Posted on 20 May 2025

Morning Brief: The famous Alang ship-breaking yard, the world's largest scrap ship dismantling facility in terms of capacity, seems to have hit a low tide. Ship-breaking volumes in Alang's yards, which lie in Gujarat's Bhavnagar district, have fallen precipitously over the last decade and a half, thereby affecting the local economy and livelihoods.

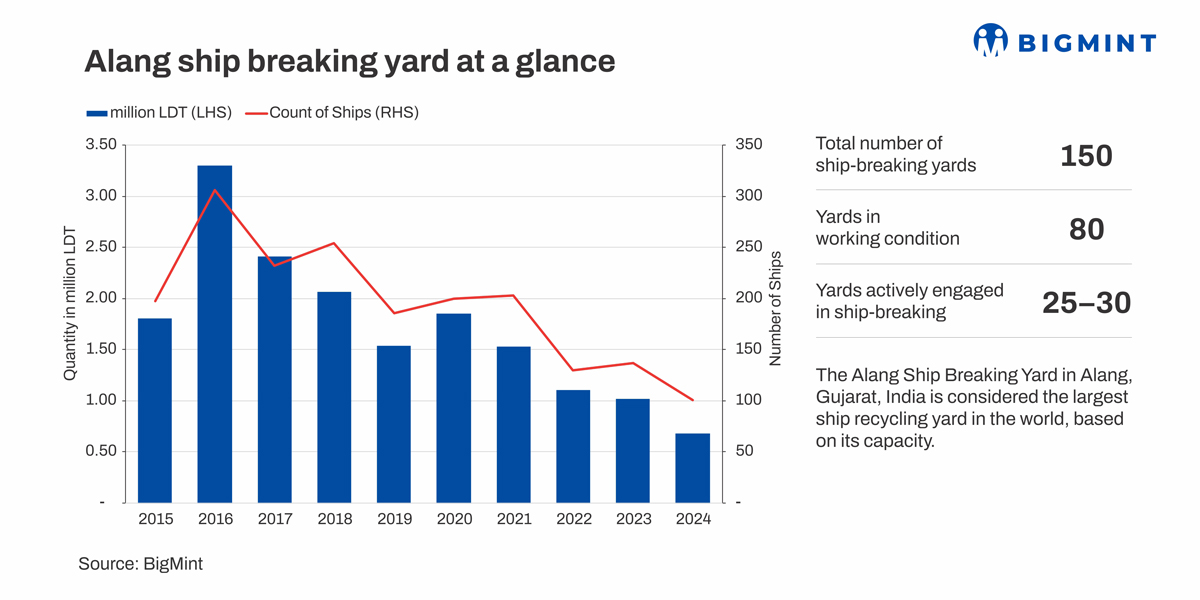

BigMint data show that ship dismantling volumes in Alang declined to the lowest level since the global financial crisis in 2008, falling to around 680,000 light displacement tonnage (LDT) in 2024 compared with 1.02 million LDT in 2023 -- a decrease of 35% y-o-y.

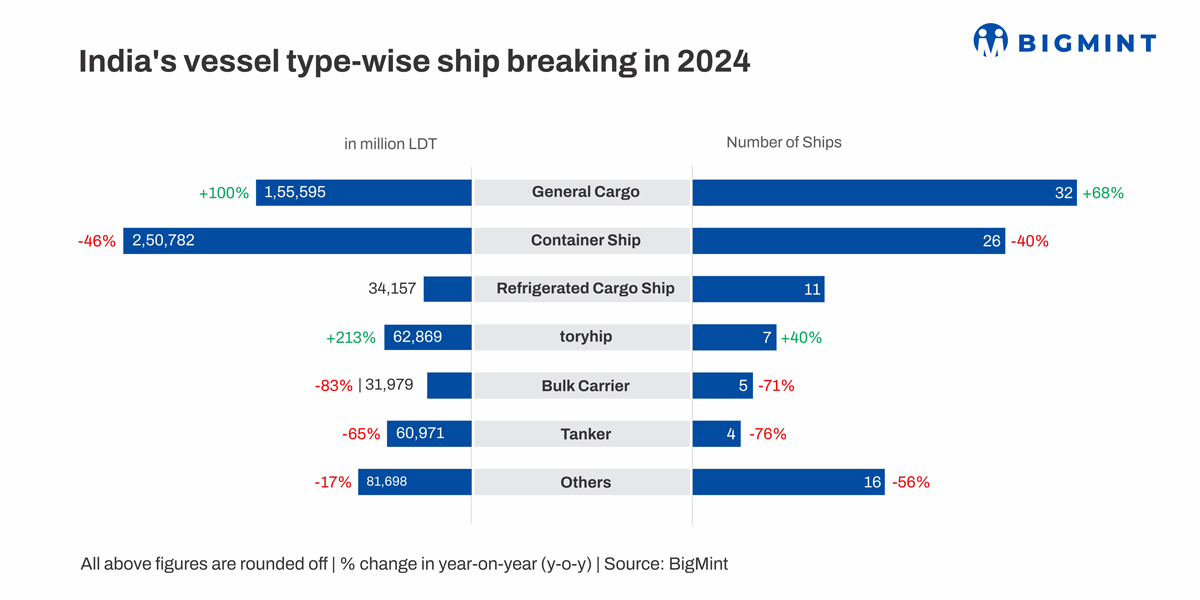

The total number of ships dismantled last year was 101 compared with 137 in 2023. While 32 general cargo ships beached in Alang last year, another 26 were container ships, with the rest being bulk carriers, tankers, etc.

Ship-breaking volumes have declined by over 75% from 2.78 million LDT in 2014, as per data, reflecting the growing hardships faced by recyclers amid loss of competitiveness, tightening quality and environmental regulations, as well as global steel and scrap market volatility.

Capacity underutilisation

Currently Alang has around 150 plots and can recycle 450 ships in a year with 4.5 million LDT. However, overall global sluggishness and local maritime board policies, such as limitations on plot sizes and guidelines for meeting global standards, aim to transform Alang into a green shipyard. Despite efforts by ship-breakers to adopt green practices and upgrade facilities, business has declined.

As a result, out of 150 plots, only 80 are operational, and out of that only 25-30 yards currently have ships for breaking, while the rest remain idle.

Moreover, newer vessels are more efficient and stay operational longer, reducing scrapping rates, thanks to cutting edge technology.

Why are ship-breaking volumes plunging?

Geopolitical conflicts, vessel demand & freight surge: The violent conflicts in the Middle East and in the Red Sea over the last two years have forced ships to transit from other channels through the Cape. So the number of ships being utilised has increased and the major container companies, instead of selling the old ships, are buying old ships to cater to the surge in demand for vessels. This has affected availability of old ships for scrapping, a source said.

On the other hand, the Russia-Ukraine war in Europe had sparked a sharp rally in global energy and bulk commodity prices, with freight rates increasing rapidly, by some accounts almost tripling since 2022. In such a scenario, operators were naturally unwilling to scrap old and existing carriers.

BIS standards & quality criterion: Sources said that Alang recyclers have become less competitive because the ship-breaking scrap, which was previously used for the production of steel bars for construction, is not being considered suitable, as per BIS, due to the uncertain metallurgical origin of steel plates used in shipbuilding. Therefore, the requirement for ship-breaking scrap has been affected, thereby impacting the business of dismantlers who have been forced to sell the scrap for melting at lower prices.

Fewer ships coming to Alang for dismantling has hurt the nearby re-rolling mills in Sihor, about 50 km away. Although the government prohibits using Alang's scrap plates directly to make TMT bars, they can be melted down and processed. However, this process is costly and not feasible for the mills.

Competition from neighbouring countries: Data show that neighbouring countries such as Bangladesh and Pakistan are posing tough competition when it comes to the purchase of scrap ships. These countries, especially Bangladesh, are faced with growing domestic steelmaking capacity along with near-total dependence on imported scrap. Therefore, these countries are prepared to pay higher prices for ships compared with Indian buyers. Moreover, as these countries remained outside the HKC framework for long they were able to bid competitively for decommissioned ships.

That apart, sources indicate that the European yards are also taking more vessels as well as Turkiye to meet growing domestic demand for steel production.

Tightening environmental regulations: Global norms like the Hong Kong Convention and EU Ship Recycling Regulation are shifting vessels to certified "green" yards. There are concerns related to labour rights, health and hygiene and environmental protection standards. While over 105 yards are compliant with the International Maritime Organisation's Hong Kong International Convention (HKIC) for the Safe and Environmentally Sound Recycling of Ships, 2009, they are not complaint with the EU's Ship Recycling Regulation.

Volatile steel & scrap prices: Over the last year or so global steel prices have witnessed a downtrend and domestic steel and scrap prices have been under pressure amid surging steel imports. The weakening of domestic steel and scrap prices was obviously a disincentive for the ship-breaking industry.

Outlook

The global trade war has worsened economic sentiments and may trigger inflation and affect consumption which will be inconducive to the growth of the sector.

However, the Gujarat Maritime Board (GMB), the nodal state government agency managing the operations of Alang, remains optimistic about future prospects. "The current situation at Alang is due to the overall global sluggishness. Since the COVID pandemic, arrival of ships has been on a decline. However, in the coming three-four years, we are expecting ship arrivals to increase," Rajkumar Beniwal, vice-chairman and CEO of GMB, told . The board is looking to tie up with the European Union (EU) to attract ships to Alang.

GMB is also undertaking initiatives such as doubling the size of the Alang yards. "We will be increasing the size of plots as per international standards. We are also cooperating with plot owners to train their workforce," Beniwal added.

In the mid- to long term, amid increasingly tightening environmental regulations controlling the global shipping industry, the retirement of old and inefficient fleet and fuel switch in the maritime sector, it is expected that global ship demolition volumes may grow rapidly towards the end of this decade and the next. Alang can upgrade itself to be in a position to reap real benefits from this trend.

Source:BigMint