Posted on 05 Mar 2025

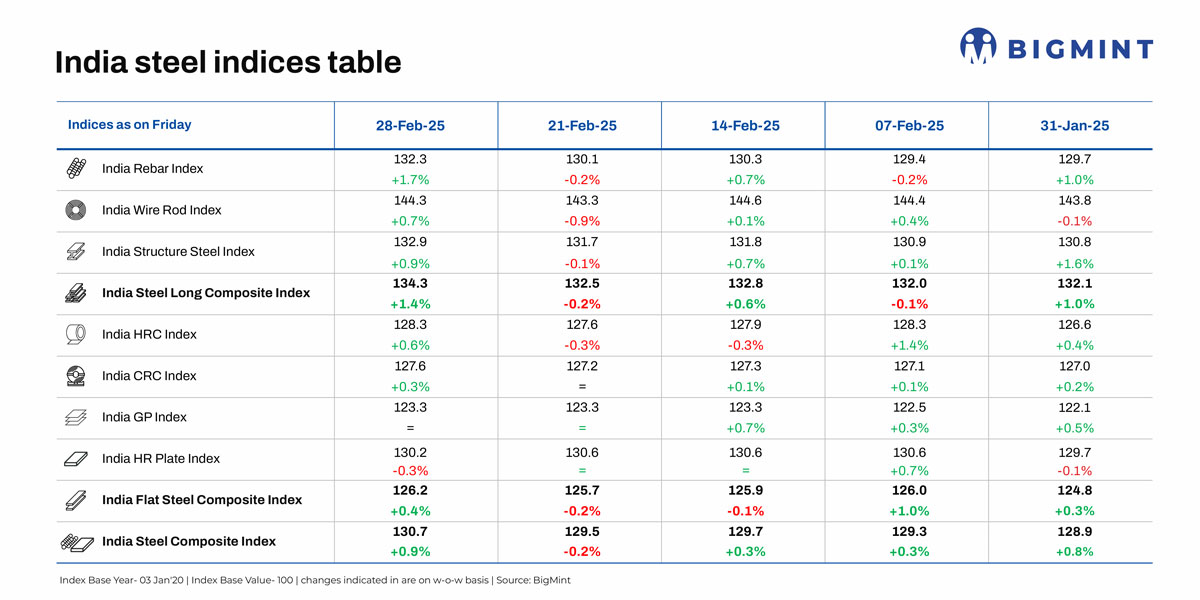

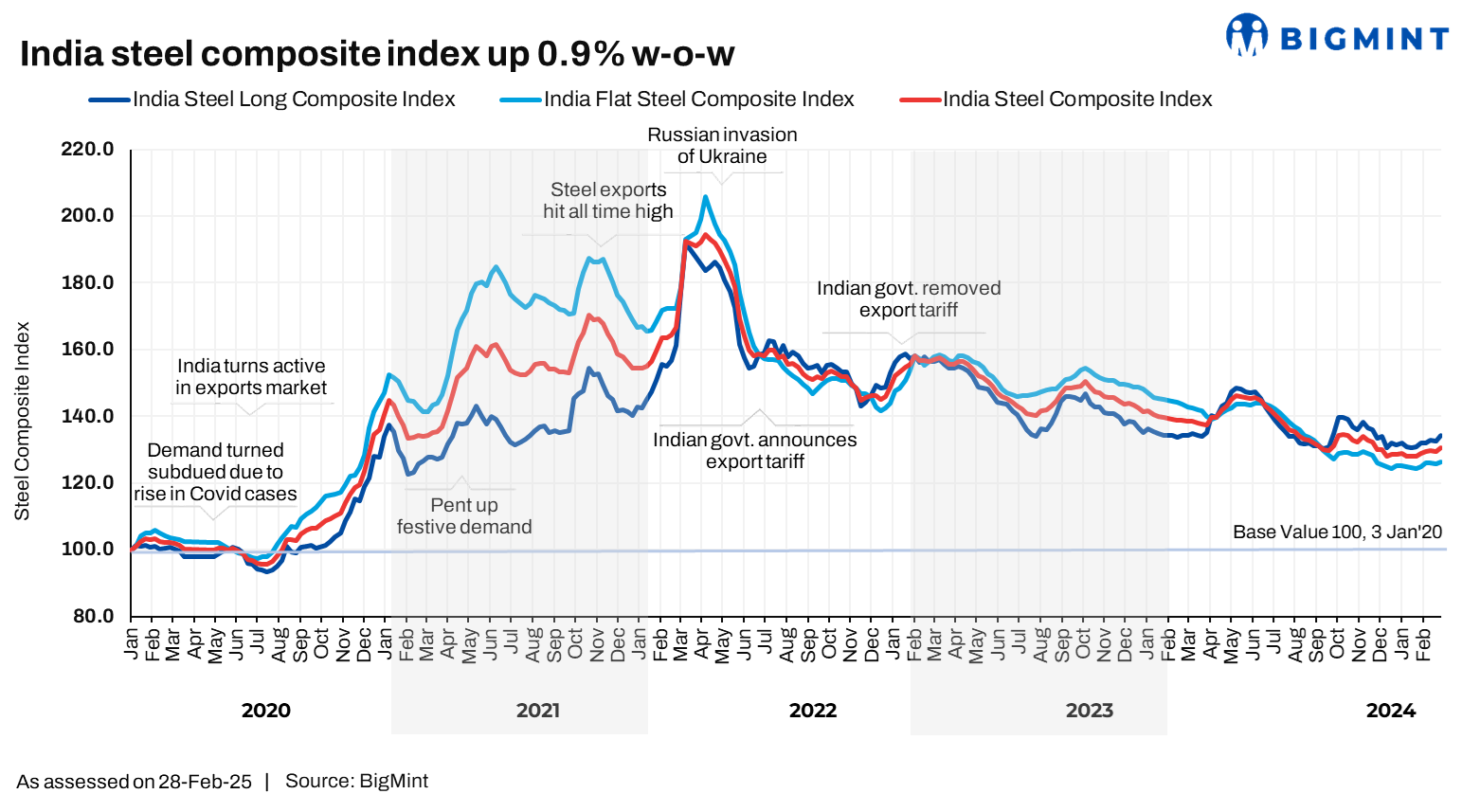

Morning Brief: BigMint's Steel Composite Index bounced back to over a three-month high amid reports of supply constraints, which follows rumours of maintenance shutdowns by major steelmakers. The index moved up by 0.9% w-o-w to 130.7 points on 28 February 2025, finally lifting itself from the 128-130 levels it had stayed at over the past 14 weeks.

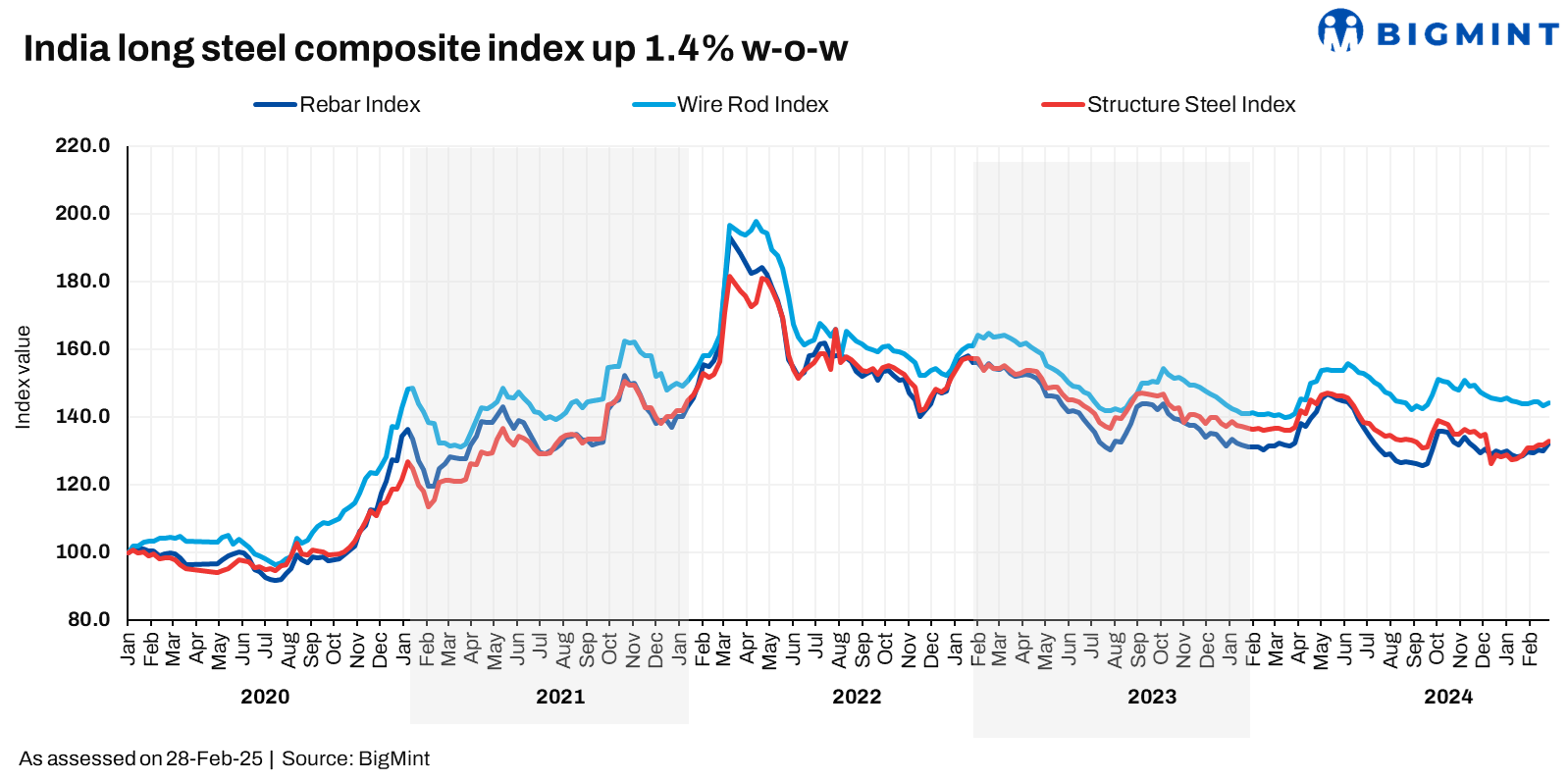

Among the sub-indices, longs jumped by 1.4% w-o-w, on the back of a 1.7% surge in the rebar segment. Wire rods and structural steel were up significantly too, by 0.7% and 0.9%, respectively.

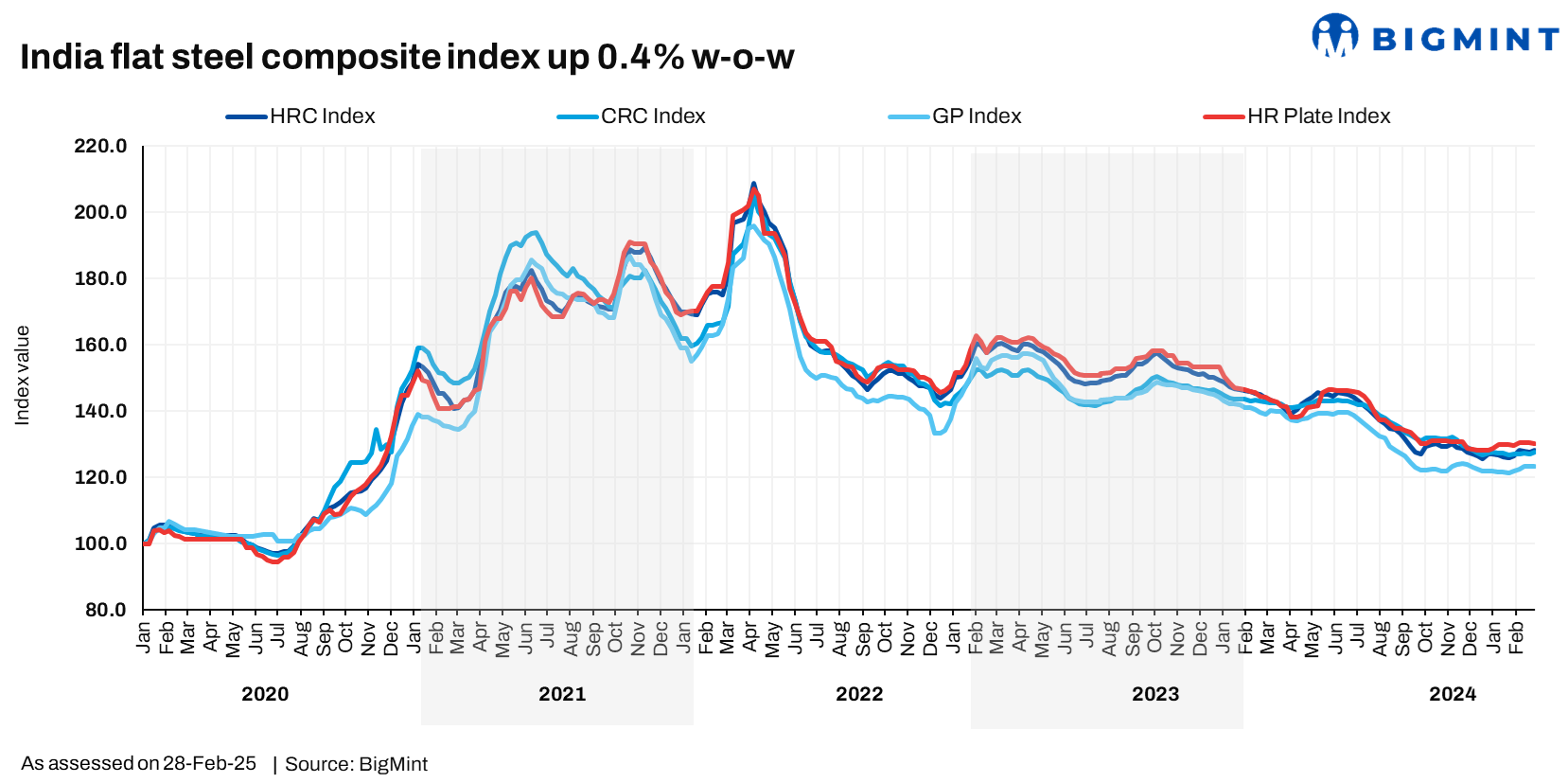

The flats index recorded a slight 0.4% uptick, with hot-rolled coils (HRCs) moving up by 0.6% and CRCs by 0.3%.

Factors impacting index last week

BF rebar stocks sink to lowest level in recent times: Supply shortages in major markets sparked an uptrend in blast furnace (BF) rebar prices, with tags climbing up by INR 600/t ($7/t) w-o-w to INR 53,200/t ($609/t) exy in Mumbai.

A number of factors led to a supply squeeze in the market. First, there were logistical disruptions, BigMint learns, which affected the distributor network. Secondly, the project segment witnessed a substantial spike in order volumes. Thirdly, at yards, inventories stood at their lowest in recent times.

Due to stock unavailability, mills had to divert material to the project segment, which limited supply in the trade network.

Empowered by this, leading mills raised list prices by INR 500-1,000/t ($6-11/t) w-o-w to around INR 53,500-54,500/t ($612-624/t) on a landed basis.

IF rebar tags climb up as trades improve: Trade-level prices of induction furnace (IF) rebars rose w-o-w, with Mumbai witnessing a hike of INR 500/t ($6/t) to INR 49,100/t ($562/t) exw.

First, the market saw moderate bookings, an improvement from last week, which prompted manufacturers to lift tags while pushing down discounts. Notably, however, demand slowed towards the weekend, amid resistance to higher prices.

Sponge iron and billet tags also increased, while inventory idling time was on the lower side, at around 10-12 days.

HRC prices rise on supply crunch but concerns arise: HRC prices increased by up to INR 800/t ($9/t) w-o-w, to range within INR 48,000-50,000/t ($549-572/t). Supply shortages, especially in north India, pushed up prices despite demand remaining comparatively subdued.

The supply shortage comes at a time when unconfirmed reports of production cuts by the leading steelmakers are swirling in the market. However, concerns have emerged with sources pointing out that the prevailing crunch may have been artificially created, driven by a pressing need among steelmakers to temporarily pause the steady market downtrend.

Meanwhile, CRC tags also increased by up to INR 600/t ($7/t), to settle at INR 53,500-56,000/t ($612-641/t) across markets.

HRC imports remain pressing concern: Imports of bulk HRCs and plates stood at 383,294 t till 24 February, and an additional 38,195 t are expected by the month-end, as per BigMint's vessel line-up data. Imports are still continuing at a worryingly high level, with another 82,349 t set to arrive in the first week of March.

The market had been expecting some relief following the oral hearing for the anti-dumping investigation into Vietnamese hot-rolled steel. However, given that it has been deferred, uncertainty has intensified. However, the deferral may also hint at an impending blanket safeguard duty announcement by the government following the imposition of 25% tariffs on steel imports by the US.

Moreover, the renewal of the BIS licences of Vietnam's Hoa Phat Group and Formosa Ha Tinh has emerged as a cause for concern, BigMint heard from sources. Given that US steel tariffs may further boost shipments, the market awaits an expedited response to the problem of steel dumping.

Notably, in a development that may put market participants' minds slightly at ease, the oral hearing for the anti-dumping investigation into cold-rolled non-oriented (CRNO) steel from China has been scheduled for 18 March 2025. The outcome of this may play a significant role in future market dynamics.

HRC export offers keep facing pressure: BigMint's India HRC (SAE 1006) export index for the Middle East and Vietnam remained stable w-o-w at around $505/t FOB east coast India. Trade activities slowed down ahead of Ramadan in the Middle East. Chinese offers were also firm at $495/t CFR UAE.

Meanwhile, Indian mills remained inactive in the EU, as market participants awaited the results of the anti-dumping investigation, along with details of the new import quotas.

Notably, Vietnam has imposed anti-dumping duties on HRC imports from China but exempted India. However, Indian mills are not actively offering to Vietnam amid concerns about parity between domestic and Vietnamese prices.

Outlook

Presently, the market is too volatile and uncertain to predict as to which way the wind might blow. Prices may ultimately remain range-bound in the near term, and price shifts, if any, will be limited.

Market participants are also uncertain as to whether the apparent supply shortage is genuine or an illusion created to jack up prices. If the supply issue does not persist, demand and procurement trends, which are rather subdued at the moment, will continue exerting pressure on prices.

India Steel Composite Index

The India Steel Composite Index is assessed on a weekly basis, every Friday at 18:30 IST, as per the weighted average prices based on manufacturing capacity and production.

BigMint considers the Composite Index with the base year being 3 January 2020 (financial year 2019-2020) and the base value as 100. The Composite Index does not give the absolute price but a trend of the market. The Indian Steel industry is broadly classified into the BF-BOF and the electric/induction furnace routes. Keeping this broad classification in view, BigMint proposes to release the Composite Index by considering both production routes by manufacturing capacity and the production weighted method to compute the index for India.

Source:BigMint