Posted on 20 May 2025

Morning Brief: After three years of intense negotiations, the India-United Kingdom Free Trade Agreement (FTA) has finally come into force. The trade deal holds up the promise of boosting domestic manufacturing and India's global presence.

The FTA will ensure 99% of Indian exports will receive duty-free access to the UK market. India stands to gain substantial advantage from tariff elimination on approximately 99% of tariff lines. Notably, Indian exporters of steel and aluminium are expected to garner considerable benefits from the FTA.

India is already among the top exporters of steel products to the UK. With the steady and rapid decline in the UK's domestic steel production, loosening of import safeguard quotas, and now the much-awaited FTA, will Indian mills seize the opportunity of channelling higher steel exports to Britain?

Mills may find this a great opportunity since subdued demand in key geographies and intense price competition from China led to a 30% y-o-y reduction in India's steel exports in FY'25.

UK hikes import quota volume

In September 2024, the British government accepted the Trade RemediesAuthority's(TRA) recommendation to vary the tariff rate quota (TRQ) on imports of Category 1 steel products. These changes came into effect from 1 October 2024. As a result of the reduction in domestic production of Category 1 steel, the TRA proposed that the steel safeguard measure be varied by duplicating Category 1 to form Categories 1A and 1B.

According to the UK government, "the quota for Category 1A, which will be accessible by parties looking to import the products for commercial applications, will be retained at current levels of roughly 1 million tonnes (mnt) annually. The quota for Category 1B, which would be accessible solely for downstream processing, will be set 132% higher than that of 1A".

Taking Category 1A and B together, the total Category 1 quota of hot-rolled steel will be approximately 3.3 mnt per year, with 2.3 mnt for Category B. If these limits are exceeded, importers will have to pay a 25% tariff. The category 1B quota will be distributed on a global basis, and with a 40% cap to ensure that no one country dominates exports under this new quota.

UK steel production slumps

The raising of flat steel import quotas by the UK was due to the closure of the Port Talbot blast furnace facility in Wales by Tata Steel in September last year which had a nameplate capacity of 3 mnt of hot-rolled products. Tata Steel is transitioning the facility to an EAF which is expected to start operations from end-2027.

Similarly, British Steel's Scunthorpe blast furnace facility, which was taken over by China's Jingye Group in 2019 as part of an insolvency resolution process, is staring at closure as Jingye has cited operational losses and raw material supply problems while refusing the government's GBP 500 million support to transition to EAF technology.

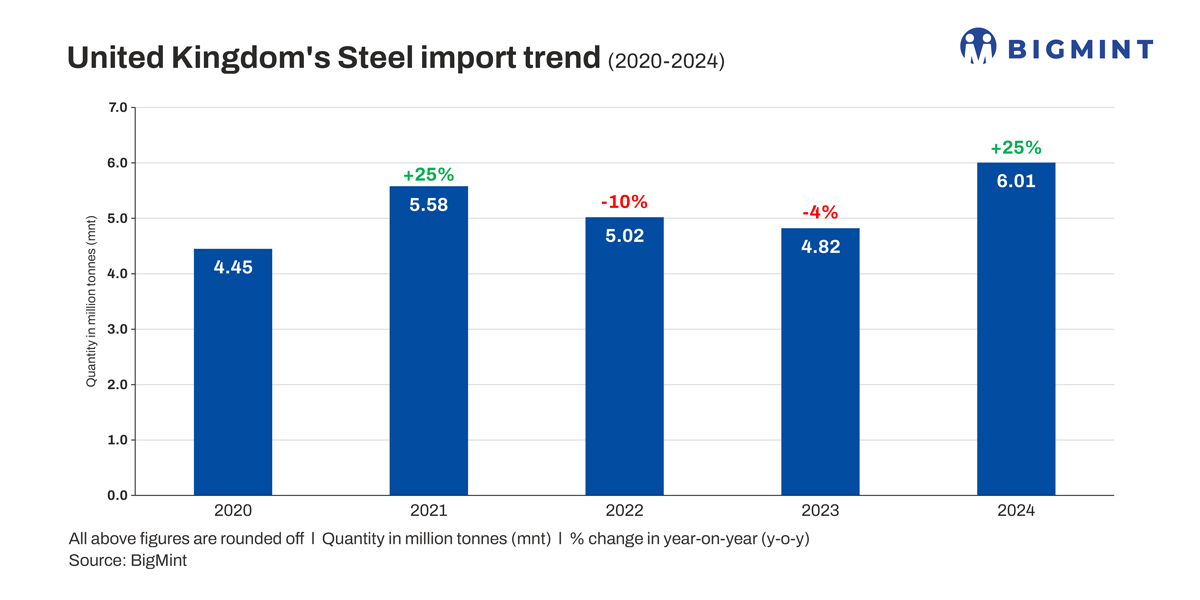

Therefore, the UK has become the only major economy in the world without virgin steelmaking capacity of its own. The UK's steel production dropped nearly 30% y-o-y to 4 mnt in CY'24 even as apparent steel consumption, as per the US Department of Commerce data, reached around 8 mnt. This naturally necessitated higher steel imports.

UK's growing import dependency

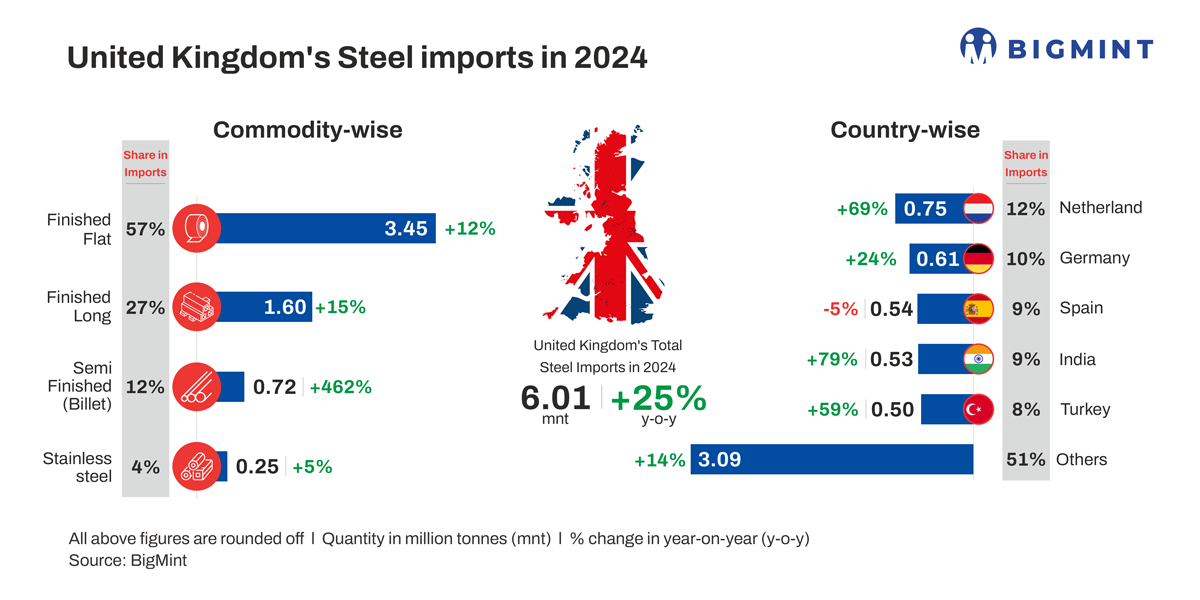

BigMint data show that steel imports into the UK increased by 25% y-o-y to over 6 mnt in CY'24. Imports of finished flats soared by 12% y-o-y to 3.45 mnt.

Interestingly, as one of the top exporters, India raised its share of exports to the UK by a whopping 77% y-o-y to 0.53 mnt in CY'24. Moreover, the UK's imports of semi-finished steel rose sharply because of reduction in primary production.

In terms of consumption outlook, the British Society of Motor Manufacturers and Traders (SMMT) forecasts an increase in domestic car production in the UK by 7.6% in CY'25. The Construction Products Association (CPA) expects construction volumes to grow by 2.1% this year and 4% in 2026. The driver will be the private housing sector.

Therefore, the UK's dependency on steel imports is only expected to grow this year and the next, as the possible winding down of the Scunthorpe facility cuts domestic production still further.

Window of opportunity for India

The FTA can provide the required push for Indian steel producers to explore the opportunity of raising exports of hot-rolled flat steel products into the UK.

This is especially significant because Indian steel exports in the past fiscal have dropped sharply due to trade restrictions in different countries and predatory Chinese steel export prices. With US tariffs on steel and aluminium in place, the diversion of Chinese exports to the UK is also a possibility.

Besides the 1 mnt of annual quota under Category 1A, Indian mills have the prospect of theoretically utilising the 40% limit (for an individual country) on the UK's total 1B quota, which equates to over 0.9 mnt of steel annually. If exports exceed this level in a year calculated as per quarterly quotas, a 25% tariff comes into force.

The FTA has envisaged a gradual reduction in tariffs in different sectors such as automobiles and base metals, while excluding certain sensitive sectors. However, steel is not one of them. Also, India is optimistic of sealing an FTA with the EU sometime later this year. However, the only downside for Indian exporters may turn out to be the EU CBAM-like carbon tariff that the UK is mulling to impose on steel exports going forward.

Source:BigMint