Posted on 01 Aug 2023

South Korea's ferrous scrap imports rose to a 13-month high in June as firmer country and housing economic data spurred sentiment, while local steelmakers sought more scrap in the month.

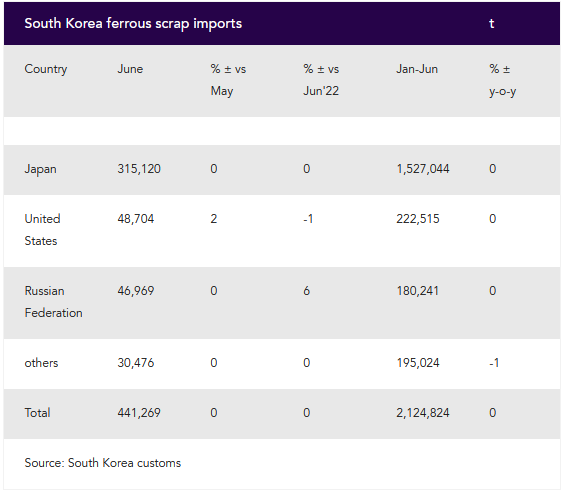

Imports of ferrous scrap to South Korea totalled 441,269t in June, a 32pc jump month on month and a 12.2pc hike year on year, customs data show. This also marks the highest import volume since May 2022 at 465,281t. The net import volume for ferrous scrap was 2.1mn t across the first half of this year, 22pc lower than the same period in 2022.

South Korea's economy rose at a faster-than-expected pace in the second quarter. The country's gross domestic product grew by 0.6pc in April-June and was 0.9pc higher, compared to the second quarter of 2022.

The second quarter also saw improved housing statistics. According to the ministry of land, infrastructure and transport, the number of unsold homes in the country was 66,388 at the end of June, down by 3.6pc month on month. This also marked the fourth consecutive month of decline in unsold housing statistics.

Japan remains the top exporter of ferrous scrap to South Korea at 315,120t in June, accounting for approximately 71pc of the country's overall net imports. This also marks the highest exports from Japan since April 2022 at 364,160t. Net imports from Japan were higher by 31pc and 44pc month on month and year on year, respectively. Japan exported a total of 1.53mn t of scrap into South Korea across the first half of this year, which is 10pc lower than the same period in 2022. Trade sources said a weakened Japanese yen against the US dollar led to keen selling interests by Japanese scrap exporters in the second quarter.

The US was the second-largest exporter of scrap into South Korea at 48,704t in June. While this was an almost twofold increase from a low base in May, it also marks a 60pc decline year on year. In the first half of 2023, net imports from the US stood at 222,515t, marking a 43pc decline year on year. Trade sources said slow scrap generation and low scrap prices led exporters to adopt a wait-and-see approach in April and May.

Scrap imports from Russia trailed closely behind the US at 46,969t in June, from a mere 6,500t in June 2022. On a month-on-month basis, the import volume was 1pc higher from May.

Many trade sources said despite the positive economic news, cheap semi-finished product offers from Indonesia, Russia, and China may pose headwinds for local steelmakers and raw material prices, benefitting rerollers instead.

Source:Argus Media