Posted on 20 May 2025

Morning Brief: Steel and steelmaking raw material prices in India witnessed marginal growth in April 2025 and domestic market sentiments improved slightly even as the 12% safeguard duty on flat steel imports was ratified by the Ministry of Finance and took effect from 21 April.

However, a cautious optimism prevailed in the market amid global tariff wars, drop in steel prices in key exporting countries and the apprehension of a spike in inflation and general slowdown due to trade conflicts involving major economies.

Notably, domestic steel production saw a nearly 7% y-o-y growth in Q1CY'25, as per WSA data, and weakening steel prices in January and February forced major mills to opt for maintenance shutdowns to regulate supplies in the market. Although the overall bearishness has lifted with the imposition of the provisional safeguard duty and import volumes of flat steel have dropped in April, the recovery of domestic market sentiments is still underway.

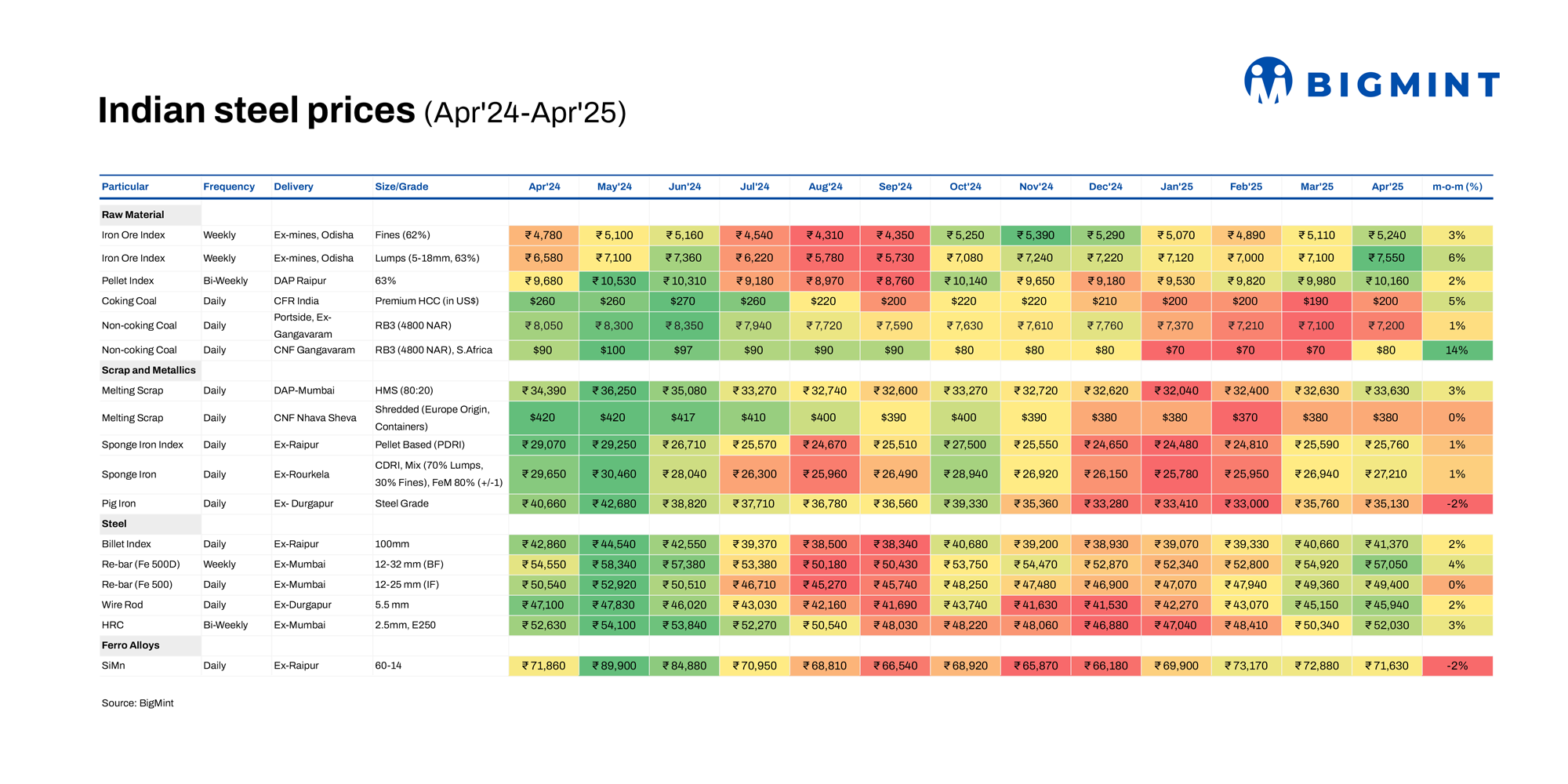

BigMint traces the price trajectories of domestic steel and steelmaking raw materials in April.

Raw materials

Iron ore: Iron ore prices increased in Odisha on active demand from steelmakers for fresh EC material and supportive bids in OMC's auction. Offers from miners were higher last month. Over 2 million tonnes (mnt) of iron ore - around 1.15 mnt of fines and 0.97 mnt of lumps - were sold in the auction on 19 April, with bids remaining stable against March.

Sources said that miners are holding offers firm and prices in the eastern region are likely to remain firm as buying interest may be seen for pre-monsoon restocking.

PSU miner NMDC increased prices of fines and lumps for May. The miner has fixed prices of DR CLO (10-40 mm, Fe 67%) at INR 7,210/t ($85/t) and of iron ore fines (-10 mm, Fe 64%) at INR 5,500/t ($65/t), an increase of INR 140/t ($2/t) and INR 440/t ($5/t), respectively. Prices are on FOR basis and include all taxes.

Pellets: BigMint's Raipur pellet index in April showed a marginal 2% growth as prices received support from the rise in pellet-based sponge iron (PDRI) and steel billet prices in Raipur, along with the uptick in iron ore prices in Odisha. Pellet prices are expected to remain firm as NMDC recently hiked prices for May delivery of iron ore.

Coking coal: BigMint's index for premium hard coking coal from Australia recorded a 5% m-o-m increase in April to settle at $200/t CFR India. The rise could be attributed to supply-side constraints in Australia, which was reflected in the slight uptrend in prices towards the end of the month. In the Chinese met coke market, too, a second hike in prices was proposed recently on strong molten iron production supporting seaborne market sentiments.

Thermal coal: Portside prices of South African thermal coal in India remained under pressure due to shift in preference for domestic coal due to cost-effectiveness. Domestic sponge iron producers were mostly interested in domestic coal amid weakening prices. However, low portside inventory for RB3 coal kept prices steady. On the other hand, seaborne South African coal prices recorded a surge as some import deals were concluded for April-May shipments which prompted miners in South Africa to raise prices.

Ferrous scrap: Domestic heavy melting scrap prices in the Mumbai market, a key hub, witnessed a marginal growth in April following the gradual improvement in steel market sentiments, while imported scrap prices were sluggish on global cues and cautious buying. Despite seasonal support for finished steel, scrap demand stayed muted as mills leaned on local scrap and sponge iron due to cost and liquidity concerns. Prices softened amid limited deals and wide bid-offer gaps along with rising freight rates.

Sponge iron: Despite subdued market conditions, domestic sponge iron prices in major production hubs showed a slight increase on improvement in semis and IF-origin finished steel prices. BigMint's Raipur billet index rose by 2% m-o-m, averaging INR 41,370/t in April. This supported sponge iron prices. The increase in iron ore and pellet prices in major markets is expected to boost sponge iron prices.

Pig iron: Pig iron prices in April declined 2% m-o-m as sentiments weakened from the second week of the month, driven by reduced buying interest in finished steel and increased availability of scrap in the market. The easy availability of HMS at lower prices pressured pig iron prices. Moreover, auctions conducted by key market players towards the end of April witnessed weak response, with a lot of material failing to elicit bids. This naturally weighed on prices despite maintenance shutdowns by some leading primary steel producers and the rise in domestic coke prices.

Ferro alloys

Silico manganese: The domestic silico manganese market witnessed a marginal price correction m-o-m, largely attributed to subdued procurement by steel mills and intensified price competition among suppliers. Declining imported manganese ore prices, too, resulted in a downtrend in alloys prices.

Steel

Rebar: BF-origin rebars stood at INR 57,100/t ($675/t) in April, up by INR 2,200/t ($26/t) m-o-m. With the project and trade segments witnessing strong demand, Tier-1 mills raised rebar list prices by up to INR 3,000/t ($35/t) to around INR 55,500-57,000/t ($656-674/t) on a landed basis for early-April deliveries compared to end-March.

But IF-route rebar prices remained flat m-o-m as prices corrected in the range of INR 200-2,100/t m-o-m across regions owing to weak buying inquiries at higher prices. However, bulk bookings at lower prices were seen in March and suppliers were busy dispatching orders booked previously. Therefore, inventory pressure was somewhat absent helping to keep prices rangebound.

HRC: Average HRC prices reflected a 3% m-o-m growth in April as leading manufacturers raised their list prices for April by INR 2,000-2,300/t ($24-27/t) to INR 52,000-53,000/t ($614-626/t). Supply tightness amid maintenance-related production cuts at certain key steelmaking units and a decline in HRC imports in recent months bolstered prices in several locations, as per BigMint assessment.

Outlook

Maintenance downtimes taken by some integrated steelmakers may cause supply tightness in the domestic market in May and the simultaneous decline in import shipments will certainly contribute to further supply squeeze.

Moreover, the $675/t CIF threshold for HRC and plate imports under the safeguard mechanism allows domestic producers the leeway to increase current prices. In fact, there are rumours that mills may raise list prices by INR 1,500-2,000/t ($18-24/t) shortly.

Domestic demand is inherently resilient; however, global sentiments and economic uncertainties are likely to impact prices, especially of flat steel. Widespread macroeconomic uncertainty has forced the World Steel Organisation to suspend its April outlook on the global steel market due to the yet unaccounted for impact of tariffs.

Some leading industry representatives have voiced concerns about the 12% duty being too weak when other countries have already imposed double that levy. Largely due to weakening demand in key steel exporting countries such as Japan and South Korea and softening HRC export prices, apprehensions regarding the prospect of continued inflow of cost-competitive imports are not entirely unfounded. For perspective, China's steel exports increased by over 6% y-o-y in Q1CY'25.

Therefore, domestic steel and raw material prices in May could find some support with mills possibly eyeing a hike in the near term. But global headwinds will certainly impact the sector going forward.

Source:BigMint