Posted on 16 Jul 2025

Message from the Secretary General: ASEAN-6 GDP Q4 2024 and Full Year Macroeconomic Results

ASEAN-6 Macroeconomics Results

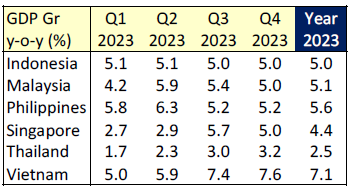

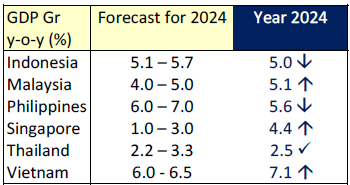

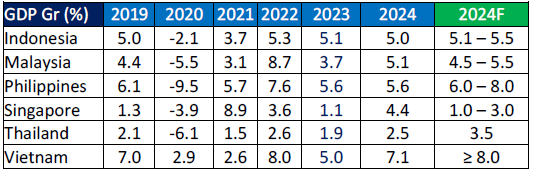

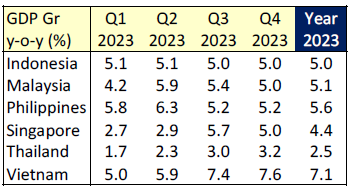

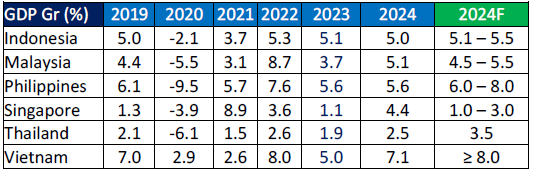

Q4 2024 was another quarter of expansion for all ASEAN-6 countries. Singapore, Thailand and Vietnam registered stronger growths through the 2024. On the other hand, growth in Indonesia, Malaysia and the Philippines was steady in H2 2024.

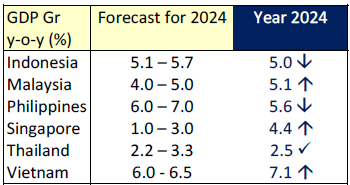

For the full year, while all ASEAN-6 countries registered growth in 2024, Indonesia, Singapore and Vietnam met their forecasts while Malaysia, Philippines and Thailand growths were below forecast.

ASEAN-6 by Countries

Indonesia’s economy held steady at 5% growth in Q4 2024, growing at a similar pace over the four quarters of 2024.

For the whole year, GDP held steady at 5.0%. On the industry side, growth came from:

- Construction (+7.0%)

- Manufacturing (+4.4%)

- Base metal (+13.3%)

- Metal goods (+6.2%)

- Machinery & equipment (-0.4%)

- Transportation equipment (-2.1%)

- Mining & Quarrying (+4.9%)

- Metal ore mining (+8.3%)

- Coal & lignite (+6.8%)

- Oil & Gas (-0.8%)

2023 growth was supported by:

- Household consumption growth (+4.9%).

- Government spending increase (+6.6%), expanding from 3.0% a year ago.

- Investments (+4.6%), expanding slightly from +3.8% a year ago.

- Machinery & equipment (+7.5%)

- Buildings (+5.5%)

- Other equipment (+11.6%)

- Vehicles (-10.3%)

- Exports grew at +6.5%, mainly from services (+14.2%) and goods (+5.8%).

However, imports also expanded (+8.0%), due to expansion in imports of goods +8.2%) and imports of services (+6.7%).

Malaysia’s economy grew (+5.0%) in Q4 2024, slightly slowing down from Q3 2024 (+5.4%) and Q2 2024 (+5.9%).

For 2024, Malaysia’s growth was 5.1%, slightly above the country’s forecast for the year. On the industry side, growth came from:

- Construction (+17.5%), higher than a year ago (+6.1%) from:

- Specialised construction (+21.0%)

- Residential buildings (+18.8%)

- Civil engineering works (+16.3%)

- Non residential buildings +14.0%), mostly data centre related construction

- Manufacturing (+4.2%), up from +0.7% growth in 2023:

- Fabricated metals (+9.1%)

- Base metal (+4.6%)

- Machinery & equipment (3.8%)

- Motor vehicle & transport equipment (+0.7%)

- Electrical equipment (-0.6%)

- Mining & Quarrying (+0.9%)

- Natural Gas (+0.3%)

- Others mining & quarrying activities (+3.4%)

- Crude oil and condensate (-2.6%)

2024 growth was supported by:

- Private consumption growth (+5.1%).

- Government spending increase (+4.7%), accelerating from a year ago (+4.5%).

- Investments (+12.0%), accelerating from +5.5% a year ago.

- Building structure (+15.3%)

- Machinery & equipment (+9.2%)

Exports grew (+8.5%) in 2024, reversing the contraction (-8.1%) from a year ago, mainly due to expansion of export of goods (+5.5%). Export of goods form 82.2% of total exports.

Similarly, imports also grew (+8.9%) reversing a contraction of -7.4% a year ago, again mainly due to decline in import of goods (+9.4%). Import of goods form 79.8% of total imports.

In Philippines, the economy held steady (+5.6%) in Q4 2024, compared to Q3 2024 (+5.6%).

For 2024, Philippines’ growth was 5.6%, slightly below the country’s forecast of 6.0 – 7.0% for the year. On the industry side, growth came from:

- Construction (+10.3%), faster than a year ago (+8.8%)

- Manufacturing (+3.6%), also faster than 2023 (+1.3%)

- Machinery & equipment (+10.9%)

- Electrical equipment (+9.7%)

- Fabricated metals (+3.3%)

- Transport equipment (+2.3%)

- Base metal (-6.2%)

- Mining & Quarrying (+1.3%)

- Nickel ores (-3.0%)

- Gold and other precious metals (-3.9%)

- Coal mining (+9.5%)

- Crude oil and natural gas (-11.0%)

2024 growth was supported by:

- Private consumption growth (+4.8%).

- Government spending increase (+7.2%), accelerating from a year ago (+0.6%).

- Investments (+6.2%), slowing from +8.2% a year ago.

- Construction (+10.4%). Construction forms ~65% of the total investments.

- Durable equipment (-0.8%)

Exports grew marginally (+3.4%) in 2024, accelerating from the previous year’s growth (+1.4%), mainly due to expansion of export of services (+8.2%). Export of goods, which forms 48% of all exports, declined -0.7% from the previous year.

Similarly, imports also grew (+4.3%) compared to a year ago (+1.0%). Imports of goods grew +2.0%. Import of goods form ~78% of total imports.

Singapore’s economy grew at +5.0% in Q4 2024 and +5.7% in Q3 2024, which are high growth rates for a developed country.

For 2024, Singapore’s growth was +4.4%, beyond its forecast of 1.0 – 3.0% for the year. On the industry side, growth came from:

- Construction (+4.5%), slightly slower than a year ago (+5.8%):

- Construction output grew (+10.0%), extending previous 2 quarters of 15+% growth

- Public construction grew (+19.1%) driven by:

- Industrial buildings (+44.4%)

- Public residential (+20.0%)

- Commercial buildings (+15.4%)

- Institutional & others (+10.1%)

- Private construction expanded (+1.2%) due to:

- Civil engineering (+28.1%)

- Private residential (+2.4%)

- Institutional & others (+4.9%)

- Private commercial (-3.1%)

- Industrial (-2.8%)

- Construction demand expanded (+29.5%) from

- Public construction (+27.2%) driven by:

- Institutional & others (+117%)

- Commercial building (+284%)

- Private construction (+32.5%) due to:

- Institutional & others (+74.4%)

- Private commercial (+44.5%)

- Private residential (+43.8%)

- Industrial (+9.2%)

- Manufacturing expanded (+4.3%) in 2024 reversing a contraction (-4.2%) a year before.

- The transport engineering cluster activities expanded +9.4%

2023 growth was supported by:

- Private consumption growth (+4.8%).

- Government spending increase (+8.3%), accelerated from a year ago (+1.8%).

- Investments grew (+2.9%), reversing a contraction a year ago (-0.9%).

- Construction (+3.2)

- Transport equipment (+6.1%)

- Machinery & equipment (+2.5%)

Exports grew (+5.4%) in 2024, slowing slightly from the previous year’s growth (+5.7%). Similarly, imports also grew (+6.6%) compared to a year ago (+5.3%).

Thailand’s economy expanded +3.2% in Q4 2023, expanding from +3.0% in Q3 2023.

In 2023, economic growth was +2.5%, below its forecast of 2.2 – 3.3% for the year. On the industry side, the performance of the steel related sectors is as follows:

- Construction grew (+1.3%) in 2024, reversing a contraction a year ago (-0.6%).

- The construction sector expanded by 18.3% in Q4, continuing from a 15.2% increase Q3 2024, and reversing the decline in Q1 and Q2 2024

- This growth was primarily driven by public sector construction, which grew significantly by 40.8%, accelerating from 31.9% in the previous quarter. The expansion was mainly due to a 67.9% increase in government construction while state-owned enterprise construction grew by 3.4%.

- However, private sector construction declined by 3.9% percent.

- Manufacturing activities contracted (-0.5%), slower than the -2.7% decline in 2023.

- Light industries (+1.4%) in 2024 from -2.3% before

- Raw materials (0.7%) in 2024 from -1.0% in 2023

- Capital goods (-4.8%) in 2024 from -5.9 before

- Transport & Storage (+9.0%)

- Mining & Quarrying (9.2%)

2024 growth was supported by:

- Private consumption growth (+4.4%), slowing down from a year ago (+7.1%).

- Government spending expanded (+5.4%), accelerating (+1.2%) from a year ago.

- Investments (+0.0%), slowing from +1.2% a year ago.

- Construction (+2.2%)

- Dwellings (-6.1%)

- Non-Dwellings (+4.0%)

- Other construction (-1.3%)

- Dwellings (-8.6%)

- Non-Dwellings (+7.1%)

- Other construction (-5.3%)

- Machinery & equipment (-1.1%)

- Exports grew marginally (+7.8%) in 2024, expanding from the previous year’s growth (+2.4%). Export of domestic goods expanded (+4.3%). Export of goods form ~80% of total exports.

- Imports also grew (+6.3%) reversing the decline a year ago (-2.5%), mainly due to expansion in import of goods (+5.3%) and services (10.3%). Import of goods form about ~79% of total imports.

Vietnam’s economy expanded +7.6% in Q4 2024, expanding from +7.4% in Q3 2024.

In 2024, Vietnam registered an economic growth of +7.1%, exceeding its forecast of 6.0 – 6.5% for the year. On the industry side, growth is supported by:

- Construction grew (+7.9%), slightly accelerating from a growth a year ago (+7.1%).

- Manufacturing (+9.8%), slowing from 2023 (+3.6%)

- Basic metals (+9.5%)

- Fabricated metals (+10.8%)

- Electrical equipment (+11.9%)

- Machinery & equipment (+3.4%)

- Motor vehicles (+21.1%)

- Mining & Quarrying (-7.2%)

- Metal ores (+14.4)

- Other mining (+2.9%)

- Coal & lignite (-5.5%)

- Crude petroleum & natural gas (-10.9%)

Outlook for ASEAN-6

To summarise, ASEAN-6 economies have continued to grow strongly. But that was before Trump. With Trump in power and with trade wars unfolding rapidly, further risks of an economic slowdown appear to be imminent.

In addition, climate change impacts are expected to continue to intensify with natural disasters, unpredictable weather, storms, flood, heatwaves like never before.

ASEAN governments have these GDP forecast for 2025:

*****

Stay Healthy. Stay Safe.

See You at SEAISI Events.

*****

Source:SEAISI