Posted on 15 Jul 2025

Today, China accounts for 55% of global steel production and more than 60% of greenhouse gas emissions in the global steel industry. Therefore, its decarbonization directly depends on China’s success. Today, the production of 1 ton of finished rolled steel in China generates 2.33 tons of CO2 emissions, compared to the global average of 1.92 tons. So the potential is enormous. And it is gradually being realized as part of Beijing’s climate policy. Its effectiveness will largely be determined by this year’s outcomes, as China aims to meet a set of ambitious targets within this timeframe.

In 2020 the Chinese government adopted the national “1 + N” plan to achieve zero CO2 emissions by 2060. As part of this strategy, the China’s national greenhouse gas emissions trading system (ETS CH) has been in operation in the country since July 2021. It currently covers approximately 35% of all CO2 emissions in the Chinese economy. This is the share attributable to the energy sector.

As of today, 2,162 power companies, representing 99.5% of all market participants, are involved in ETS CH. From 2022 to 2024, total quota trading volume reached 634 million tons, with a cumulative market value of $6.06 billion. This includes 188 million tons traded in 2024 alone, valued at $2.52 billion.

In March this year, China’s Ministry of Ecology and Environment announced that preparations for the expansion of the ETS CH had been completed. According to ministry representative Liu Shizhe, in 2025-2026, the national greenhouse gas quota market will cover eight more sectors. These include steel industry, which accounts for 17% of all Chinese CO2 emissions.

As with the energy sector previously, emission allowances will initially be allocated to companies free of charge. In the future, the total quota will be reduced, which will lead to an increase in the price of emissions. Currently, their cost (for energy companies) is $12.5/ton of CO2. In 2022, trading started at $7.4/ton. The introduction of CO2 emissions system with fees, taking into account their gradual increase in price, will be an important incentive for the decarbonization of the Chinese steel industry.

Among other instruments of state regulation, notable measures are outlined in the Special Action Plan for Energy Conservation and Carbon Emission Reduction in the Steel Industry, approved by China’s National Development and Reform Commission (NDRC) in July 2024.

As is well known, the Chinese authorities periodically restrict the utilization of steelmaking capacities for environmental reasons, in particular to combat smog. According to the NDRC’s decision, this will not apply to steel enterprises that have achieved Class A emission levels.

Government agencies have been given the right to restrict and even completely ban the export of energy-intensive steel products. Conversely, low-energy steel products are given priority.

Local authorities are also prohibited from issuing permits for the construction of new steel plants that do not meet the requirements for reducing and replacing coal consumption, regional reduction, and complete control of emissions.

In addition, higher electricity tariffs are being introduced for steel companies with Class C and D environmental performance. With these mechanisms, the NDRC plans to achieve the following by the end of 2025:

It is worth noting that as early as 2024, the authorities did not approve a single new BF-BOF project. According to the Centre for Research on Energy and Clean Air, permits were only issued for the construction of EAF plants with a total capacity of 7.2 million tons per year.

Thus, the Chinese government is persistently pushing local steel companies toward green changes. First and foremost, this involves the introduction of energy-saving technologies, digitalization, and the rejection of low-grade iron ore in favor of high-grade ore.

These are changes that need to happen right now. In the medium term, they plan to cut carbon emissions by switching to R-EAF scrap-based production.

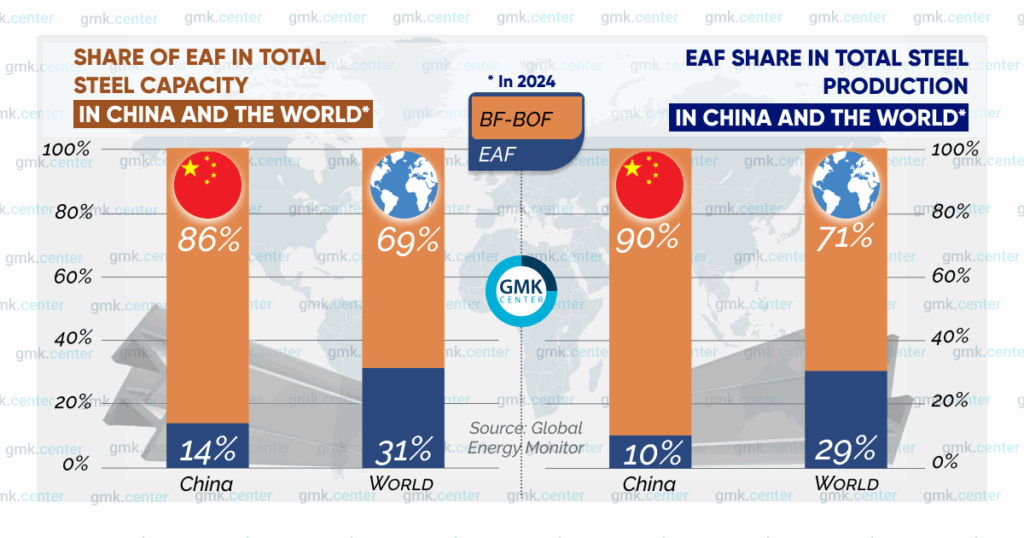

Electric arc furnace production in China is called “the short route.” Currently, it can be called a niche sector of the Chinese steel industry. At the same time, EAF utilization is lower than BF-BOF. Therefore, the contribution of electric arc steelmaking to Chinese steel production is even smaller than its share of nominal capacity.

Meanwhile, by increasing the share of EAF scrap-based steel production to 56% of total steel production, China could reduce emissions by 39% by 2050 compared to 2020, according to calculations by the E3G climate change think tank. This is why this area is considered so important. However, in moving along the “short path,” the Chinese steel industry faces one very serious obstacle.

Initially, the authorities set a target of achieving a 20% contribution from EAFs to total production by 2025. That is, to double the figure compared to 2023. This requires not only working at full capacity at all existing electric steel plants, but also building new ones.

Currently, EAFs with a total capacity of 48 million tons are being built in China. At the same time, inefficient EAF facilities with a capacity of 21 million tons are to be closed. This means that the real increase will be 27 million tons, which is not enough to produce 200 million tons of electric steel this year. Therefore, the NDRC has lowered the target for EAFs for 2025 to 15% of total steel production. To achieve this, 143-150 million tons will need to be produced. This corresponds to the existing capacity.

It follows that the pace of development of electric metallurgy in China is lagging behind the previously set parameters. The reason is a shortage of scrap used as raw material for EAF. China’s scrap consumption in 2024 amounted to 214 million tons. However, only 30% of this volume was used in electric steel production. A significant part of it goes to BF for production of pig iron.

The authorities see a way out of the situation in increasing scrap procurement to 300 million tons in 2025. The drivers are state programs of subsidies to consumers for new cars and household appliances. On the one hand, this increases the volume of depreciation scrap. On the other hand, it increases the load on mechanical engineering plants. Their production waste is the main resource for scrap collection.

In addition, in June of this year, the China Iron and Steel Association (CISA) proposed that the government add steel scrap to the list of critically important materials. This, in turn, implies a restriction or complete ban on its export.

But even these measures will not provide the resource base for a complete transition to RE-EAF scrap-based production. This is despite the power of Chinese machine building and the possibility of importing scrap. This is because the steel industry in the China is even more powerful. Therefore, its final decarbonization is only possible with hydrogen technologies.

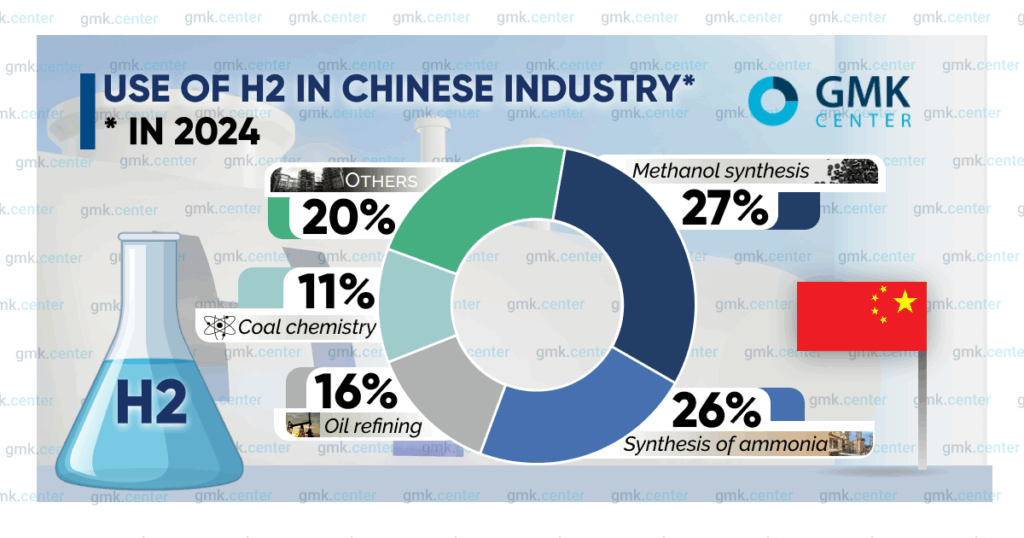

China is the clear leader in the industrial use of H2. In 2024, hydrogen production grew by 3.5% to 36.3 million tons, according to the National Energy Administration (NEA). However, most of this is so-called “gray” and ‘blue’ hydrogen based on SMR and ATR technologies, which are not environmentally friendly products. The share of green hydrogen in this volume is insignificant.

Nevertheless, some progress has been made. In 2024, 35 new projects for the production of green H2 with a total capacity of 48,000 tons were launched in China. Thus, the potential of the green hydrogen industry reached 125,000 tons per year. This is 50% of the global figure.

For comparison, Europe’s largest operating green H2 production plant, owned by the German concern BASF, has an electrolysis capacity of 54 MW. The capacity of China’s largest plant, Sinopec Xinjiang Kuqa Green, is 260 MW.

In 2020, the NDRC approved the Long-Term Plan for the Development of Hydrogen Energy for 2021-2035. According to the document, by 2025, the production of green H2 in the country should reach 100-200 thousand tons per year. In other words, the industry is developing according to schedule, and the targets are being met. At the same time, hydrogen currently has very limited application in steel industry.

Among the projects already in operation, it is worth noting the HBIS Group plant in the Zhangjiakou area, which produces DRI using H2 as an iron reducing agent. The plant has a capacity of 600,000 tons per year, with plans to expand it to 1.2 million tons. According to Italian equipment supplier Danieli, this project is the most environmentally friendly DRI production facility in the world, with emissions of 0.25 tons of CO2 per ton of product.

HBIS intends to produce up to 1.5 million tons of automotive sheet using green steel made via EAFs, utilizing hydrogen-based direct reduced iron (H₂ DRI). HBIS also plans to test technology for carbon capture, storage, and utilization (CCUS) at this plant. According to preliminary estimates, it will allow 0.125 tons of CO2 to be captured per 1 ton of DRI produced.

Also noteworthy is the 1 million ton per year H2 DRI plant of Baosteel Zhanjiang Iron & Steel in Guangdong Province.

At the same time, the NEA notes problems with demand for green hydrogen. Therefore, of the more than 600 planned projects for its production by the end of 2024, only 90 have been completed, with another 80 under construction. The reason is that the price of such a product is still too high.

The cost of producing green H2 in China in 2024 was $3.85/kg, according to the NEA. This is 15.6% less than a year earlier. The price for end consumers also fell by 13.7% to $6.69/kg. Such a significant markup, almost twice as much, is explained by the high cost of transportation. And this is despite the fact that most H2 plants are located in northeastern China, i.e., where the main steelmaking capacities are concentrated.

In other words, China’s problem now is not to reduce the cost of producing green H2 itself. Cheaper delivery solutions are needed. For comparison. According to S&P Global Commodities, H2 price in the US is $5.2/kg, and in the European Union – $6.94/kg. And under current conditions, the green premium for steel in China exceeds $225/t, according to Global Efficiency Intelligence. This is too much, about 50% of the price of conventional BF-BOF steel.

For example, in shipbuilding, a bulk carrier with a displacement of 40,000 tons needs about 13,200 tons of steel. In the low-carbon version, this means an additional $3 million per ship. Its average cost is over $30 million, i.e., the markup will be 10%. This is very noticeable for the buyer.

In residential construction, with an average steel consumption of 50 kg/m2, the markup for a standard 2-room apartment with an area of 50 m2 is only $563. If we take the average current price for such an apartment in Chongqing at $70,000, the markup is less than 1%. Thus, even in the current market situation, there are realistic prospects for the sale of long products manufactured using RE-EAF-scrap based technology.

When assessing the potential for reducing CO2 emissions in the Chinese steel industry, it is worth recalling the statement made by the NDRC in March this year. At that time, the Commission indicated in a message to the National People’s Congress that it would “resolutely promote the restructuring of the steel industry through production cuts.”

The scale of the reductions was not specified, but industry sources estimated that it would be around 50 million tons per year. The timing of the planned restructuring was also not announced – whether it would be by the end of the current five-year plan (i.e., by the end of this year) or the next one, by 2030.

Nonetheless, given that this thesis has been incorporated into an official policy document issued by China’s top economic policymaking body, it signals that a reduction in steel production is indeed on the horizon.

This can be achieved by limiting existing production or closing inefficient facilities. Or a combination of these two mechanisms. In any case, these measures will lead to a significant additional reduction in CO2 emissions in the steel industry of the PRC.

Source:GMK Center