern. With 50% tariffs on steel imports, the domestic steel industry in the US is expected to witness higher production in the near term which would require more scrap and thus leave little for exports.

On the domestic front, however, the outlook for the downstream segment remains subdued, as demand continues to remain sluggish during monsoon. Market participants anticipate limited activity until seasonal conditions improve, with a potential recovery expected as infrastructure and construction projects regain momentum post monsoon.

Source:BigMint