Posted on 28 Feb 2024

Chinese export prices of commercial grade hot-rolled coils (HRC) eased during the week of February18-23, while overseas demand for China-origin hot coils was tepid, Mysteel's weekly market roundup shows. February 18 was a substitute working day in much of China after the Chinese New Year holiday, Mysteel Global notes.

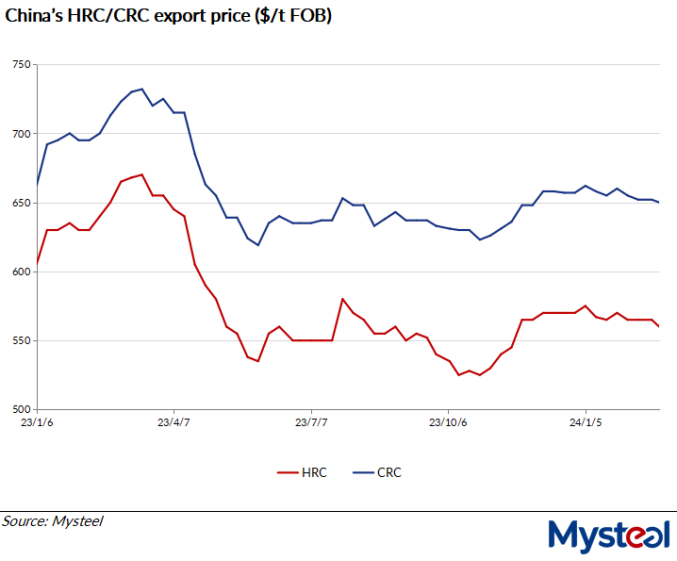

As of February 23, the export price of Chinese SS400 4.75mm HRC under Mysteel's assessment had dipped by $5/tonne from February 18 to $560/t FOB from North China's Tianjin port. On the same day, the export price of China-origin SPCC 1.0mm cold-rolled coil had also inched down by $2/t during the same period to $650/t, also on FOB Tianjin basis.

Under the impact of tepid overseas demand and the slower-than-expected recovery in domestic HRC market, Chinese steel mills chose to clip the export quotations for their flat products, hoping to facilitate deals, market watchers noted, adding that overseas buyers generally held wait-and-see stance.

For example, during the first half of last week some steelmakers in North China tabled their export offering prices for Q195 HRC at $560/t CFR to Vietnam, while the price was later lowered to $552/t CFR in the latter part of the week.

During the same period, they also lowered their export quotations for Q355B HRC to Vietnam from $577/t CFR to $569/t CFR, according to Mysteel's tracking.

Mysteel also heard that a deal involving Q195 HRC to Vietnam was reached at a price of $545/t CFR last week.

In parallel, Vietnam's major steel group, Formosa Ha Tinh Steel (FHS), announced via its latest price revision released on February 23 that it has reduced its HRC prices for domestic sales for April delivery by $30/t from prevailing levels to $605-618/t CIF Ho Chi Minh City (dollar equivalent). Lower imported HRC offers and the weak domestic market sentiment were factors behind FHS's price revision, sources believed.

Source:Mysteel Global