Posted on 02 Jul 2025

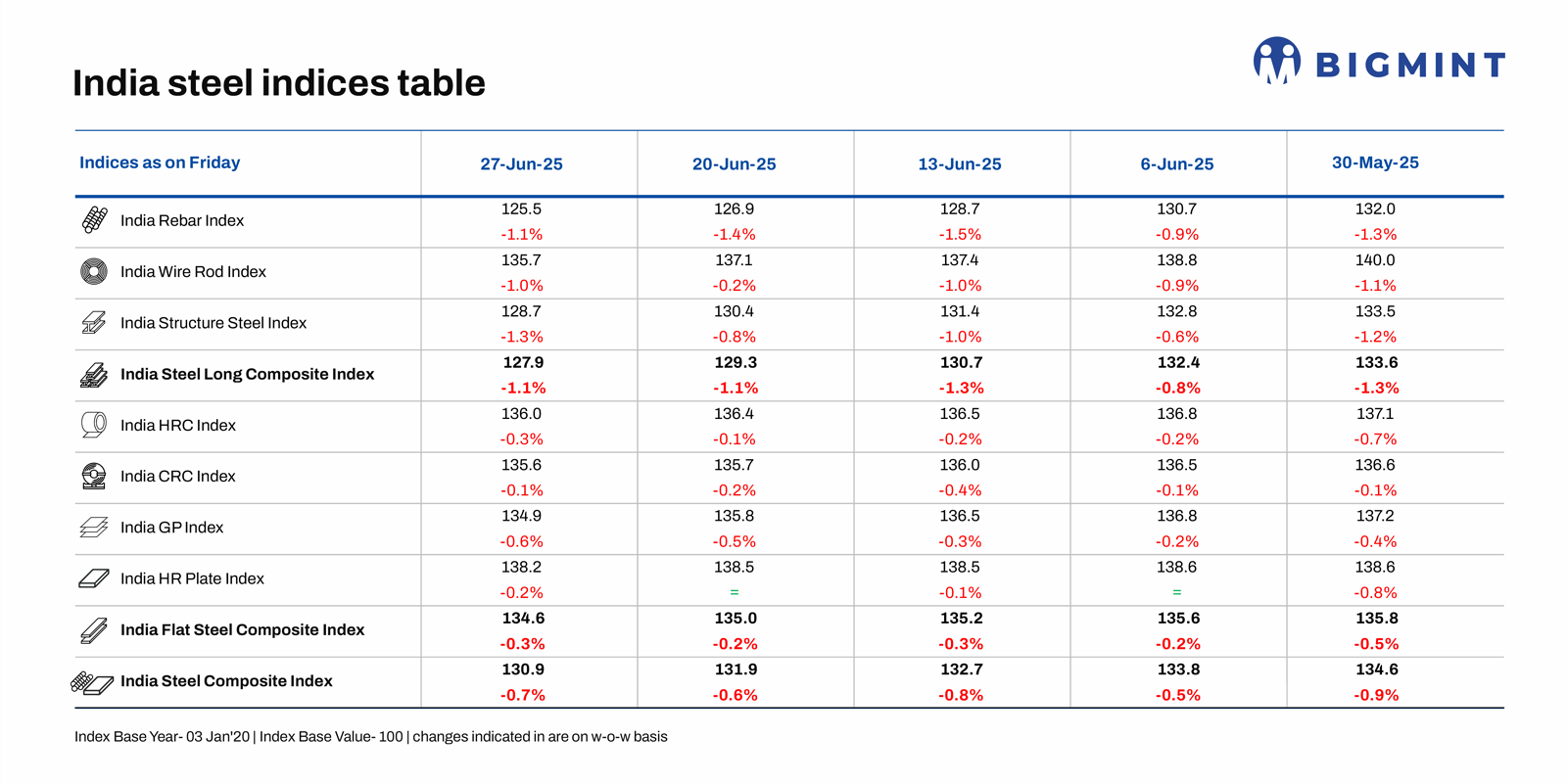

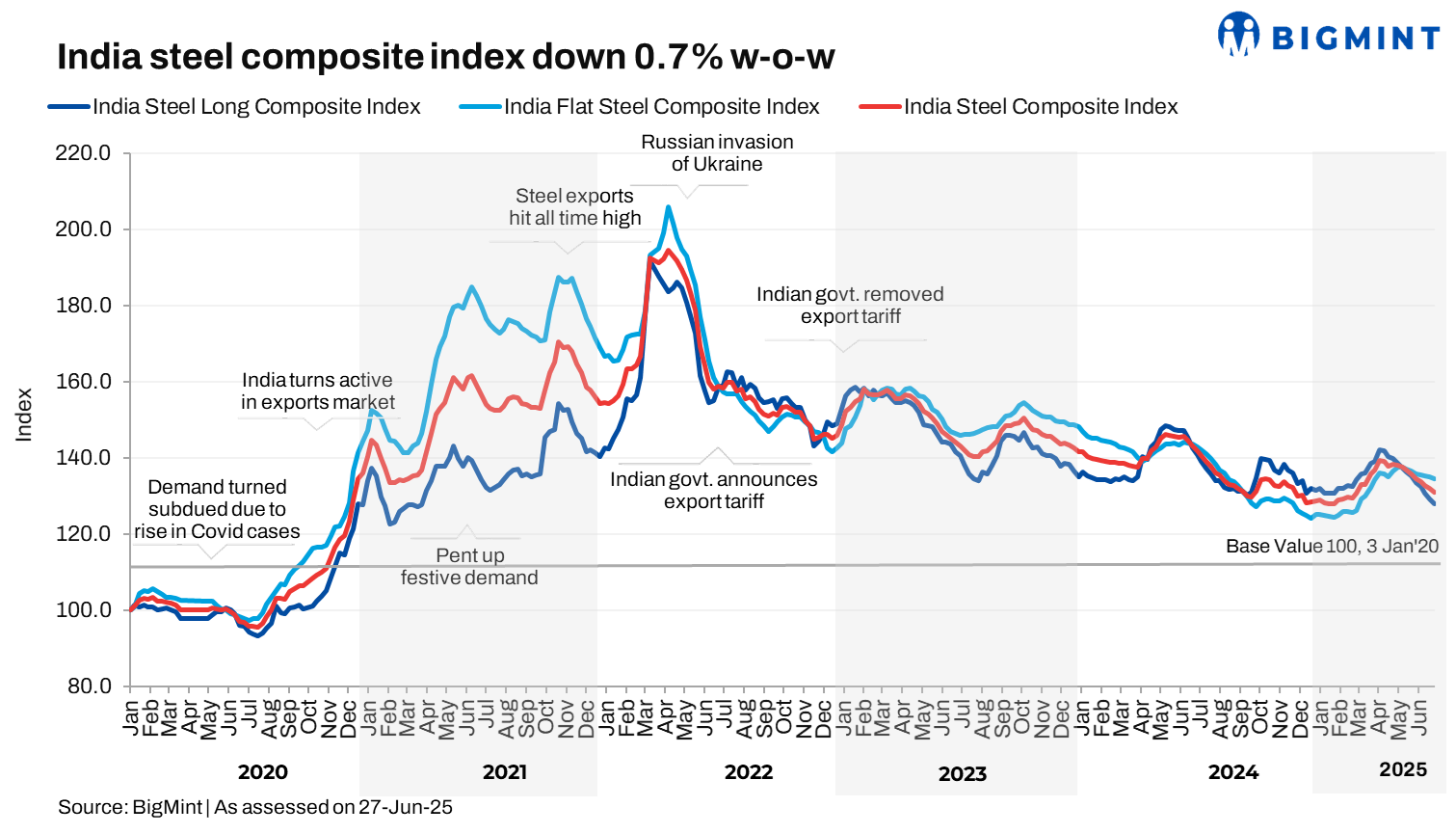

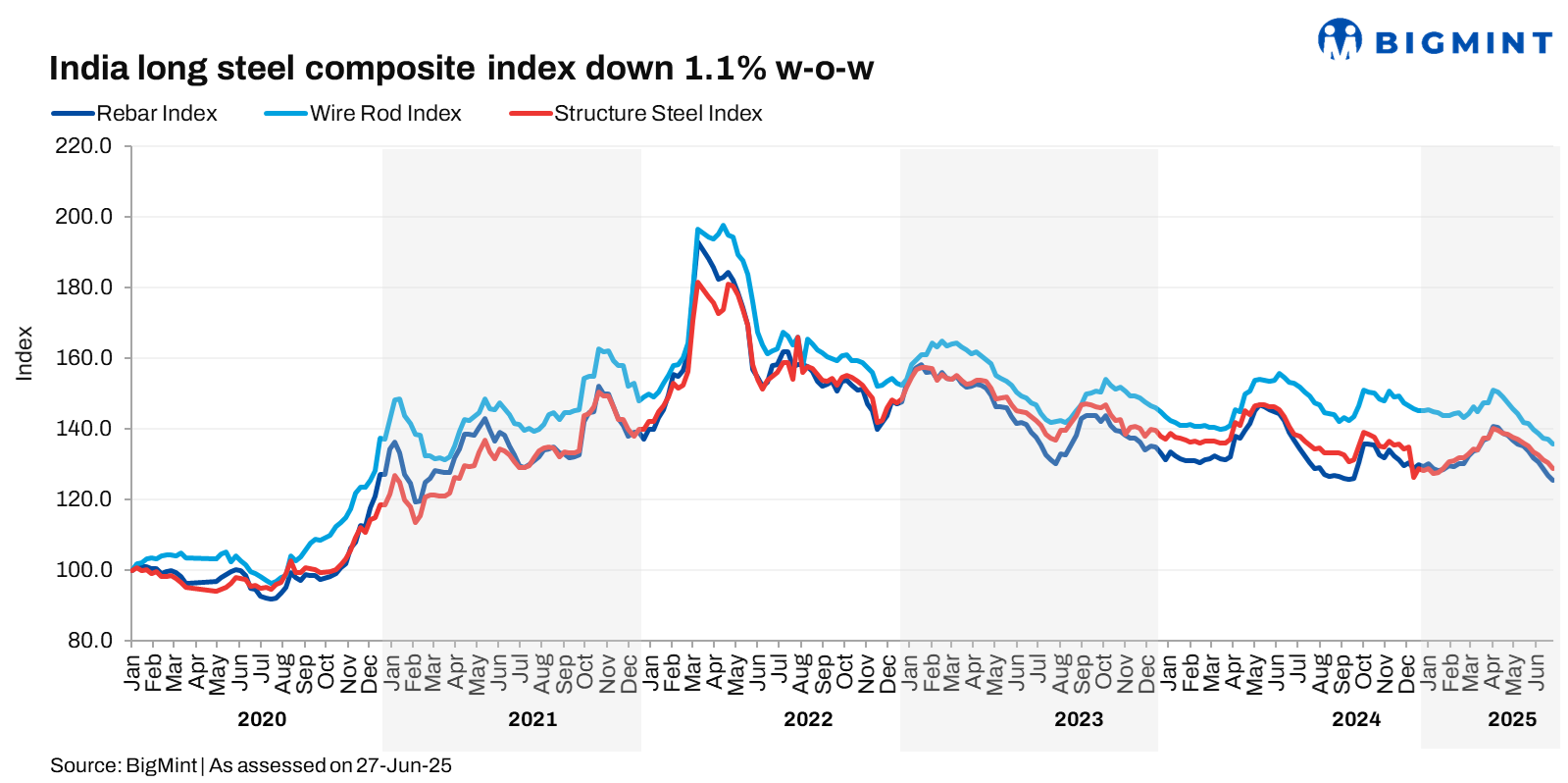

Morning Brief:The acute depression in the domestic steel market continued in the last week of June, with steel prices witnessing a steady downward spiral. BigMint's India steel composite index, a barometer of the domestic steel market, dropped 0.7% w-o-w on 27 June 2025, with long steel prices correcting more sharply than flats.

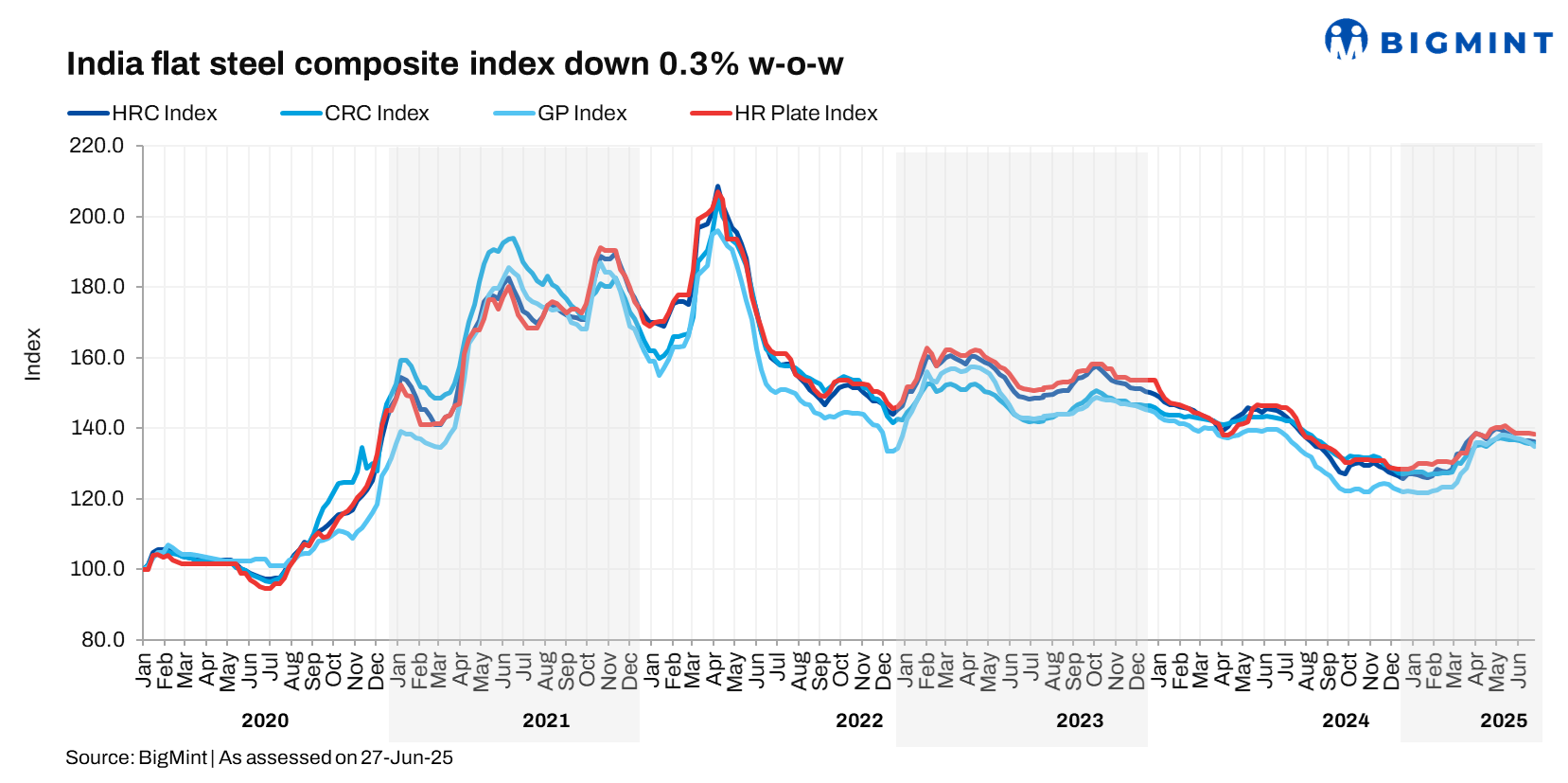

This trend has continued throughout the month, with BigMint data showing that while the rebar index dropped nearly 5 percentage points in June, the HRC index declined at a much slower pace of 1 percentage point. Regulatory support in the form of the safeguard duty has cushioned flat steel prices somewhat amid deteriorating global prices.

Steel price movements

BF rebar prices edge down:Trade-level BF rebar prices declined by INR 1,200/t ($14/t) w-o-w to INR 50,700/t ($593/t) exy-Mumbai on 27 June. Prices are exclusive of GST at 18%.

BF rebar prices were weighed down by subdued domestic demand and slowing market activity due to the onset of monsoon. Market sentiment remained cautious, with buyers shying away from bulk purchases amid persistent bid-offer gaps, while distributors aimed to offload previously procured high-cost inventories.

The major primary steel producers reduced rebar prices amid lacklustre trade even as demand in the project segment remained subdued.

IF rebar market weakens:IF rebar prices dropped by INR 200/t ($2/t) w-o-w to INR 43,800/t ($512/t) exw-Mumbai as on 28 June. A marginal increase in prices was seen in some markets amid improved inquiries. However, order bookings remained subdued despite trade discounts, as buyers continued need-based procurement.

Inventory levels stayed elevated at 12-15 days, keeping market sentiment weak. Given the monsoon-led slowdown, some market participants believe that mills may consider production cuts.

HRC prices soften:Trade-level prices of hot-rolled coils (HRCs) declined by up to INR 400/t ($5/t) w-o-w to INR 50,600-52,500/t ($588-610/t) across markets. Cold-rolled coil (CRC) prices fell by up to INR 300/t ($3/t) w-o-w at INR 56,200-60,700/t ($653-705/t).

The market is waiting for clarity on whether mills will provide price support, as trade-level prices have dropped below mill prices and have remained lower for a while. Meanwhile, demand continues to be weak, with few inquiries and an even slower rate of converting inquiries into actual sales.

A source informed BigMint: "The market expects mills to announce price support soon. So, many buyers are holding off on restocking, hoping for better prices as the quarter-end approaches. Distributors, on the other hand, are under pressure to meet their MoU commitments, which is forcing them to sell at lower prices to clear old inventory."

HRC export prices decline: BigMint's India HRC (S275) export index fell by $5/t w-o-w to $550/t FOB main port, following a 5,000-t deal to the EU. Buyers remained cautious amid expectations of a summer slowdown which exerted pressure on prices. In the Middle East, geopolitical tensions continue to impact demand. Indian mills are holding back HRC offers to the region amid strong competition from other suppliers.

Outlook

The seasonal downtrend in the domestic steel market is expected to continue even though the pressure exerted by high inflow of steel imports has waned. Imports dropped 20% y-o-y in April-May and the trend is likely to continue.

Prices of HRC and CRC are expected to be under pressure as distributors are selling at lower prices to meet quarterly commitments, while buyers are delaying purchases in anticipation of mill price support. HR strip and coil inventory in the system has been edging up due to soft demand. Also, limited export demand may prevent any significant price recovery.

Long steel prices, on the other hand, will continue to edge lower. However, market participants expect rebar prices to bottom out in the near term.

India Steel Composite Index

The India Steel Composite Index is assessed on a weekly basis, every Friday at 18:30 IST, as per the weighted average prices based on manufacturing capacity and production.

BigMint considers the Composite Index with the base year being 3 January 2020 (financial year 2019-2020) and the base value as 100. The Composite Index does not give the absolute price but a trend of the market. The Indian steel industry is broadly classified into the BF-BOF and the electric/induction furnace routes. Keeping this broad classification in view, BigMint proposes to release the Composite Index by considering both production routes by manufacturing capacity and the production weighted method to compute the index for India.

Source:BigMint