Posted on 20 May 2025

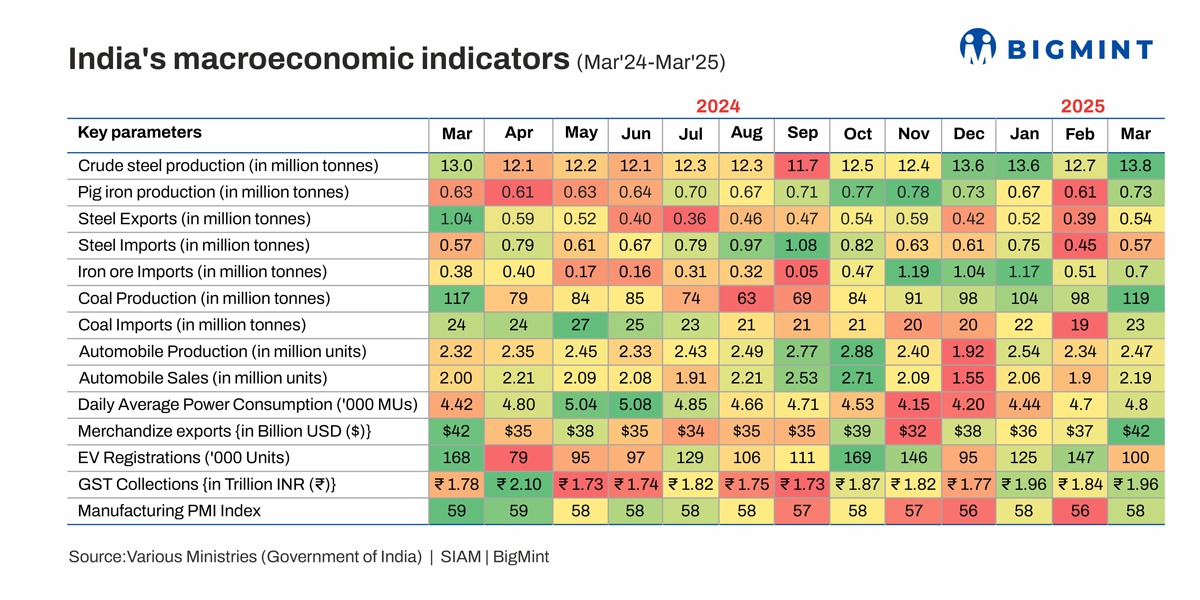

Morning Brief: India's steel industry staged a recovery in March compared to the downtrend in February, with relevant macroeconomic indicators showing an improvement m-o-m.

Crude steel production increased m-o-m in March, and so did coal and iron ore output. Parallelly, the manufacturing segment strengthened, as evidenced by an uptick in the purchasing managers' index (PMI), automobile sales, and merchandise exports.

BigMint goes behind the scenes.

Crude steel production up on demand surge

Crude steel production grew 9% m-o-m to 13.8 million tonnes (mnt) in March compared to 12.7 mnt in February. March witnessed a surge in demand, buoyed by increased government spending and accelerating construction activity, especially as project deadlines approached ahead of fiscal year end. Additionally, the announcement of a 12% safeguard duty on steel imports kept market sentiment upbeat. Moreover, steelmakers generally amplify production before the FY-end to meet annual targets. In March 2024 too, production had increased by 8% m-o-m.

Similarly, pig iron output surged 20% m-o-m to 0.73 mnt in March compared to 0.61 mnt on positive sentiments in the finished steel segment, which saw robust bookings and price gains throughout the month.

Steel exports rise, but so do imports

India's steel exports logged a 38% m-o-m increase to 0.54 mnt in March compared to 0.39 mnt. Notably, exports to the EU received a boost after India was exempted from the anti-dumping duties recommended by the European Commission.

Imports, too, witnessed a 27% rise to 0.57 mnt in March against 0.39 mnt in the previous month. Although imports increased m-o-m, March's volume was lower compared to that recorded in the other months of the year. In fact, March recorded the second-lowest monthly imports in FY'25.

The export-import gap was relatively narrow in March at - 0.03 mnt.

Iron ore imports rise

Iron ore production grew a slight 1% to 25.8 mnt in March compared to 25.6 mnt in the earlier month, as per BigMint data. However, the National Mineral Development Corporation (NMDC) recorded a 23% decline in production, which stood at 3.55 mnt in March against 4.62 mnt in February, due to labour strikes over wage settlement issues. Certain miners' environmental clearances (ECs) expired in March, which prevented them from continuing with mining.

Imports surged by 37% to 0.7 mnt compared to 0.51 mnt in February. The rise could be attributed to tight supply of desired ore grades in the domestic market, which was unable to meet demand, and the 9% m-o-m uptick in crude steel production.

Coal production, imports up 20% m-o-m

Coal production shot up by 21% m-o-m to 119 mnt in March compared to 98 mnt in February, with Coal India Limited (CIL) posting a 15.7% increase m-o-m to 85.81 mnt. Notably, March's output was the highest monthly total in FY'25.

Despite the jump in domestic production, coal imports soared by 20% m-o-m to an eight-month high of 23 mnt in March. This was due to higher metallurgical coal demand amid the rise in crude steel output and the increase in power consumption with the gradual onset of warmer weather.

Daily average power consumption increased 2% m-o-m to 4800 million units.

Auto segment picks up as sales gain steam

Among the end-user segments, the automotive sector witnessed a 15% pick-up in sales to 2.19 million units, with FY-end depreciation benefits, higher variant availability, and festive discounts luring buyers. Meanwhile, production edged up by a modest 6% m-o-m to 2.47 million units, possibly indicating caution among automakers regarding sustained consumer demand. Production volumes could also have been pressured by concerns and speculation regarding the tariff war, which was in full swing in March-early-April. Notably, Trump announced import tariffs on auto components, which account for a significant share of the industry's revenue, on 26 March.

Manufacturing PMI hits 8-month peak

India's manufacturing PMI rose by 3% m-o-m to 58.1 points, an eight-month peak. Healthy demand trends and a decline in finished goods inventories pushed up the index, despite a deceleration in export order growth due to global uncertainties.

Even the Index of Industrial Production grew 3% y-o-y in March compared to 2.7% y-o-y. Electricity (6.3% y-o-y growth in March compared to 3.6% y-o-y in February) and manufacturing (3% y-o-y growth in March versus 2.8% y-o-y in February) were the best-performing sectors. Electrical equipment and the motor vehicles, trailers, and semi-trailers segments were the highest contributors to manufacturing activity. Moreover, the index for infrastructure and construction goods grew 8.8% y-o-y.

Merchandise exports climb up amid tariff tensions

Merchandise exports moved up by 14% m-o-m to $42 billion in March, as Indian companies stepped up shipments to offset possible future losses due to Trump's tariff announcements. Notably, at this time, uncertainties were at a peak in the export market over the US's potential reciprocal tariff strategy.

GST collections rise by 7% m-o-m

In tandem with the increase in consumption and business activity, GST revenues increased by 7% m-o-m to INR 1.96 trillion. A jump in tax payments during the year-end also boosted the collection volume.

Outlook

India's steel industry is expected to have witnessed mixed momentum in April. Preliminary analyses suggest that both crude steel production and consumption fell. While maintenance-related downtimes led to production cuts, high pricing kept buyers on the sidelines.

Although manufacturing grew in April, as indicated by the manufacturing PMI climbing up further to a 10-month peak of 58.2 points, the momentum moderated considerably, with only a 0.1 percentage point rise m-o-m. However, international orders surged, and consumer goods producers registered the sharpest expansion.

Given these mixed signals, the bullishness of March is likely to have tempered considerably in April. India's macroeconomic indicators may see fluctuations in a limited range.

Source:BigMint