Posted on 25 Sep 2024

Chinese export prices of commercial grade hot-rolled coils (HRCs) finally gained some ground last week, mainly driven by improved market sentiment buoyed by favorable macro-economic factors, while export transactions for the flat product stayed limited, Mysteel's weekly market roundup shows.

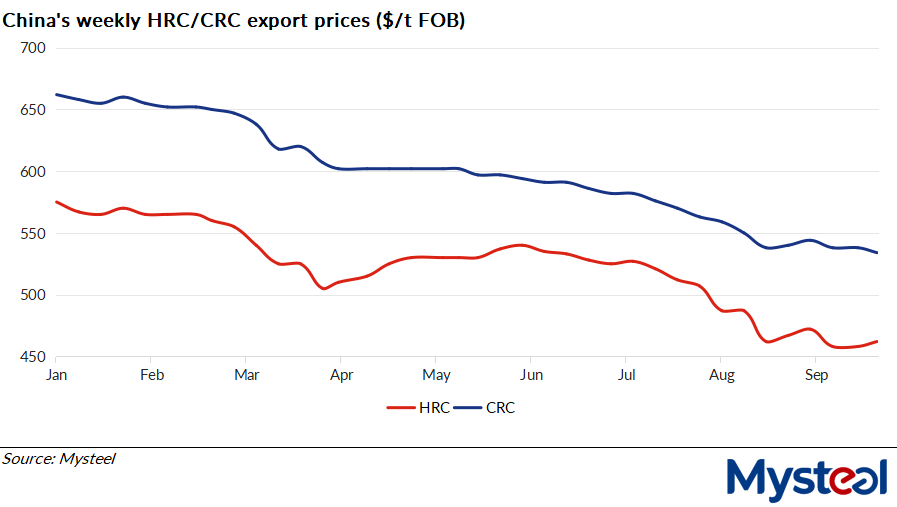

As of September 20, the export price of SS400 4.75mm HRC under Mysteel's assessment had moved higher by $4/tonne on week to reach $462/t FOB from North China's Tianjin port.

Early last week, the Chinese hot coil export market was mostly stagnant due to the country's Mid-Autumn Festival holiday over September 15-17, with export quotations for SS400 3mm HRC steady at around $450/t FOB and sparse inquiries from overseas buyers, Mysteel Global notes.

Following the holiday, activity in the Chinese export HRC market picked up. Positive signals from the macroeconomic front, including the long-anticipated rate cut from the US Federal Reserve and China's commitment to increased policy support, bolstered market sentiment.

The export offering prices for China-origin SS400 3mm HRC increased to around $457-465/t FOB by late last week, according to Mysteel's tracking.

Despite this price uptick, overall activity in the Chinese export HRC market was limited during the past week. Market participants expressed concerns about whether weak HRC demand could continue to support the price growth, Mysteel's survey revealed.

By Friday, China's export price for SPCC 1.0mm cold-rolled coil had decreased by $4/t on week to land at $534/t on FOB Tianjin basis, according to Mysteel's assessment.

Source:Mysteel Global