Posted on 02 Feb 2024

The inventories of finished steel products held by Chinese traders monitored by Mysteel grew further and faster over January 26-February 1, swelling by another 9.4% on week, as against the 4.8% on-week increase in the prior period, according to the latest survey result.

Behind the large rise in stocks was the strong festive mood pervading the domestic steel market, survey respondents remarked, noting that many workers had already left for their hometowns and traders had shut their shops to celebrate the Chinese New Year (CNY) holiday commencing February 10.

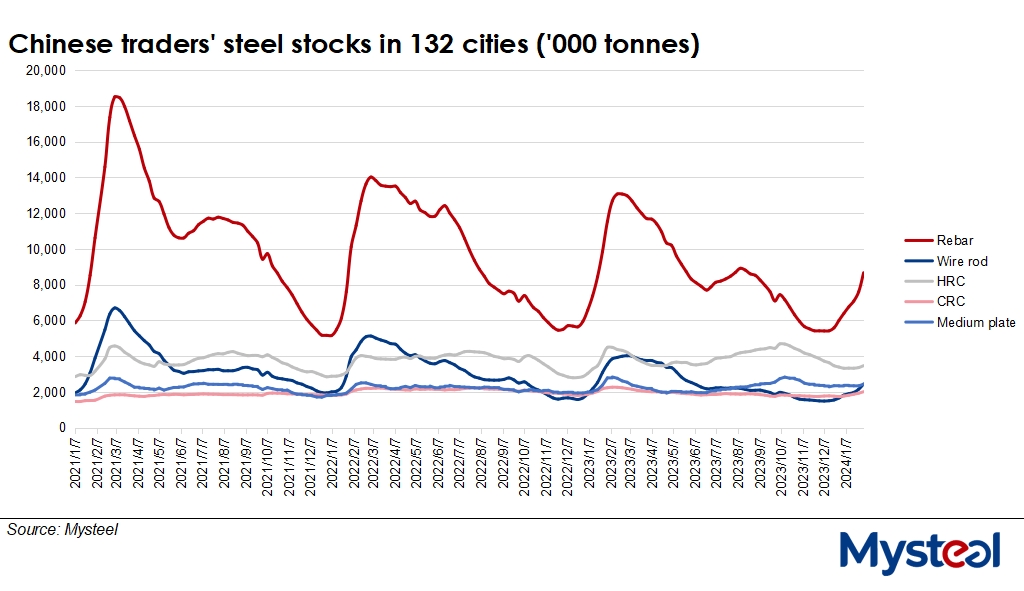

As of February 1, the stocks of the five major steel items held by traders in the 132 cities Mysteel tracks nationwide had mounted for the seventh week in a row, rising by another 1.6 million tonnes on week to reach about 19 million tonnes, a 4.5-month high. The five steel products comprise rebar, wire rod, hot-rolled coil, cold-rolled coil and medium plate.

All five items experienced on-week rises in their inventories, the survey data showed. Among these, rebar and wire rod stocks gained the most, with the former swelling by 1.1 million tonnes on week to a five-month high of 8.7 million tonnes as of Thursday, and the latter up 289,300 tonnes during the same period at 2.4 million tonnes, refreshing a new high since early June last year.

Mysteel's survey among the 237 Chinese trading houses it follows showed that their trading volume of rebar, wire rod and bar-in-coil averaged just 45,138 tonnes/day over January 25-31, plummeting by 53.7% on week and indicating the significant fall in spot trading as the holidays loom.

"Steel consumption in our local market is sluggish, and only a few construction companies still have limited demand for steel," according to a source in Xiamen in Southeast China's Fujian province. "Most traders have opted to put steel products in storage."

On the other hand, China's finished steel prices showed mild fluctuations last week. As of January 31, the country's national price of HRB400E 20mm dia rebar, for example, was assessed by Mysteel at Yuan 4,040/tonne ($562/t) including the 13% VAT, inching up Yuan 4/t from a week earlier.

Steel inventories held by traders in Mysteel's former smaller sample across just 35 cities soared for the sixth week, with the tonnage jumping by 9.6% or 999,500 tonnes on week to 11.4 million tonnes by February 1, also a 4.5-month high.

Source:Mysteel Global