Posted on 22 Jul 2025

The conversion spread from pellet-based sponge iron (PDRI) to steel billets in the key secondary steelmaking hub of Raipur in central India widened y-o-y in January-June 2025 (H1CY25), possibly indicating that billet manufacturers continue to witness decent margins despite finished steel and raw materials trading at over four-year lows.

Sponge iron is the mainstay of merchant billet production in India as domestic ferrous scrap availability is limited, though growing. The share of PDRI in domestic sponge iron production, which stands at around 55 million tonnes (mnt), is roughly 63-65%.

Billet-DRI spread

BigMint data shows that the average billet-sponge iron price spread in H1CY25 stood at INR 15,100/tonne (t), up by INR 1,000/t from INR 14,100/t in H1CY24. Moreover, the spread was higher by INR 1,500/t from INR 13,600/t in H2CY24. The spread widened due to a sharper drop in sponge iron prices than billet. While sponge iron averaged INR 24,600/t in H1CY25, down by INR 2,900/t y-o-y, billets fell by a lower INR 1,800/t to an average of INR 39,700/t, both exw-Raipur. Recently, both sponge iron and billet prices retreated to their pandemic lows.

To illustrate, in June, monthly average sponge iron prices were nearly at a five-year low, last seen in October 2020. Meanwhile, billet prices were at their lowest since February 2021. Interestingly, although prices of both commodities were at over four-year lows in H1CY25, the spread between them was much higher than the average INR 11,300/t observed in July 2020-June 2021. In fact, on a half-yearly basis, the spread has fluctuated within the INR 13,500-INR 15,700/t range since January 2022.

Factors impacting billet-sponge iron price spread in H1CY'25

Falling thermal coal prices lower sponge iron production costs:Both domestic and imported non-coking coal prices have suffered steep declines over the past year, withdrawing cost support for sponge iron producers in particular. Portside South African RB2 (5500 NAR) coal prices hovered at INR 8,400/t ex-Gangavaram in January-June 2025, down by INR 1,000/t y-o-y. Additionally, domestic thermal coal prices averaged at INR 4,600/t exw-Bilaspur in H1CY25, dipping by INR 200/t from H1CY24 levels.

Billets see better export momentum:Indias billet exports fared better than sponge iron. Billet exports doubled to 0.71 million tonnes (mnt) in H1CY25 from 0.35 mnt in H1CY24, while sponge iron shipments climbed up by 34% y-o-y to 0.83 mnt from 0.62 mnt. Export demand for billets was stronger than sponge, especially from Nepal, due to competitive pricing, quality preferences, and regional shortages. Nepal also faced higher power tariffs and weak finished steel demand, so direct billet procurement from India was more cost-effective. These factors supported Indian billet exports in Q1CY25, but Q2 saw cautious trade amid global uncertainties.

On the other hand, sponge iron exports to Nepal and Bangladesh showed moderate growth. Demand from Nepal remained muted, while bookings from Bangladesh showed some improvement. Moreover, sponge iron export offers remained volatile, tracking global scrap prices and freight variations. H1CY25 witnessed limited high-volume bookings due to price parity challenges.

Other factors impacting sponge iron, billet prices

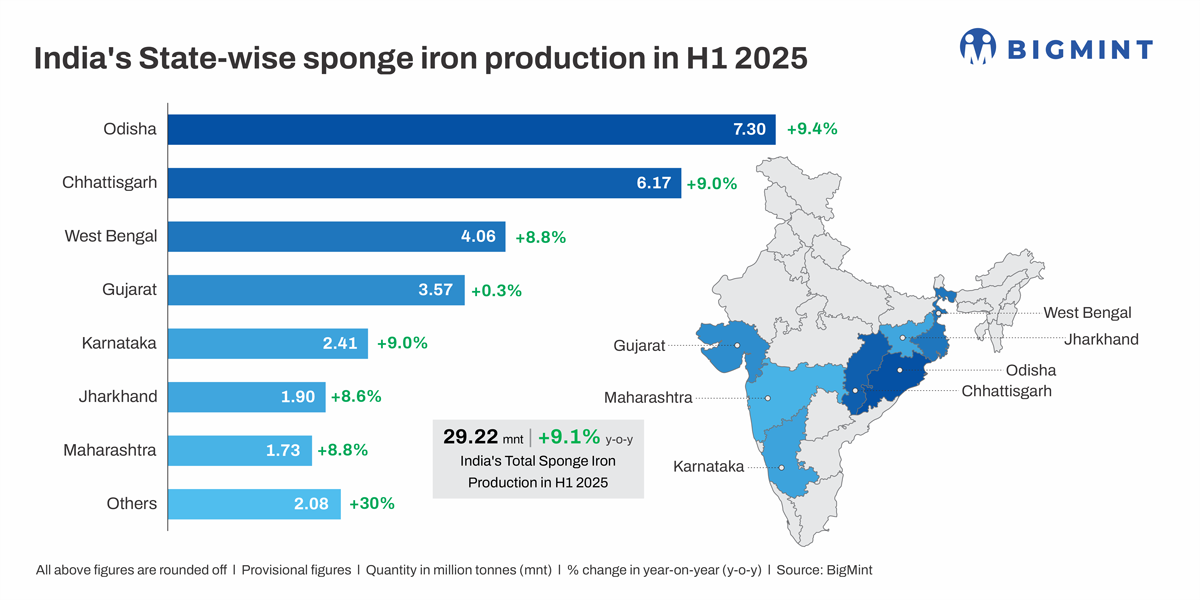

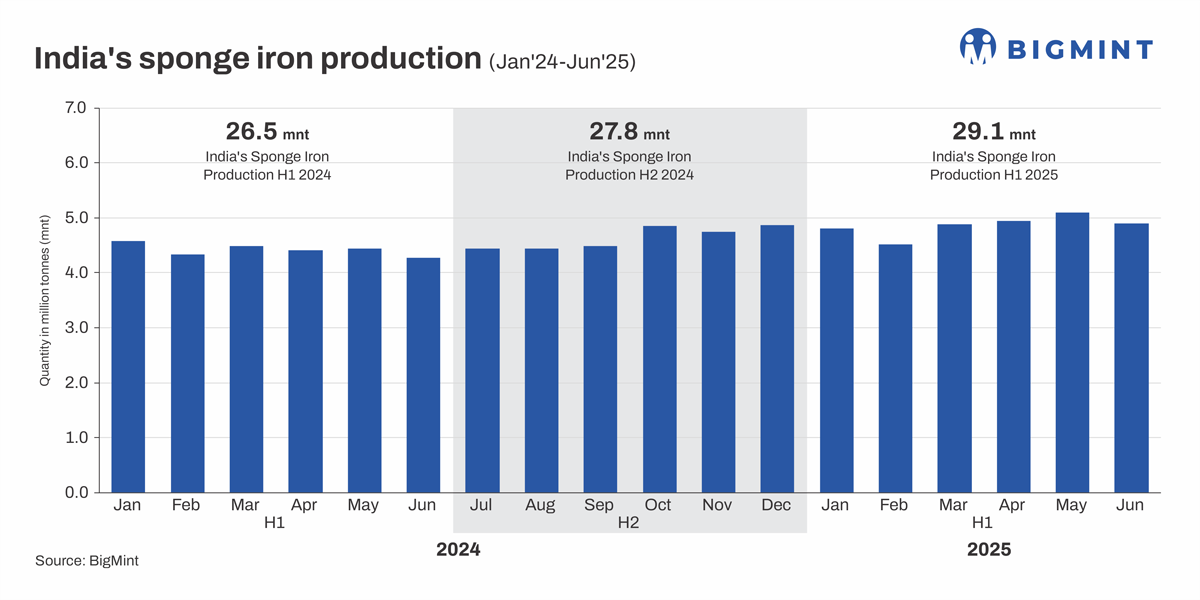

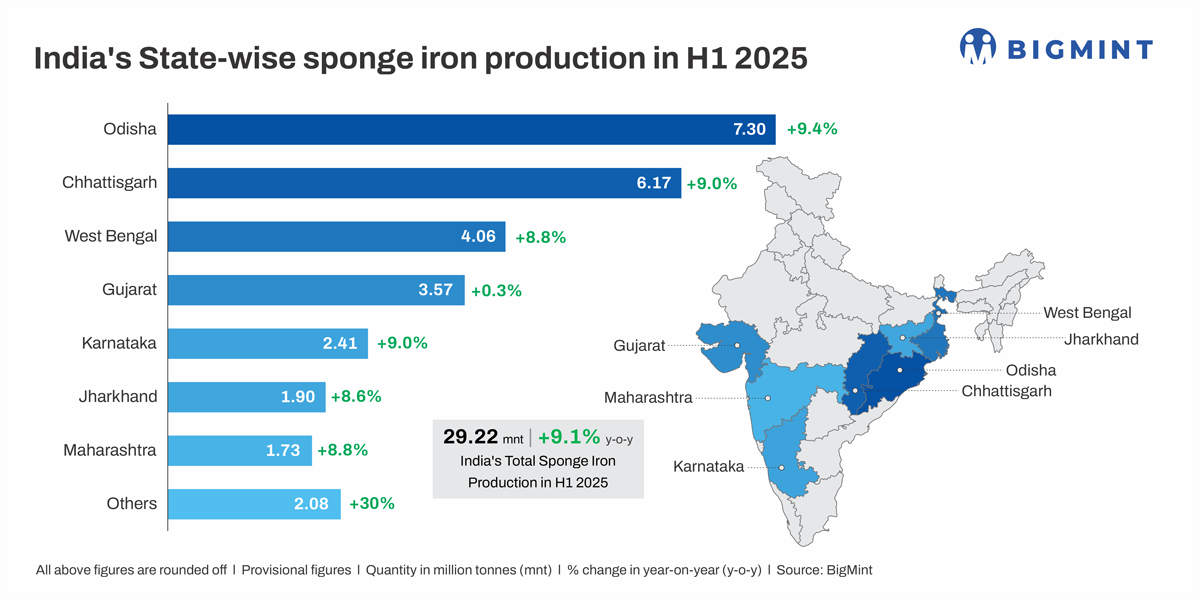

Production growth continues at healthy pace: India witnessed modest upticks in both sponge iron and billet production, aligned with the steady growth in crude steel production. Sponge iron output was higher by 9% y-o-y in H1CY25, at 29 mnt. The uptrend was supported by stable operations and increased capacity utilisation across central and eastern India. There has been rapid growth in domestic sponge iron production capacity in the past few years, with output of around 55-56 mnt in FY25 and installed capacity projected to be at 68-70 mnt. The share of coal-based sponge iron production in India is at over 80%.

Odisha (+9.4% y-o-y), Chhattisgarh (+9% y-o-y), and West Bengal (+8.8% y-o-y) were the leading producers in the first half of this year. Conversely, billet output is expected to have witnessed 5-7% growth in H1CY25, though final figures are not available. This is attributed to improving finished steel demand and a strengthening in domestic pricing during Q1CY25. Rapid growth in production capacities may have contributed to the oversupply in the market and the consequent price correction, especially for sponge iron.

Finished steel prices plunge to over 4-year lows:In Raipur, rebars manufactured through the induction furnace (IF) route were traded at an average of INR 41,200/t in June, with such values previously recorded in February 2021. The weakness in finished steel prices percolated upstream, leading to a corresponding downtrend in billet and sponge iron tags. Prices of alternative raw materials, such as pig iron and melting scrap, have also dropped. For example, melting scrap (end-cutting) was priced at INR 36,300/t DAP Mandi Gobindgarh in June, the lowest since July 2021. Pig iron tags also fell to a four-year low in May.

Outlook

In the near term, both sponge and billet tags are expected to continue trending down due to elevated inventories and price resistance from buyers. Sluggish construction activity due to the monsoon will also exert downward pressure, with recovery likely only after the monsoon. Additionally, the significant increase in domestic production capacitymay limit any drastic price recovery in the short to medium term, though production cuts couldoffer some short-lived support.

Source:BigMint