Posted on 18 Mar 2024

The inventories of finished steel products at the warehouses of Chinese traders regularly sampled by Mysteel declined over March 8-14 after steadily mounting since mid-December last year, the latest stocks survey shows. However, the decrease was a mere 0.4% on week and the market mood remains gloomy, survey respondents said.

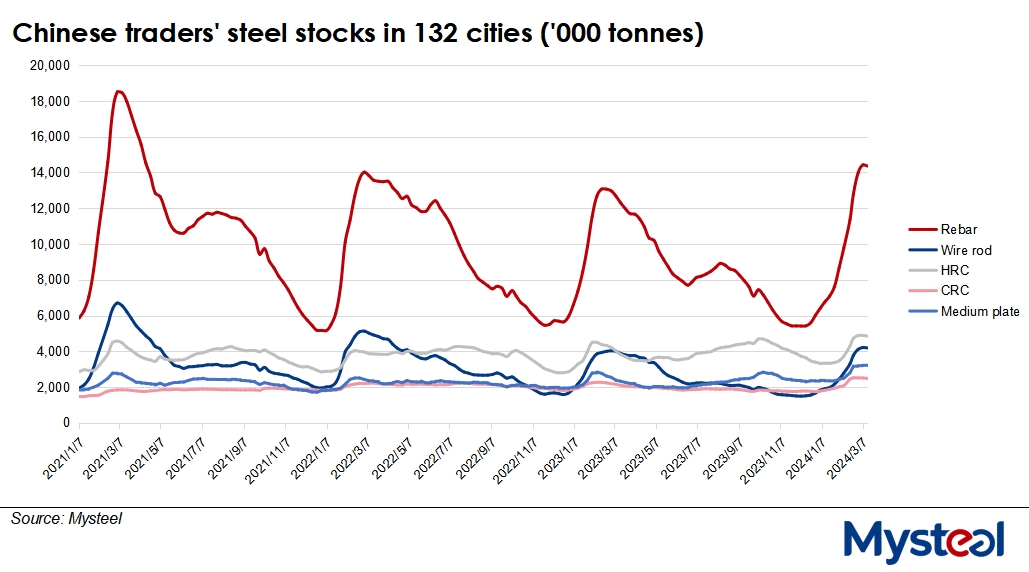

The stocks of five major steel products held by traders in the 132 cities Mysteel tracks thinned by 117,400 tonnes on week to 29.1 million tonnes as of March 14, the survey showed. The five items comprise rebar, wire rod, hot-rolled coil, cold-rolled coil and medium plate.

The stocks dip was mainly due to the on-week rise in spot sales as March is usually a good month for steel consumption in spring, with the weather becoming more pleasant for building activities, Mysteel Global noted.

The daily trading volume of construction steel including rebar, wire rod and bar-in-coil among the 237 traders across the country checked by Mysteel rose by 24.6% on week to average 110,616 tonnes/day over March 7-13.

However, market sources commented that the operation rate among construction companies after the Chinese New Year has proven lower than the previous year's level, leading to a slow recovery in long steel demand this year.

Some market participants are also worried about financial liquidity. "Although polices relating to real estate purchases and development have been relaxed, funds among property developers are tight and the number of newly-launched property projects is below market expectations," said a Shanghai-based analyst. "This means that steel consumption in the real estate market will struggle to grow," she explained.

Among the five steel items, rebar inventories witnessed the sharpest decline, falling by 63,000 tonnes on week to 14.4 million tonnes as of Thursday, the survey showed. Meanwhile, the stocks of hot-rolled coils slipped by 32,500 tonnes on week to 4.9 million tonnes.

On the other hand, another market insider said that lower production costs for steelmakers would give domestic finished steel prices more space to trend downward.

China's national price of HRB400E 20mm dia rebar, for example, was assessed by Mysteel at a 6.5-month low of Yuan 3,761/tonne ($523/t) including the 13% VAT on March 13, plunging by Yuan 129/t on week. For the country's iron ore market, Mysteel SEADEX 62% Australian Fines had softened by $10.55/dmt to $106.45/dmt CFR Qingdao over the same period.

The inventories of finished steel products in Mysteel's former smaller sample across just 35 cities also reversed down last week by 0.3% or 45,800 tonnes on week to 17.6 million tonnes as of March 14.

Source:Mysteel Global