Posted on 02 Jan 2024

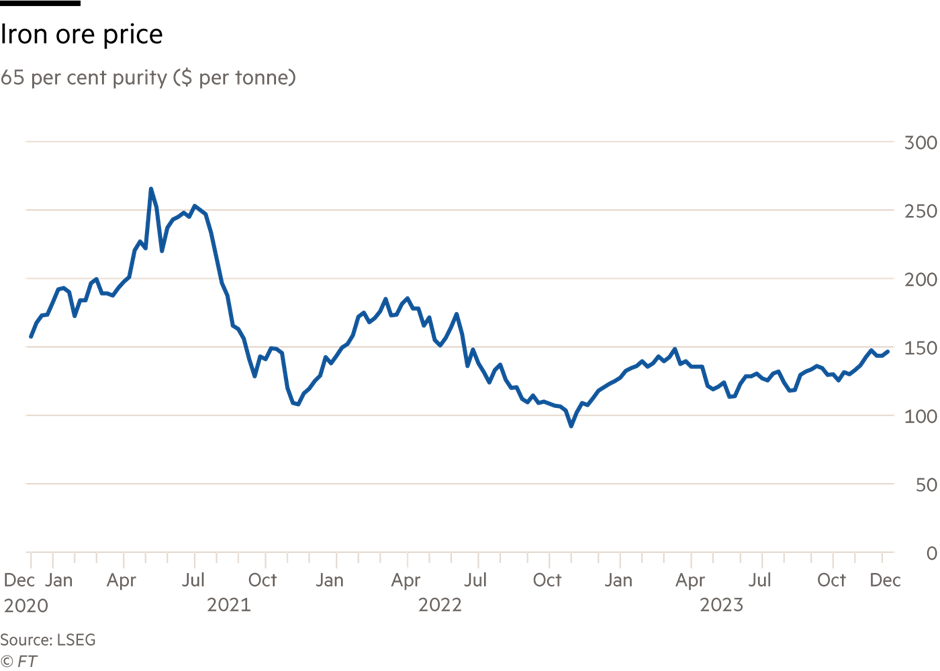

China’s love affair with property may be ending but no one seems to have told iron ore traders. Imports of the transitional metal used for construction steel rose in 2023 compared to the previous year. Iron ore’s price gains made it one of the best performing commodities of the year, up over a fifth by mid December.

That is odd. Chinese steel mills appear to be losing money when producing basic steel for construction. Both coking coal and iron ore are relatively expensive. Steel prices have had a mini rebound since mid-October but Chinese mills will not continue to produce at a loss indefinitely.

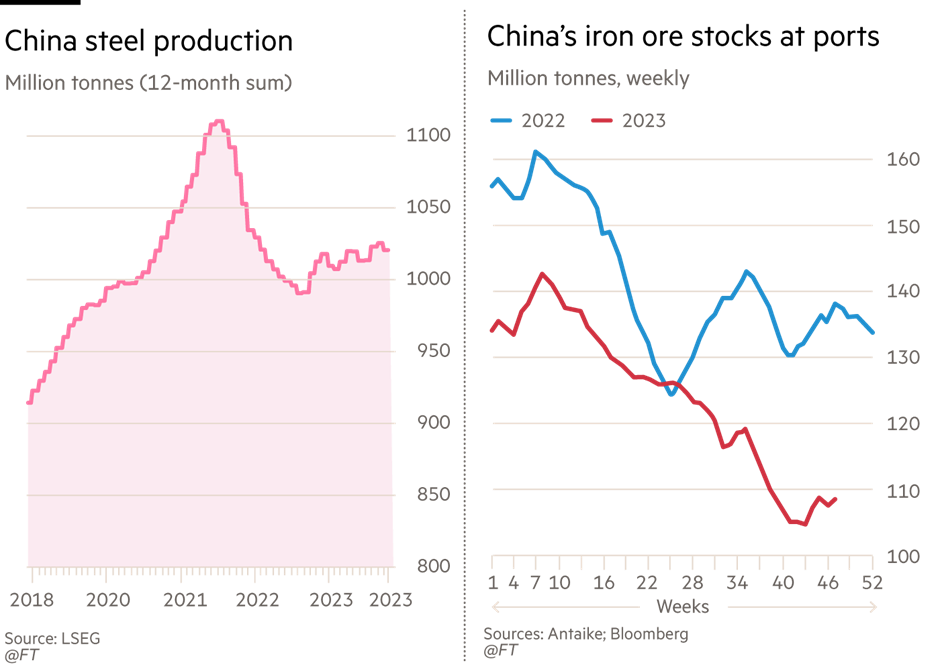

China’s steel output is starting to fall. In October, this figure dropped below an annual rate of 900mn tonnes. That is lower than the seasonal five-year range. In part, this is because of a slow down of domestic real estate-related construction, which accounts for 35 per cent to 40 per cent of Chinese steel demand.

Line chart showing iron ore price. 65 per cent purity ($ per tonne) from Dec 2020 to Dec 2023. Yet iron imports grew in 2023 when compared to the previous year. The Baltic Dry index, which indicates the rates for bulk carrier ships, climbed 49 per cent in the year to December. Bulk carriers mostly carry iron ore.

China accounts for 70 per cent of the world’s seaborne iron ore. Various explanations have surfaced for this apparent bullishness. Beijing‘s plans to stimulate the economy with another round of heavy infrastructure spending have caused some producers to hope steel demand will jump.

It is possible some domestic steel output is being under-reported too. China’s steel exports rose 45 per cent in 2023, mostly going to south-east Asia and Europe. This increase could explain the boost to iron ore demand. A stronger renminbi in the later months of the year also made iron cheaper to buy — just when inventories at Chinese ports were low.

Two charts. First, an area chart, showing China steel production. Million tonnes (12-month sum) from 2018 to 2023. Second chart, Line chart, China’s iron ore stocks at ports million tonnes, weekly. Figures are comparative for 2022 and 2023.

The result has been a boon for global iron ore producers, in particular Australia’s Fortescue and to a lesser extent Vale of Brazil. The former’s share price is up 31 per cent over the past three months. China’s deflated real estate market is still grabbing global headlines. But iron ore traders have reason to remain optimistic.

Source:Financial Times