Posted on 28 Feb 2022

Exports of ferrous scrap from Russia dropped in 2021 compared with a year earlier, as the country made multiple increases to its ferrous scrap export duty.

Russia's ferrous scrap exports totalled 4.29mn t last year, down by 13pc on the year and fell to the lowest level in 11 years, the country's customs data show. The fall in exports was mostly driven by higher scrap export duty.

Moscow lifted the scrap export duty to €45/t ($50.30/t) in January 2021, before further raising it to €70/t ($78.25/t) on 1 August 2021. It announced another rise in late November to €100/t ($111.78/t) from 1 January 2022.

The lower shipments came despite stronger prices from the country's key scrap buyer, Turkey. Exports to Turkey fell by just under a third on the year to 1.73mn t in 2021 and accounted for 40pc of Russia's total scrap exports.

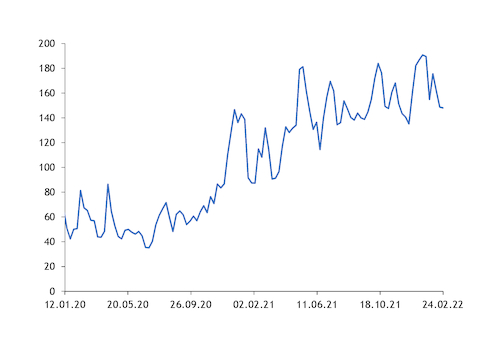

The Argus daily cfr Turkey HMS 1/2 80:20 assessment averaged $463.19/t last year, up by 62.2pc from the average in 2020. Dockside purchase prices from Russian exporters, mostly located in northwest Russia, rose broadly in line with the Turkish import price but at a slower rate (see graph). The US dollar-denominated midpoint equivalent of the Argus weekly northwest European Russian A3 grade dockside assessment averaged $323.69/t delivered to St Petersburg in 2021, which was 44.4pc higher year on year. The larger increase in Turkish import prices partially offset the impact of the higher duty (see spread).

As a result, scrap exports from Russia were more than doubled on the month to 521,000t in December, although exports were still 3pc lower on the year. Some panic-selling ahead of the introduction of the €100/t duty in January also contributed to the significant month-on-month increase, many market participants said.

Of the December total, 155,000t were traded to Turkey, 2.4 times up on November, but 54.8pc down on the year. In comparison, shipments to Belarus — the second-largest buyer of Russian scrap — slipped by 0.1pc month on month and by 35.6pc on the year to 59,100t, even though they are not subject to the export duty. Scrap exports to Belarus contracted by 1.3pc year on year to around 1.1mn t in 2021.

In addition, some market participants attributed the drop in exports to tighter domestic supply, resulting from rail logistic disruptions, and lower sales appetite from suppliers because of incoherent pricing policies from Russian steelmakers and restrictions from the country's authorities.

This led to an undersupply for most Russian steel mills, especially in the second half of last year, despite domestic scrap collection hitting a 10-year high in 2021. The higher collection was mostly supported by strong prices and robust demand in the domestic and export markets during the first seven months of last year.

Increased scrap imports from Kazakhstan failed to reduce the tightness in supply. Kazakh shipments of ferrous scrap to Russia rose by around 46pc year on year to 681,800t, with about 73,000t delivered in December, down by 5.4pc on November and 1pc lower on the year.

As a result, Russian steel producers were forced to raise purchasing prices more sharply than exporters. The US dollar-denominated equivalent of the Argus weekly central European Russia A3 grade scrap assessment averaged $360.65/t in 2021, up by 61.6pc on the year. The assessment renewed its multi-year high several times in November.

The assessment reached a fresh high over the past two weeks amid a severe domestic shortage of scrap. But, even in the absence of export activity since the beginning of this year and record-high domestic prices, Russian mills' ferrous scrap receipts of rail-delivered material totalled just around 700,000t in January, down by 45pc on the month and around 10pc lower than January 2021, rail data show.

Russia's invasion of Ukraine yesterday effectively removed any near-term possibility of a resumption of exports from the country, although prices in Turkey are sufficient to offset the impact of the higher scrap export duty while remaining under upward pressure, market participants said.

By Valery Zavyazkin

Turkey import prices - Russian exporters’ buying prices spread $/t

Argus ferrous scrap prices $/t

Source:Argus Media