Posted on 13 Oct 2025

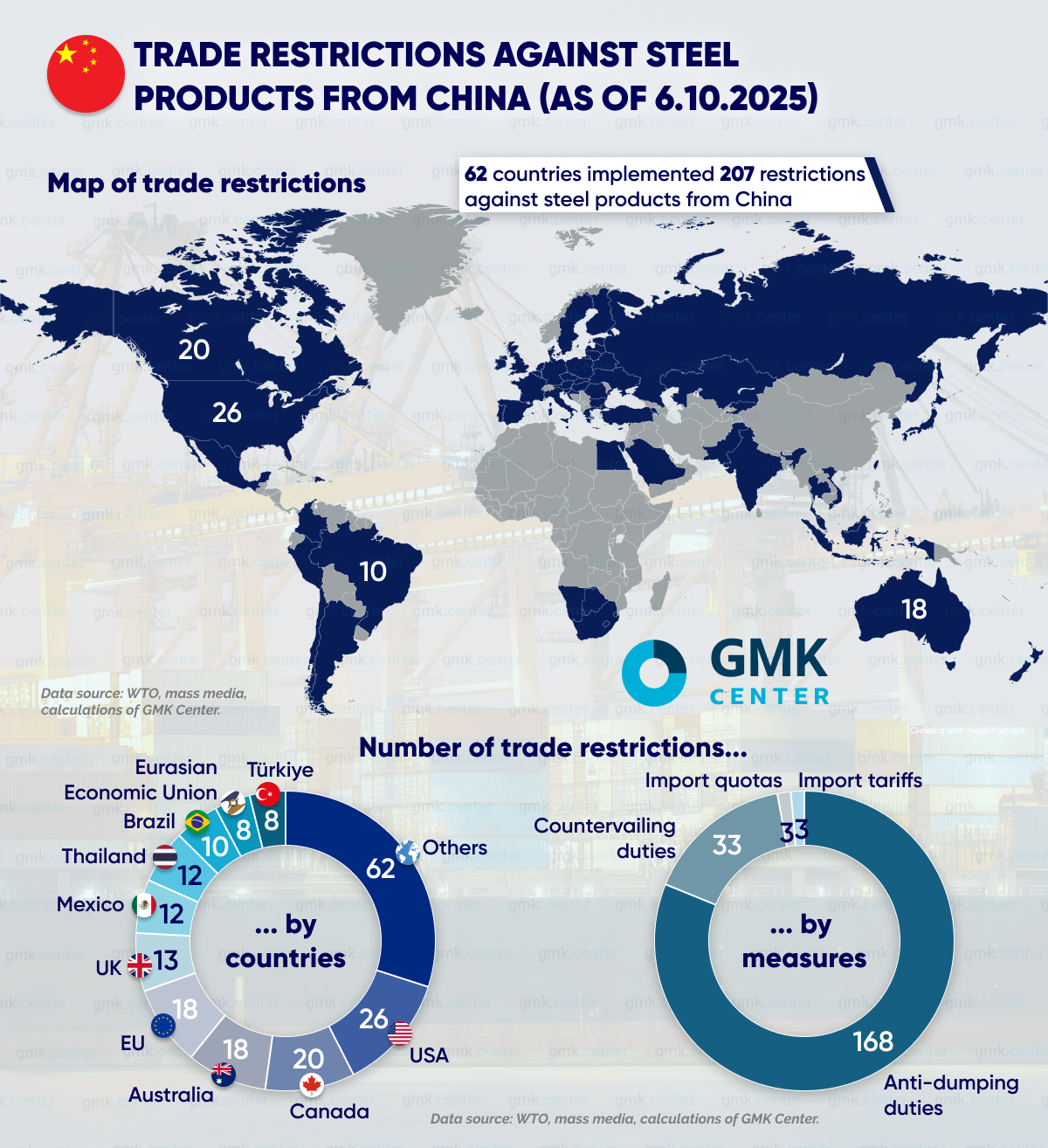

As of early October 2025, 62 countries have introduced trade restrictions on steel imports from China. These actions respond to the state subsidies in China that distort competition and destabilize global steel market.

According to OECD estimates, the subsidization rate for Chinese steelmakers (as a share of firm revenues) is about five times higher than the average for other economies – trade partners. Supported by grants, tax incentives, below‑market loans, and subsidized energy, Chinese mills can continue operating even at a loss, dumping low‑priced steel abroad and harming producers elsewhere.

Chinese steel exports have more than doubled since 2020, reaching a record 118 million tonnes in 2024. In January-August 2025, China exported 77.5 million tonnes of steel (up 10 % y‑o‑y) meaning annual exports could surpass last year’s level.

Trade remedies against China cover almost the entire range of steel products – rebar, wire rod, hot‑rolled and cold‑rolled coils, galvanized and stainless sheets, plates, and seamless and welded pipes.

Anti‑dumping duties remain the most common measure because they offer a direct, WTO‑compliant way to counter unfair pricing practices when imports are sold below domestic market value. These duties allow authorities to act quickly, target specific products or exporters, and restore fair competition without imposing broad trade bans.

Unlike anti‑dumping duties, countervailing measures are used less frequently because they require not only a comparison of domestic and export prices but also clear proof that foreign producers receive specific government subsidies which cause measurable injury to domestic industries. Such investigations demand extensive data collection and verification making them more complex and difficult to introduce.

The United States, Canada, Australia, the European Union, the United Kingdom, and Mexico account for more than half of the restrictions imposed. They have substantial domestic steel markets and local steelmakers injured by actions of Chinese suppliers.

The EU and Canada have tariff‑rate‑quota (TRQ) systems that limit steel imports from China and other countries. Now the EU plans to strengthen TRQ by halving quota volumes and raising the out-of-quota tariff from 25% to 50%.

The United States introduced broad restrictions in 2018 under Section 232 of the Trade Expansion Act, which imposed a 25 % tariff on steel imports, including from China. On June 4, 2025, the U.S. doubled the Section 232 tariff to 50 %.

Canada applies a 25% surtax on steel produced in China. This measure targets products made from steel melted and poured in China. Such import tariff complements the country’s TRQ system ensuring that Chinese-origin steel faces extra costs even when processed elsewhere. The EU also wants to introduce “melted and poured” approach, but it will be used for calculating usage of quota volumes.

Unfairly priced Chinese steel threatens industrial employment, investment, and the green transition in the steel industry. As a result, many countries are building layered systems of trade defenses to restore market balance and counteract disruptions caused by China’s export surge.

As GMK Center previously reported, the EU may impose tariffs of 25-50% on Chinese steel. European Commissioner for Industry Stéphane Séjourné said that Europe has no choice but to find a new balance. This requires fewer internal trade barriers with an effective domestic steel market, as well as protective measures to restore balance with partners who no longer follow any rules.

Source:GMK Center