Posted on 02 Jul 2025

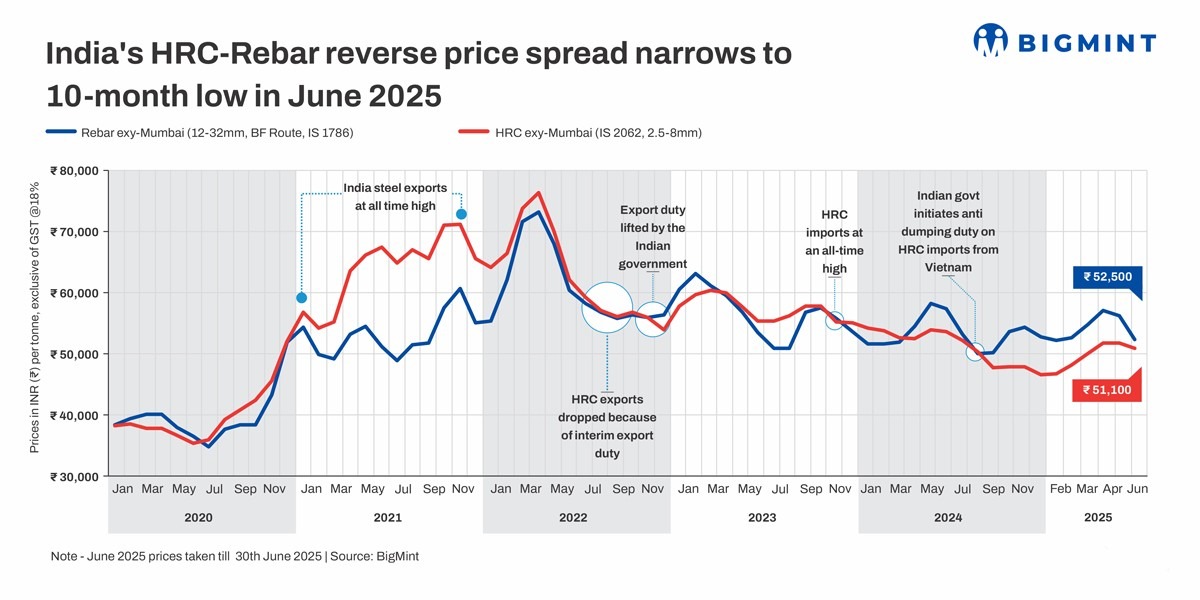

Morning Brief: Indias HRC-rebar spread remained in reverse territory in June 2025, though it contracted by INR 2,900/tonne (t) ($34/t) m-o-m to a 10-month low of INR 1,400/t ($16/t).

The reverse spread narrowed sharply because of a steep fall of INR 3,800/t ($44/t) m-o-m in trade-level blast furnace (BF)-route rebar prices, which stood at a monthly average of INR 52,500/t ($613/t) in June. Meanwhile, hot-rolled coils (HRCs) were down by a comparatively modest INR 900/t ($11/t) m-o-m to INR 51,100/t ($596/t).

Both price tags are exy-Mumbai and exclusive of 18% GST.

Normally, HRCs are sold at a premium of INR 4,000-5,000/t ($47-58/t) over BF-route rebars. However, since September 2024, rebars have consistently commanded higher prices than HRCs, leading to a reversal of the spread. June also marks the 10th consecutive month in which the spread has been in reverse gear.

Factors influencing Indias HRC-rebar spread in Jun25

HRCs

Mills roll over list prices: Perhaps the first signal of subdued trade activity was Indian steel manufacturers rolling over list prices of HRCs for June sales.

Following the announcement, leading steel manufacturers' list prices of HRCs were recorded to be in the range of INR 52,150-54,000/t ($609-630/t) ex-Mumbai.

New entrants prices were slightly lower, at INR 51,900-52,000/t ($606-607/t) ex-Mumbai.

The price stability, as well as the prevailing need-based demand trends, did not give distributors the confidence to raise offers.

However, despite lacklustre demand, most mills did not offer rebates or price support. This helped prevent a steeper drop, as distributors, facing negative margins, were unwilling to further reduce their offers, considering that trade values were lower than mills prices.

Demand slowdown drags down trade prices: The trade segment largely witnessed cautious sentiment and need-based demand, with distributors struggling to close deals amid limited inquiries. This led to a sustained price drop throughout the month.

Amid expectations of further price drops, sellers ramped up efforts to liquidate stocks, determined to avoid further declines in their margins. However, buyers continued to put off purchases, expecting potential rebates or further reductions in list prices.

With the quarter-end approaching, distributors also faced increased pressure to clear inventories, especially to meet MoU commitments. This forced them to sell off material at lower prices to clear old inventory. However, again, many buyers delayed restocking decisions, hoping for better prices during the quarter-end.

Downtrend in imports continues: HRC and plate imports remained relatively low in May, at 0.14 million tonnes (mnt), as per customs data. The same stood at 0.98 mnt in January-May, a 38% drop y-o-y.

The exit of cheap imports from market circulation also helped rein in steeper price cuts in June.

Exports remain lacklustre: Indias HRC export activity continued to be listless in June. While offers to the European Union (EU) declined by $25/t to $565/t, buyers remained unreceptive, evidenced by the fact that India consumed merely 7% of the EU-mandated quota in Q2CY25.

Indias HRC offers to the Middle East continued to be on hold, with competitive Chinese tags driving away Indian exporters.

Globally, HRC prices weakened too, which also exerted pressure on domestic tags to a certain extent. Chinese HRCs were priced at $445/t FOB Rizhao, down $10/t m-o-m.

BF rebars

Mills reduce list prices: At the beginning of the month, Tier 1 mills reduced rebar list prices by up to INR 1,500/t ($18/t) for early-June deliveries as against end-May levels, sources informed BigMint. Post-revision, list prices were within INR 54,500-55,500/t ($636-648/t) on landed basis.

This decision was precipitated by a 10% increase m-o-m in rebar inventories at Tier 1 mills in early June, resulting from sluggish offtake in May.

However, as subdued demand trends continued in June, inventories at large integrated mills surged to around 400,000 t in mid-June, according to sources.

Consequently, some major primary steelmakers were forced to trim prices later in the month. By end-June, list prices ranged between INR 50,500-51,500/t ($589-601/t) on landed basis.

Monsoon-led demand slowdown pressures prices: The monsoon, which is typically considered an off-season for the domestic steel market, arrived early this year, limiting construction activity and, consequently, reducing demand from this segment.

Additionally, persistent bid-offer gaps slowed down trading momentum, while expectations of further price corrections pushed buyers to postpone purchases. Buyers also remained on the sidelines due to unclear pricing and demand dynamics.

Meanwhile, amid sustained market uncertainty, distributors tried to perk up buyer interest by slashing offers.

The project segment was similarly affected. Prices plunged from around INR 54,000-54,500/t ($630-636/t) FOR Mumbai to INR 49,500-50,000/t ($578-583/t). There was heightened competition to secure orders.

IF rebar prices soften amid slow bookings: The bearish sentiment also extended into the induction furnace (IF)-route rebar market. Prices fell by INR 3,000/t ($35/t) m-o-m to a monthly average of INR 44,800/t ($523/t) exw-Mumbai.

Buyers were conservative regarding purchases amid uncertainty regarding market direction. Consequently, buying activity was mostly restricted to immediate requirements, with a lack of bulk bookings.

To liquidate material, manufacturers further reduced list prices or offered market-specific discounts. Yet the average holding period for inventories rose from around 12 days at the end of May to 12-15 days throughout June, potentially indicating that order bookings remained subdued despite trade discounts.

Lower semi-finished and sponge iron prices also weakened cost support. Billets were down by INR 2,000/t ($23/t) m-o-m to INR 37,900/t ($442/t) exw-Raipur in June, while PDRI fell by INR 1,300/t ($15/t) to INR 22,900/t ($267/t) exw-Raipur.

Outlook

The near-term outlook remains clouded in uncertainty. While mills are expected to announce cuts for rebar tags in July, the price direction for HRCs is difficult to predict due to markets being rather silent.

Nonetheless, some market participants believe that rebar prices may bottom out soon. In the last week of June, the IF market saw a slight pick-up in inquiries, though trading volumes remained subdued. If the trend sustains, the BF rebar market may also see strengthening. A concerning factor, however, is the possibility of increased supply in the system, due to production ramp-ups at certain plants.

Meanwhile, HRCs are expected to see the downtrend persisting through August. Market participants believe that demand will improve only as restocking interest emerges ahead of the autumn festive season. However, the drop is unlikely to be steep, with mills yet to announce rebates.

Given that rebar prices are poised to recover while HRCs may continue declining, the HRC-rebar spread may widen in July.

Source:BigMint