Posted on 19 May 2025

The number of profitable blast-furnace steel mills in China continued to increase this week, mainly thanks to the recovery in finished steel prices after market sentiment turned positive, Mysteel Global learned.

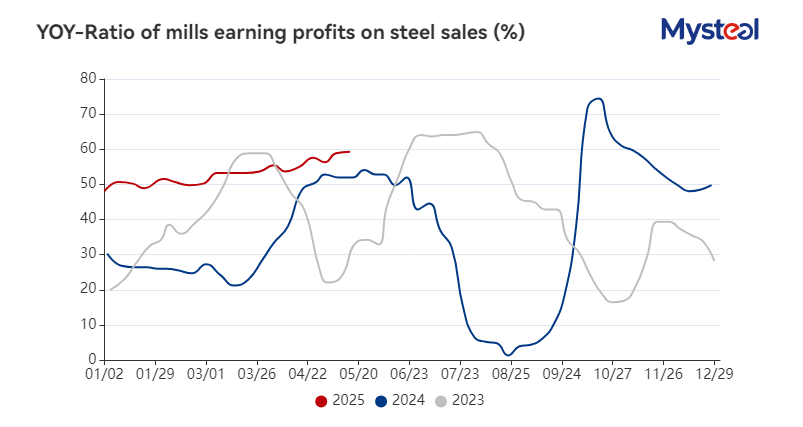

Mysteel's latest weekly survey showed that as of May 15, about 59.3% of the 247 sampled BF steel mills under its regular tracking had achieved profits on finished steel sales during the May 8-15 week, higher by a 0.4 percentage point on week and recording the highest number responding positively since mid-November 2024.

The improvement in Chinese steel mills' profitability was mainly attributed to the growth in finished steel prices amid the positive market sentiment. After China and the United States had announced on May 12 that they would temporarily roll back high tariffs on each other's goods, the measures officially took effect on May 14 and signalled a significant easing of trade tensions between the world's two largest economies, as Mysteel Global reported.

Domestic steel prices in both the physical and futures markets strengthened, with the national average price of HRB400E 20mm dia rebar, a bellwether of domestic steel-market sentiment under Mysteel's assessment, standing at Yuan 3,353/tonne ($465/t) including the 13% VAT as of May 15, rising by Yuan 30/t on week and by Yuan 51/t from the recent low on May 9.

On Thursday, the most-traded rebar contract on the Shanghai Futures Exchange for delivery in October closed the daytime trading session at Yuan 3,118/t, higher by Yuan 46/t from the settlement price on May 8, according to the exchange's data.

The growth in finished steel prices offset the impact of a slight rise in the production costs of Chinese steelmakers caused by higher prices of iron ore, Mysteel Global noted.

Over May 9-15, the average cost of making hot metal among the 114 Chinese mills monitored by Mysteel was at Yuan 2,363/tonne excluding the 13% VAT, edging up Yuan 2/t on week. As of May 15, Mysteel's SEADEX 62% Australian Fines iron ore index was assessed at $102.35/dmt CFR Qingdao, up by $4.65/dmt from one week earlier.

Source:Mysteel Global