Posted on 21 May 2025

While favorable macro-economic factors improved market sentiment last week and encouraged many Chinese hot-rolled coil (HRC) suppliers to raise their export quotations, overseas buyers of China-origin hot coils failed to respond, Mysteel's weekly market roundup of the commodity notes. The buyers' determined disinterest eventually resulted in a slight on-week decline in Chinese HRC export prices, the data show.

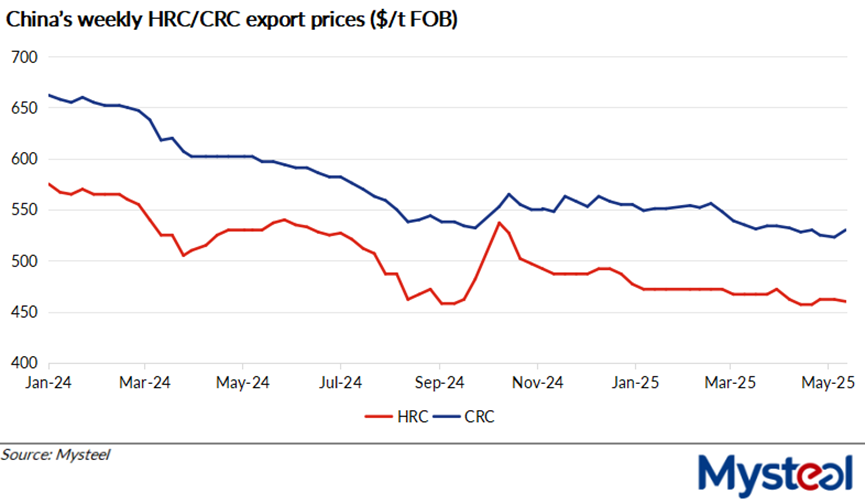

As of May 16, the export price of SS400 3mm HRC under Mysteel's assessment had nudged down by $2/tonne on week to land at $460/t FOB from North China's Tianjin port.

Two days earlier on May 14, China and the United States had on officially lowered tariffs on each other's imports, de-escalating the trade tension that had weighed on global commodities markets for weeks, as reported. To mark the occasion, Chinese mills and traders quickly lifted their export HRC offer prices to $459/t FOB from the $452/t FOB level offered during the first half of last week. Some major Chinese steel mills were especially keen and lifted their quotations to over $470/t FOB, Mysteel heard.

Overseas buyers, however, remained in wait-and-see mode and showed only limited willingness to chase the rising quotations, resulting in significant bid-ask spread. Speculative buying for Chinese HRC was sparse and the actual tradable prices were generally below $450/t FOB, industry sources said.

By late last week, China's export HRC offers were mostly hovering around $460/t FOB although some major mills defended their quotations of $470/t FOB. The tradable prices were generally $5/t lower, however.

In the United Arab Emirates, Chinese HRC quotations stayed unchanged on week at $480-490/t CFR last week, while offers for India-bound coils also firmed at $520-530/t CFR. Mysteel did not hear of any deal concluded.

On the other hand, Mysteel learned that the transaction price of China-origin 1.2mm HRC sold to Saudi Arabia was $525-530/t CFR last week, higher by $10/t from the prior week.

In Vietnam, Chinese Q235 HRC was priced at $480-482/t CFR last week, higher by around $10/t on week. But mounting stocks of hot coils at hand and the possible adjustment of Vietnam's anti-dumping penalties against Chinese HRC together hindered local buyers' interest in China-branded HRC.

Meanwhile, Vietnamese steel major Hoa Phat Steel Group has recently idled a blast furnace due to fire incident, with the two-weeks of repairs seen as clipping the company's billet production by 50,000 tonnes and that of HRC by 54,000 tonnes. But Hoa Phat officials say the company has sufficient stocks to maintain normal shipments of products, Mysteel learned.

Source:Mysteel Global