Posted on 20 May 2025

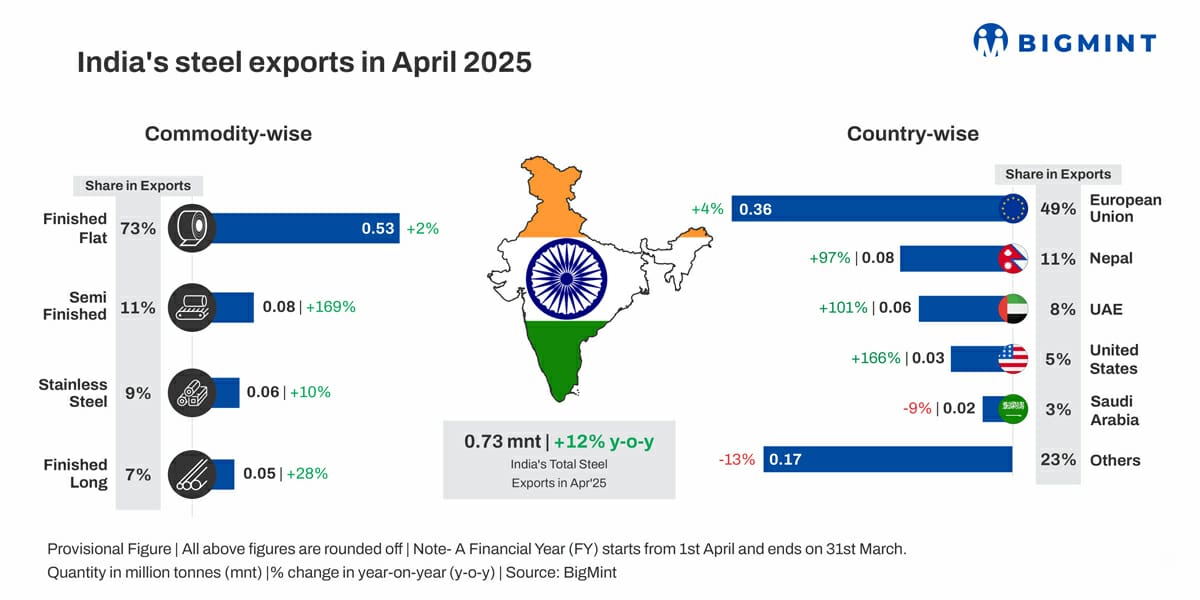

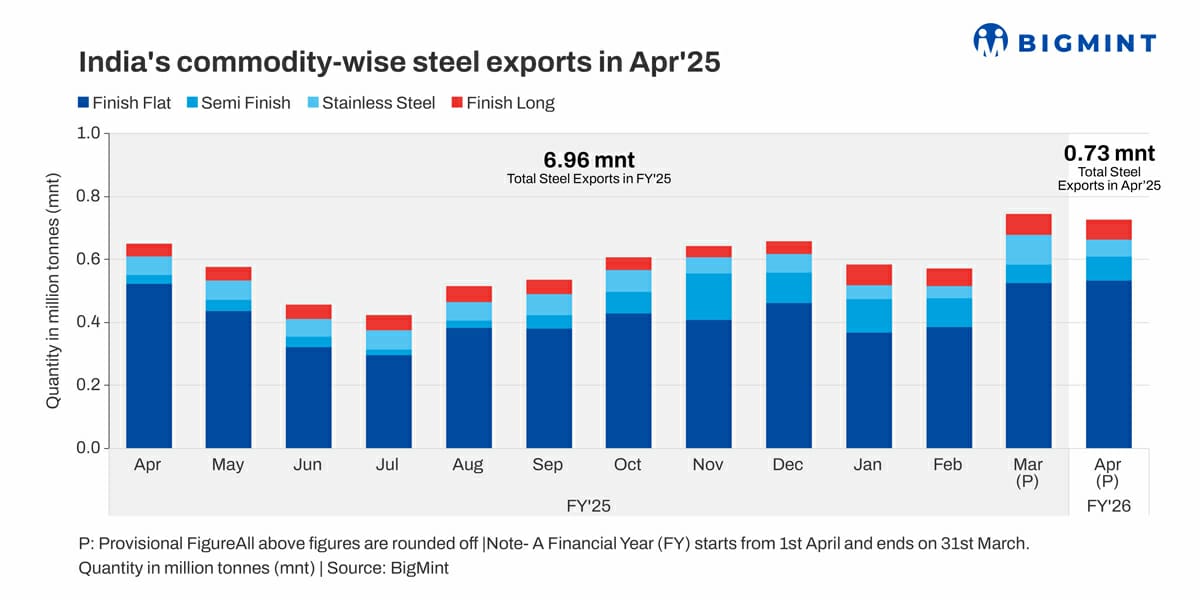

Morning Brief: India's steel exports (including stainless steel) dipped 3% to 725,547 tonnes (t) in April from 745,510 t in March, according to provisional data compiled by BigMint. Y-o-y, steel exports improved by 12% from 649,500 t.

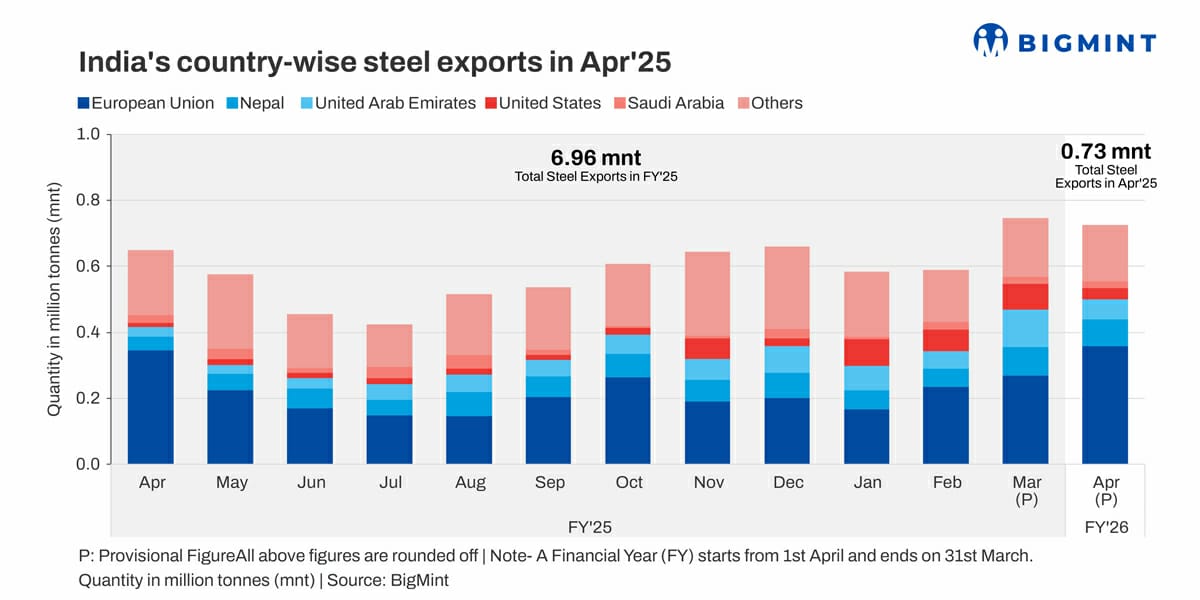

In April 2025, although shipments to the US and Saudi Arabia declined sharply m-o-m, overall volumes remained similar to last month, as exporters shifted their focus to the EU market, where fresh import quotas for Q2CY25 set in. Consequently, the EU's steel imports from India scaled to a 13-month high of 358,054 t.

Commodity-wise exports

India's total flats exports stood at 556,509 t, up by 1% m-o-m, and the highest since March 2024, while semi-finished steel shipments climbed up by 30% to 78,645 t. Conversely, finished longs suffered a 32% fall to 90,392 t in April.

All figures are inclusive of stainless steel.

Among flats, hot-rolled coil (HRC) exports (excluding stainless steel) declined by 12% m-o-m to 130,631 t, and galvanised steel decreased by 6% to 103,494 t. On the other hand, exports of pipes and tubes increased by 7% and CRCs by 17%.

Country-wise shipments

India's steel exports to the EU increased by 33% to 358,054 t, while those to Nepal declined by 6% to 82,703 t. Shipments to the UAE declined by 47% to a six-month low of 58,483 t and to the US plunged by 56% to 34,169 t. Additionally, volumes to the UK decreased by 12% to 42,959 t.

Factors impacting India's steel exports in Apr'25

EU import quota gets renewed: With the start of the new quarter, the EU's steel import quotas were reset. This led to a spike in exports to the EU, as Indian mills redirected shipments there amid poor demand in the Middle East.

As of 5 May, among the various quotas, India completely exhausted its quota for 4A metallic coated sheets (total of 53,636 t), used up 80% for 4B metallic coated sheets (31,434 t), and consumed 28% for plates (110,038 t). Additionally, India used up 7% of its allocation for cold-rolled coils (total 349,207 t with transferred amount) and only a negligible amount of its HRC allowance (total 773,831 t with transferred amount).

Indian mills not actively offering to Middle East: Amid poor demand in the Middle East, Indian mills paused actively offering to the region in April. Indian mills had been hoping that following the festive lull during Ramadan, trade would gain momentum. However, Chinese offers proved too competitive for Indian mills, at around $485-500/t CFR UAE. Ultimately, Indian exporters decided to focus on the domestic segment, given better realisations there.

US steel tariffs stem imports from India: The US imposed 25% blanket tariffs on steel imports, which led to the halving of Indias shipments to the country.

Overall, the tariffs' impact on Indian steel exports is expected to be minimal, given that India's exports to the US are generally limited. However, in January-March, Indian exports to the US had hovered around 80,000 t, compared to around 20,000 t in the preceding months, probably due to buyers ramping up shipments in expectation of the tariff imposition.

China continues to dominate export market: Ultimately, the overall slowdown in exports by India, as well as several other countries, can be traced back to China and the collapse of its realty segment. Ailing under lacklustre domestic demand, China lifted its steel exports by 8.1% y-o-y in April, while volumes remained range-bound m-o-m. Additionally, exports to the US sank 21% y-o-y, while those to Southeast Asian countries surged by the same quantum.

Meanwhile, China also continued with its strategy of aggressive pricing. Notably, HRCs, FOB Rizhao, dropped to $459/t in April from $468/t in March. In comparison, Japanese HRC offers were at $463/t FOB. Additionally, Chinese HRC offers to the Middle East declined by $10/t m-o-m to $485/t CFR UAE in April.

This affected India's exports to the UAE, for example, but overall, volumes remained stable because of the increase in exports to the EU.

Outlook

Expectations for India's future export trade seem bleak for multiple reasons. First, given that mills have kept offers to the Middle East on pause so far till mid-May, volumes to the Middle East may remain low. Secondly, the EU may also see a drop in imports from India amid weak demand and local mills preferring domestically produced material.

While the European Commission has not imposed any anti-dumping on Indian HRCs, there seem to be no takers for Indian material, as the country's quarterly quota remains pretty much unused. Thirdly, Chinese exports remain a huge concern, which may continue to diminish India's export market.

A pillar of support, however, remains the recently inked free-trade agreement (FTA) between India and the United Kingdom. India's shipments to the UK increased 77% y-o-y to 0.53 mnt in CY'24, and the FTA, which ensures duty-free exports across several commodities, is expected to help Indian producers to boost these volumes.

Source:BigMint