Posted on 27 May 2025

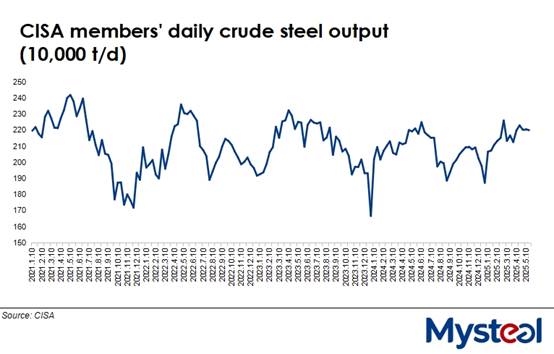

Daily crude steel output among the member mills of the China Iron and Steel Association (CISA) recorded a slight decline during May 11-20, edging down by just 0.3% compared with early May, according to the association's new release on May 23.

The CISA showed that during mid-May, these member mills' crude steel production nudged down by 6,000 tonnes/day from May 1-10 to 2.2 million t/d on average, which was also 0.5% lower on year.

An official with an East China steelmaker commented that most integrated mills had maintained stable operations during the middle ten days of this month, supported by relatively healthy profit margins on steel sales.

The results of Mysteel's latest survey showed that among the 247 Chinese mills it tracks nationwide, 148 could earn some profits on selling steel products as of May 22, more than the 145 on May 8 who said they were earning money.

Based on its members' output, CISA estimated that the country's daily crude steel output averaged 2.79 million t/d for mid-May, down 0.3% from early May, the data show.

Meanwhile, finished steel inventories held by CISA's member mills increased further by 1.8% or 290,000 tonnes from May 10 to settle at 16.4 million tonnes by May 20. The increase suggested a slowdown in demand from end-users, likely due to less favorable weather conditions impacting construction activities.

Mid-May's tonnage was down a small 2.9% from the same period last year though, CISA notes.

The spot trading volume of rebar, wire rod and bar-in-coil among the 237 Chinese trading houses under Mysteel's tracking reached an average of only 107,014 tonnes/day over May 11-20, falling by a significant 21.3% on year.

For Chinese finished steel prices, these initially trended upward and then declined during mid-May, Mysteel Global notes. As of May 20, the country's national price of HRB400E 20mm dia rebar, for example, was assessed by Mysteel at Yuan 3,302/tonne ($460/t) including the 13% VAT, unchanged from the price on May 9.

Source:Mysteel Global