Posted on 02 Jul 2025

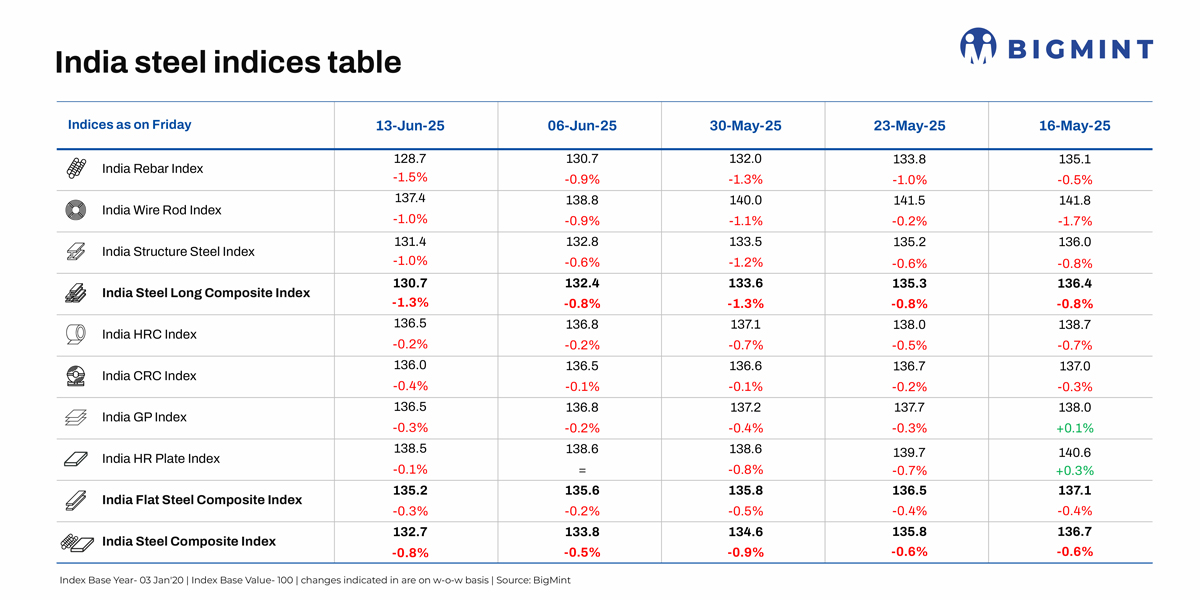

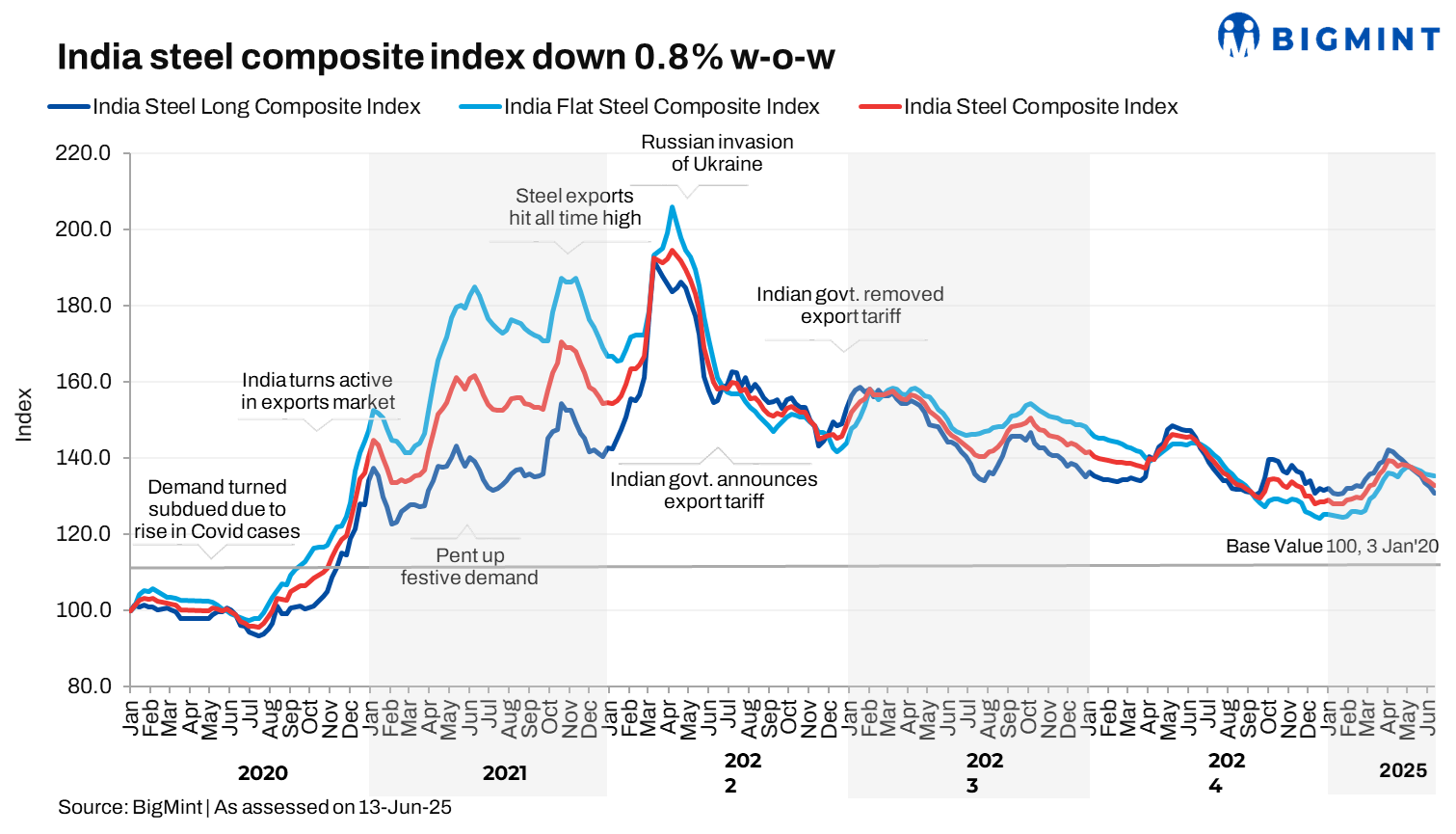

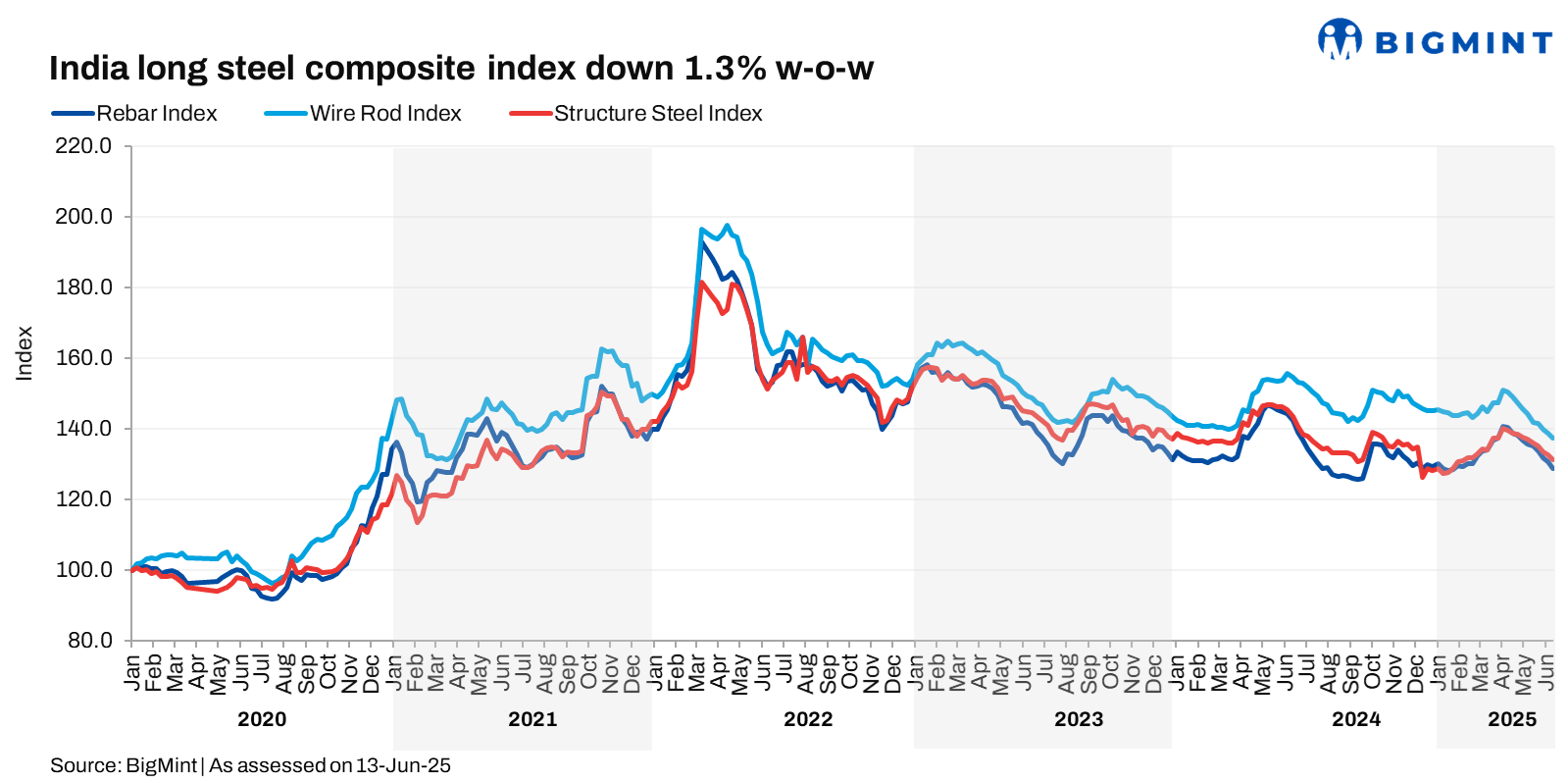

Morning Brief:The depression in the domestic steel market deepened towards mid-June 2025, with steel prices continuing their steady downward spiral. BigMints India steel composite index, a fixed reference point for the domestic steel market, dropped 0.8% w-o-w on 13 June, with long steel prices correcting more sharply than flats.

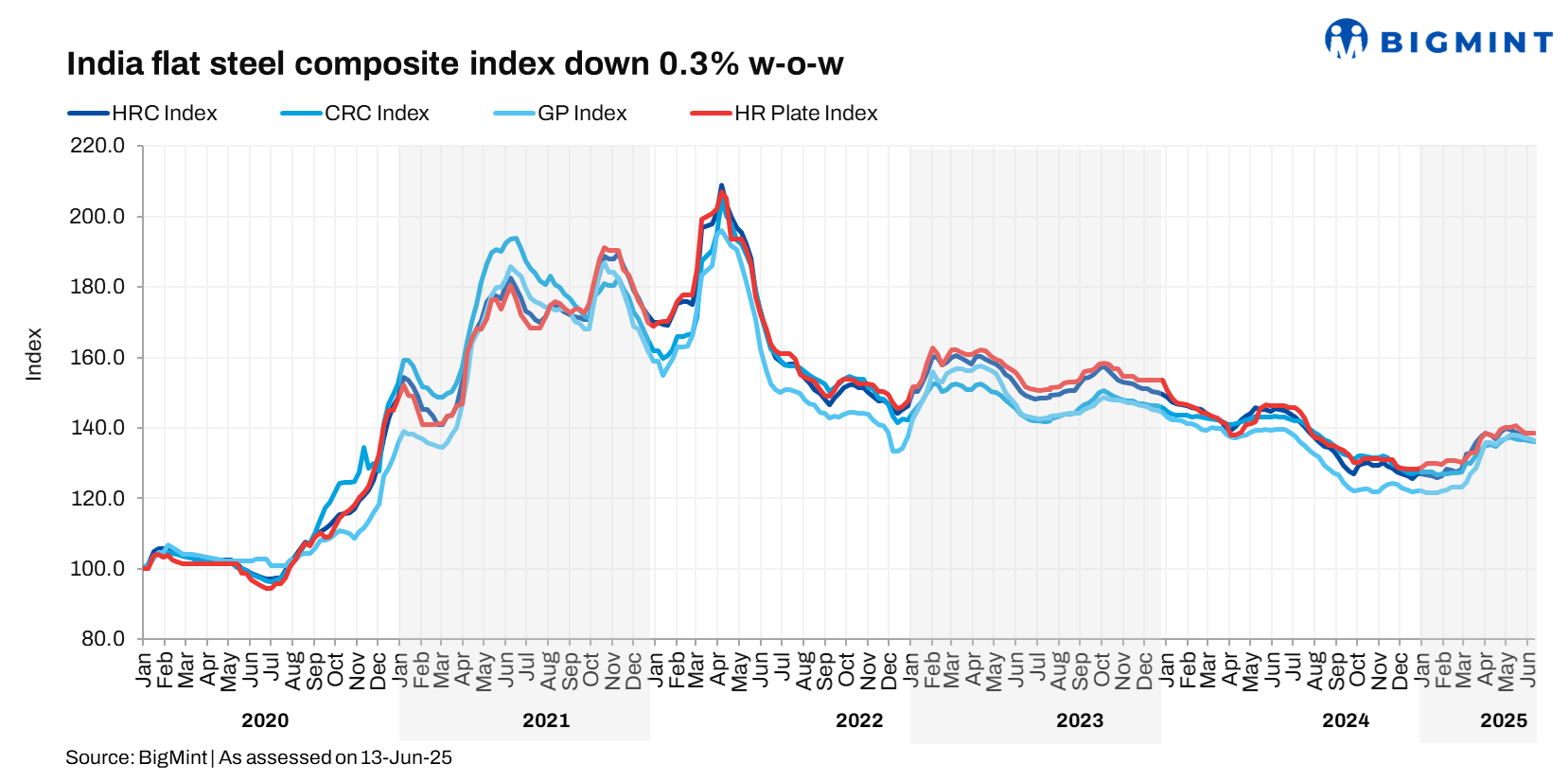

While the flats index decreased by 0.3% w-o-w, the longs composite index plunged 1.3%. The early onset of monsoon has exacerbated the market slowdown; however, in general, deteriorating trade sentiments and geopolitical unrest have been exerting pressure on the global steel market for quite some time.

Analysis of steel price movements

BF rebar prices decline:Trade-level BF rebar prices declined by INR 1,100/tonne (t) ($12/t) w-o-w to INR 53,200/t ($617/t) exy-Mumbai, as per BigMint's assessment on 13 June. Prices are exclusive of GST at 18%.

Rebar prices continued to decline as buyers postponed their purchases amid ongoing price correction and market uncertainty. Distributors remained in destocking mode, while major mills reduced list prices.

In the projects segment, prices slipped further to INR 52,000-52,500/t ($604-610/t) FOR Mumbai, as slower construction activity and negative outlook weighed on procurement decisions.

Downtrend in IF-rebar market:IF rebar prices dropped by INR 900/t ($10/t) w-o-w to INR 44,600/t ($518/t) exw-Mumbai as on 13 June. Buying activity remained largely need-based, with procurement limited to immediate requirements. Uncertainty in market direction kept traders and end-users cautious.

In response, manufacturers further reduced list prices or offered discounts to liquidate material. Inventory levels rose slightly, hovering around 12-15 days.

HRC prices stable:BigMints benchmark assessment (bi-weekly) for HRCs (IS2062, Gr E250, 2.5-8 mm/CTL) remained stable w-o-w at INR 51,300/t ($601/t) on 11 June. But CRC (IS513, Gr O, 0.9 mm/CTL) prices declined by INR 100/t ($1/t) w-o-w to INR 58,100/t ($684t). These prices are ex-Mumbai for the distributor-to-dealer segment and exclude 18% GST.

Distributors are trying to keep prices firm as mills havent offered any price breaks for May. Buyers are holding back, only purchasing what is essential to capitalise on falling prices and to avoid the monsoon slowdown, a market participant informed.

In the coated segment, galvanized plain (GP) coil prices dropped INR 200/t w-o-w, as per latest BigMint assessment, while pre-painted galvanized iron (PPGI) coil prices remained firm.

Inventories in the distribution system have been drained out in the last couple of weeks. Meanwhile, production-related difficulties and ongoing refractory maintenance at the blast furnace of a major private producer lent some stability to prices despite weak market sentiments.

HRC export prices drop:Indian HRC export offers to the EU declined by $15/t w-o-w to $620-625/t CFR Antwerp ($570-575/t FOB eastern Indian port) as compared to $630-635/t CFR the previous week. Global HRC offers remained subdued, with Chinese offers for the Middle East decreasing by $5/t w-o-w.

Outlook

Since early June, media reports indicated that the government might consider raising the safeguard duty on steel imports might be from 12% to 24%. This speculation gained momentum following the USs decision to increase its steel and aluminium import tariffs from 25% to 50%.

The industry has raised concern that Chinese exporters may be finding ways to go around existing safeguard measures.

However, flat steel imports have fallen sharply since the implementation of the provisional safeguard duty and, therefore, raising the duty is unlikely to affect domestic prices much. HRC prices are likely to remain under pressure on weakening exports and the slowdown in global demand amid high tariffs.

On the other hand, Steel Ministry data show that while domestic steel consumption in India edged up by 7% in April-May 2025 versus April May 2024, production during the same period increased by 7.6%. Increased supplies in the market, due to capacity expansion across production routes, are likely to affect steel prices.

India Steel Composite Index

The India Steel Composite Index is assessed on a weekly basis, every Friday at 18:30 IST, as per the weighted average prices based on manufacturing capacity and production.

BigMint considers the Composite Index with the base year being 3 January 2020 (financial year 2019-2020) and the base value as 100. The Composite Index does not give the absolute price but a trend of the market. The Indian steel industry is broadly classified into the BF-BOF and the electric/induction furnace routes. Keeping this broad classification in view, BigMint proposes to release the Composite Index by considering both production routes by manufacturing capacity and the production weighted method to compute the index for India.

Source:BigMint