Posted on 02 Jul 2025

Morning Brief: India's Ministry of Finance published the 'Framework of India's Climate Finance Taxonomy' last month where a detailed sectoral coverage of the 'hard-to-abate' sectors is included. The climate finance taxonomy aims to direct investment towards the hard-to-abate sectors to support the development of indigenous low-emission technologies and the deployment of mature climate technologies.

Emissions from industries such as iron and steel and cement are hard to abate due to their reliance on energy, complex processes and technologies that have high emissions. The document notes, "While these industries are inherently capital-intensive, their transition to low-emission technologies will be even more capital-intensive."

Financial needs of decarbonisation

Based on different pathways built on different technologies and due to the complex nature of the domestic iron and steel industry comprising many small and medium units, it is difficult to make a fixed estimate of total costs that would have to be incurred to make the transition to low-emissions and climate-friendly steel production across steelmaking routes.

According to the Ministry of Steel, various estimates to achieve India's overall target of net-zero emissions by 2070 place the requirement in excess of $10 trillion (INR 83,000 crore) till 2050. In contrast, the global estimates for making the sector net-zero range from $5.2 and $6.1 trillion, including options such as green hydrogen and CCUS (carbon capture utilisation and storage).

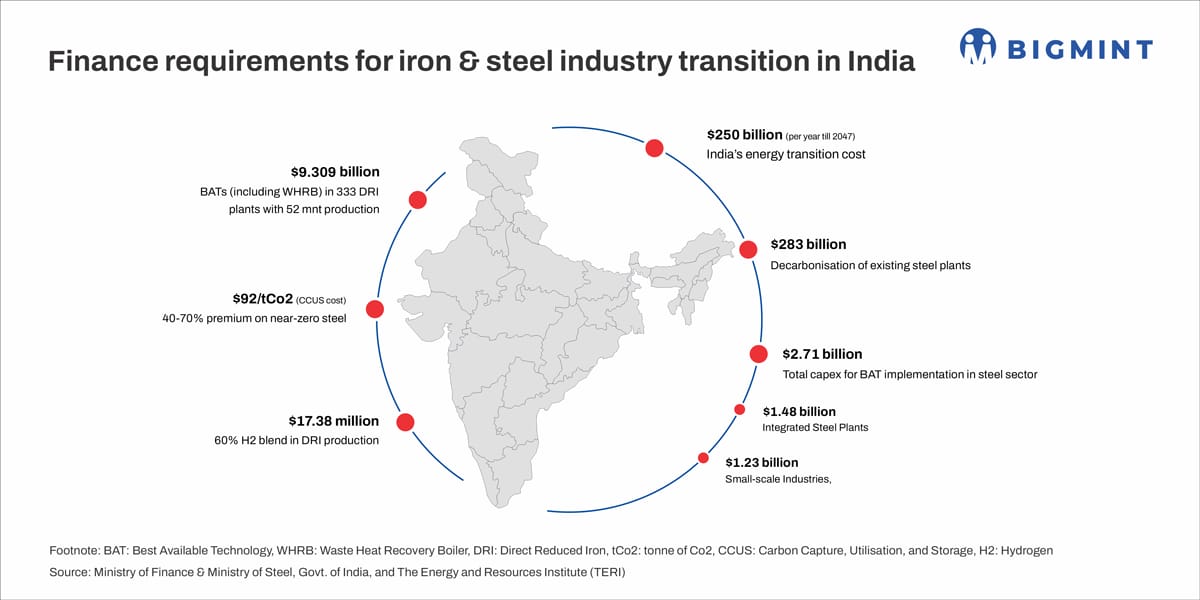

Various estimates show that the existing steel plants in India alone would require $283 billion investment to become green. Another estimate suggests that the cost of adoption of best available technologies (BATs) in the existing secondary sector alone is estimated to be more than $13 billion and cost of process transition is an additional $150 billion.

As per a TERI study based on CY'22 data, for 333 DRI plants, 55 EAF units, 1,103 IF units, and 1,257 re-rolling units, the financing requirements for incremental decarbonisation pathways would be $15,129 million and further rise to a cumulative total of $169,583 million when transitional pathways are accounted for.

Challenges in mobilising finance

High capital costs:According to the Ministry of Steel, the combination of high upfront capital requirement and high cost of capital increases overall cost of steel production. There are a wide range of estimates suggesting that the additional capital expenditure required for a greenfield green steel project ranges from 30% to 60% depending upon the technological interventions adopted. For existing plants, it ranges up to 20%. At the current lending rate, such additional costs are prohibitive.

Concerns about competitiveness:It is not possible to transfer the full additional cost to the end consumers as it will affect the total demand negatively. The cost disadvantage of producing green steel would directly restrain the industry.

Problems afflicting secondary sector:The Steel Ministry has previously highlighted the problems faced by the secondary steel sector in accessing green finance such as lack of awareness of decarbonisation options is low, creditworthiness is also low, and knowledge about the efficiency and the payback periods of low-carbon technologies is scant.

According to the government, the secondary sector steel plants are neither as large as integrated steel plants, nor as small as the micro enterprises of other sectors. Rather, their capacities vary greatly in the range of medium and small, which makes homogenous financial servicing to the sector difficult.

Outlook

The government's formulation of the green steel taxonomy and pledge of public procurement for infrastructure will go a long way in boosting the green steel ecosystem.

The Carbon Credit Trading Scheme (CCTS), the voluntary offsets and compliance mechanisms, as well as carbon contract for difference (CCfD) are expected to incentivise low-emissions technologies and create the urge within industry to seek to monetise actual reductions in emissions and efficiency gains.

Source:BigMint