Posted on 07 Aug 2024

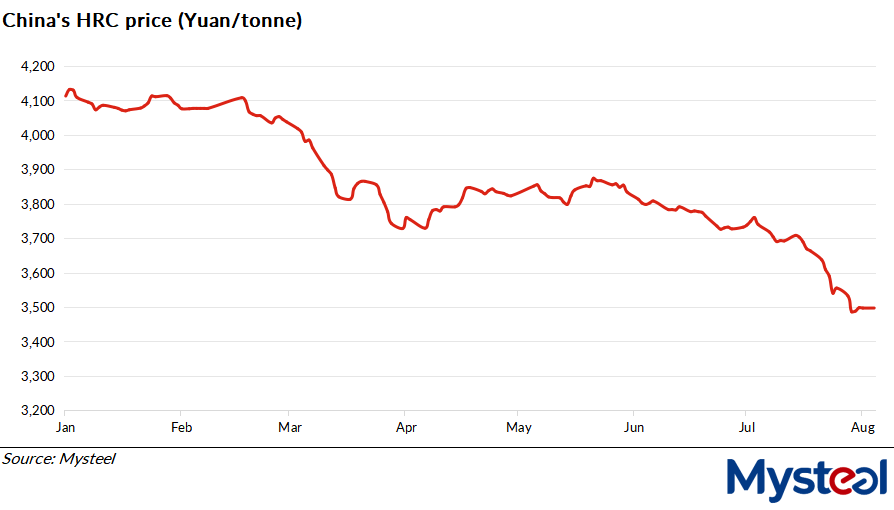

The contradiction between dull demand and abundant supply in China's market for hot-rolled coil (HRC) is expected to continue this month, with HRC prices seen likely to fluctuate between Yuan 3,400-3,500/tonne ($475.7-489.6/t), compared with the range tracked during July of Yuan 3,480-3,760/t, according to Mysteel's latest monthly report on the key flat-rolled item.

As of July 31, China's spot price of Q235 4.75mm HRC under Mysteel's assessment was at Yuan 3,488/t including the VAT, lower by Yuan 239/t or 6.4% on month.

Overall, domestic steel consumption including that of hot coils is predicted to stay weak in August as the high daytime temperatures and the occasional torrential downpours that China has experienced this summer seem set to continue, Mysteel's report noted.

Overall, domestic steel consumption including that of hot coils is predicted to stay weak in August as the high daytime temperatures and the occasional torrential downpours that China has experienced this summer seem set to continue, Mysteel's report noted.

Besides, the steady fall seen recently in finished steel prices nationwide including HRC has further weakened the already tepid market sentiment, with many end-users procuring hot coils just for their immediate needs – rather than buying extra tonnage – in case prices fall further, the report added.

Also, two major end-use sectors of flat products, namely the structural steel and machinery sectors, will stay under pressure this month amid seasonal factors.

For the former, for example, only around 12% of respondents among the 89 structural steel companies Mysteel recently sampled across China replied that they had won more orders for August delivery than those in July. Meanwhile, for the latter only 17% of the 59 sampled Chinese machinery enterprises said their orders for August delivery were better than those last month.

In parallel, China's home appliance sector shows relatively high levels of stocks and might be less interested in replenishing more flat products this month, Mysteel's report observed.

The total scheduled production in August of China's three most popular home appliances – air-conditioners, refrigerators and washing machines – is expected to decrease by 6.4% on month to sit at 26.72 million units, as reported.

Although Chinese steel mills are struggling with reduced profitability and even losses, some could still gain some profits from hot coils when compared with the more lackluster construction steel market, the report observed, adding that any rapid decline in hot coil production might be difficult to see this month.

By end-July, HRC production among the 37 Chinese flat steel producers Mysteel regularly monitors had slipped by 0.5% on month to around 3.23 million tonnes. Meanwhile, total HRC inventories held by traders in the 33 Chinese cities Mysteel tracks nationwide, and among the 37 steel mills it samples, had climbed by 4.7% on month to reach 4.32 million tonnes by end-July.

Source:Mysteel Global