Posted on 02 Sep 2024

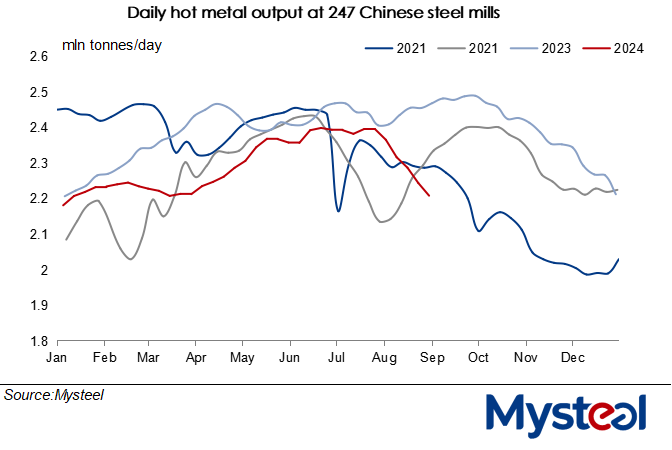

Daily hot metal production among the 247 Chinese blast-furnace (BF) steelmakers sampled in Mysteel's regular survey averaged 2.26 million tonnes/day during August 1-29, down by 5.3% compared with the daily average of 2.39 million t/d in July, according to Mysteel's latest monthly report on BF operations. When compared with August last year, the daily average saw a larger decline of 7.9%.

This year's weak August for hot metal production in China resulted from extensive maintenance stoppages of BFs at domestic steelmakers, with as many as 43 BFs taken offline during the month while only 15 were brought back online, the report pointed out.

This year's weak August for hot metal production in China resulted from extensive maintenance stoppages of BFs at domestic steelmakers, with as many as 43 BFs taken offline during the month while only 15 were brought back online, the report pointed out.

"To avoid losing more money, mills had no choice but to halt more blast furnaces," a Shanghai-based market analyst explained, adding that mills have been suffering severe losses due to slumping steel prices.

For example, China's national price of HRB400E 20mm dia rebar under Mysteel's assessment dropped to just Yuan 3,205/tonne ($452.3/t) including the 13% VAT on August 16, the lowest since December 2016, though prices have shown tentative signs of rebounding since then.

The coming September usually marks the beginning of China's autumn peak season for steel demand, which will likely spur most domestic mills into lifting their hot metal production significantly. However, Mysteel estimates that the daily hot metal output among the surveyed mills will stay largely flat at 2.26 million t/d, or up by a small 2,000 t/d on month.

Behind the forecast is Mysteel's new survey of the production schedules of furnaces at these 247 mills, which indicated that 16 BFs with a total pig iron capacity of 61,300 t/d will be reignited next month, while nine BFs are to be halted – and their combined capacity is much smaller at 33,300 t/d.

Most mills are still on course for clearing their yard stocks of old-standard rebar through offering cheaper prices, before the new standards take effect later next month, as reported. Discounting their sales mean the mills remain deeply in the red and thus, lacking the motivation to ramp up their production, the report argued.

As of August 29, the average profit ratio of the 247 mills stood low at 3.9%, though it had improved from the historical low of 1.3% in the previous week, Mysteel's tracking showed.

Nonetheless, there is also potential that hot metal output could rise further than expected in the month ahead, the report added. If the stocks of superseded rebars can be fully digested before the new rules regarding rebar production and performance take effect on September 25, and if mills' profit margins improve through an uptick steel demand, steelmakers will be more willing to lift their hot metal output, the report suggested.

Source:Mysteel Global