Posted on 20 May 2025

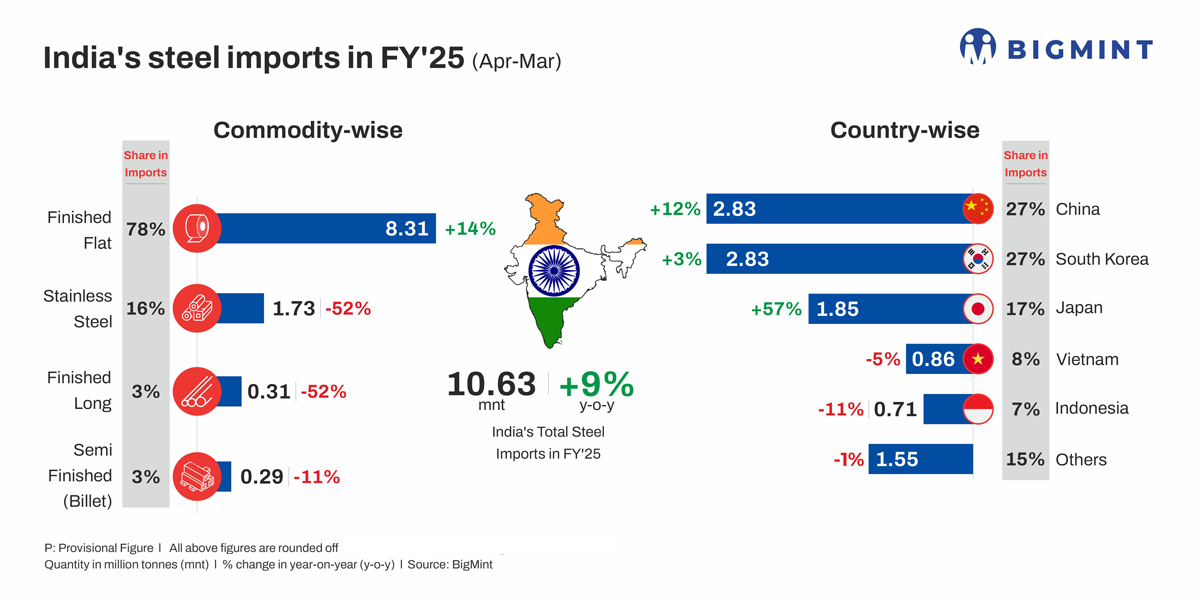

Morning Brief: India wrapped up FY'25 with a 9% y-o-y increase in steel imports, fuelled by the persistent export deluge from China and free-trade agreement (FTA) countries that are grappling with weak demand and surplus steel supply.

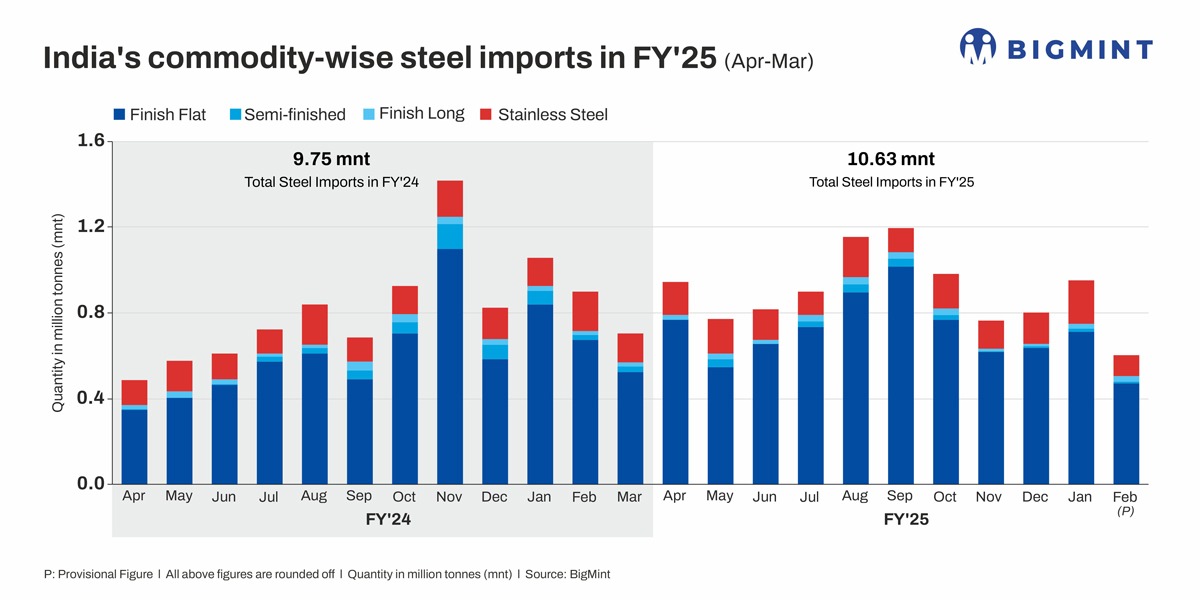

India's steel imports (including stainless steel) totalled 10.63 million tonnes (mnt) in FY'25, up 9% from 9.75 mnt in FY'24, according to provisional data with BigMint. This is the highest volume recorded in nine years.

In comparison, exports stood at 6.25 mnt in FY'25, down by nearly 30% from 8.75 mnt in FY'24. The gap between exports and imports stood at -4.38 mnt in FY'25, widening considerably from - 1 mnt in FY'24. As such, India maintained its status as a net steel importer for the second straight year in FY'25.

Commodity-wise break-up

Finished flats, which comprised 89% of India's total import volumes, stood at 9.47 mnt in FY'25, up 14% from 8.31 mnt in FY'24.

Semi-finished steel shipments declined by 25% to 0.82 mnt compared to 1.1 mnt. Meanwhile, finished long steel imports remained stable y-o-y at 0.34 mnt.

All these figures include stainless steel volumes.

Stainless steel arrivals, as a whole, comprised 16% of the total imports, increasing by 2% y-o-y to 1.72 mnt compared to 1.69 mnt.

Country-wise scenario

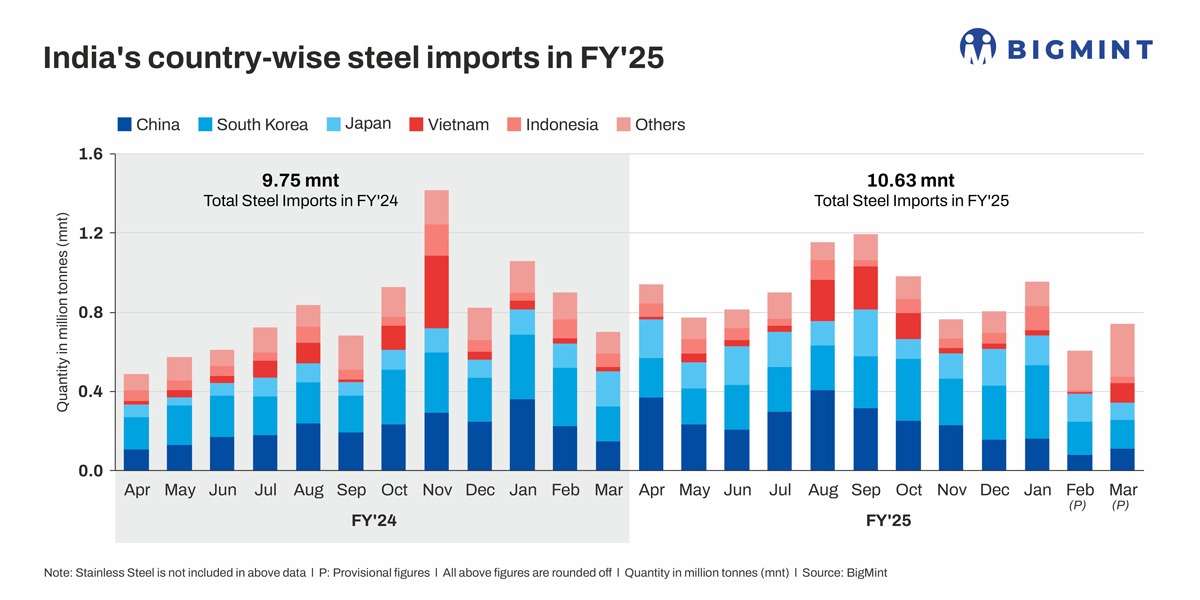

Both South Korea and China shipped 2.83 mnt to India in FY'25. While this marks a modest 3% y-o-y rise for South Korea, China's volumes climbed up by 11%. Each country constituted 27% of India total imports.

Japan, the third-largest contributor, recorded a massive 58% y-o-y increase to 1.85 mnt in FY'25 compared to 1.17 mnt in FY'24.

Imports from Vietnam declined by 5% y-o-y to 0.86 mnt from 0.91 mnt, while Indonesia logged an 11% drop to 0.71 mnt from 0.8 mnt.

Factors driving steel imports

Competitive pricing from China, FTA countries: With aggressive competition emerging in the seaborne market, exporters adopted predatory pricing tactics to keep buyers' interests piqued. This kept the landed costs of imports much lower than domestic prices for a large part of the year, driving Indian buyers to source imports.

To illustrate, during January-August, Indian hot-rolled coil (HRC) prices were consistently higher, averaging INR 52,660/tonne (t), while the landed cost of imports from FTA countries stood at INR 50,780/t and from China at INR 51,600/t. Subsequently, the price differentials started fluctuating, with imported material at times becoming costlier, for various reasons: either domestic suppliers cut offers to spur trade; fiscal stimuli by the Chinese government boosted market confidence; or anti-dumping or other protective trade measures, such as India's safeguard duty, began to be considered.

Overall, in FY'25, prices of Indian HRCs averaged INR 49,925/t, higher than the INR 49,330/t of imports from FTA countries. Meanwhile, domestic HRCs were largely at par with Chinese material, which were at INR 50,100/t.

China, Japan rev up exports amid low domestic demand: Chinese steelmakers continued to struggle with piling inventories and squeezed margins in FY'25, amid subdued consumption by the construction and real estate sectors. Meanwhile, Japan faced a downturn in its automotive and construction segments, which kept steel buyers cautious.

Mills fell back on exports to recoup costs, pushing down prices as much as possible to foist off material that found no takers in the domestic market.

Japan also took advantage of its FTA, which allows it to export to India at nil duty.

Mills push up exports amid BIS licence expiry/renewal: Certain mills in China increased shipments to India ahead of the expiry of their Bureau of Indian Standards (BIS) licences.

For example, Bengang Steel's licence reportedly expired in early November 2024, while that of Baosteel Zhangjiang ended in January 2025. Following this, sources suggested that the licences of some mills were not renewed, which helped suppress imports to an extent in early CY'25.

Meanwhile, volumes from Vietnam recorded a sharp uptick in August-October 2024 following the renewal of the BIS licences of Formosa Ha Tinh and the Hoa Phat Group.

Electrical steel imports surge amid supply-demand gap: Interestingly, imports of electrical steel surged by 40% to 1.97 mnt in FY'25 compared to 1.41 mnt in FY'24.

This increase is due to a supply gap in the domestic market, with the Global Trade Research Initiative (GTRI) revealing in December that India's power segment faces a 30% supply deficit for cold-rolled grain-oriented (CRGO) steel, required in the manufacturing of electric motors and transformers. Domestic output is only able to fulfil 10-12% of the country's demand.

Notably, the Directorate General of Trade Remedies (DGTR) has excluded CRGO and cold rolled non-oriented electrical steel (CRNO) from the purview of the safeguard duty.

Impending safeguard duty keeps buyers wary: In December 2024, the Indian government initiated a safeguard investigation into steel imports, recommending in March this year a 12% duty on most grades of flat products for 200 days. While the duty was finally imposed in April, speculation regarding its scope and timeline led Indian buyers to desist from imports. This market caution led to a gradual decline in HRC imports in January-February.

Outlook

India's steel imports are expected to remain on the lower side in Q1FY'25 due to the imposition of a provisional safeguard duty of 12% ad valorem on most categories of flats imports.

Considering the HRC export offers prevailing in March, this 12% safeguard duty is set to raise the landed cost of material from FTA and non-FTA countries to INR 54,059/t and INR 52,092/t, respectively, compared to INR 51,300/t for domestic HRC. This will give domestic suppliers some leeway to raise prices or enable them to leverage the price advantage to pull in buyers.

However, uncertainty remains, given the current tariff tensions sparked off by President Trump. Overall, the near-term outlook appears to be stable, though clouded by geopolitical conflicts and macroeconomic uncertainty.

Source:BigMint