Posted on 02 Jul 2025

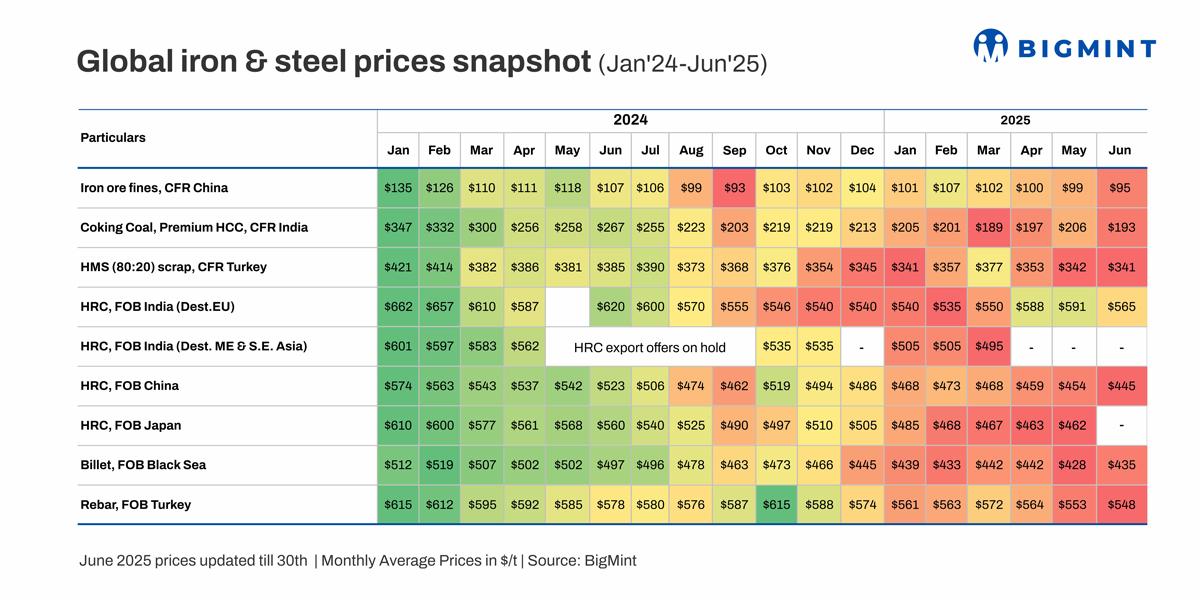

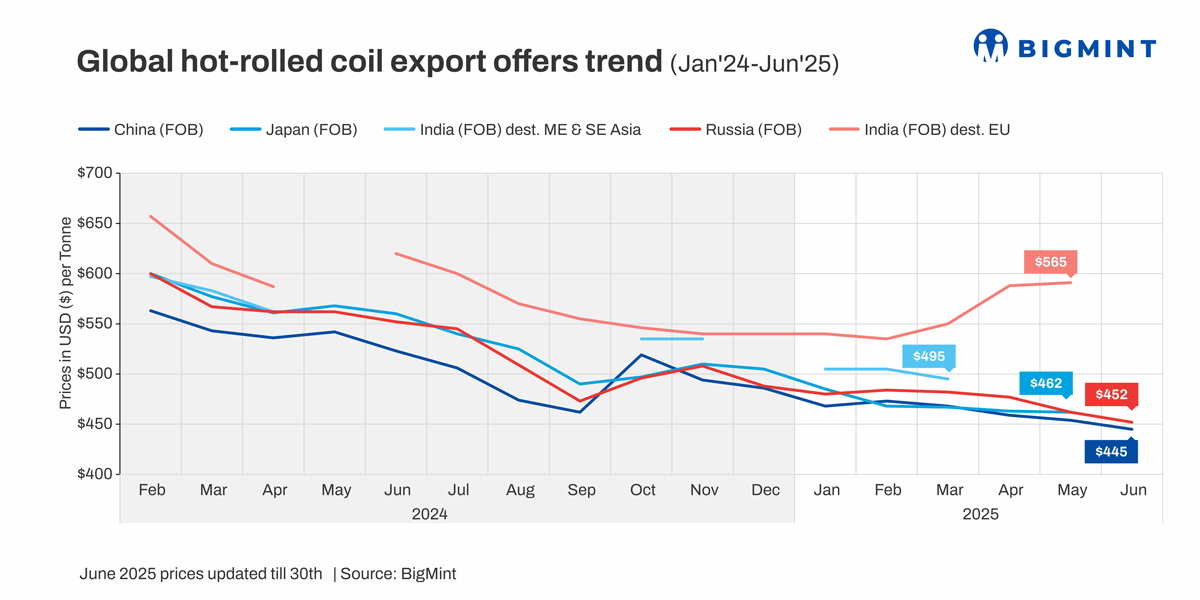

Morning Brief:Global steel and raw material prices continued to dive in June 2025, with several commodities near or at intra-year lows. Chinese hot-rolled coil (HRC) export offers (monthly average, FOB Rizhao)hit a five-year low too.

Seasonal market slowdowns, stemming from the arrival of the summer or monsoonor festive holidays, dampened demandin several regions. US tariffs on steel imports, which were doubledto 50% in late-May, and the Iran-Israel conflict also heightened market uncertainty. Overall, trade momentum was listless, particularly as downstream sentiment remained weak.

Only Russian billet prices increased, primarily due to a hike in the currency exchange rate rather than a demand uptick.

Factors influencing global steel, raw material prices in Jun'25

Chinese iron ore prices drop on soft downstream demand:Falling rebar demand, the seasonal steel market slowdown,and the ongoing property crisissuppressed demand forFe62%iron ore fines and led to a $4/tonne(t)drop m-o-m to $95/t CFR in June. Additionally, mills favouredmid-grade fines to optimisecosts and protect marginsand drew upon portside inventories, which remained high.According to SteelHomedata, iron ore port stocksstood at 133.6 mnton 26 June.

Falling met coke prices weigh on coking coal tags:Premium hard coking coal (PHCC) fell $13/t m-o-m to $193/t CFR India amid sluggish demand, driven by elevated port inventories, lower bids, and declining met coke prices, which hit a five-year low in eastern India. China also witnesseda fourth consecutive price cut in met coke, and the Indian buyers mostly stayed on the sidelines.

Slow rebar offtake caps Turkish scrap demand:Heavy melting scrap(HMS)80:20, CFRTurkiye, dipped by $1/t m-o-m to $341/t in June, as poor rebar demand limited scrap consumption. Initially,prices fell ahead of the Eid-al-Adhaholidays. However, following a brief period of stability, prices rebounded by the month-end, as mills cautiously started replenishingtheir inventories. The availability of competitively priced Chinese billets and high interest rates also affected trade activity.

HRC export offers decline on weak market cues:Chinese HRC export offers were down by $9/t m-o-mat $445/t in June2025, to levels last seen in June 2020, driven by lacklustredemand,inventory build-up,and a volatile global trade landscape. A bearish domestic market - due to the seasonal slowdown and a lack of strong demanddrivers - also contributed to lower offers. Chinese exporters saw muted sales in Vietnam,as most buyers sourced domestic HRCs, though some deals were concluded for re-export purposes.

In June, Indian mills were more focused on the domestic segment due to better realisations, continuing to abstain from the Middle East market due to rock-bottom pricesfrom competitorssuch as China. Meanwhile, Indian HRC offers to the EU fell by $26/t m-o-m to $565/t, under strain fromsluggish demand, regional summer holidays, and cautious sentiment.

Currency appreciation lifts Russian billetprices:Thestrengthening of the roubleagainst the USD to 78.7 from 80.8 pushedRussian exportersto raisebillet prices by $7/t m-o-m to $435/t FOB Black Sea, to preserve profit margins. However, demand from Turkiyeand Egypt was weak, especially due to the Eid-al-Adhaholidays.

Turkish rebar sales remaindepressed:Turkish rebar prices weakened by $7/t m-o-m to $548/t FOB amid tepid sales in both domestic and export markets. While there was a lack of clarity among European buyers regardingimport quotas, economic pressures, policy uncertainty, and the Eid holiday period limited domestic offtake.Additionally, firmscrap prices squeezed producers' margins.

Outlook

The short-term outlook for the global steel market remainsbleak, with supportive few supportive factors. Slowing crude steel production, with a 1.3% drop in January-May, will likelycurbraw material demand, while the UStariffs maycontinue to keepdemand fragile and market participants jittery. Given that China remainsmired in recessionary risks, it would be safe to concludethat a global market recovery is still a long way ahead.

Source:BigMint