Posted on 16 Jul 2025

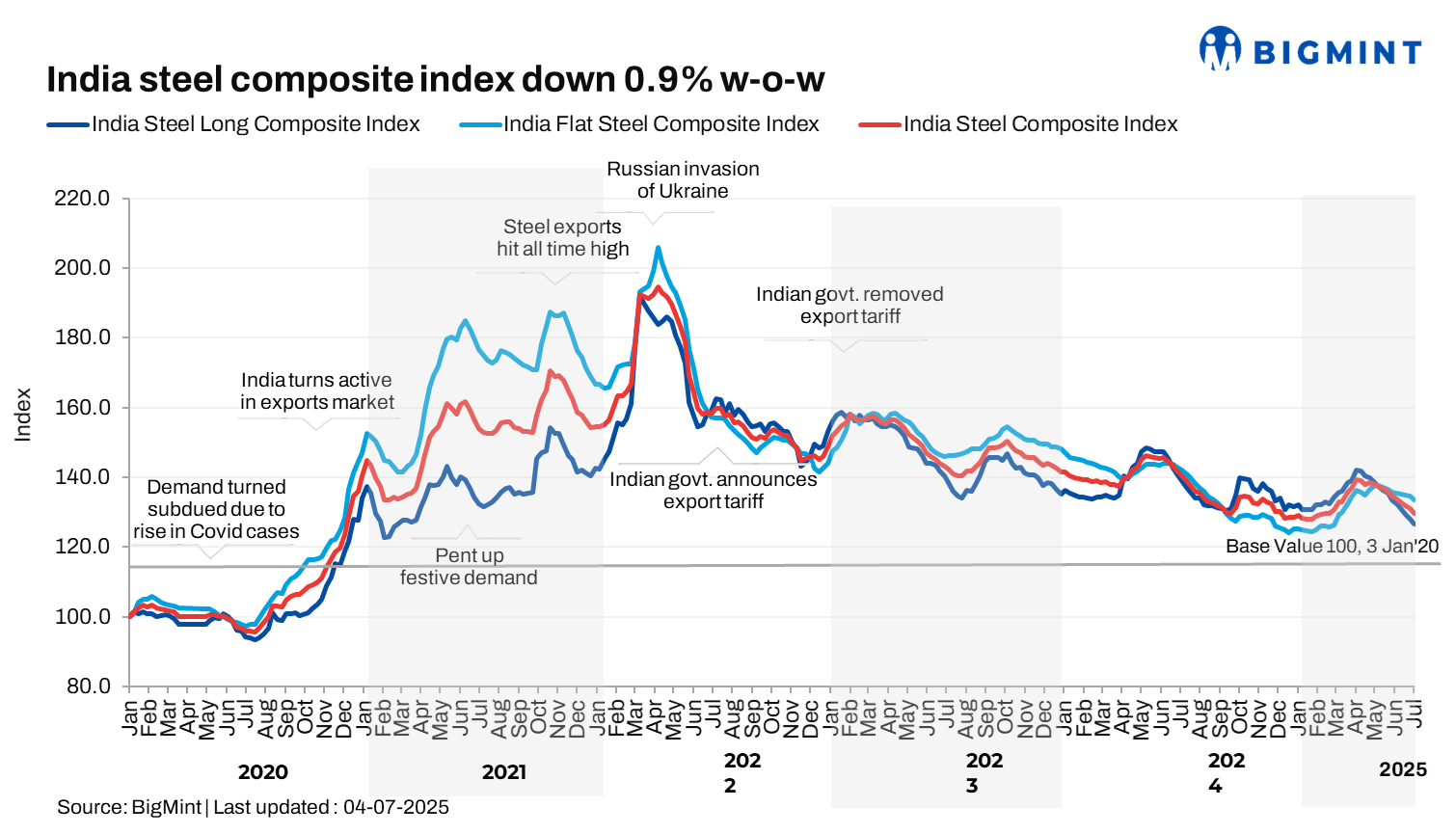

Morning Brief: Domestic steel prices continued to soften in the first week of July 2025 as bearish sentiments prevailed with the onset of monsoon and cyclical seasonal slowdown, as well as weak global steel production and price trends.

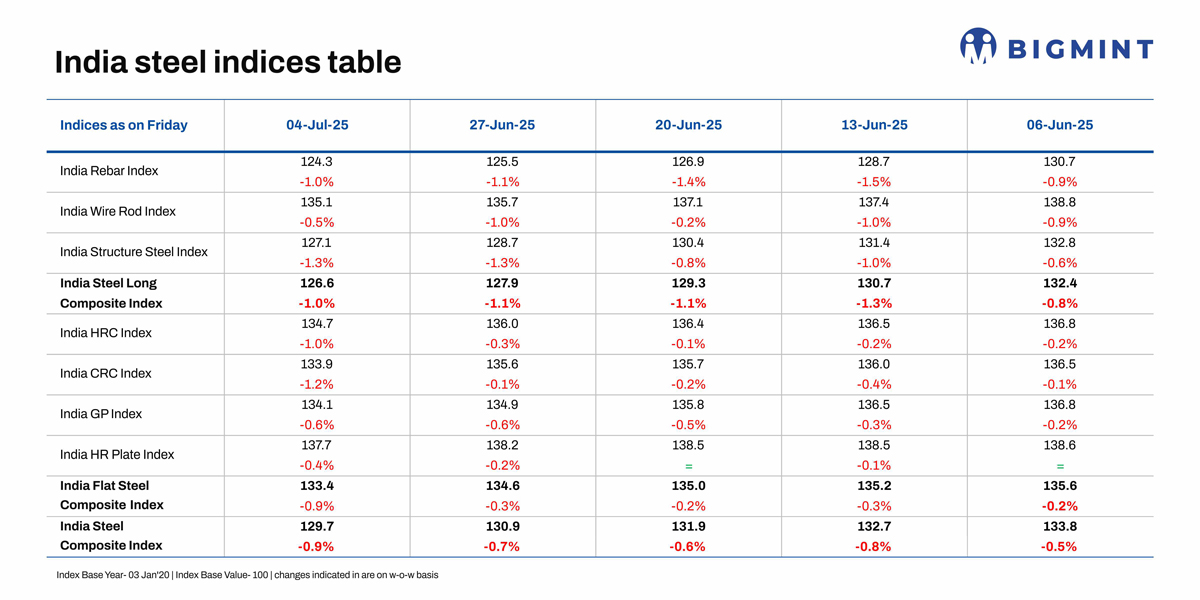

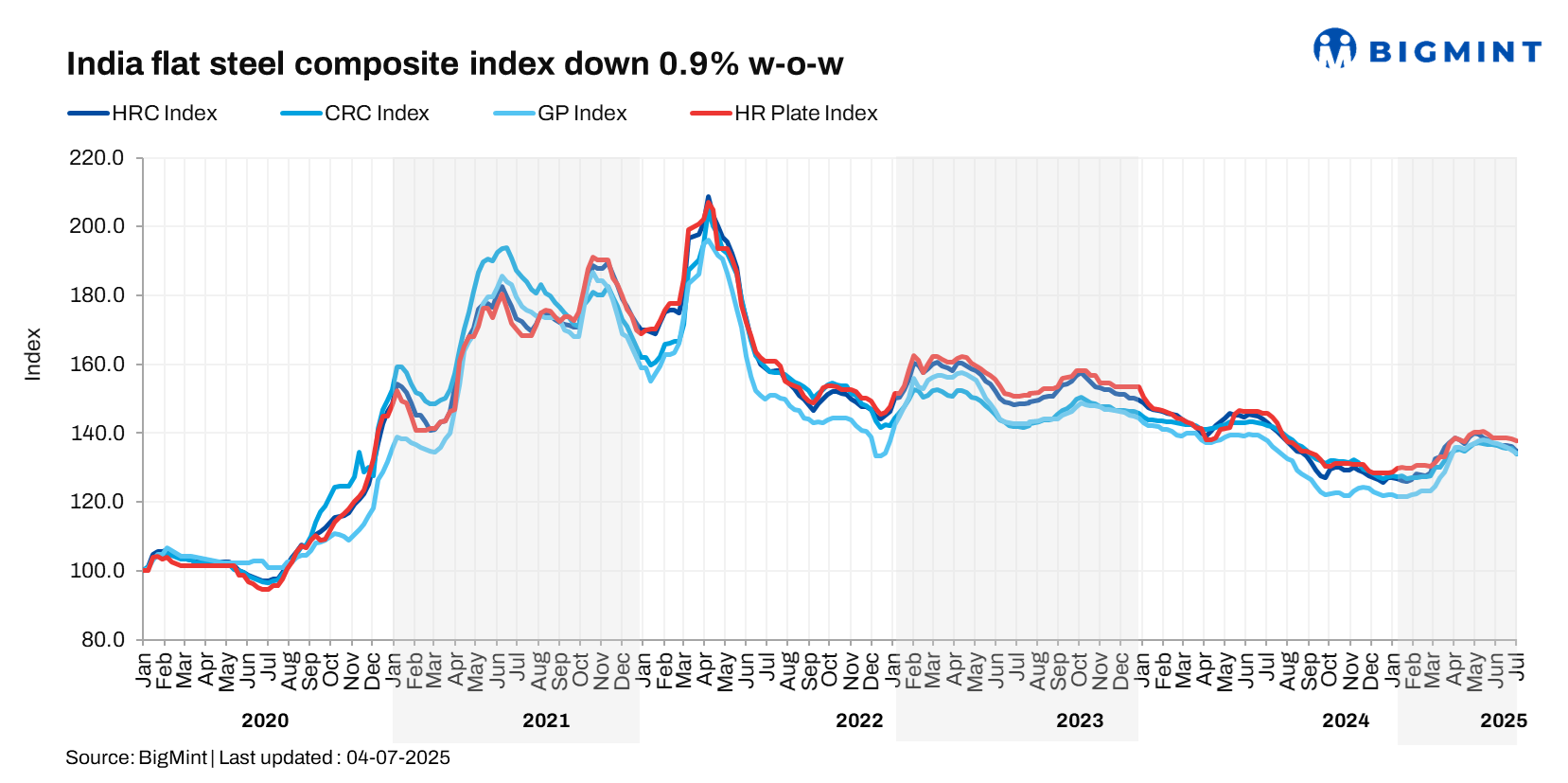

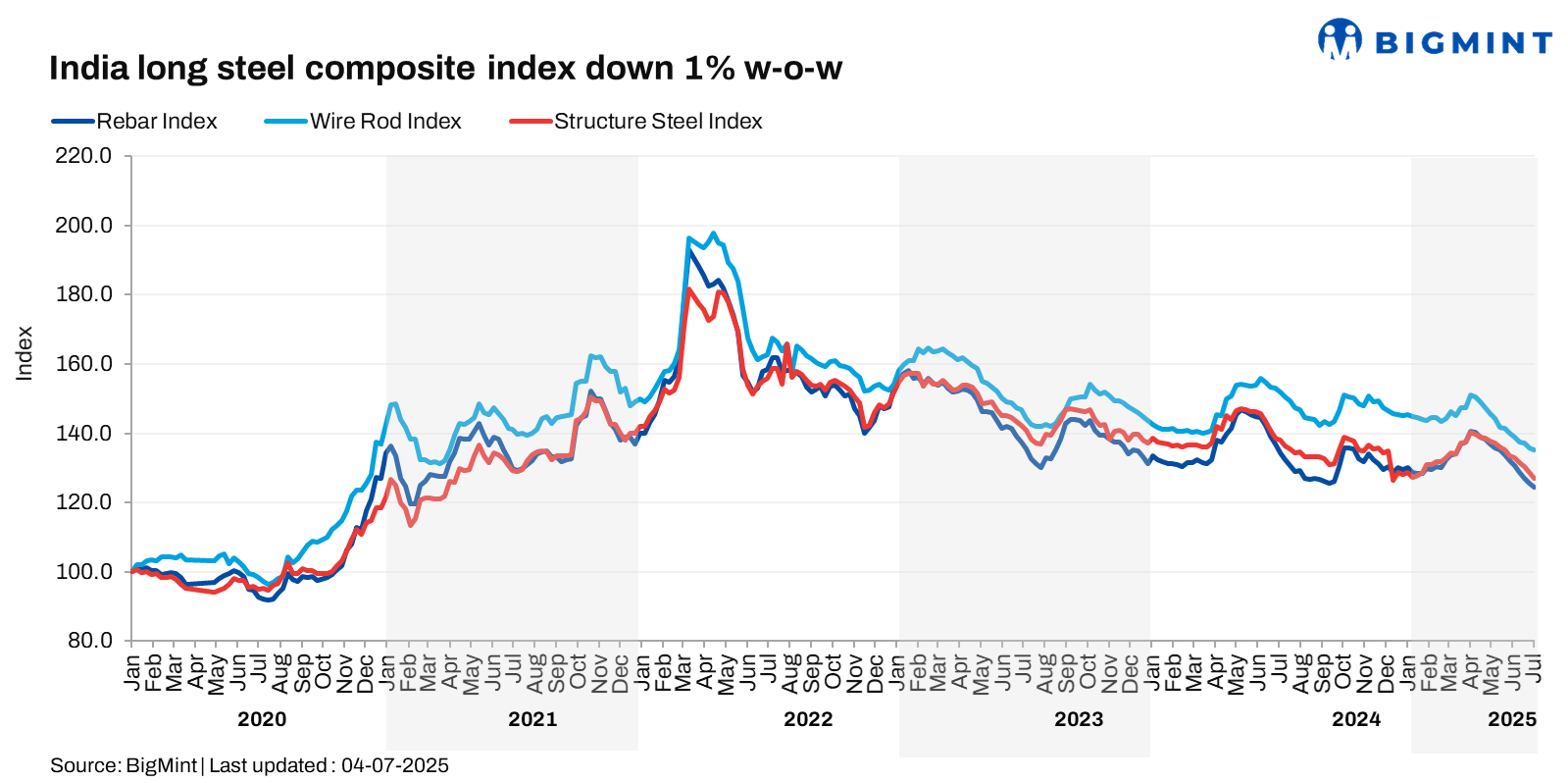

BigMint's flagship composite steel index, a barometer of the domestic steel market, edged down by 0.9% w-o-w on 4 July, as per latest assessment. While the long steel composite index fell by 1.1% w-o-w, the decline in flat steel prices accelerated over the past week, with the composite flats index slipping by a sharper 0.9% w-o-w compared to 0.3% the previous week.

Price movements

HRC prices remain under pressure: The Tier-1 mills rolled over list prices for hot-rolled coils (HRCs) and cold-rolled coils (CRCs) for July sales. While most mills officially maintained the same prices, market participants suggested that some price support in the form of a reduction of INR 1,000-2,000/tonne (t) ($12-23/t) was possibly offered. Actual transactional prices continued to soften in the spot market as buyers pushed back against prevailing levels.

In June, average trade-level HRC prices fell by INR 900/t ($11/t) m-o-m to INR 51,100/t ($599/t), while CRC prices declined by INR 800/t ($9/t) to INR 58,100/t ($681/t), both exy-Mumbai and excluding 18% GST.

Domestic demand was need-based amid continued price resistance. Buyers pushed for lower rates, expecting further cuts, and delayed purchases. Sellers aimed to clear inventories before the quarter-end but distributors limited price cuts, as trade rates were already well below mills' list prices.

Hot-rolled (HR) plate (IS2062, Gr E250 Br, 20-40 mm) prices fell by INR 600/t w-o-w to INR 53,500-56,000/tonne (t) exy-Mumbai on 2 July amid declining sales. Prices of coated coils and strips, too, dipped w-o-w.

"Steel prices are struggling to find stability amid subdued demand. The early onset of monsoon has dampened construction activity and disrupted material transportation, further impacting sentiment and trade volumes," a market participant informed BigMint.

Global prices, imports: Notably, global HRC prices remained weak, with Chinese export offers dropping to a five-year low. Major Vietnamese mills, too, reduced offers in early July. This obviously had an impact on domestic prices even as import volumes of bulk HRCs touched 0.32 mnt in June, slightly up m-o-m but down 19% y-o-y.

Steel Ministry data showed that India's finished steel imports dropped 8% y-o-y.

Rebar prices decline: The primary mills cut rebar prices by up to INR 1,000/t ($12/t) for early-July deliveries as against prices prevailing in end-June, sources informed. Post-revision, list prices stood at INR 50,000-51,500/t ($585-603/t) on landed basis.

Trade-level BF rebar prices declined by INR 800/t ($9/t) w-o-w to INR 49,900/t ($584/t) exy-Mumbai, as per BigMint's assessment on 4 July. Prices are exclusive of GST at 18%.

Rebar inventories at Tier-1 mills increased 30% m-o-m in early-July, sources informed, owing to sluggish sales in the previous month, as volatility in prices and subdued demand posed challenges for mills in securing new orders.

Notably, IF rebar prices dropped by INR 1,100/t ($13/t) m-o-m to a monthly average of INR 43,700/t ($511/t) exw-Mumbai in June. This was due to weak construction demand, monsoon disruptions, and labour shortages.

Despite improved inquiries in some markets, order bookings remained subdued due to cautious buying and limited procurement. Inventories rose to 12-15 days. Continued pressure from falling semi-finished and sponge iron prices weighed on market sentiment, prompting mills to offer discounts and consider production cuts.

Outlook

In the longs segment, the impact of the seasonal slowdown will take some time to lift, while gradual inventory drawdown might lead to a partial recovery in the near term even as prices bottom out.

Domestic HRC and CRC prices are likely to face mild downward pressure. While mills have kept list prices unchanged for July, limited demand, elevated inventories, buyers' expectations of further corrections, and strained cash flows may drive trade-level prices down.

On the other hand, export activity remains subdued due to weak EU demand, with offers to the EU dropping $26/t on FOB basis in June. This will only reinforce the pressure on domestic prices.

India Steel Composite Index

The India Steel Composite Index is assessed on a weekly basis, every Friday at 18:30 IST, as per the weighted average prices based on manufacturing capacity and production.

BigMint considers the Composite Index with the base year being 3 January 2020 (financial year 2019-2020) and the base value as 100. The Composite Index does not give the absolute price but a trend of the market. The Indian steel industry is broadly classified into the BF-BOF and the electric/induction furnace routes. Keeping this broad classification in view, BigMint proposes to release the Composite Index by considering both production routes by manufacturing capacity and the production weighted method to compute the index for India.

Source:BigMint