Posted on 08 Sep 2023

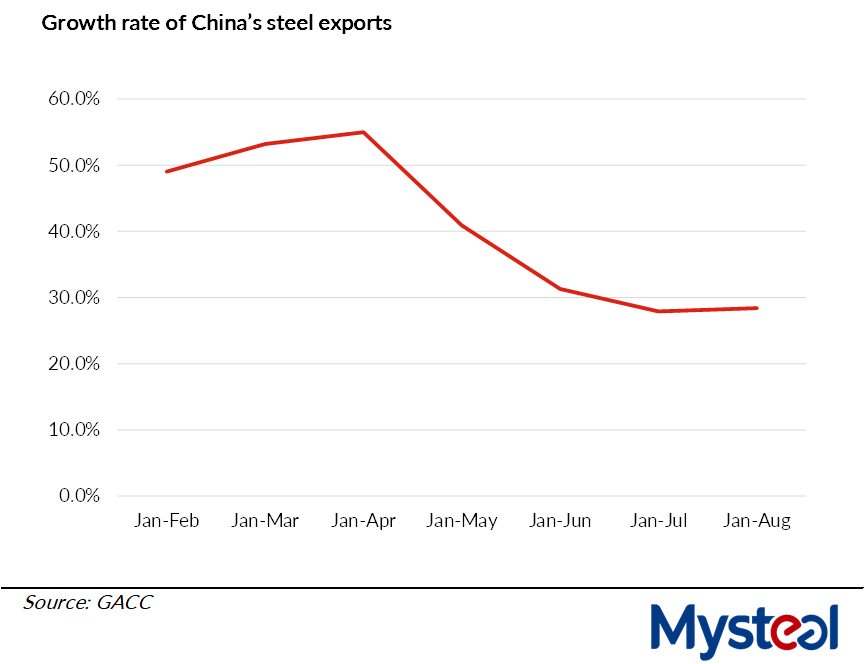

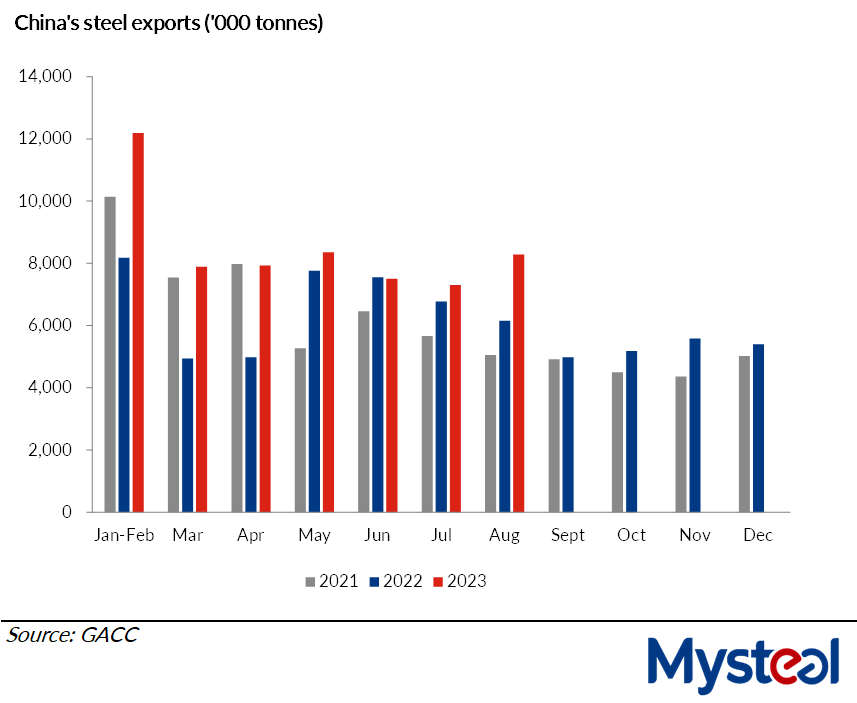

China's finished steel exports reached 58.79 million tonnes over January-August, leaping by 28.4% on year, according to the latest data released by China's General Administration of Customs (GACC) on September 7.

Notably however, the growth rate in the first eight months was slower than the phenomenal 31.3% increase recorded during this year's first half, Mysteel Global observed.

For August alone, China's steel exports posted an on-month gain of 13.3% and a larger on-year rise of 34.6% to total 8.28 million tonnes, indicating the relatively active foreign order volume compared with recent years, Mysteel Global noted.

China's steel shipments abroad during August were mainly fulfilling orders signed about two months earlier, Mysteel Global noted.

June is traditionally an off-season for steel demand in China due to the hot weather and frequent heavy rains, and this year China's steel market was conflicted by strengthening steel production on the one hand and weakening domestic consumption on the other, industry watchers recalled. This contradiction led Chinese steel producers to seize overseas trading opportunities as a key channel for offloading their inventory.

As of June 30, capacity utilization among the 247 blast furnaces mills nationwide under Mysteel's tracking recorded 91.98%, the highest since early March 2021, according to Mysteel's weekly survey.

By contrast in June, the country's major steel consuming sector, real estate development, continued to perform badly and failed to provide much of a spur for steel sales among the mills and traders, the sources noted.

For example, within China's total fixed asset investment over January-June, funding for the domestic property market dropped by 7.9% on year to Yuan 5.9 trillion ($799.08 billion), according to the country's National Bureau of Statistics (NBS).

Meanwhile, by end-June inventories of unsold property in China had climbed by 17% on year to 641.6 million sq m, the NBS data showed.

Besides, the depreciation of China's Yuan strengthened the price advantages of China's steel products in the international steel market, meaning that Chinese steel exporters could shave US dollar-denominated offer prices and still earn Yuan profits.

In June, when most export deals for August shipment were being negotiated, the average central parity rate of the Yuan against the US dollar was Yuan 7.1492=$1, compared with Yuan 6.6991=$1 in June 2022, according to data from China Foreign Exchange Trade System.

During this year's first eight months, China also imported 5.06 million tonnes of steel products, dropping by 32.1% on year, according to the GACC's data.

Source:Mysteel Global