Posted on 27 May 2025

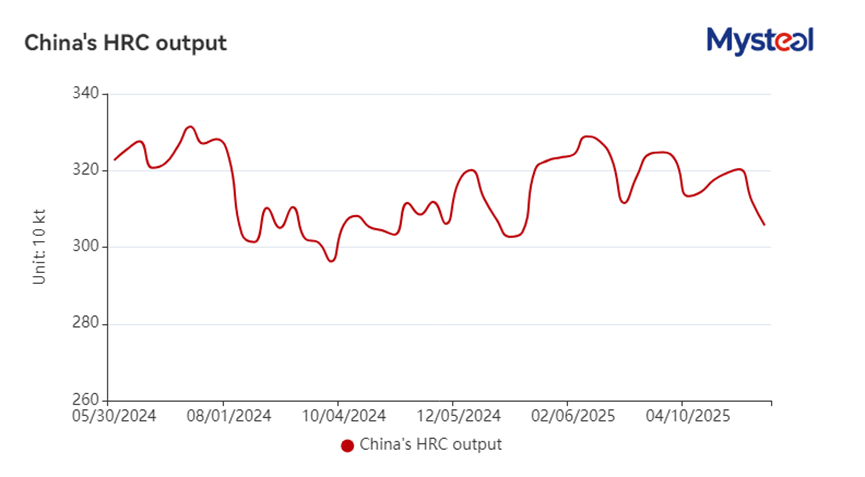

Production of hot-rolled coils (HRC) among the 37 Chinese flat steel producers Mysteel regularly monitors slid again to 3.06 million tonnes during the May 16-22 week, down by another 63,000 tonnes or 2% on week, the results of Mysteel's latest production survey show.

The hot-rolling capacity utilization rate among the sampled mills also declined by another 1.61 percentage points to average 78.09% during the same period, the results indicated.

Behind the on-week decline was mainly the fact that some steelmakers in North China had halted their hot strip mills to conduct maintenance during the survey period.

With steelmakers and re-rollers controlling their pace of production recently, hot coil stocks overall in China are at a relatively low level, Mysteel data shows.

By May 22, HRC inventories held by the 37 surveyed mills had slid for the third week by another 1.7% on week to 769,200 tonnes. As of the same day, stocks held by traders at commercial warehouses in the 33 Chinese cities that Mysteel monitors nationwide had eased again by 2.3% on week to 2.63 million tonnes.

But hot coil makers may soon resume their production or might even expand output, now that they are enjoying some profit margins, according to industry observers.

On the other hand, HRC consumption remained tepid during the survey week. The industry sources pointed out that the steady slide in HRC derivatives prices had further dampened buyers' optimism, leading them to be cautious about purchasing.

On the Shanghai Futures Exchange, the most-traded HRC contract for October delivery eased by 1.2% on week last Friday to close the daytime trading session at Yuan 3,189/tonne ($444/t), exchange statistics show.

On the same day, China's national price of Q235 4.75mm HRC under Mysteel's assessment inched down by 0.6% on week to Yuan 3,324/t including the VAT.

Source:Mysteel Global