Posted on 20 May 2025

India's iron ore production rises modest 4% in FY'25, outlook positive

- Karnataka leads charge, output rises 24% y-o-y

- Odisha stumbles as JSW gives up Jajang block

- NMDC production dips amid supply disruptions

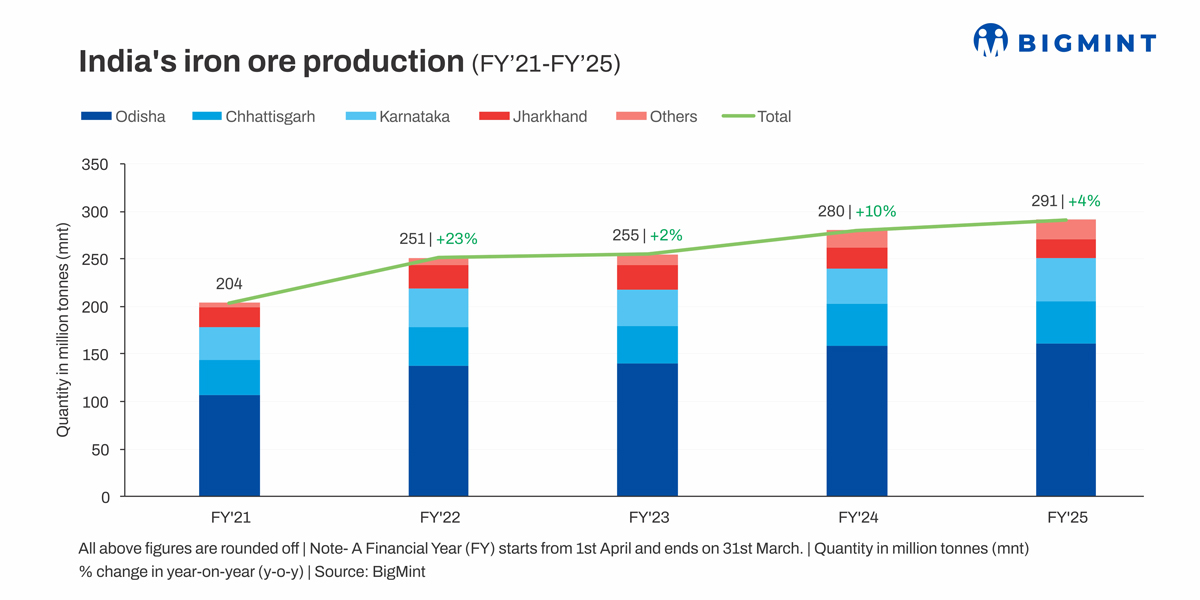

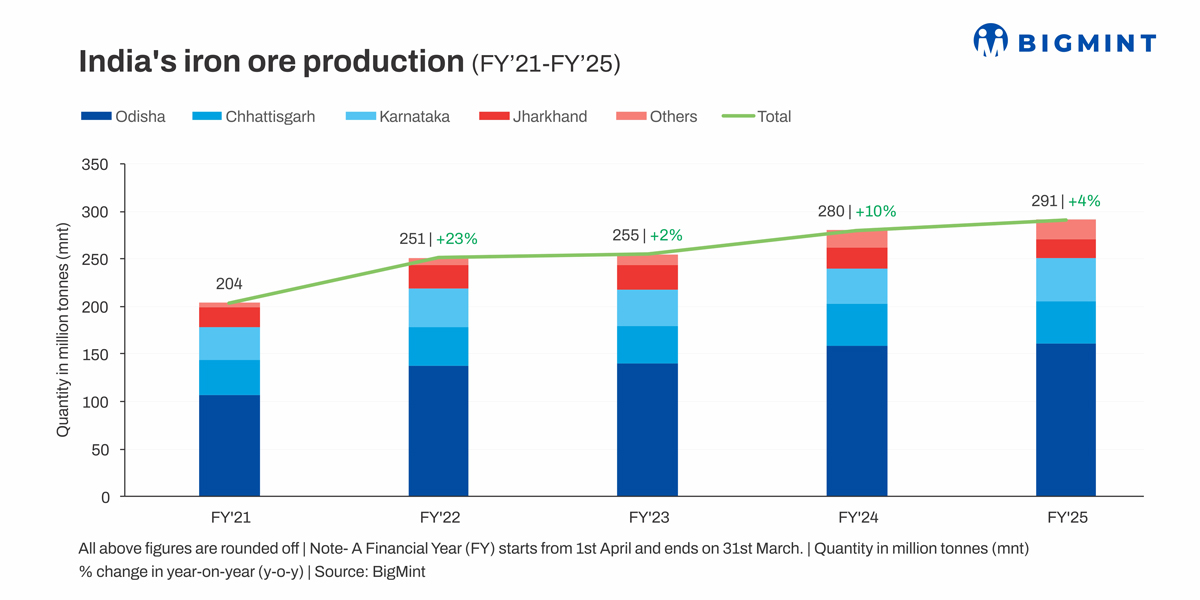

Morning Brief: India's iron ore production increased by a rather modest 4% to 291 million tonnes (mnt) in financial year 2024-25 (FY'25) against 280 mnt recorded in FY'24, as per provisional data available with BigMint. It may be recalled that the growth momentum was marginally better at 9% in the first half of FY'25 (April-September, 2024) at 139 mnt against 128 mnt seen in the same period in FY'24.

However, FY'25's volumes fell short of the expected 305-310 mnt.

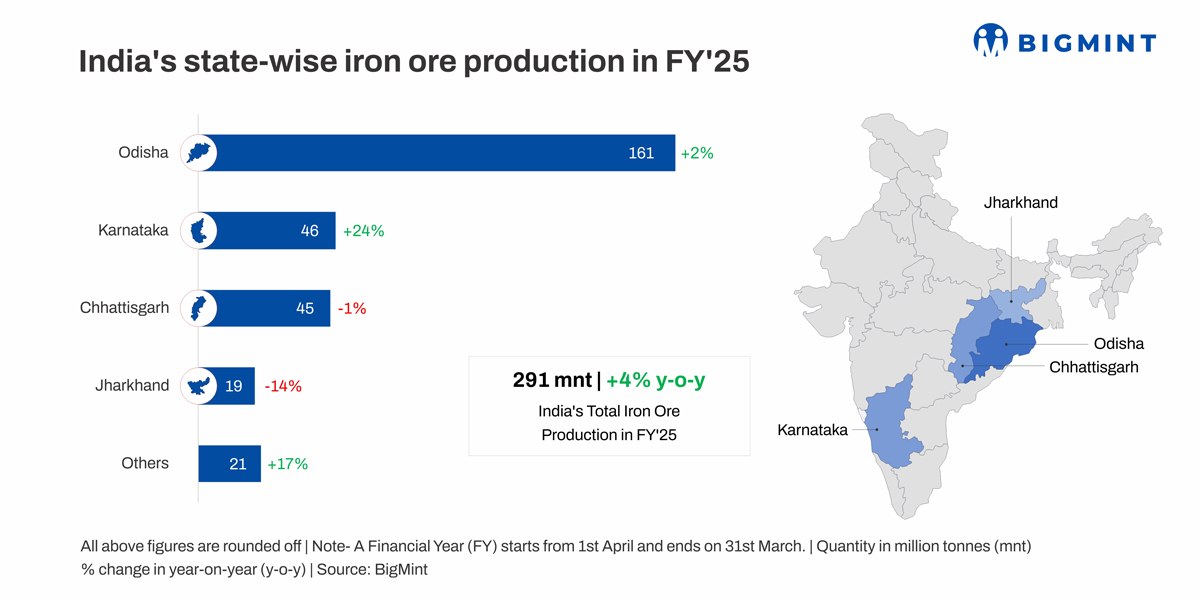

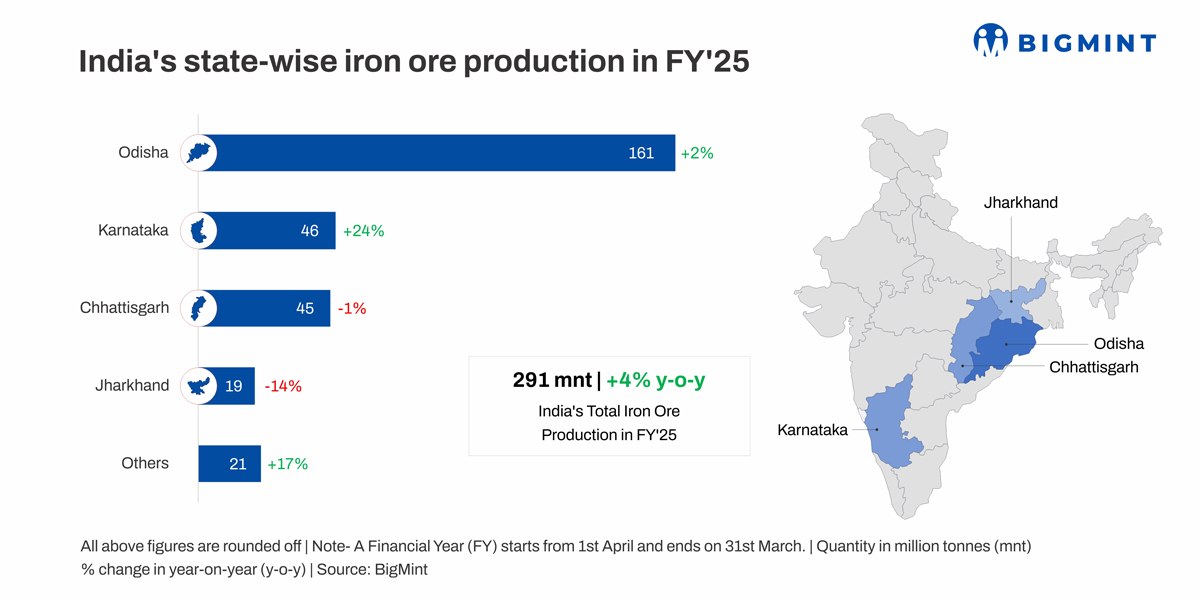

State-wise break-up

The trend last fiscal reveals that of the four iron ore producing states, two were in negative growth mode while the balance two showed increases. However, Odisha, the leading iron ore producing state of India, showed a modest less than 2% growth in FY'25 at 161 mnt (158 mnt in FY'24). Karnataka, on the other hand, led the charge with a handsome 24% increase to 46 mnt (37 mnt). In fact, Karnataka's volumes lifted the overall production performance last fiscal. Jharkhand showed a 14% decline to 19 mnt (22 mnt) while Chhattisgarh remained almost range-bound, with a 1% dip at 44.5 mnt (45 mnt). 'Others' posted a 17% y-o-y increase to 21 mnt (18 mnt).

Factors that impacted India's iron ore production in FY'25

- NMDC's output dips: India's largest iron ore producer NMDC's cumulative output saw a slight 2% dip in FY'25 to 44.04 mnt, compared to 45.02 mnt in FY'24. Iron ore sales inched down to 44.40 mnt in this period (44.48 mnt). The decline can be attributed to workers' strikes on account of wage issues that disrupted production in Chhattisgarh and Karnataka. That apart, heavy monsoon rains over July-August last year also impacted mining activities.

- JSW's Jajang surrender pulls down Odisha volumes: Odisha traditionally the largest iron ore producing state in India, put in a very modest performance last fiscal on account of JSW surrendering its key Jajang block in Keonjhar, citing "uneconomic operation". It had explained to the stock exchanges in a notice that operating the mine at a 110% premium was uneconomical. It had produced 7.8 mnt in FY'24 which saw an over 33% drop to 5.2 mnt in FY'25, as per BigMint data. That apart, Odisha's volumes were added mainly by Odisha Mining Corp (OMC) at 35.7 mnt in FY'25 against 33 mnt in the previous fiscal, which was again a modest 3 mnt increase.

- JSW boosts Karnataka output: Karnataka's output was boosted by JSW Steel in particular. The company increased production from its Sandur and Chitradurga blocks in this state by over 14% to 9.5 mnt against 8.3 mnt in FY'24.

- India's crude steel production capacity rises: India's crude steel production capacity rose around 10% to 205 mnt in FY'25 against 186 mnt in FY'24. Increased production necessitated higher usage of iron ore. Actually, India's iron ore demand, at 9%, exceeded supply, which rose a slower 4%.

- Iron ore & pellet exports decline: Another reason for the modest increase in iron ore production lay in the over 35% plunge in the country's iron ore and pellet exports in FY'25 to 30 mnt from 47 mnt in FY'24. The reasons were chiefly better domestic realisations, steep drop in global prices, steel production cuts in China, which somewhat dried up overseas demand. Domestic realisations (Fe 62% fines, ex-mines, Odisha index) climbed up to a high of INR 5,600/t ($66/t) against INR 5,150/t ($60/t) in FY'24, although average prices last fiscal dipped 4% y-o-y. Similarly, the Fe 63% lumps from Odisha peaked to INR 7,800/t ($91/t) against INR 7,130/t ($83/t) in FY'24 but overall showed a y-o-y dip of 5%.

Outlook

India's iron ore production is projected to increase to 325-330 mnt in FY'26, as per BigMint's estimates. Existing states are slated to add to their production while two more states, Maharashtra and Goa, are expected to contribute more over the medium to long term.

Source:BigMint