Posted on 20 May 2025

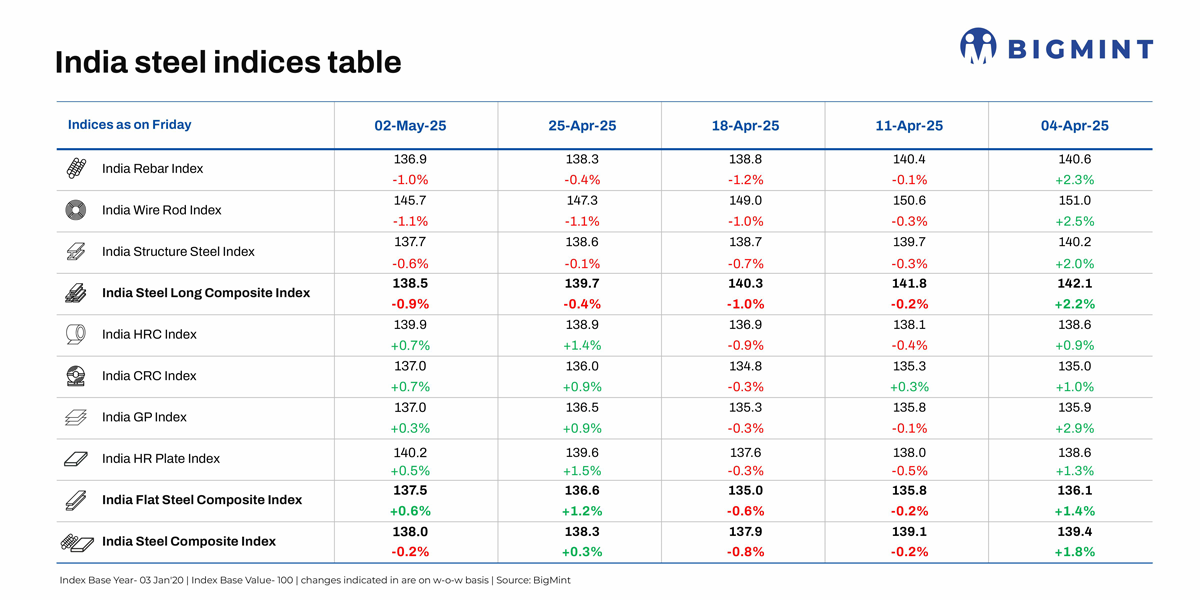

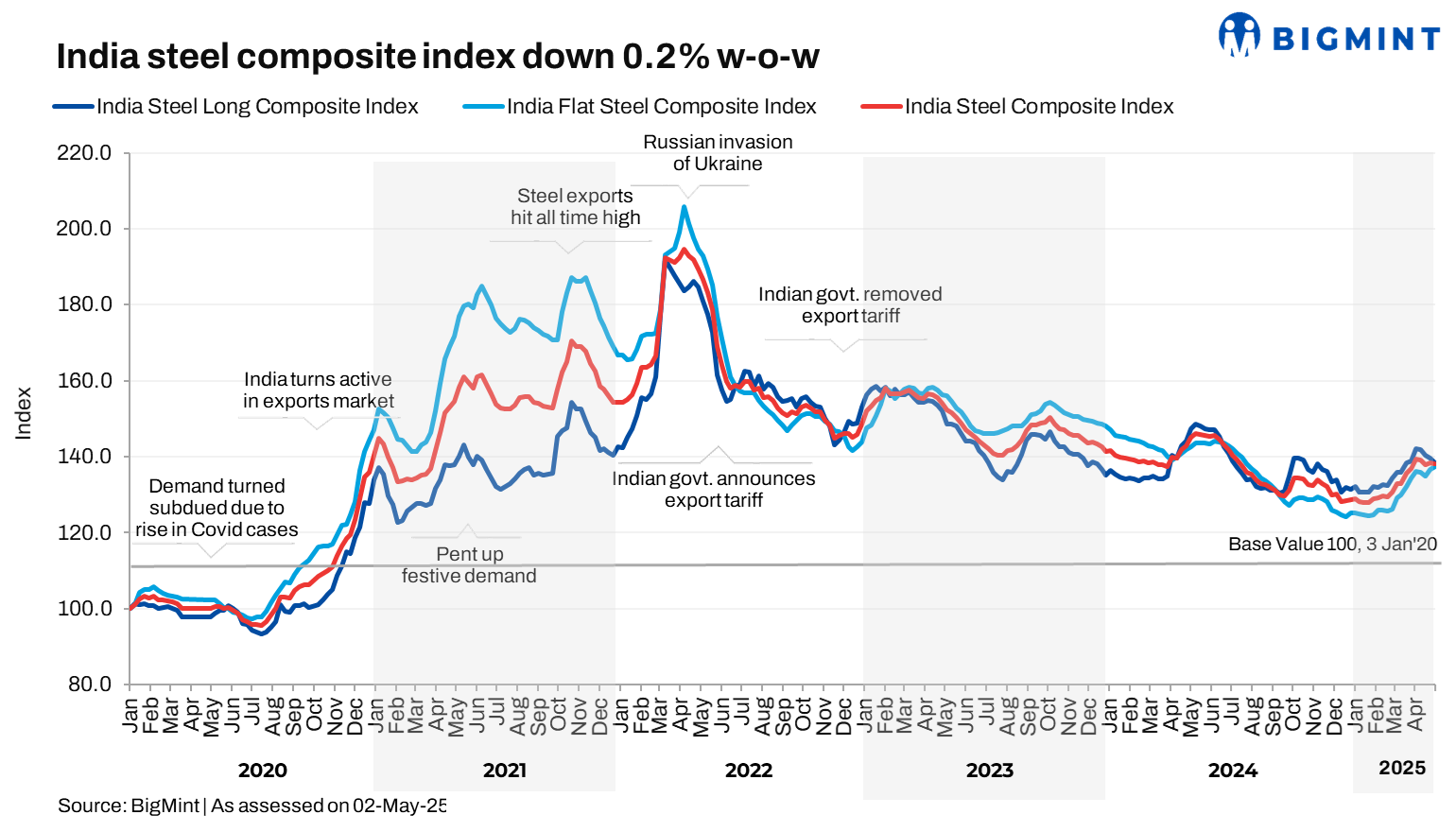

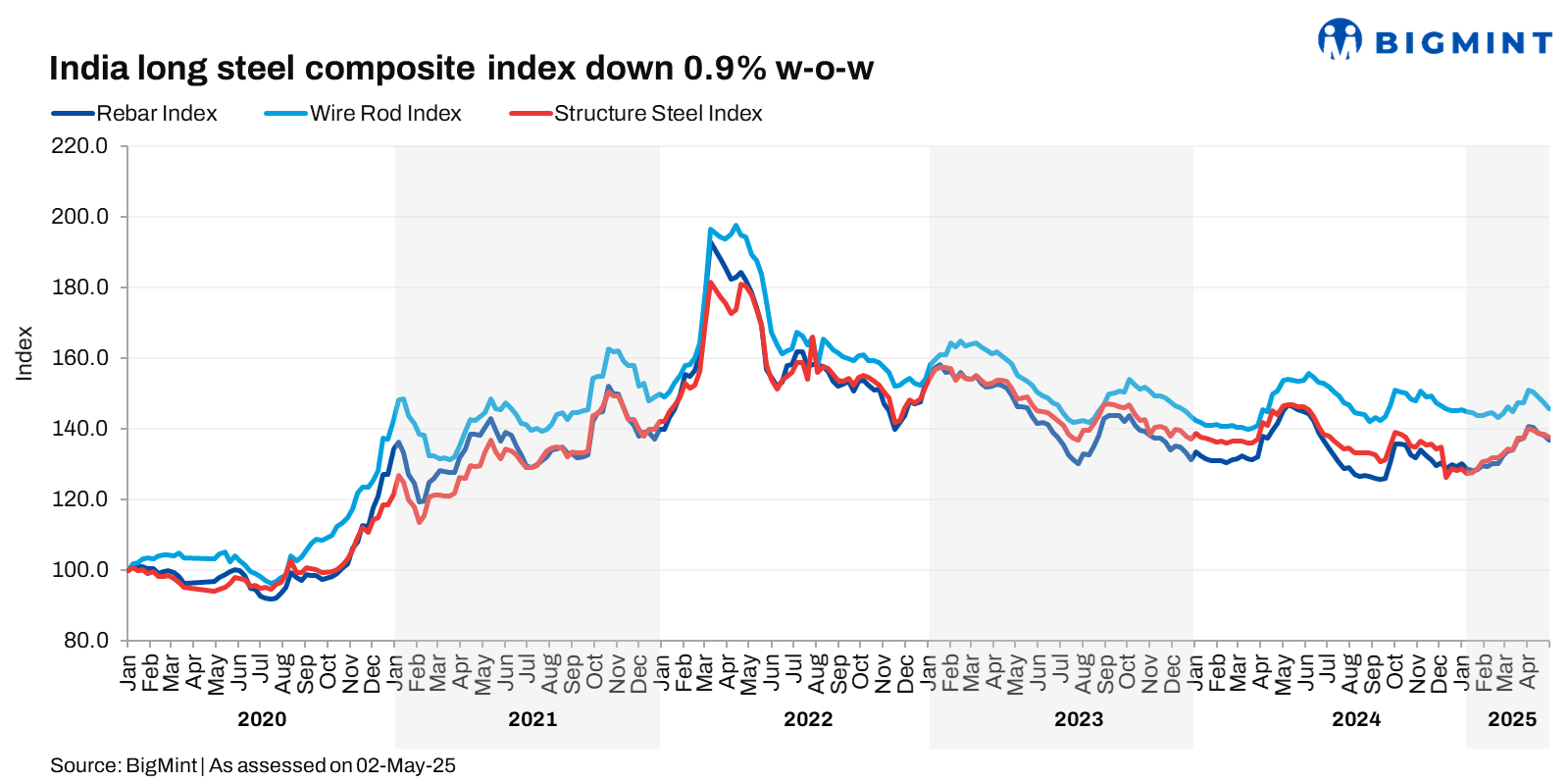

Morning Brief: BigMint's India Steel Composite Index dropped a minor 0.2% w-o-w to 138 points on 2 May 2025, pressured by a significant price decline across the longs segment. The long steel index was down by 0.9% w-o-w to 138.5 points, with rebar eroding by 1% and wire rod by 1.1%.

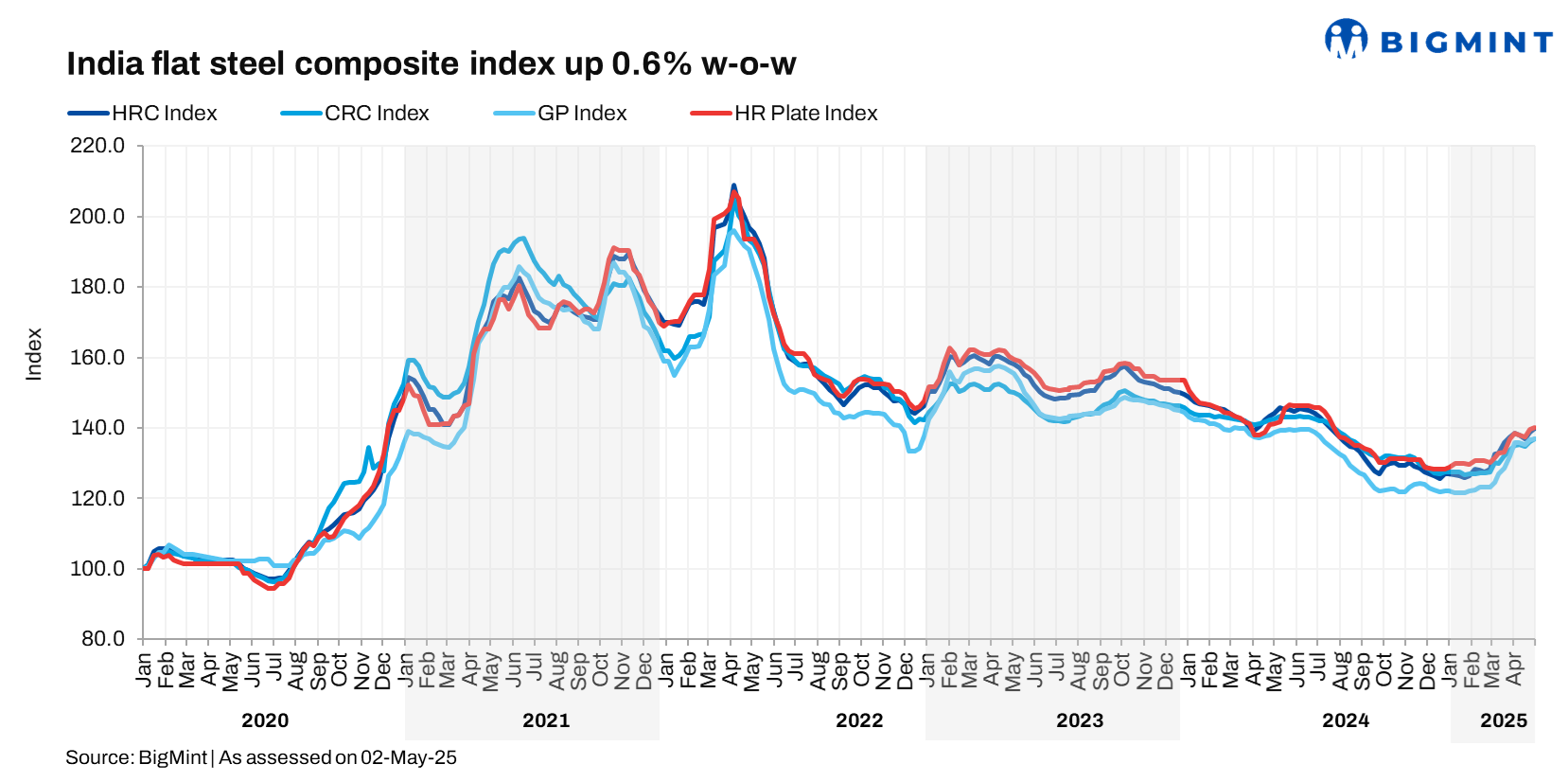

However, the robust price momentum in flats continued, as evidenced by a 0.6% rise in the index. Both hot-rolled coil (HRC) and cold-rolled coil (CRC) indices recorded a decent 0.7% uptick.

Factors impacting index last week

BF rebar remains range-bound in dull market: Trade-level blast furnace (BF) rebar prices were largely range-bound w-o-w across key locations amid dull trade activity. Notably, benchmark prices edged down by INR 100/tonne (t) ($1/t) w-o-w to INR 56,800/t ($672/t) exy-Mumbai, excluding GST on 2 May.

This range-bound trend could be attributed to two factors. First, demand was need based. Last week, despite the drop, prices in Mumbai were around INR 4,000/t ($47/t) higher than those prevailing in end-February, and these elevated values discouraged buyers from making deals. Most market participants were also on their guard, amid anticipation that prices could ease in the near term. The trade segment also opted to wait for mills' price announcements for May, expecting that these would provide clarity on near-term dynamics.

Secondly, there was cost support from the raw material side. BigMint's Odisha iron ore fines (Fe 62%) index edged up by INR 50/t ($1/t) w-o-w to INR 5,300/t ($63/t) on 26 April amid active buying by steelmakers. Additionally, Australian premium hard coking coal (PHCC) prices increased by $5/t w-o-w to $204/t CNF Paradip on 2 May. The increase in production costs due to higher raw material expenses prevented a sharper drop in rebar prices.

In the projects segment, prices remained stable w-o-w at around INR 55,500-56,500/t ($656-668/t) FOR Mumbai.

IF rebar prices drop w-o-w amid sluggish buying: Induction furnace (IF) rebar trade prices fell w-o-w, with Mumbai witnessing a drop of INR 400/t ($5/t) w-o-w to INR 49,000/t ($579/t) exw on 2 May.

The price drop was due to slow procurement and limited inquiries, which prompted some manufacturers to either keep their list prices stable or slash prices, while others offered discounts. Transactions at higher prices were sparse.

However, there was no inventory pressure on mills, with average holding periods remaining at 7-8 days.

HRC prices head north despite need-based buying: Trade-level prices of hot-rolled coils (HRCs) climbed up across markets, with prices in the benchmark Mumbai market recording an INR 300/t ($4/t) w-o-w increase to INR 52,800/t ($624/t). Positive sentiments from the safeguard duty coming into force continued last week, with prices increasing despite need-based buying.

Prices headed north due to the following factors: First, the supply crunch persisted last week as well. Notably, one of Tata Steel's blast furnaces has been under maintenance for an extended period. Additionally, JSW's Dolvi plant may undergo maintenance for 20-25 days this month, sources suggest.

Secondly, prices remained elevated due to the impact of the safeguard duty and the substantial decline in imports. India's bulk imports of HRCs and plates totalled 283,840 t as of 28 April, based on vessel line-up data from BigMint. Another 94,919 t are expected to arrive shortly. In comparison, March recorded 408,762 t and February 413,020 t.

Thirdly, with cheaper, older material no longer in circulation, suppliers were disinclined to reduce prices of fresh stocks. Moreover, the trade market expects mills to raise list prices for May, by INR 1,500-2,000/t ($18-24/t).

However, prices faced pressure from sluggish, need-based buying. Liquidity was also tight, and new sales were largely on credit and payment recovery was slow.

HRC export offers to EU drop w-o-w: Indian mills decreased their HRC (S275) offers to the EU to $585-590/t FOB main port India amid an unfavourable euro-dollar parity. CFR Antwerp values were at $635-640/t, down by $10/t. Trade in the region was limited amid cautious market sentiment. Additionally, Indian mills continued to avoid actively offering to the Middle East market amid competitive Chinese offers and higher domestic realisations.

Outlook

There is uncertainty regarding price movements in the near term. In the rebar segment, the market largely expects Tier 1 mills to roll over prices for May, which may exert downward pressure on trade-level tags, given two reasons: First, IF prices are trending down. Secondly, the gap between BF-IF rebar prices in Mumbai widened to INR 7,500-8,000/t ($89-95/t) in end-April compared to INR 6,500-7,000/t ($77-83/t) in end-March. As such, corrections in BF rebar prices may be possible, to align them with IF values.

However, prices are expected to receive support from tight supply because of maintenance shutdowns at certain mills, which could restrict the degree of decline.

In the HRC market, prices may remain firm or strengthen further following the expected list price hikes. However, the sustainability of the continuous price increase remains in question because demand is still not strong enough to absorb the current supply. Additionally, there are concerns that if tags keep on rising, imports may become more cost effective given that mills' prices are approaching the landed cost of imports.

A significant development last week was the Supreme Court's rejection of JSW Steel's INR 19,350-crore acquisition of Bhushan Power and Steel (BPSL). BPSL contributes about 10% to JSW Steel's EBITDA and 9.5% (3.5 million tonnes) to its crude steel capacity. In FY'25, BPSL produced 1.8 mnt of HRCs, 1.2 mnt of CRCs, 0.56 mnt of galvanised plain (GP)/galvanised corrugated (GC) coils, 0.45 mnt of colour-coated flats, and 0.6 mnt of wire rods, among several other products. The potential production impact would be commensurate with these volumes.

Source:BigMint