Posted on 20 May 2025

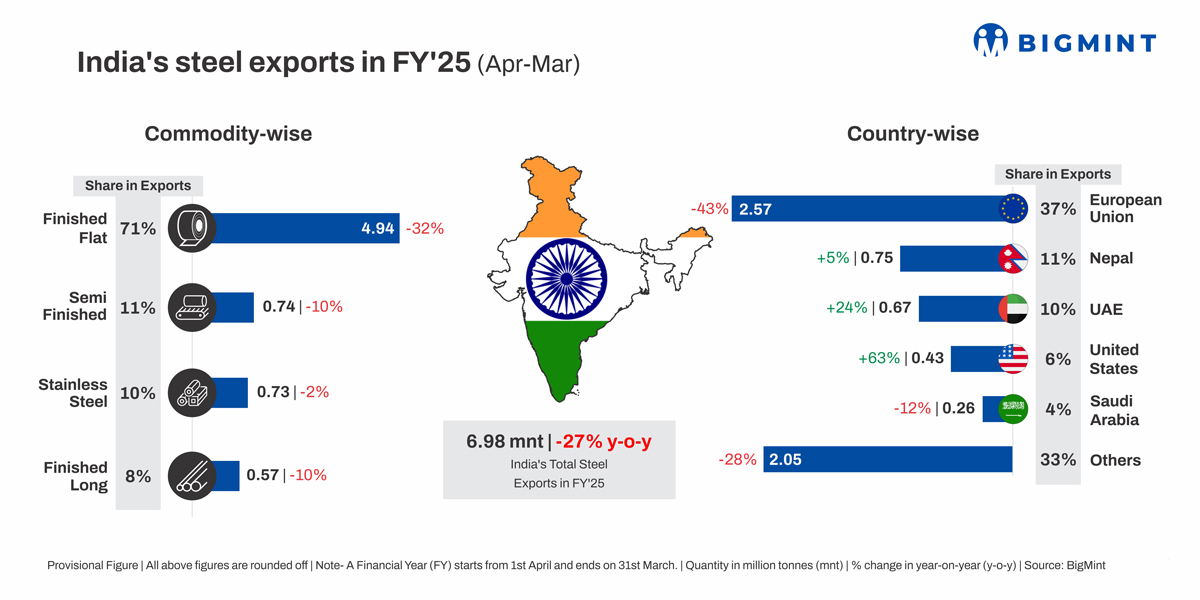

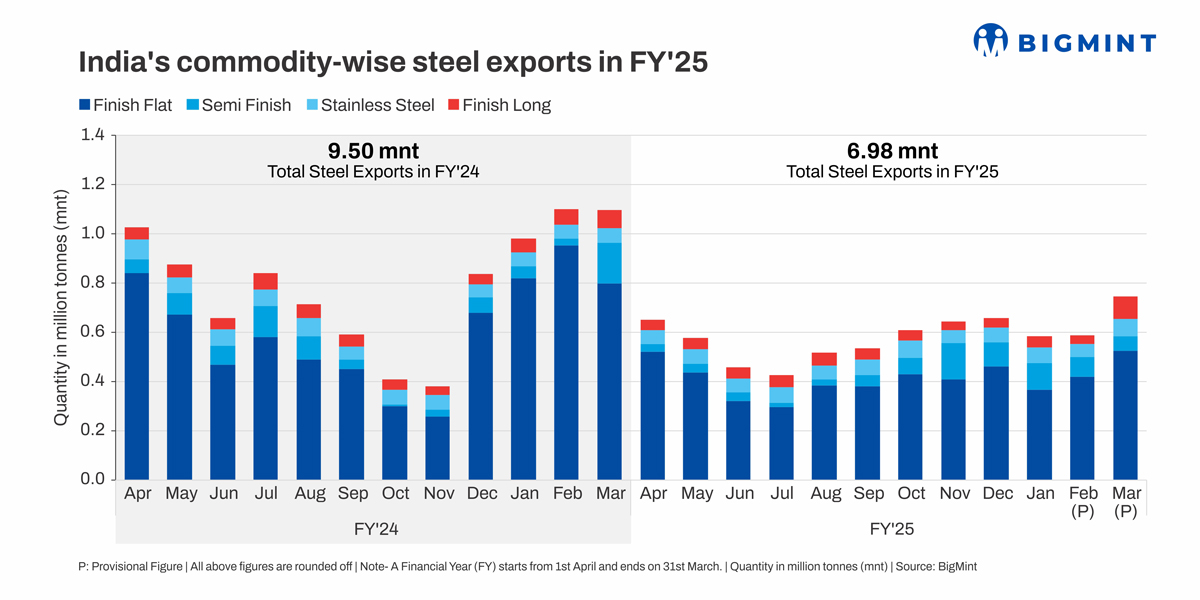

Morning Brief: India's steel exports, including finished flats, longs and semis, dropped nearly 30% y-o-y in FY'25, as per provisional data available with BigMint. Total exports of steel were recorded at around 6.25 million tonnes (mnt) in the last fiscal compared with 8.75 mnt in FY'24-a drop of over 2.5 mnt y-o-y.

Data show that exports of flat steel products witnessed the sharpest decline of over 32%. Flats exports fell below 5 mnt, while semi-finished and finished longs, too, recorded declines y-o-y.

Why steel exports slumped in FY'25?

China dominates with predatory prices: The global steel market remained oversupplied through much of FY'25, with Chinese steel exports rising to a multi-year high. Chinese suppliers increased exports amid weak domestic demand especially due to a liquidity crisis affecting the construction and property markets.

China's presence was overbearing in India's traditional export markets such as Vietnam. For instance, Chinese hot rolled coil (HRC) prices to Vietnam were lower by around $60/t compared with Indian prices in CNF terms in CY'24. Indian HRC export prices were around $60/t higher than Chinese FOB prices in CY'24. Even in Q4FY'25, Chinese HRC offers to the Middle East were over $30/t lower than India's. Therefore, Indian suppliers found it difficult to compete with Chinese offers.

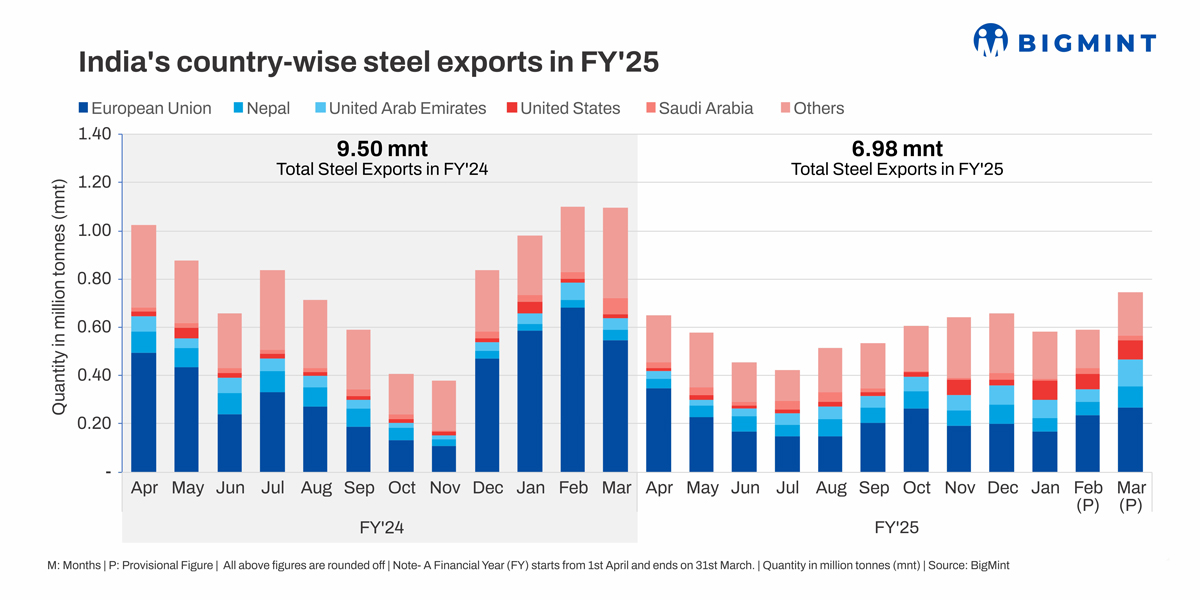

Weak demand in key markets: Exports to traditional destinations such as the UAE, Nepal and Turkiye edged down, thereby impacting total shipments. Turkish steel production increased in FY'25 and the expansion in Nepal's melting capacity resulted in lower imports of semis from India. Stiff competition from Chinese suppliers in the UAE and import duties on long steel products weighed on imports from India. Demand from the Middle East became sluggish ahead of the onset of Ramadan from March.

Anti-dumping probes impact exports: India utilised only 3% of its HRC quota for the October-December quarter for steel exports to the EU which were hit by weak demand and the EU's anti-dumping probe launched in August. In fact, India's exports plunged 40% y-o-y in January-February 2025. Vietnam launched anti-dumping investigations against HRC exports from China and India in August. Malaysia's trade ministry has also imposed provisional anti-dumping duties on flat-rolled steel products from India and other countries.

Outlook

Undoubtedly, protectionist trade policies and steep US tariffs are likely to put a brake on exports even though India's steel exports to the US are not substantial. High tariffs pose the distinct threat of global inflation which will naturally have a detrimental impact on consumption sentiment and steel demand globally. This is expected to weigh on Indian exports.

Moreover, the European Commission is tightening steel import quotas from April in order to protect its domestic mills. The duty-free quotas per quarter will shrink by 12.1% to 1.9 mnt. India's quota will get reduced by 23%, although Indian steel has been exempted from the EU's anti-dumping duties.

However, China's steel exports have fallen by 7% y-o-y in January-February even as domestic steel production has edged down. The decline in Chinese steel exports presents an upside to global steel prices which remained depressed throughout FY'25 on burgeoning Chinese supplies. Again, Indian products have been excluded from provisional anti-dumping duties by Vietnam. These developments are positive for India.

Source:BigMint